ES Wednesday 2-11-2015

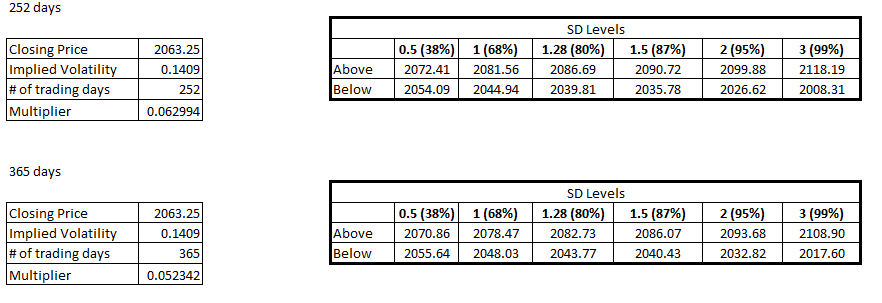

Bands for the day. We also have the weekly 0.5 band at 2071.25 to go with the daily 0.5 band at 2070.75 so we have confluence there. Good luck to all.

the crazy thing is he usually is trading while speaking. i just cannot do it. i need to focus and need quiet, which is what i am finding out very recently.

Originally posted by PAUL9

i find it very hard to trade while Dalton is speaking

so does Dalton

He never traded when I took the first intensive, it was a 60 day intensive back in the Fall of 2013.

There was only one trade he ever announced (that I can remember).

There was only one trade he ever announced (that I can remember).

how's he been doing in the trading?

you can hear the beeps in the background notifying his fills and he has started to say what he is doing. i heard him enter and exit a position in a very short time. he did say that he never used to do that but he is learning that sharing his trades can sometimes help traders so he is doing a little of it. he definitely does not share all his trades but he is definitely sharing more

from the little he has shared, he is human just like us. he gets confused from time to time and makes a wrong call but he is pretty decent for sure.

one thing i have noticed is that he is very quick to get out of a position very quickly if he thinks he is wrong and usually he is right about it.

he does not trade much and is very very selective.

also he trades very exotically. for example, he might have a long futures position, would have bought puts, sold calls, etc. it can get complicated.

one thing i have noticed is that he is very quick to get out of a position very quickly if he thinks he is wrong and usually he is right about it.

he does not trade much and is very very selective.

also he trades very exotically. for example, he might have a long futures position, would have bought puts, sold calls, etc. it can get complicated.

Originally posted by PAUL9

how's he been doing in the trading?

Bruce, that was one heck of an entry going long at 59. that was great analysis

well that's a big change... he must have gotten complaints...

I never complained to him about it but I will say that his failure to execute trades... with the reason for the trade and an explanation of what could happen that would cause him to get out the trade... his failure to do that was a big disappointment to me... You wanna know why? If you're going to be a trader, YOU HAVE TO TRADE...

I have to identify a trading opportunity and TAKE the trade. win or lose.

I don't get paid to tell stories and charge 960 bucks for 3 or 4 webinars a week for 60 days.

I never complained to him about it but I will say that his failure to execute trades... with the reason for the trade and an explanation of what could happen that would cause him to get out the trade... his failure to do that was a big disappointment to me... You wanna know why? If you're going to be a trader, YOU HAVE TO TRADE...

I have to identify a trading opportunity and TAKE the trade. win or lose.

I don't get paid to tell stories and charge 960 bucks for 3 or 4 webinars a week for 60 days.

another thing i've noticed is that you rarely see only one - one minute bar in a weekly distribution ( except when we have blank space due to gap opening above or below prior ranges or if we get one of those brilliant late day rallies) with that said I think there are high odds that we come back down to 58.75 before the day is out....or perhaps the week.....lol...the point is that the LTN down there I think needs a revisit....only thing that would change my mind is if we leave single prints on a late day rally today....otherwise I think we are coming back to that area.. ..the first clue will be a weak bounce up off the 62 area that runs out of steam and then the rollover down.....so I think it is safer to just wait for 62 to print before attempting it...or else wait for new weekly highs up into the 66 - 68 and the 70 area...

to be honest, his associate Julia is better at explaining trade locations, stop placements, etc. And she has been leaning on him to explain it a little more.

also him not trading does not bother me as much. i am just trying to learn how to read the market from him. my trade executions are going to be leaning more towards using the market reading skills coupled with volume/greenies study that we do here. also some basic statistics from other factors like VPOCs, pivots, etc

at the end of the day i am looking at market profile as a tool to read the markets and help guide me, that is all

also him not trading does not bother me as much. i am just trying to learn how to read the market from him. my trade executions are going to be leaning more towards using the market reading skills coupled with volume/greenies study that we do here. also some basic statistics from other factors like VPOCs, pivots, etc

at the end of the day i am looking at market profile as a tool to read the markets and help guide me, that is all

thanks.....I was prepared to go in at lower prices too...also keep in mind that I didn't get filled at 59...I just waited for the print....but I also had a bigger plan of action....just want folks to keep that in perspective......those who claim to get in on exact lows or highs are full of baby poo !!!!

Originally posted by NewKid

Bruce, that was one heck of an entry going long at 59. that was great analysis

goods odds they come back up for the 55.50 retest

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.