ES Monday 9-11-17

Always remember.....!! Here's how I see the levels today....I'll update with a hard copy but for now here is video ramble....

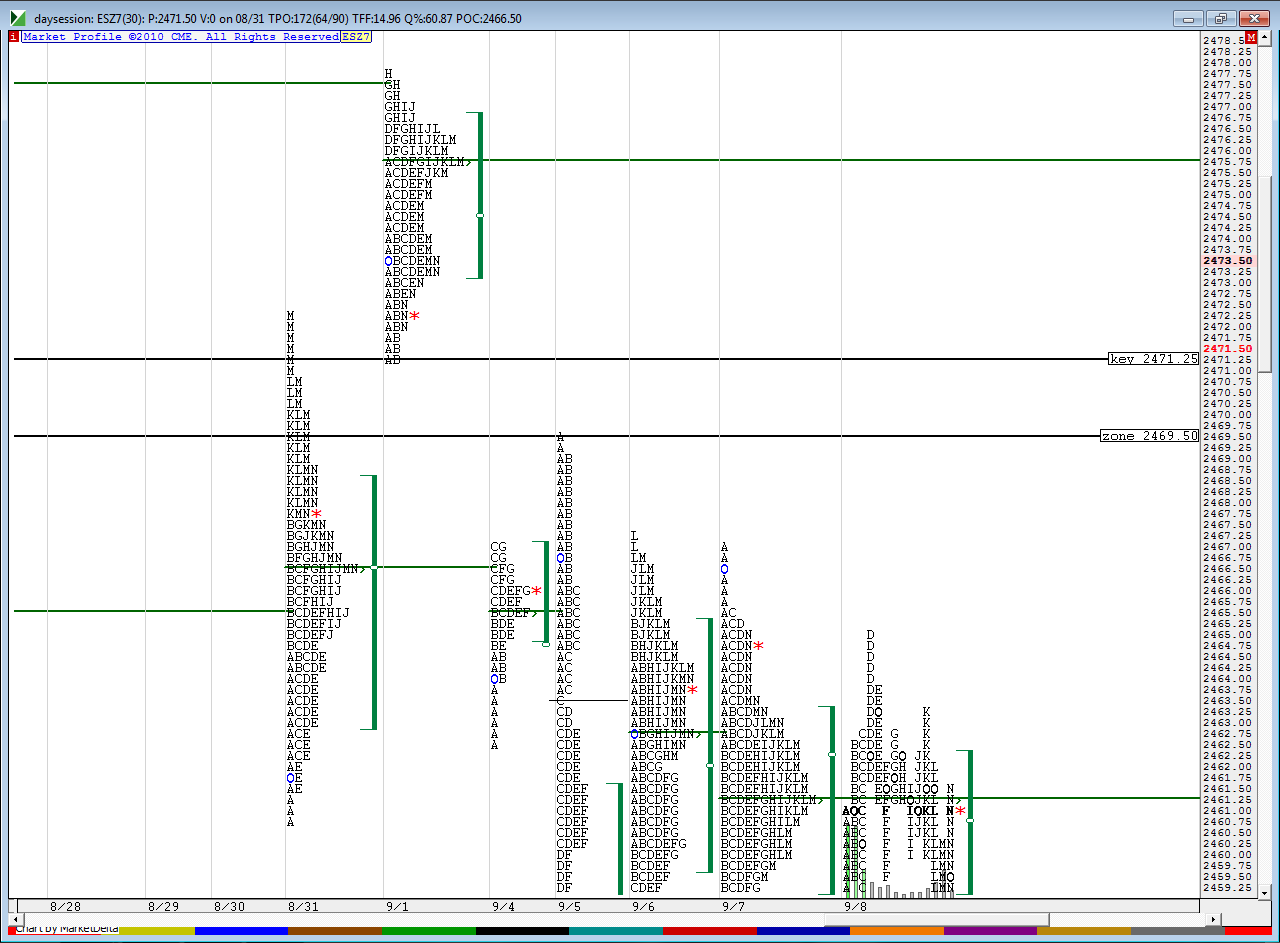

ok, this isn't much but watch 69.50 - 71.25 closely when we dip down there in the future...

.

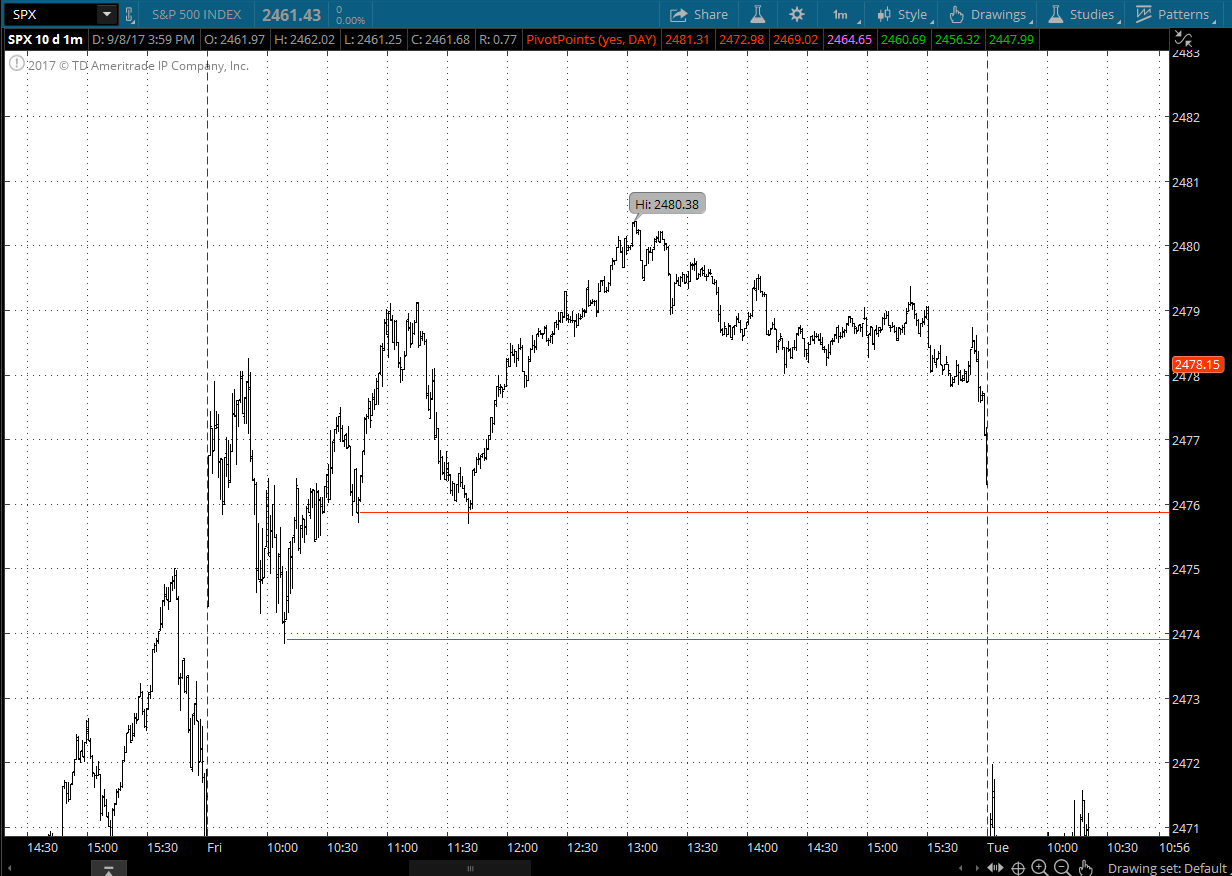

Also watch 2474 - 2476 as per cash today...here's why...the swing lows from August 1st

ok, this isn't much but watch 69.50 - 71.25 closely when we dip down there in the future...

.

Also watch 2474 - 2476 as per cash today...here's why...the swing lows from August 1st

just came out heavy at 78.75...I always come out heavy up front but even more so when I have averaged in...will try to get 77.75 retest next

yes, I get the idea..thank you...those friday sellers got cooked good ....I just question how most actually enter this trade but also how they exit......so lets say they buy the open and they have almost 8 points of profit.....so how do they monitor continuation and what do they do when they give up almost 50% of that profit ( like what just happened)?....so the next logical question would be how does one actually "monitor for continuation" ? These are the reasons I have mostly developed my own way of using the Mp data............Most of these things looked good after they have happened and Dalton has never specifically mentioned how he actually gets on board a trend but he is excellent for setting up context....no personal insult to you Aladin...I appreciate your input as I know you have studied Dalton and follow shadow

Originally posted by Aladdin

Bruce, think of the truncated double inside days (Wednesday & Thursday) as a (tightly) wound up spring.

Friday's balancing day did not change any of this.

Come Monday something's gotta give.

Trading is about change.

So today was the culmination of three balancing days. The clues were:

(1) the double inside days (Wednesday & Thursday) & Friday's balancing day

(2) Friday's late break did not bring in any sellers

(3) today's gap open higher and no sellers at open

Balance trading rules apply, with today currently being a 'look above balance and accelerate'.

For Dalton this would be a 'go with gap'. "Put on the trade and monitor for continuation" he always says.

(Because I was already expecting this gap since Friday, I got long at 2475.75; I guess I was lucky to imagine today's scenario before market open)

I apologize if my writing is repetitive, but typing and monitoring the trade is difficult for me.

That is why I have all the more respect for Bruce's ability to do post and trade at the same time.

now lets see if all those buyers at that volume bar come back or they give it up and we get a nice roll over.......this is key decision spot now

that 77.75 has the R2, the half back and last weeks highs on the December contract........interesting spot if sellers have anything in them

Ha, Bruce, now here's the beauty of trading.

Every trader has his/her own trading style.

For me, monitoring for continuation of a long position would mean that I'm imagining which scenario's could jeopardize my longs.

So what do I not want to see today:

(1) one-time-framing lower

(2) a sudden break creating a double distribution lower

I agree, that 'monitoring for continuation' always looks better in hindsight...

But with value building higher and POC now 5 wide, I'm okay with giving up even 100% of my unrealized profit as the odds of trading lower have decreased.

My position is long 2475.75 with a target somewhere above 2486.50 (ATH)

(In case they do try something funny, I also have a short scenario if today turns out to be a 'look above balance and fail')

Every trader has his/her own trading style.

For me, monitoring for continuation of a long position would mean that I'm imagining which scenario's could jeopardize my longs.

So what do I not want to see today:

(1) one-time-framing lower

(2) a sudden break creating a double distribution lower

I agree, that 'monitoring for continuation' always looks better in hindsight...

But with value building higher and POC now 5 wide, I'm okay with giving up even 100% of my unrealized profit as the odds of trading lower have decreased.

My position is long 2475.75 with a target somewhere above 2486.50 (ATH)

(In case they do try something funny, I also have a short scenario if today turns out to be a 'look above balance and fail')

Thanks Aladin...I think this would have been a very hard trade to make for me as we opened almost 5 points outside the bracket highs.......the other challenge for me and many other Mp players is they probably would have covered when we took out the low of the second 30 minute bar today thinking we would begin one time framing lower....but like you said " every trader has his/her own trading style" ...so more power to ya...nicely done and thanks for taking the time writing

Originally posted by Aladdin

Ha, Bruce, now here's the beauty of trading.

Every trader has his/her own trading style.

For me, monitoring for continuation of a long position would mean that I'm imagining which scenario's could jeopardize my longs.

So what do I not want to see today:

(1) one-time-framing lower

(2) a sudden break creating a double distribution lower

I agree, that 'monitoring for continuation' always looks better in hindsight...

But with value building higher and POC now 5 wide, I'm okay with giving up even 100% of my unrealized profit as the odds of trading lower have decreased.

My position is long 2475.75 with a target somewhere above 2486.50 (ATH)

(In case they do try something funny, I also have a short scenario if today turns out to be a 'look above balance and fail')

just wanted to take a quick moment to thank all who vote - even on days I get it somewhat wrong....I appreciate it !!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.