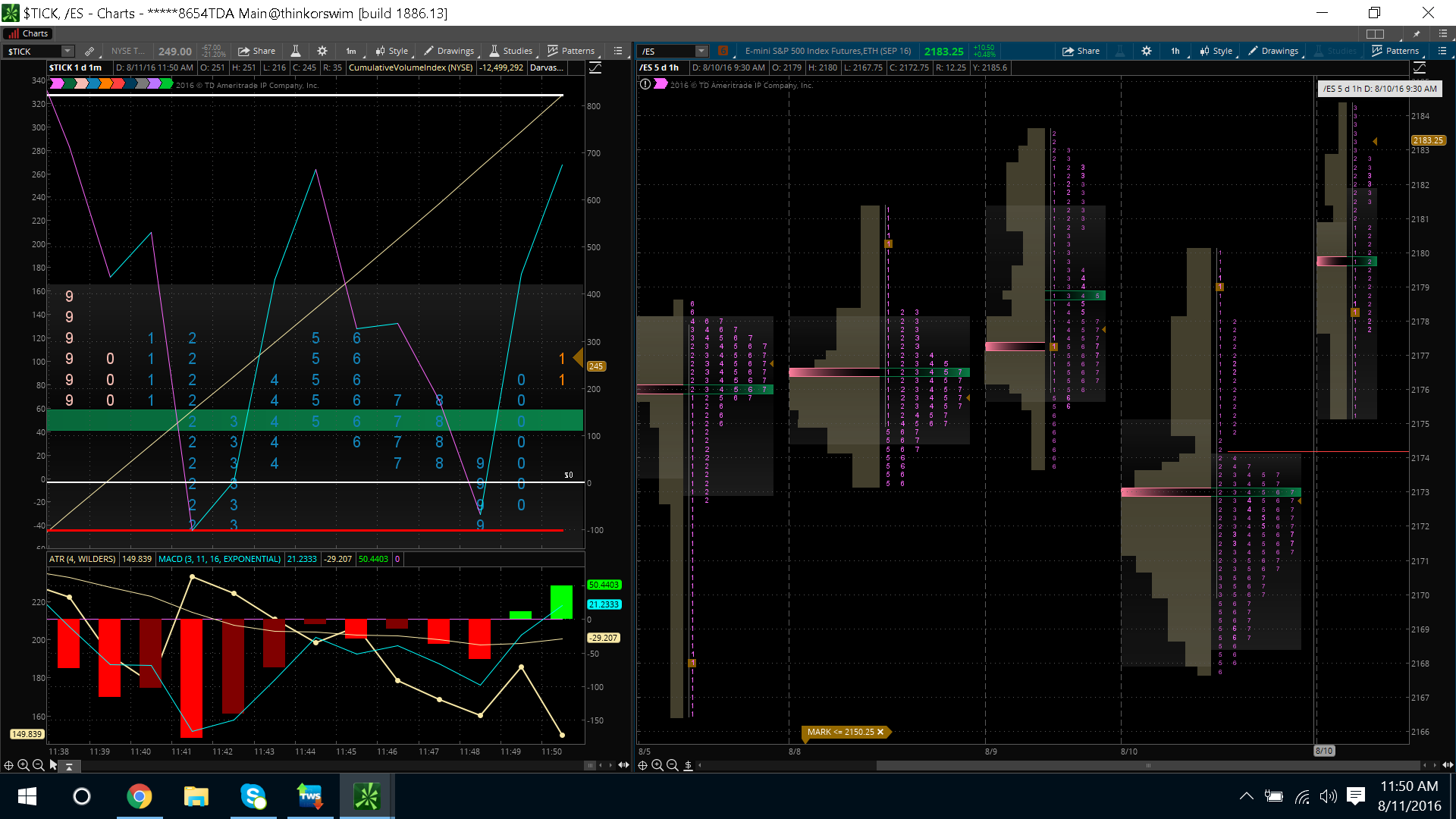

ES 8-11-16

77 is the key today at least in early trade....I like 74.25 as a target but if wrong on that bias then 82 is next magnet I see on upside......we can use the OR in the usual way and the plus 4 and minus 4 .....3 am opening is right near our 77 number too

How do you use the OR bar? Is it a 5 minute bar? Do you get in at one tick above (or below) as the range is passed on the second bar? or do you wait for a dip/fade after the range is passed to get in?

Best Regards,

Simon

Best Regards,

Simon

OR is first one minute bar....many ways to use the OR bar but for our most recent discussions we have been talking about taking breakouts from it's high and/or low to reach targets........often you will have to stop and reverse on the opposite side and yesterday I suggested using at he MOST a 1.5 point stop if the OR is 2 points or more....either way don't switch back and forth more than 4 times and don't lose more than $300 on these trades in general

Originally posted by Simonig

How do you use the OR bar? Is it a 5 minute bar? Do you get in at one tick above (or below) as the range is passed on the second bar? or do you wait for a dip/fade after the range is passed to get in?

Best Regards,

Simon

78.25 is open print so the OR traders would really want to hit 82.25 or 74.25........for me I'd like to see the 74.25 but.for OR discussion the buyers have bought the OR high and would have to reverse on new lows of the day ..

TOS rarely leaves gaps in data and there is one at 78.50 and 79.50...that denotes very thin trade to me and I'm trading now as if price will come back down to fill those in...so I am in at 80.25 and will add on 82 if needed

hoping to make a video of that later if my JIng can get sound working again...both just filled and a drop to 77 and then 74.25 would be perfect....wishfull thinking perhaps

this coil is tight be cautious if you plan to fade breakouts from the current range.....

out heavy at 77.25 ...that is key number....will try to hold for minus 4 if I can on final

I think that if you are trading the OR mechanical then you need to reverse with twice as many contracts and cover the first loss as soon as you can if given the opportunity......the following comments don't include slippage or if you entered on limit orders after a breakout/ breakdown etc but lets look at today ...we had an OR that went from 78.25 - 79.75...so 1.5 - points ....if you reversed to short at the breakdown...then you want to make good and cover something ( the loss on the long ) 1.5 points under the 78.25 which would have been 76.75...then try for minus 4 at 74.25 on last contract

edit : one alternative would be to take both contracts off at the 76.75 so you make some profit....just tossing ideas here again as the OR trades are breakout trades and many will play breakouts differently and naturally one needs to watch and see if they can handle a day that flips through the OR multiple times....can you handle "doubling up " on each flip..?

edit : one alternative would be to take both contracts off at the 76.75 so you make some profit....just tossing ideas here again as the OR trades are breakout trades and many will play breakouts differently and naturally one needs to watch and see if they can handle a day that flips through the OR multiple times....can you handle "doubling up " on each flip..?

stop on final runner for me is just inside the OR at 78.75...I don't like all those one minute highs at 79.75 ( what a surprise, the OR high) but more important I don't want to manage this one measly contract and would rather work on my JIng problem

the volume is terrible.....very hard to expand ranges when volume is lacking...I just got stopped out on runner...poc of one minute time today is 79.25....good luck....if you are playing the OR and we get another long reversal then I hope it gets your plus 4 up into 82.....it is always better to hit the plus or minus 4 early in the session...we've been trading an hour and can't go 4 points up or down so that is telling you something too...best thing for longs would be to see price consolidate above the POC and the OR high.... but my concern would still be the volume

I really only trade the first 60 - 90 minutes but I like the idea of getting back to 74 if they can retake the 79- 80.50 but even so we would be asking the market to drop 9 points from these current highs and I wouldn't expect that today....most of my trading is based off of Probabilities and many of those have been reached already except for the overnight midpoint but I like those to happen early in the day and I don't wait around just because a probability hasn't hit.... I have not found many people who can hold for the bigger moves....that's probably best done with buying debit put spreads in this case ...sorry I can't be of more help

Originally posted by gto11520

nice analysis bruce what do think of retracing back 2074 i see some single prints in those areas

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.