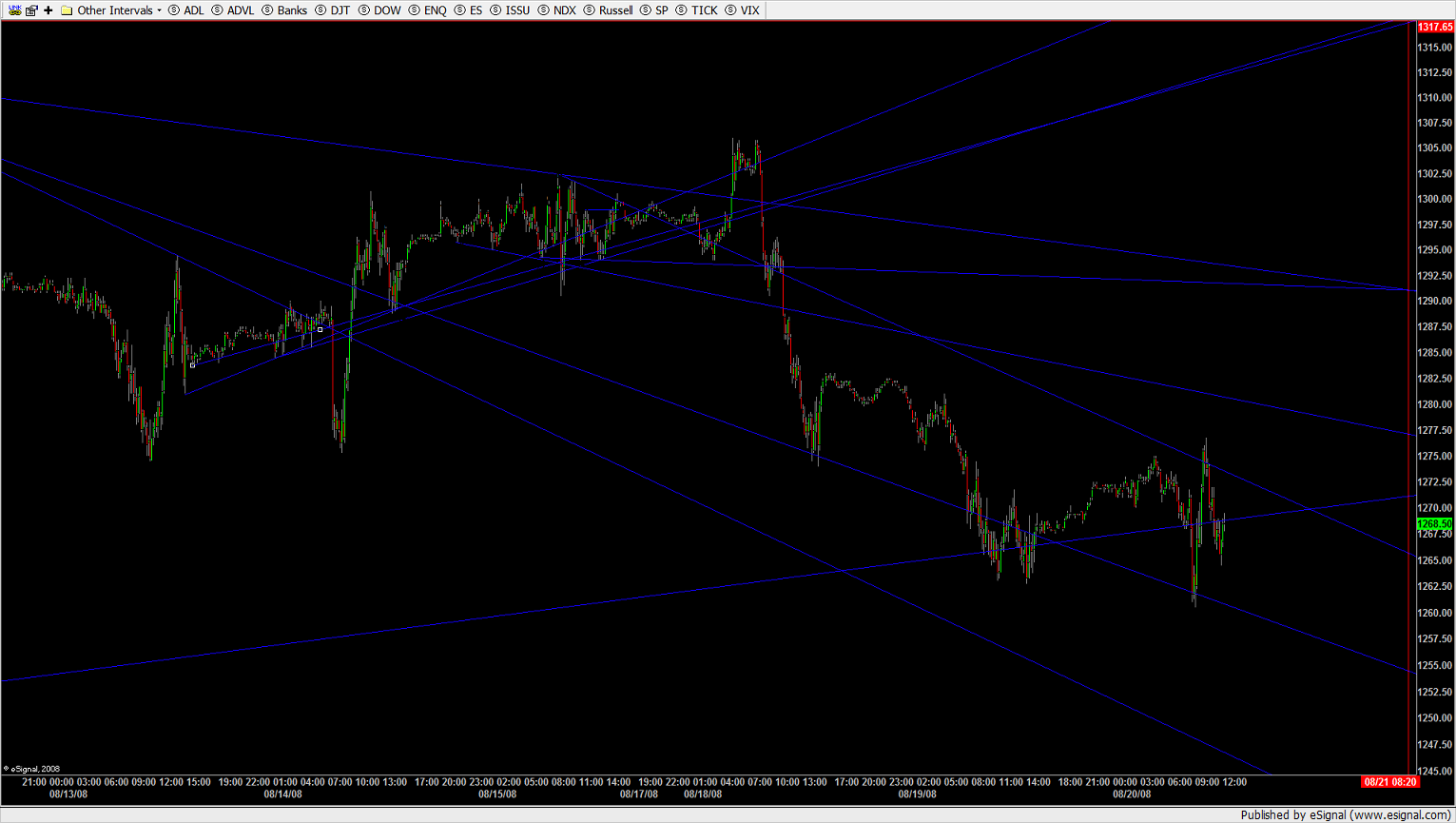

ES 8-20-08

ES is as I type down 50cent, they were up about 6 bucks in the overnight. I would have perferred a gap up since we've been down 50.75 points since the 1313.5 high on 8/11. I think this is going to add volitilty to the early morning trading.

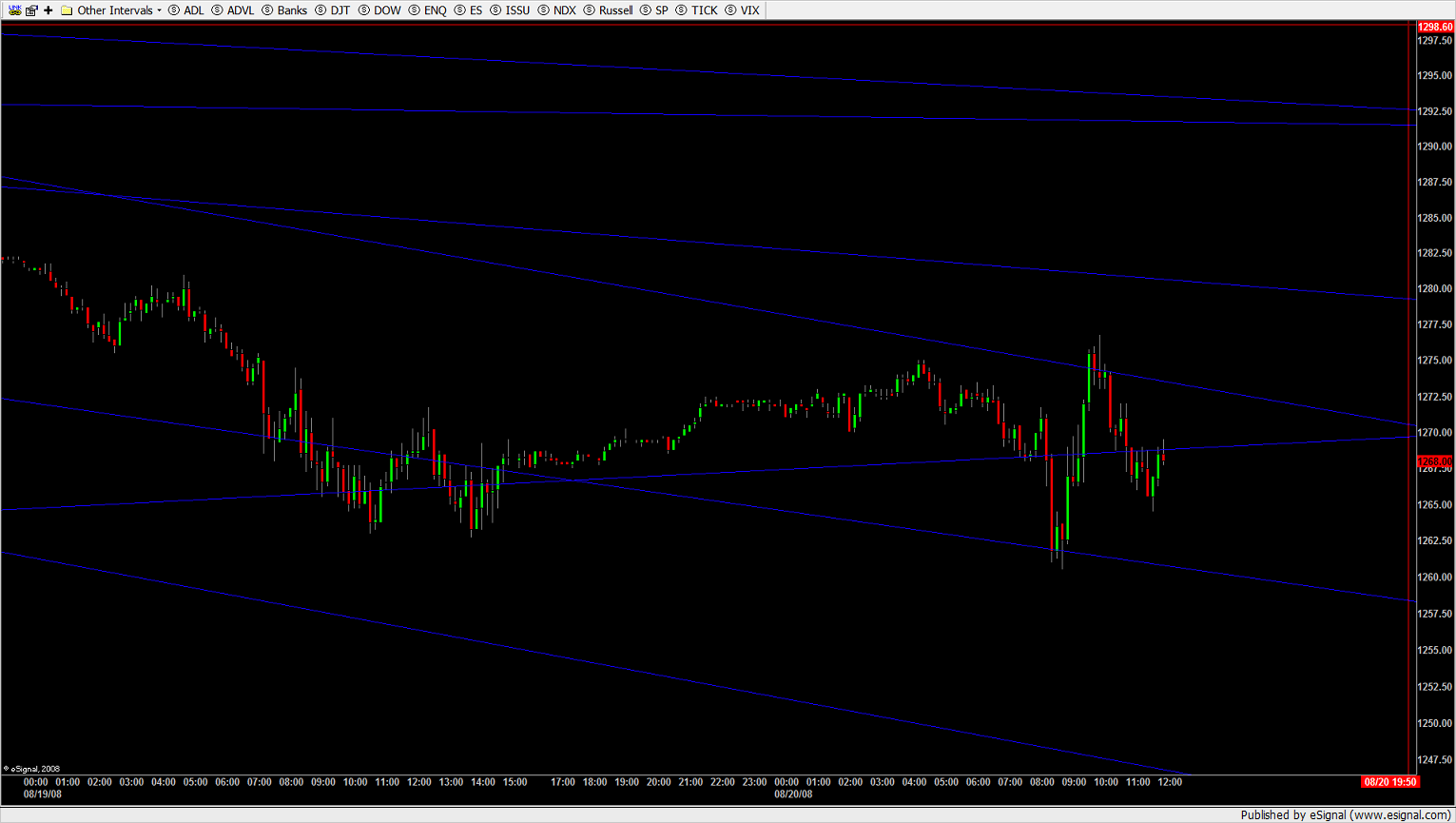

no doubt a failure on this push up will try and swing back down for those folks waiting with stops below 66.50...I'm waiting to see if they can get new highs or lows today before I do anything now...good luck if your in it

I just plotted nyse uvol - dvol, on a 2min chart, with a 10 period price channel, when it reaches new 10 period lows or highs of the channel seems to give decent signals....

edit, 12 period price channel seems a little less whippy

edit, 12 period price channel seems a little less whippy

Dam, wanted two sell two at 1273.25 10 min ago but we never made it. I really suck today.I could really use one of your charts here SPQR!

Short term scalp long at 1266.75.tight stop at 1275.00....just hit.raising stop to 1275.75

filled at 12:22,reversed to short 1265.75.ONE CONTRACT ONLY, Stop at1277.25

down 7.5 handles on the day!THIS ONE I HOPE TO HOLD FOR A WHILE.

RESETTING STOP -1268.00. If hit im done for the day.

Well, thats it for me...down 9.75 handles. Hope you all do better. See ya tommorrow

After taking out those lows from 8/07 and then trading above yesterdays high and now half-way back down forming a nice bell curve on the 15min MP, looks like a good buy low and sell high covering at the POC or VWAP for the rest of the day....

Up late, Kool. Working on something.

Let's see here: well this is the bear again. The entire bull run's lowest extremity baseline has been hit 11 times and we're trading at it still but this move likely will clench it for bears.

Bulls don't have any room to price satisfy they struggling to hold. Instead I'ld look for bear controlled bull ABC corrections when they do appear to have edge to the upside. This last bounce from 60.50 was an attempt at a bull first wave but was turned into a bear first wave, pulling up on the second wave now. We'll likely see a break into the 50s from here.

And the monthly mean pivot is at 54.

Let's see here: well this is the bear again. The entire bull run's lowest extremity baseline has been hit 11 times and we're trading at it still but this move likely will clench it for bears.

Bulls don't have any room to price satisfy they struggling to hold. Instead I'ld look for bear controlled bull ABC corrections when they do appear to have edge to the upside. This last bounce from 60.50 was an attempt at a bull first wave but was turned into a bear first wave, pulling up on the second wave now. We'll likely see a break into the 50s from here.

And the monthly mean pivot is at 54.

quote:

Originally posted by Printer

Here is a web site that has the square of nime numbers for popular futures contracts

http://www.imtc.com/cci/square_of_nine_index.htm

Printer

Thanks Printer

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.