ES Friday 11-4-16

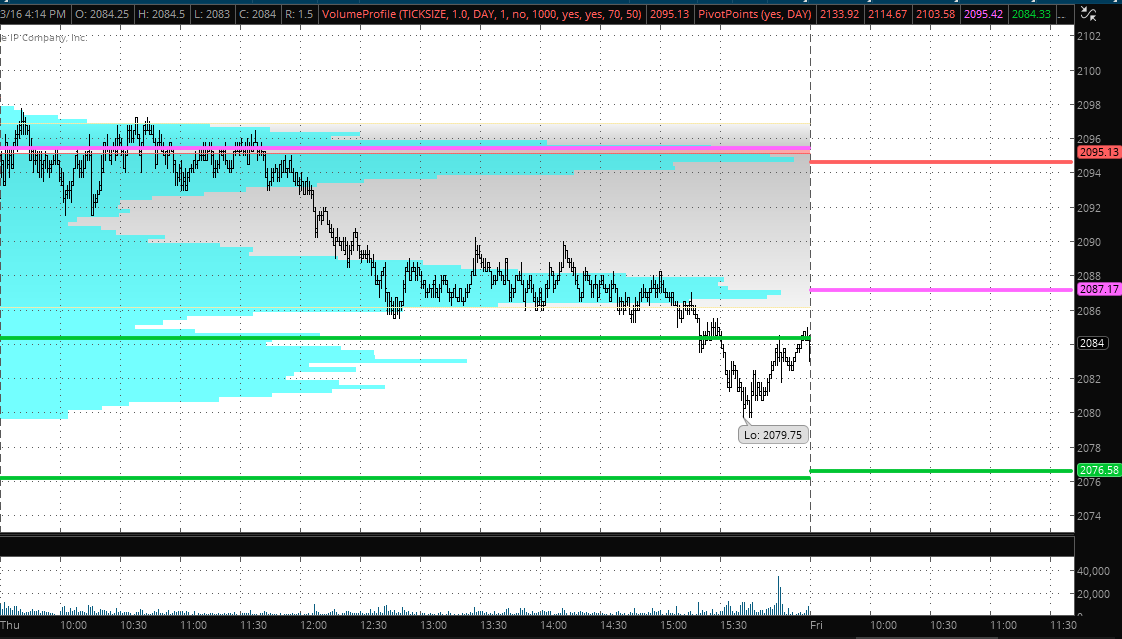

some good confluence today ...Pivot goes with a high time spot from yesterday at 87.25 and R1 goes well with official one minute POC at 95 area...between that we have low time at 90 - 91.....I'm going to try small sells at 87.25 for a 85 retest in Overnight.......but in rth I will try sells at the 87.25 , the 90 - 91 zone and the 95 if needed....I don't plan on trading heavy or making it a big long day today....not on a Friday.....

here is a chart which shows most of the lines...that 85 - 87 is most important today as it make sup a low time and high time combination zone....if that makes sense!!!!

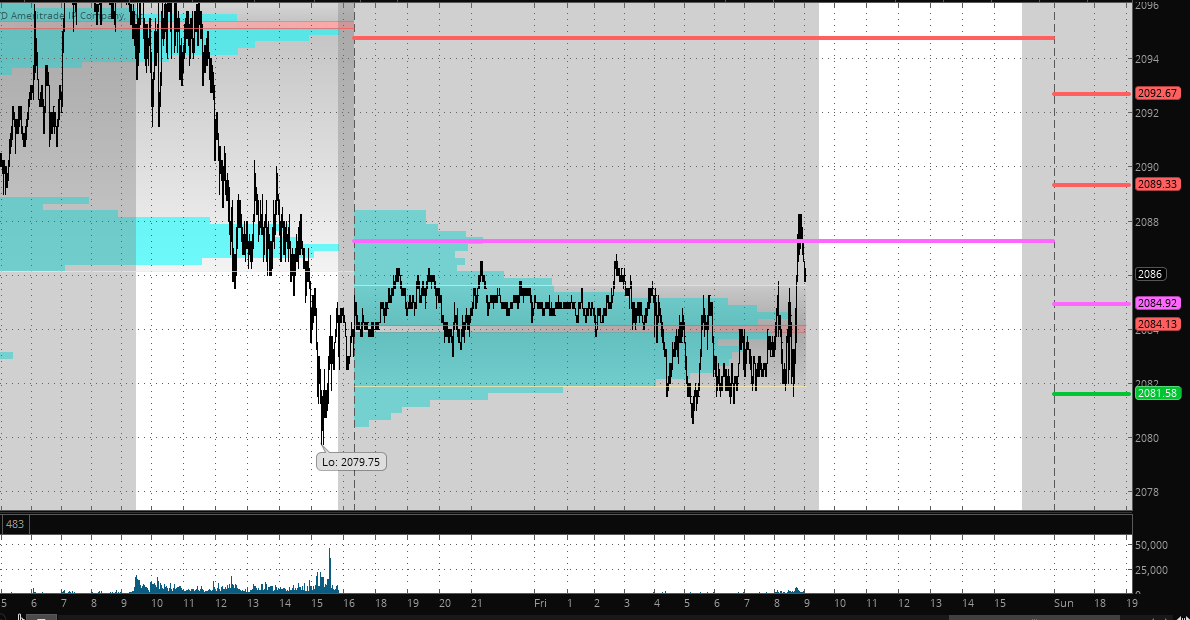

EDIT : how the overnight is playing out against the numbers so far...all time/volume in Overnight is at 84 area...

here is a chart which shows most of the lines...that 85 - 87 is most important today as it make sup a low time and high time combination zone....if that makes sense!!!!

EDIT : how the overnight is playing out against the numbers so far...all time/volume in Overnight is at 84 area...

we still have divergence in ad line as market makes new lows if you look at end of day data....I'm hoping today is the pop up day for my puts that I sold which are losing $32 per contract

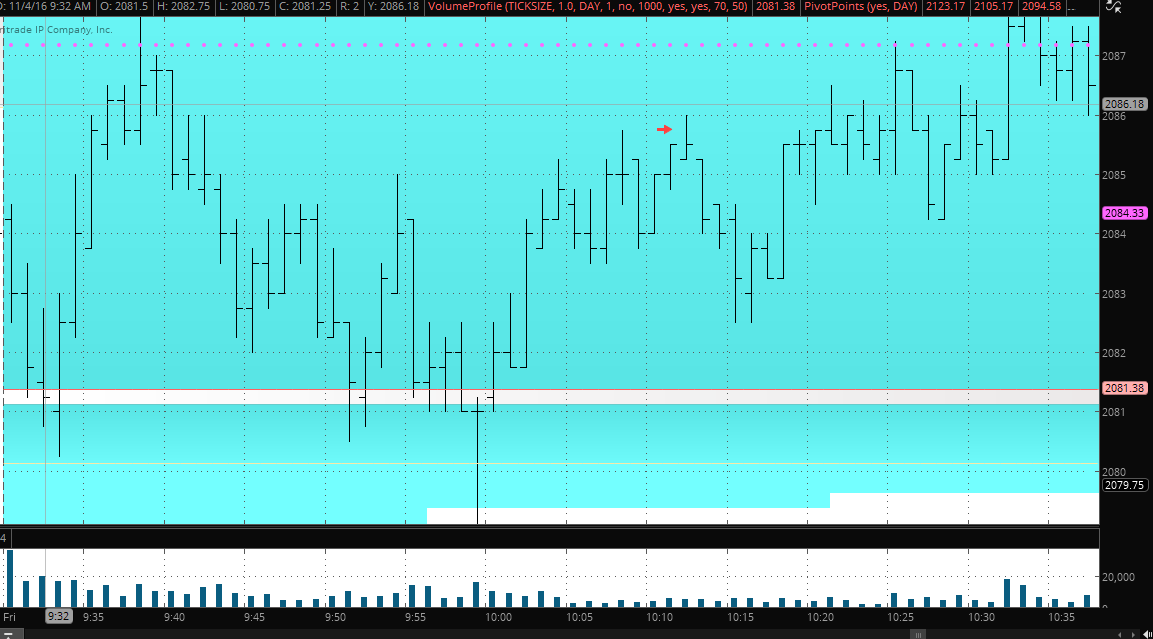

flat at 84 retest.....just ahead of rth open

I'd like to find a long setup for a retest of the open print and possibly back up to that 87 area...going to try from under overnight low and yesterdays RTH low...that is my only plan in RTH ....no shorts for me...I'll let bears have that one if it decides to go that way

85 - 87 is magnet zone so if u took the long then I would scale heavy into that area

going to see if I can get 87...ahead of pivot on final...we know we will see either the pivot or S1 print today

flat 87 print ...that's it for me......

an interesting study is that adline almost always hits a plus or minus 500 level.....so far minus 322 is low and plus 170 is high...just not sure if this will help in the long run....if u think long and adline will hit plus 500 then long ES holds....if u think short for ad line then ES shorts might work...still needs refinement...we already went through it's pivot

for anyone who may be interested, my trade posts ( entries and exits) are meaningless......it always comes down to finding what will work for u...take the ideas like overnight highs and lows and rth highs and lows throw in some high and low time areas and use them for your benefit...then throw in some Floor trader retest stats or overnight high or low stats ( which many are aware of) to help form your bias.......include the $tick examples I posted this week if that helps at YOUR predefined areas......

ok,,,not sure why I went on that particular ramble...I think it's because on another forum someone was running a " trade room" and turned out to be a vendor......and some post good ideas there but often u don't know if they are long or short or even trading since they often trade while at their real job....others from overseas talk about OTF but you never know when they are actually entering a trade....it's as if it magically appears....LOL.....I guess I just want all to remember that there is tons of crap all over the place.....just find some ideas that work for you and trade them well....don't keep jumping from one idea to another ...try to be consistent.....ok..I gotta turn up my Les Paul guitar and play some loud music before my wife comes home.....

ok,,,not sure why I went on that particular ramble...I think it's because on another forum someone was running a " trade room" and turned out to be a vendor......and some post good ideas there but often u don't know if they are long or short or even trading since they often trade while at their real job....others from overseas talk about OTF but you never know when they are actually entering a trade....it's as if it magically appears....LOL.....I guess I just want all to remember that there is tons of crap all over the place.....just find some ideas that work for you and trade them well....don't keep jumping from one idea to another ...try to be consistent.....ok..I gotta turn up my Les Paul guitar and play some loud music before my wife comes home.....

adline still didn't get to minus 500 and didn't even make new lows when ES went out lows...implies strength to me..I would expect it will be the plus 500 on adline....for me I'm just following it to see where ES is at the time these ad line readings hit but gonna check it out later

Mrs. BruceM gap trade long from 83.50 for 85.50

wouldn't u know it that almost as soon as I got the amp fired up and guitar plugged in I could hear the garage door open and my wife came home earlier than expected.........she broke the rules and should have entered 3- 5 points away from the gap in the data........she said she entered on the way back up....here is a screen shot of the gap

Originally posted by BruceM

Mrs. BruceM gap trade long from 83.50 for 85.50

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.