ES Wednesday 2-11-2015

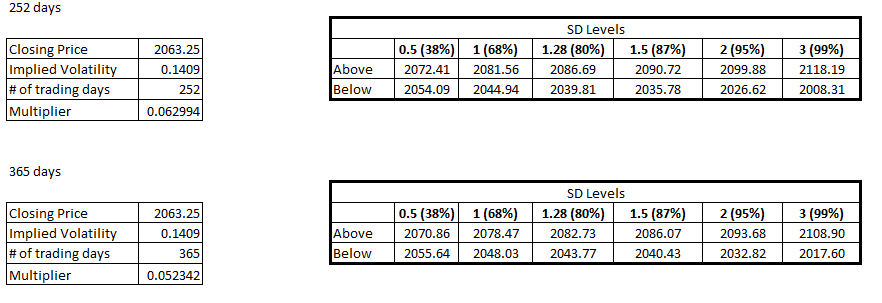

Bands for the day. We also have the weekly 0.5 band at 2071.25 to go with the daily 0.5 band at 2070.75 so we have confluence there. Good luck to all.

Edit: To go with the bands, we also have the daily R1 tomorrow at 71.5 so that is really showing confluence

Greenies:

80.25/79

76.75

66

63.5

52

49

40

37/35

Greenies:

80.25/79

76.75

66

63.5

52

49

40

37/35

Today was a low volume day. It was a little higher than Monday (barely) but down quite a bit from what we are used to seeing. That probably tells us that the price action we saw today was more of short covering from Monday and earlier on Tuesday rather than new buyers coming in. As we are at the upper end of the ~month long range, it should be interesting to see whether we see any new buyers coming in above the range or if we are going to see the bears starting to come in aggressively and take us back to the 1981 level. The highs from last Friday are not the greatest so I expect at least those to be cleaned up and maybe get to our ~71 confluence number. With the ATH relatively close by and also having poor highs should make it interesting with regards to whether we get there or not.

Today's value was overlapping to higher than yesterday so that is a bullish sign but the low volume is a definite red flag.

We have single prints from Tuesday's session from 58.75 to 61.25.

I think things will be choppy and volatile tomorrow as there is a high level of uncertainty around. We shall see how the O/N plays out and firm up the game plan in the morning.

Today's value was overlapping to higher than yesterday so that is a bullish sign but the low volume is a definite red flag.

We have single prints from Tuesday's session from 58.75 to 61.25.

I think things will be choppy and volatile tomorrow as there is a high level of uncertainty around. We shall see how the O/N plays out and firm up the game plan in the morning.

The days to look back for comparison on the upside are at 12/30, 12/31 and 1/2

The O/N range has been pretty tight so far with 6.25 points of range. The O/N low is 1 tick below YD's VAH and the high is below the 3 wide TPO price towards the top. Technically the O/N inventory is short but since the range is tight, I am going to be cautious this morning. As was alluded in last night's comments, there is uncertainty in the markets and that was reflected in the O/N as well.

Initial focus will be on YD's VAH and high to see if we get acceptance above them or fall back into YD's VA.

Good luck to all

Initial focus will be on YD's VAH and high to see if we get acceptance above them or fall back into YD's VA.

Good luck to all

For those that are interested, I have made updates in the following thread. Based on this data, there is an extremely high likelihood of hitting at least 1 weekly pivot number this week. Again, is it going to be 2090 or 2031.75?

http://www.mypivots.com/board/topic/8298/-1/pivot-point-study

http://www.mypivots.com/board/topic/8298/-1/pivot-point-study

here is how I see it and some Mp ramble ......if we get up to 66 - 68 area today they u need to watch other markets to see if they are having valid breakouts also........best to see if volume and high $ ticks come in on breakouts too........the lines for me are in the video but will post a still shot in a minute

here are my key lines

here are my key lines

seems like 61 is going to be the magnet this morning ...post 9 a.m trade..

great work on the posts today newkid and thanks for updating the weekly pivot point study.....with R1 on weekly up at 90 we really don't even need to think about it unless we get outside of last weeks highs and if it is going to be the 31.50 pivot then we really don't need to think about it until we get below this weeks developing time poc at 48.....

I wonder if the 5% failure happen when the weekly ranges exceed a threshold of weekly average true ranges ? last week had the biggest range in the last 7 weeks......just rambling but there might be a way to filter out that 5 % ....

I wonder if the 5% failure happen when the weekly ranges exceed a threshold of weekly average true ranges ? last week had the biggest range in the last 7 weeks......just rambling but there might be a way to filter out that 5 % ....

Bruce, agree on all fronts. I took a brief look at the misses and they were followed by weeks of large ranges. I will see how it looks with respect to average weekly true range. Good suggestion..

Originally posted by BruceM

great work on the posts today newkid and thanks for updating the weekly pivot point study.....with R1 on weekly up at 90 we really don't even need to think about it unless we get outside of last weeks highs and if it is going to be the 31.50 pivot then we really don't need to think about it until we get below this weeks developing time poc at 48.....

I wonder if the 5% failure happen when the weekly ranges exceed a threshold of weekly average true ranges ? last week had the biggest range in the last 7 weeks......just rambling but there might be a way to filter out that 5 % ....

here is a peek of how we touched back to 50 day ma on cash with low volume and then had bigger bar with higher volume yesterday...of course it could be the fake out but it seems more likely to try and push up again ..at least on a lower open........repeat after me " We let others go for the home runs......we just take the singles" !!!

goods odds they come back up for the 55.50 retest

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.