DVA after RE

max asks this question in the Due Diligence thread:

Okay, here is a setup that I believe works but I have not been able to back test it (yet) to confirm that it works more than it fails nor have I been able to test what type of stops or targets to use on it.

The entry signal is as follows and these are Market Profile concepts.

1. Wait for Range Extension. This will show you the direction in which you are going to trade. (if RE is on the up side then you will be taking a long.)

2. Place a limit order to go long at the Developing Value Area Low if RE is on the upside and at the DVAH if RE is on the downside.

3. The limit will need to be moved if the relevant DVA moves before the limit is hit which is highly likely.

quote:

...if there is anyone in the forum who is consistently making money can you please chime in and share some setups or techniques. i don't think my brain can take any more books or articles on trader psych.

Okay, here is a setup that I believe works but I have not been able to back test it (yet) to confirm that it works more than it fails nor have I been able to test what type of stops or targets to use on it.

The entry signal is as follows and these are Market Profile concepts.

1. Wait for Range Extension. This will show you the direction in which you are going to trade. (if RE is on the up side then you will be taking a long.)

2. Place a limit order to go long at the Developing Value Area Low if RE is on the upside and at the DVAH if RE is on the downside.

3. The limit will need to be moved if the relevant DVA moves before the limit is hit which is highly likely.

I quickly scanned through the ES to see when this strategy last triggered a trade and found that the last 2 were on 12/13 (success) and 12/15 (failure). Here are the charts for the one that worked and the one that failed.

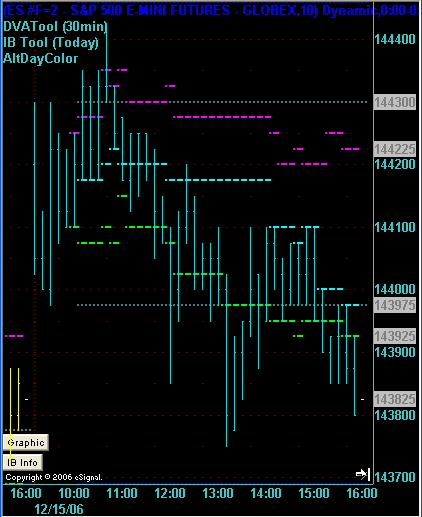

In this chart we have RE to the upside (dotted grey line) and then we move back to DVAL (dashed lime line) which is where the entry is but this trade fails and we get stopped out.

On this chart there is RE to the downside (dotted grey line) and then we move back up to the DVAH (dashed fuschia line) which is where the limit order is moved down to. Questionable if we were filled short here because we did not trade through the DVAH.

In this chart we have RE to the upside (dotted grey line) and then we move back to DVAL (dashed lime line) which is where the entry is but this trade fails and we get stopped out.

On this chart there is RE to the downside (dotted grey line) and then we move back up to the DVAH (dashed fuschia line) which is where the limit order is moved down to. Questionable if we were filled short here because we did not trade through the DVAH.

ty day. real good of you to do that. now cmon you other pro traders and join in. don't worry. the market is liquid enough for all of us to make money and still have an edge

spoken like a pro but just a newbie

max

spoken like a pro but just a newbie

max

How can we test this strategy?

What sort of stops and targets do you use for this in those instruments that you have just mentioned?

I'd like to know the answer to this question also if anyone trades it and do you find the POC or high volume area becomes a good target? Thanks

Bruce

Bruce

quote:

Originally posted by elite trader

What sort of stops and targets do you use for this in those instruments that you have just mentioned?

How do I include a market snapshot?

myptofvu: Have a look at the top 2 postings in this part of the forum: Charts

quote:

Originally posted by BruceM

I'd like to know the answer to this question also if anyone trades it and do you find the POC or high volume area becomes a good target? Thanks

Bruce

quote:

Originally posted by elite trader

What sort of stops and targets do you use for this in those instruments that you have just mentioned?

Bruce & Elite: Apologies for missing this question. In the past I have used a 2 point stop on the ES for this although I don't know if that is optimal.

quote:

Originally posted by elite trader

How can we test this strategy?

Again, apologies for taking so long to reply.

There are 2 obvious ways to back test this. One is to run it through a back testing program. This is more complicated if you're not familiar with programming and back testing. You need an indicator, for example, that will generate the developing value areas.

A much easier way to back test this for the average person is to do it manually on a daily basis. You can combine this with other market analysis and learning at the end of the day. Just make notes about what happened and if a trade was triggered and keep all of the results in a spreadsheet. If you do this for a few months then you should have some real usable stats and figures.

What I have are two png images I want to include. How do I do this?

ah cool..that makes sense...thanks DT

Bruce

Bruce

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.