Es short term trading 9-9-10

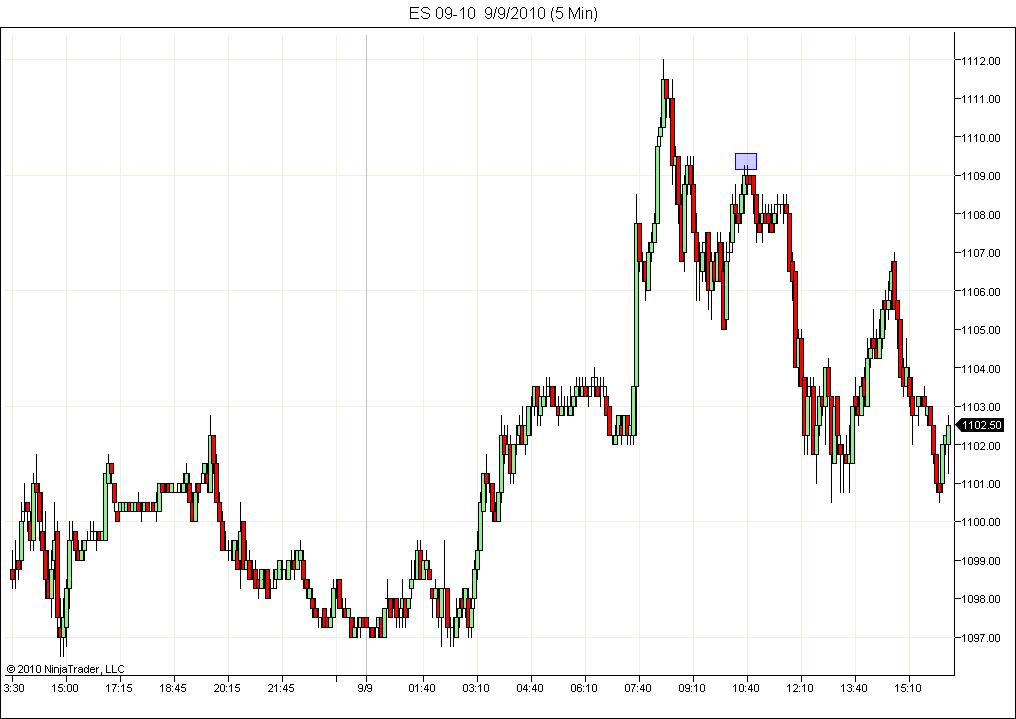

The O/N report has us going up against the first big resistance zone at 1106.75 - 1110...

so I'm trying shorts at 1108.....not risking too far above that 1110 number on this

so I'm trying shorts at 1108.....not risking too far above that 1110 number on this

took one off at 06.25...holding one...retest of 1108 stops it out here in ON

trying for 1105 on last contract...still trading September..more volume here still...will switch to Dec around 11 a.m

I think the far end of the zone will be a better sell in day session....we have consolidated for the last three days so we obviously need to be aware for a legitamite break out....but without volume flowing in then we will drift back to 1103 and lower to 1098- 1097 area

short and small at 1110.25........next zone which I am not gearing my stops to is 1118 - 1120,,,,that is the big volume magnet from the MP thread

I don't want to see this beyond 1113 in RTH but will manage trade based on RTH numbers

I don't want to see this beyond 1113 in RTH but will manage trade based on RTH numbers

ideal target is 1108 area as that is the high of the one minute bar that created the volume spike from 8:30 report

stops taken out at 1109.5 or your 1110 level

GS at 150 R level

intc above 18 here

goog broke 470 and at 477

wonder if 1115 will be any R here?

1106 now S level

GS at 150 R level

intc above 18 here

goog broke 470 and at 477

wonder if 1115 will be any R here?

1106 now S level

sorry, I won't really be back trading fulltime until Monday.

but a couple of things I can throw in the soup for today

would not be bullish if price cannot find support at yesterday's H 1103.00 SEP) would be better if last week's H (1104.50 SEP) acts as support (+/- 1 pt)

after 3 days of relatively tight range RTH, potential for a squeeze up appears High to me,

SEP has gap open RTH prices 1104.50 to 1119.75 estalished by down open on 8/11/10

my thought is squeeze up more likely, but never argue with PA. (so I would reject my meaningless thoughts if the 1104-1103 area is tested and fails (this would actually be pretty bearish)

It is a balancing act,

from my own studies of consecutive gaps in the same direction, if gap up today is greater than 1 pt, regardless of anything else, just raw data of 2 consecutive gaps, historically gap fills about 74% of the time (data 2009 back to 1999 ES)

Chance of gap fill today diminishes if price opens greater than 40% of 5 day average true range added to yesterday's close. That means if open today is greater than 1105.75, historically a gap fill occurs only about 4 times out of 10.

Today would be a good day (huh boy, here's the kiss of death) to watch SEP price once the RTH open occurs.

if price can move above the 5 day average of H versus Open before 11am eastern, that is usually a sign that bulls are in command and bears are sweating, and they will be willing to exit short positions by buying, which ironically acts as support for prices (meaning retracements not greater than 6 pts).

5 day average of H versus Open SEP is 9.25, that means, once the RTH opens, take the open and add 9.25 to the opening price. if Px can get above ther by 2 pts, it should act like a support.

here's an intangible: there might be a squeeze today for the simple reason that bears holding shorts in the SEP are ALL in losing positions for anything established below the Low of last week (1104.50) if those shorts are still in place, every print above 1104.50 is an "in the red" position for ALL those positions.

That combined with the roll forward can put a spike on the chart. Whether all the bears buy to exit at once is something I can't even guess at.

PA rules, if supports break, most of this scenario is simply wrong.

Good trading to all.

but a couple of things I can throw in the soup for today

would not be bullish if price cannot find support at yesterday's H 1103.00 SEP) would be better if last week's H (1104.50 SEP) acts as support (+/- 1 pt)

after 3 days of relatively tight range RTH, potential for a squeeze up appears High to me,

SEP has gap open RTH prices 1104.50 to 1119.75 estalished by down open on 8/11/10

my thought is squeeze up more likely, but never argue with PA. (so I would reject my meaningless thoughts if the 1104-1103 area is tested and fails (this would actually be pretty bearish)

It is a balancing act,

from my own studies of consecutive gaps in the same direction, if gap up today is greater than 1 pt, regardless of anything else, just raw data of 2 consecutive gaps, historically gap fills about 74% of the time (data 2009 back to 1999 ES)

Chance of gap fill today diminishes if price opens greater than 40% of 5 day average true range added to yesterday's close. That means if open today is greater than 1105.75, historically a gap fill occurs only about 4 times out of 10.

Today would be a good day (huh boy, here's the kiss of death) to watch SEP price once the RTH open occurs.

if price can move above the 5 day average of H versus Open before 11am eastern, that is usually a sign that bulls are in command and bears are sweating, and they will be willing to exit short positions by buying, which ironically acts as support for prices (meaning retracements not greater than 6 pts).

5 day average of H versus Open SEP is 9.25, that means, once the RTH opens, take the open and add 9.25 to the opening price. if Px can get above ther by 2 pts, it should act like a support.

here's an intangible: there might be a squeeze today for the simple reason that bears holding shorts in the SEP are ALL in losing positions for anything established below the Low of last week (1104.50) if those shorts are still in place, every print above 1104.50 is an "in the red" position for ALL those positions.

That combined with the roll forward can put a spike on the chart. Whether all the bears buy to exit at once is something I can't even guess at.

PA rules, if supports break, most of this scenario is simply wrong.

Good trading to all.

have 1111.25 on now too...likeing that 08.50 number...nobody on that and it is breakout point...see your histogram

us bears want that 04 - 05 area if we can take over that 08.50..tricky spot now...no reports to spike us, so no concrn there

hey Paul,

we hit the 1.62 of Tuedsays range on the opne....which I guess in theroy would state that we will trade to twice the range of Tuesday...

The real question is:

Can we use Tuesdays range ( first trade day of the week) for the 200% target..? I'm obviously not long but just curious how a holdiday affects that

we hit the 1.62 of Tuedsays range on the opne....which I guess in theroy would state that we will trade to twice the range of Tuesday...

The real question is:

Can we use Tuesdays range ( first trade day of the week) for the 200% target..? I'm obviously not long but just curious how a holdiday affects that

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.