Es Monday 6-26-17

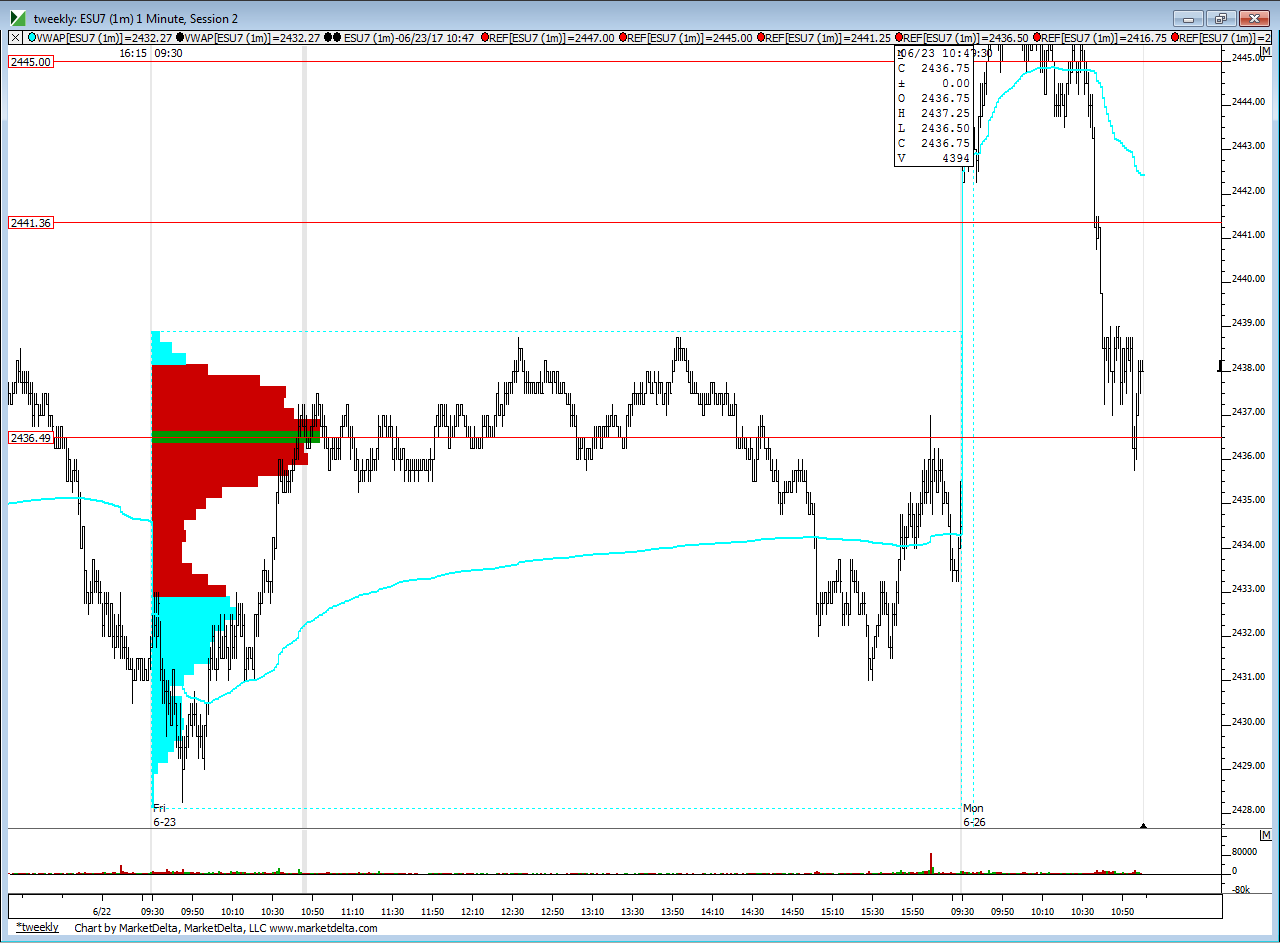

coming up on a seasonally bullish period but us day traders just use the lines and a few probabilities.....seems like the 2441 area will be most important today to decide if they want to rally it up into the 45 - 47 or roll it over down into the 37 - 38 area.......shorts off the 41 and higher should try for 39 area ( daily pivot is there) and lower into 37 and shorts off the 45 - 47 area should try for the 41 retest. Take a look at what happened last monday so you don't get too crazy on fades

ditto that Avid

They don't usually just blow through a line like they did at 2441 area...i would expect them to try and test that again from underneath...so if you feel aggressive then from the 37 - 38 area would be the place to try

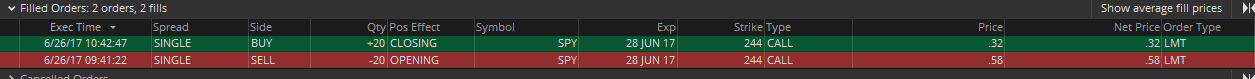

how the options did...I'm usually looking at covering when I have 1 third to half the premium taken in....but I am also looking at chart points too..

took a very small long off 36.50 and here is why...what happened on friday.....trying to see if they can retest fridays highs but 38.50 would be cool

the reason I didn't cover numbers further down on this chart on the video was because we were up at 41 area when I made the video and we also had the 37 area from the weekly chart that I mentioned......these one minute time profile charts just help me to refine areas

This is a critical idea I am always working from : I Always try to get out in front of key area that I know people will be watching.......see what just happened ...? They stopped it one tic shy of Fridays highs and then rolled it back over.....I think many do that so when we all start selling back our buys and scaling out then it has no power to even get to the highs....the point here is that I want to get out ahead of key areas when I can and that long off the 36.50 just now was a key example...

grt call bruce again

Just wanted to remind anyone that follows some of my ideas and that is this : I usually expect multiple tpo's at previous weeks value areas high and/or lows, the exception and the times I have seen this probability fail is when we open outside of Value and then either keep driving away or if we drive back in ( like we have done today so far) ....I'm not saying I know what will happen but in this volatility 3 points is a lot and we have 3 points of single prints between 38.75 and 41.75....I would expect them to try to push up into that...not sure if they will get it all the way back to last weeks VA high but they should go to try and fill in some of those singles...........options can work in these cases or trying longs in the 36 - 37 area may be a good play

thanks all for the kind words today...I appreciate it

thanks for taking the time and udating

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.