ES Thursday 7-13-17

Relative low volume and low range on a breakout yesterday leads me to believe we may need to retrace a bit... plan is to hold my calls sold as we have yet to print multiple tpo's at last weeks highs of 2436.50. In general I favor short side which is not surprising as a fader ...2346 - 48.50 is key on upside ..right now daytrades are assuming we will come back to 39.50 - 40.25 as we have vpoc,s , pivot and settlements there...

R1 goes well with yd's high at 2344 and breakout traders would want to break that out and keep going up...reverse is true for downside at yesterdays lows on a low range day with S1 at the lows

EDIT :most inventory is net long so expecting some downside adjustment is statistically wise

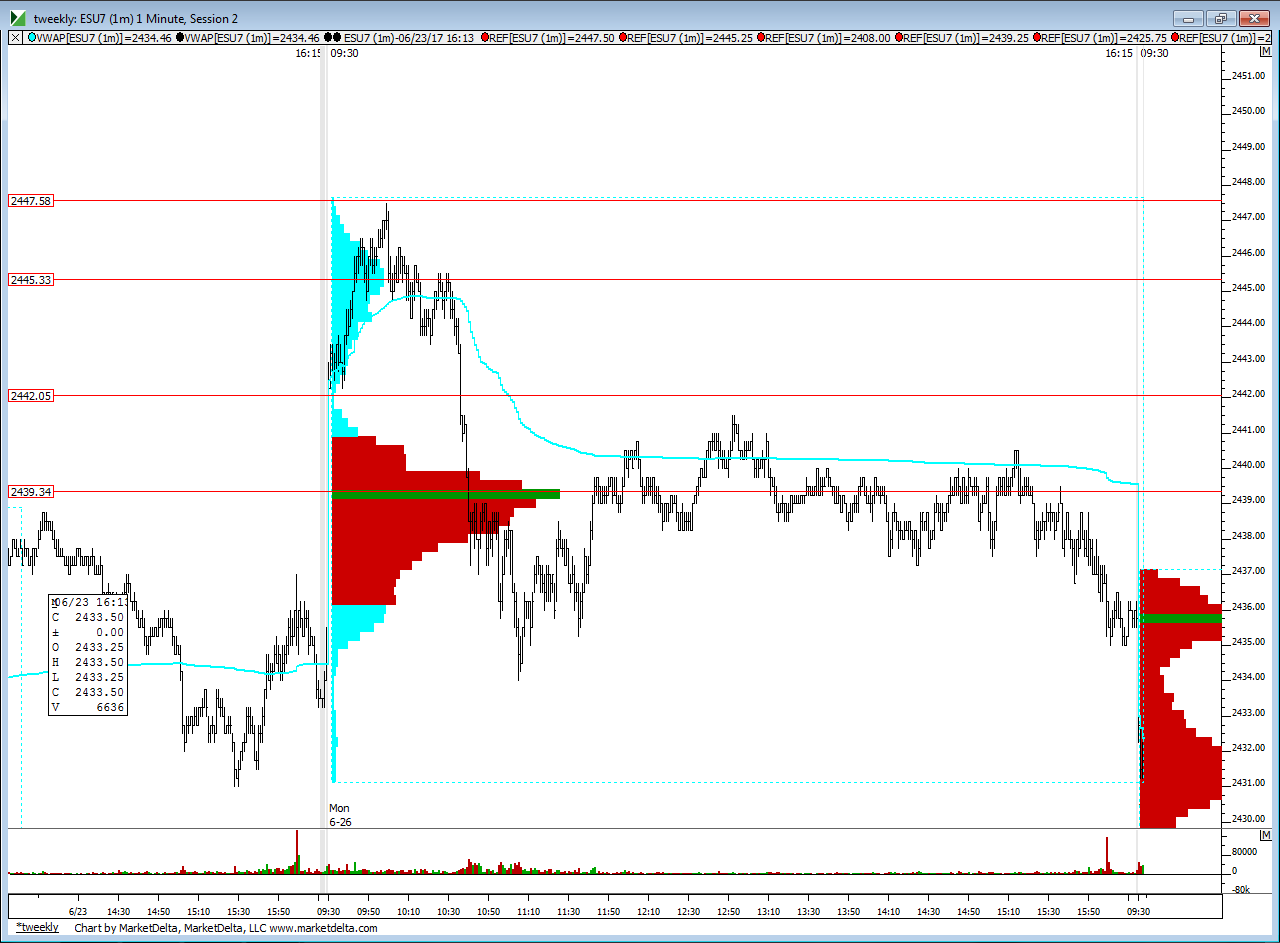

edit : here is the chart from 6-26-17 for reference and what we are working with above YD's highs

R1 goes well with yd's high at 2344 and breakout traders would want to break that out and keep going up...reverse is true for downside at yesterdays lows on a low range day with S1 at the lows

EDIT :most inventory is net long so expecting some downside adjustment is statistically wise

edit : here is the chart from 6-26-17 for reference and what we are working with above YD's highs

this sure seems like a struggle to go higher ...If I was a weekly breakout trader I'd want to see this thing get a move on to the upside...perhaps I am over-thinking it

yes duck...core campaigns are over for me now...I'm not planning to initiate anything from here....this summer has been a lot of work it seems......I grew up in a middle class Long Island home where we were kicked out into the street to play as kids....up here in Vt I always seem to be driving somewhere for my kids ( My wife plans all this stuff)....and they have kept us real busy so far...I've also been wrestling with getting the right chemical mix on this pool I just put in....and let me tell you if you want to have a level pool then don't call me.....LOL.....I had to dig down the posts on the high side AFTER the water was put in......HA! Fun stuff though...and that is more information then anyone probably needs on me....hope someone gets a kick out of this one..."Stairway to Gilligan"

https://www.youtube.com/watch?v=F8oGz0mxwks

https://www.youtube.com/watch?v=F8oGz0mxwks

have fun great call

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.