Long-term and Short-term Setups

Hello Traders,

I’m a pro with 7+ years of experience in the market. I want to help out retail traders. So, here I post some of my long-term and short-term setups and crisp points of the reasoning and my conclusion. Hope it benefits you.

AUD/USD Technical Analysis

~~ The counter has formed a gramophone pattern.

~~ It has hit the upper trendline and is coming down with strong momentum.

~~ We advise traders to go short when the pair breaks the support level of 0.71745 and expect a sell-off to lower trendline.

I’m a pro with 7+ years of experience in the market. I want to help out retail traders. So, here I post some of my long-term and short-term setups and crisp points of the reasoning and my conclusion. Hope it benefits you.

AUD/USD Technical Analysis

~~ The counter has formed a gramophone pattern.

~~ It has hit the upper trendline and is coming down with strong momentum.

~~ We advise traders to go short when the pair breaks the support level of 0.71745 and expect a sell-off to lower trendline.

NZD/USD Technical Analysis

~~ The resistance zone of 0.668-0.67 has been a tough nut for NZD/USD.

~~ It failed to cross it despite three valiant efforts and the one time it crossed it was rejected at higher levels.

~~ So, the bulls are running for cover and we expect the pair to head down to lower levels in search of support.

~~ The resistance zone of 0.668-0.67 has been a tough nut for NZD/USD.

~~ It failed to cross it despite three valiant efforts and the one time it crossed it was rejected at higher levels.

~~ So, the bulls are running for cover and we expect the pair to head down to lower levels in search of support.

CAD/JPY Technical Analysis

~~ The counter has recovered from the lows with a strong V-shaped rally.

~~ It has now crossed a critical resistance level of 80.162.

~~ The structure resembles a bearish shark pattern and we expect the pair to rally to the completion zone for now.

~~ The counter has recovered from the lows with a strong V-shaped rally.

~~ It has now crossed a critical resistance level of 80.162.

~~ The structure resembles a bearish shark pattern and we expect the pair to rally to the completion zone for now.

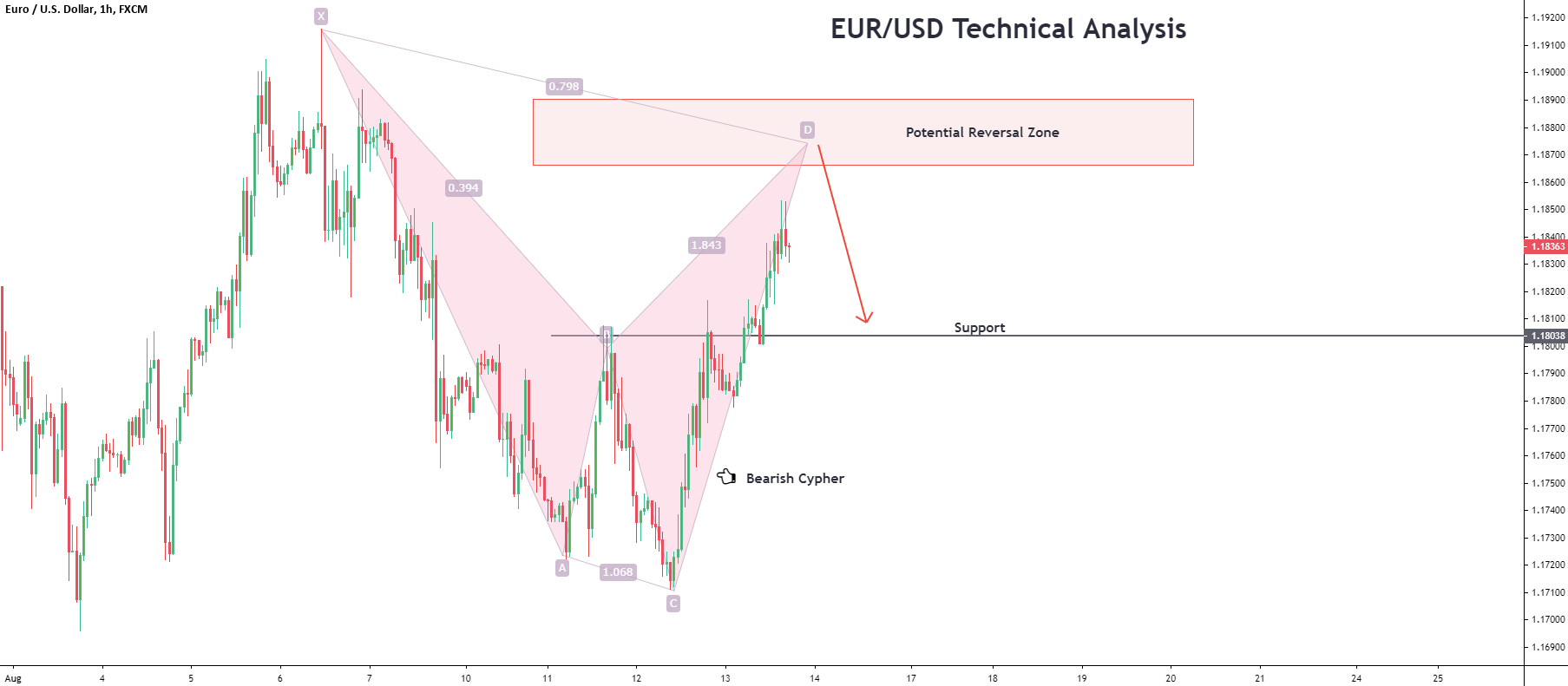

EUR/USD Technical Analysis

~~ The counter has been rising sharply from the low.

~~ The entire structure looks like a bearish cypher pattern.

~~ We expect the pair to face resistance at the reversal zone marked in the chart and move back to support level.

~~ The counter has been rising sharply from the low.

~~ The entire structure looks like a bearish cypher pattern.

~~ We expect the pair to face resistance at the reversal zone marked in the chart and move back to support level.

GBP/USD Technical Analysis

~~ The counter is forming a descending triangle at the high.

~~ It made a fake-out at the resistive trendline and then sold off only to form a bearish flag pattern in the near-term.

~~ We expect the bearish flag to break down and the price to move to the short-term support zone.

~~ The counter is forming a descending triangle at the high.

~~ It made a fake-out at the resistive trendline and then sold off only to form a bearish flag pattern in the near-term.

~~ We expect the bearish flag to break down and the price to move to the short-term support zone.

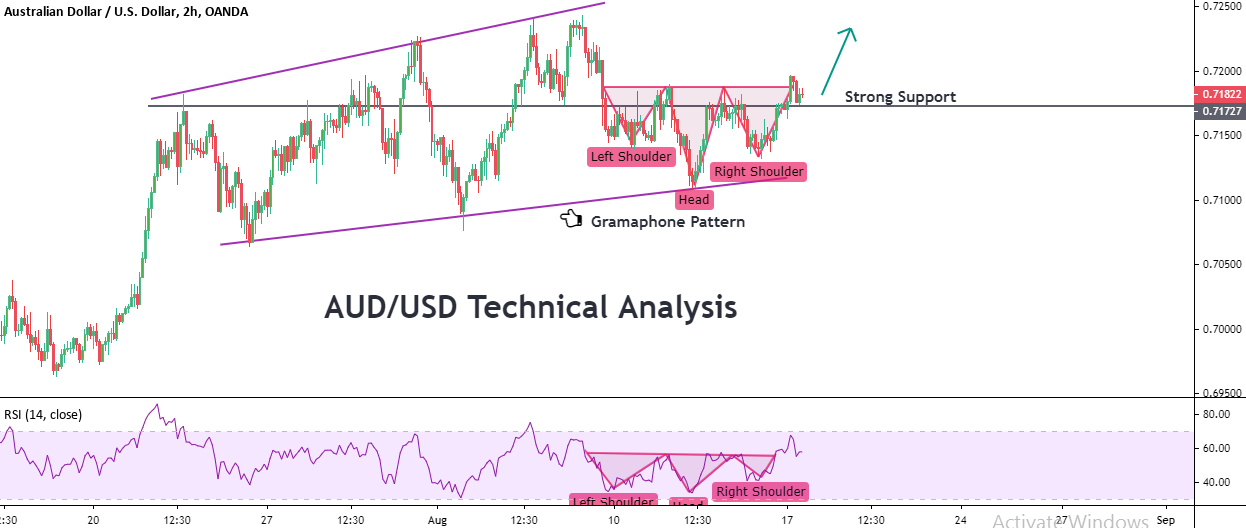

AUD/USD Technical Analysis

~~ As we mentioned earlier, AUD/USD has formed a gramophone pattern.

~~It has now formed an inverted head and shoulder pattern the supportive trendline and has broken out.

~~ And the RSI indicator has also replicated the same pattern, which validates the strength in the counter.

~~ Further, the prices are now trading above a strong support level of 0.71727.

~~ Hence, we expect the pair to be bullish from here on.

~~ As we mentioned earlier, AUD/USD has formed a gramophone pattern.

~~It has now formed an inverted head and shoulder pattern the supportive trendline and has broken out.

~~ And the RSI indicator has also replicated the same pattern, which validates the strength in the counter.

~~ Further, the prices are now trading above a strong support level of 0.71727.

~~ Hence, we expect the pair to be bullish from here on.

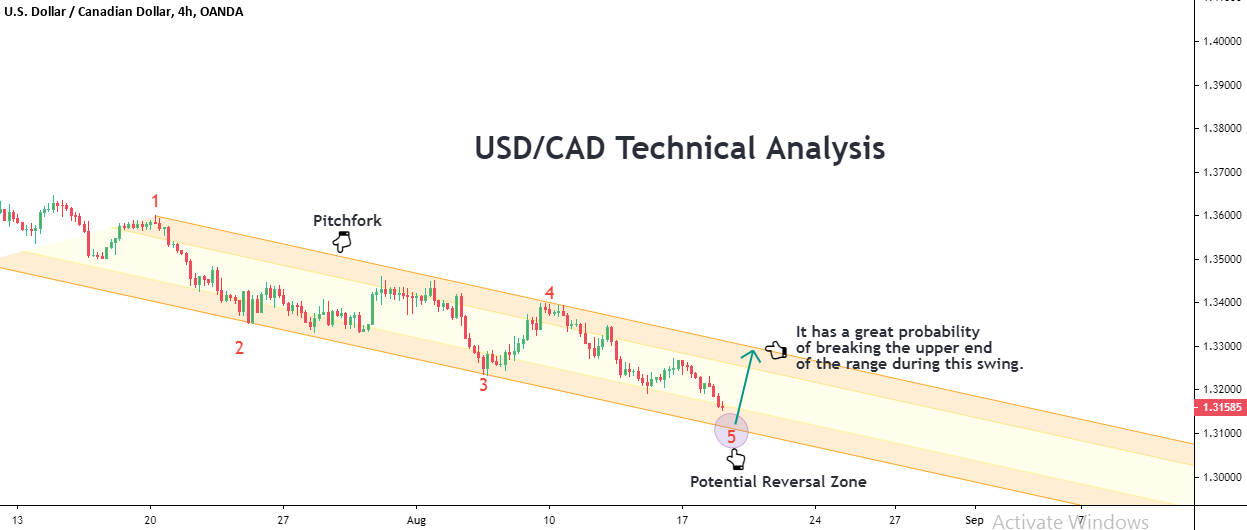

USD/CAD Technical Analysis

~~ The counter has been trading with a bearish bias for long.

~~ The down move can be plotted with a pitchfork and the pair is making its last leg of the move down.

~~ Hence, we advise traders to go long at the lower parallel.

~~ And the upswing has a great chance to break the upper end of the range.

~~ The counter has been trading with a bearish bias for long.

~~ The down move can be plotted with a pitchfork and the pair is making its last leg of the move down.

~~ Hence, we advise traders to go long at the lower parallel.

~~ And the upswing has a great chance to break the upper end of the range.

EUR/USD Technical Analysis

~~ The counter has made a bullish breakout from the consolidation.

~~ It is now taking support and broken resistance, which is a powerful sign.

~~ Further, the consolidation can be interpreted as wave 4 and it is gonna make a move to wave 5.

~~ Hence, we expect the pair to be bullish in the near-term

~~ The counter has made a bullish breakout from the consolidation.

~~ It is now taking support and broken resistance, which is a powerful sign.

~~ Further, the consolidation can be interpreted as wave 4 and it is gonna make a move to wave 5.

~~ Hence, we expect the pair to be bullish in the near-term

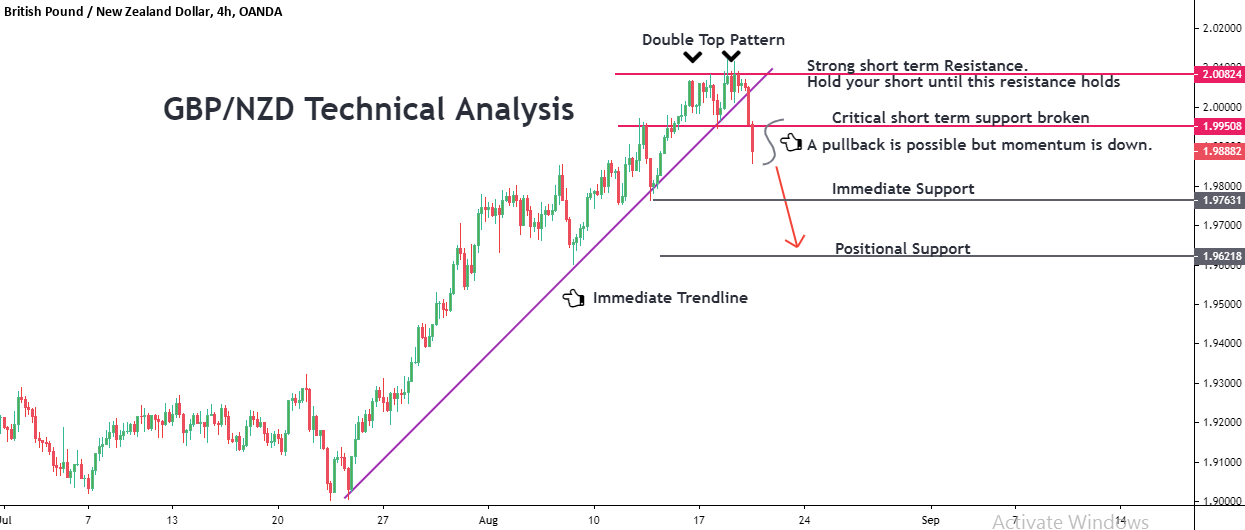

GBP/NZD Technical Analysis

~~ The counter has formed a topping out formation in the near-term.

~~ It made a double top and has broken a key support level of 1.99508.

~~ Further, the round number of 2.00 can act as psychological barrier in the near-term.

~~ Though a pullback to the top cannot be ruled out, we still expect the pair to be bearish in the near-term.

~~ The counter has formed a topping out formation in the near-term.

~~ It made a double top and has broken a key support level of 1.99508.

~~ Further, the round number of 2.00 can act as psychological barrier in the near-term.

~~ Though a pullback to the top cannot be ruled out, we still expect the pair to be bearish in the near-term.

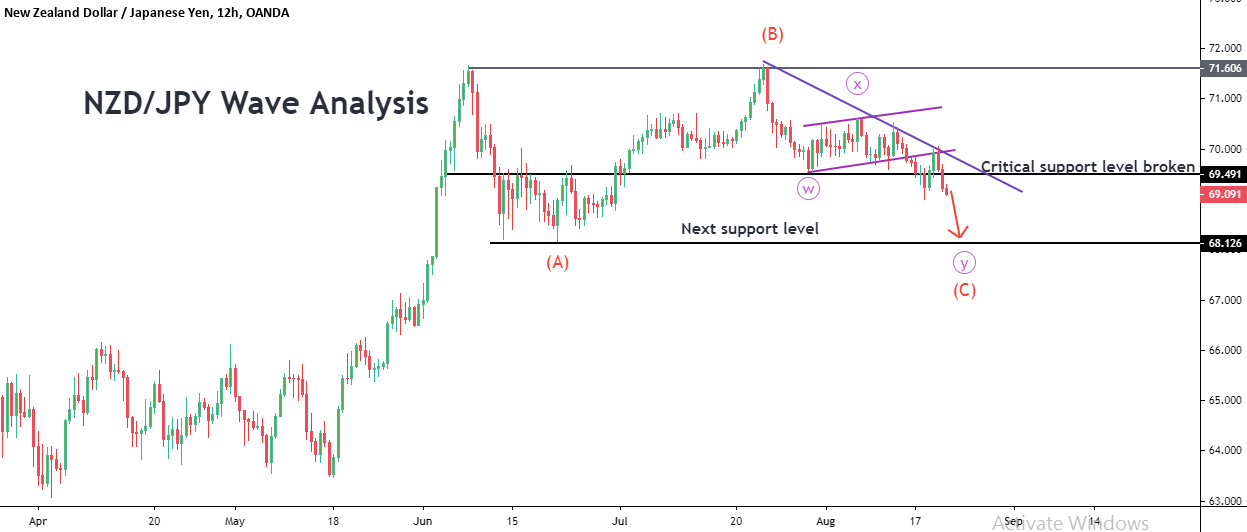

NZD/JPY Wave Analysis

~~ The counter is currently formed a flat ABC corrective wave.

~~ It broke out from a bear flag pattern, tested the broken support, and is now coming down with strong momentum.

~~ Hence, we expect the pair to be bearish in the near-term.

~~ The counter is currently formed a flat ABC corrective wave.

~~ It broke out from a bear flag pattern, tested the broken support, and is now coming down with strong momentum.

~~ Hence, we expect the pair to be bearish in the near-term.

EUR/JPY Technical Analysis

~~ The counter had multiple supports- trendline, bullish flag support and price action support.

~~ But it has broken all the levels and bulls are trapped big time.

~~ Hence, we expect some long unwinding move in the counter.

~~ The counter had multiple supports- trendline, bullish flag support and price action support.

~~ But it has broken all the levels and bulls are trapped big time.

~~ Hence, we expect some long unwinding move in the counter.

When it comes to long-term and short-term setups in forex trading, each has its own strategy and approach depending on your goals and risk tolerance. Understanding the differences and how to execute these setups effectively can make a significant difference in your trading success. Traders offer some insightful perspectives that might help you choose the right approach for your trading style.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.