Is the pitbull Crazy?

The purpose of this post is twofold. One is to explain a trade I took on 1-12-11 in the day trading threads and the other is that I am looking for feedback on peoples ability to comprehend what I am trying to explain. I donot think I am a great communicator and at times in the day trading threads it gets frustrating at the lack of questions on things I've typed in. I don't want to assume that what I write about is crystal clear to everyone reading them.

So I'd like you to vote this thread up if you understand the reasoning for the trade and the concepts and vote it down if you don't. You may not agree with the trade and it may not even be a trade you would take but that should not stop you from understanding the reasons for taking it.

For those who can't or don't vote then please leave a comment in this thread of send me a private message with your feedback. This will help me to know that my effort at posting my trades and ideas is coming through or let me know that I'm not doing a good job explaining and need to step up my efforts at getting the ideas across.

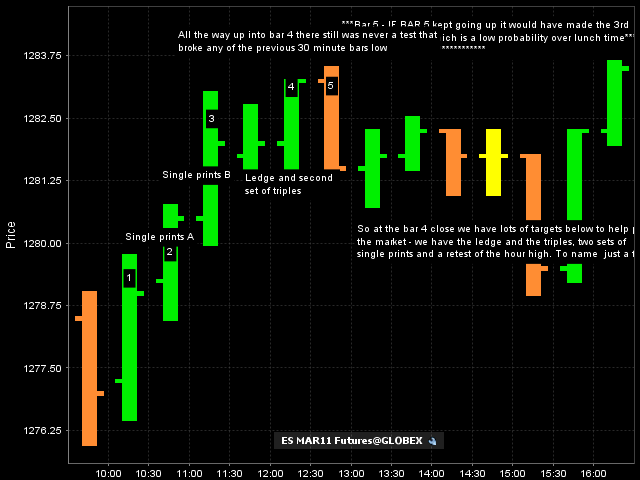

On Tueday 01-12-11 we gapped higher and started trading above the R2 level of the day. We then started making higher highs combined with higher lows on the 30 minute time frame. Up until 12:30 we never had any bar take out ( trade below) the previous 30 minute bars low. I can almost say that we ALWAYS will make a test of a previous bars low at some point during the trading day when we trend! I can't recall from memory a day in the market that we haven't in recent years.

So at the close of bar 4 we have multiple sets of single prints , and a ledge which is also an area of triples below the market. Also an air pocket on the 5 minute bars ( not shown). It's also 12:30 so it is not a great TRENDING time frame. Here is the context chart.

I took the entry ( for the record this was my second short attempt up here) at bar 4's close BECAUSE I knew that there was a high probability that even if the next bar went higher that it would probably come back down because you donot normally see THREE sets of single prints before a reaction test DOWN. So if bar 5 kept going up then a third set of single prints would have formed. This and all those targets below helped me take the trade.

here is what happened after: Note how we filled in the ledge, the air pockets and all single prints. These charts and post take too much time, probably too much time..so I'd like to know if you can understand them.

Thanks

Bruce

So I'd like you to vote this thread up if you understand the reasoning for the trade and the concepts and vote it down if you don't. You may not agree with the trade and it may not even be a trade you would take but that should not stop you from understanding the reasons for taking it.

For those who can't or don't vote then please leave a comment in this thread of send me a private message with your feedback. This will help me to know that my effort at posting my trades and ideas is coming through or let me know that I'm not doing a good job explaining and need to step up my efforts at getting the ideas across.

On Tueday 01-12-11 we gapped higher and started trading above the R2 level of the day. We then started making higher highs combined with higher lows on the 30 minute time frame. Up until 12:30 we never had any bar take out ( trade below) the previous 30 minute bars low. I can almost say that we ALWAYS will make a test of a previous bars low at some point during the trading day when we trend! I can't recall from memory a day in the market that we haven't in recent years.

So at the close of bar 4 we have multiple sets of single prints , and a ledge which is also an area of triples below the market. Also an air pocket on the 5 minute bars ( not shown). It's also 12:30 so it is not a great TRENDING time frame. Here is the context chart.

I took the entry ( for the record this was my second short attempt up here) at bar 4's close BECAUSE I knew that there was a high probability that even if the next bar went higher that it would probably come back down because you donot normally see THREE sets of single prints before a reaction test DOWN. So if bar 5 kept going up then a third set of single prints would have formed. This and all those targets below helped me take the trade.

here is what happened after: Note how we filled in the ledge, the air pockets and all single prints. These charts and post take too much time, probably too much time..so I'd like to know if you can understand them.

Thanks

Bruce

Here is my impression Bruce.

A lot of information is being delivered on this chart and in your comments. I understand the trade you took and can see all the data points you are looking at.

My sense though is this trade is successful for you due to your experience. I can't figure out what your actual trade idea (setup?) is or what the trigger is.

I can gather your idea is based on 30 min closes but other than that it needs some additional clarification.

A lot of information is being delivered on this chart and in your comments. I understand the trade you took and can see all the data points you are looking at.

My sense though is this trade is successful for you due to your experience. I can't figure out what your actual trade idea (setup?) is or what the trigger is.

I can gather your idea is based on 30 min closes but other than that it needs some additional clarification.

Excellent Lorn...I hope more people have feedback like this. You hit upon something which is so important and that is believing in your trade ideas. Many times that comes from your own experience or wacthing and learning from others. One of the main reasons I focus on posting trade ideas and concepts is that no two traders are alike so expecting someone to take the exact same trade as I would is expecting a lot. Afterall, I don't know anybodies specific account size or risk tolerance.

The things I share are usually things that happen in the market a very high percent of the time but it is always up to the individual to find a way to use the information they think has value.

You know all of that so lets briefly discuss this trade idea or setup from my viewpoint.

1)It is lunch time yesterday and we traded through a ratchet level at 81.25.

2)We have created single prints that are unfilled twice already

3)We have air pockets on the 5 minute chart below

4) We have two sets of triples under the current market prices

5) We never tested a previous 30 minute bars low.

6) we have major $tick and volume divergences

That is an expanded version of the context for me. As you know I trade on expectations and more than 90% of the time I am looking for mean reversion ideas....so the market is rallying yesterday on much lower volume than it did earlier in the day and when Bar 4 ends and bar 5 begins I take the short. There IS no specific entry bar but I know that there are low odds that we will keep rallying all day and I am not expecting a THIRD set of single prints to form. So that is a heads up for me. My trades ALWAYS start with a target...something that needs testing...then I find a way to take the trade. Even if I just jump intio the market.

The real trick to any of this is to know when you are wrong. Without having any good numbers up that high yesterday I was using the Rats....so if the market kept going I would have stopped out at the next Rat up at 87.50 but that would have also created more single prints if bar 5 went up that high right away...so good chance I would have looked for shorts again after I cleared my mind.

The bottom line with all of this is that we have great ideas out here on the forum. So the trader needs to decide how to use the information if they like to use target/ mean regression trading. I know you are familiar with Dr. Bretts work so you can easily see how we had a huge divergence in Volume and in $ ticks after we put in those 11:30 a.m highs.....we need volume to sustain a move outside of a range and broad participation....we had neither at the time of that fade...so we reverted back into the current range.

and keep after me...if that doesn't clarify anything then let me know..I will work harder....sometimes these trades may look almost random but they are put on in proper context.... I am not usally concerned with a specific fill price on my entry or my exits.

The things I share are usually things that happen in the market a very high percent of the time but it is always up to the individual to find a way to use the information they think has value.

You know all of that so lets briefly discuss this trade idea or setup from my viewpoint.

1)It is lunch time yesterday and we traded through a ratchet level at 81.25.

2)We have created single prints that are unfilled twice already

3)We have air pockets on the 5 minute chart below

4) We have two sets of triples under the current market prices

5) We never tested a previous 30 minute bars low.

6) we have major $tick and volume divergences

That is an expanded version of the context for me. As you know I trade on expectations and more than 90% of the time I am looking for mean reversion ideas....so the market is rallying yesterday on much lower volume than it did earlier in the day and when Bar 4 ends and bar 5 begins I take the short. There IS no specific entry bar but I know that there are low odds that we will keep rallying all day and I am not expecting a THIRD set of single prints to form. So that is a heads up for me. My trades ALWAYS start with a target...something that needs testing...then I find a way to take the trade. Even if I just jump intio the market.

The real trick to any of this is to know when you are wrong. Without having any good numbers up that high yesterday I was using the Rats....so if the market kept going I would have stopped out at the next Rat up at 87.50 but that would have also created more single prints if bar 5 went up that high right away...so good chance I would have looked for shorts again after I cleared my mind.

The bottom line with all of this is that we have great ideas out here on the forum. So the trader needs to decide how to use the information if they like to use target/ mean regression trading. I know you are familiar with Dr. Bretts work so you can easily see how we had a huge divergence in Volume and in $ ticks after we put in those 11:30 a.m highs.....we need volume to sustain a move outside of a range and broad participation....we had neither at the time of that fade...so we reverted back into the current range.

and keep after me...if that doesn't clarify anything then let me know..I will work harder....sometimes these trades may look almost random but they are put on in proper context.... I am not usally concerned with a specific fill price on my entry or my exits.

Originally posted by Lorn

Here is my impression Bruce.

A lot of information is being delivered on this chart and in your comments. I understand the trade you took and can see all the data points you are looking at.

My sense though is this trade is successful for you due to your experience. I can't figure out what your actual trade idea (setup?) is or what the trigger is.

I can gather your idea is based on 30 min closes but other than that it needs some additional clarification.

Bruce,

Your explanation is great and more importantly its showing how a discretionary trade is placed.

At first I thought you were trying to show us a mechanical trade idea you were working on but now I realize that's not the case.

We have all been down the mechanical trade setup road and I'm sure there are traders who have tremendous success that way but what you are showing here is by far in my view the best type of trade setup ie. discretionary.

What does that mean exactly? It means a trader's ability to use experience to start building a case for a trade and when the risk/reward presents a suitable entry you take it.

All these ideas you look at, trips, single prints, low volume, 30 min closes, etc. are all pieces to your business plan and its the experience you have from years of working at it that allows you to execute the plan you are trading.

Great stuff Bruce, showing us how the mind of a trader works.

Your explanation is great and more importantly its showing how a discretionary trade is placed.

At first I thought you were trying to show us a mechanical trade idea you were working on but now I realize that's not the case.

We have all been down the mechanical trade setup road and I'm sure there are traders who have tremendous success that way but what you are showing here is by far in my view the best type of trade setup ie. discretionary.

What does that mean exactly? It means a trader's ability to use experience to start building a case for a trade and when the risk/reward presents a suitable entry you take it.

All these ideas you look at, trips, single prints, low volume, 30 min closes, etc. are all pieces to your business plan and its the experience you have from years of working at it that allows you to execute the plan you are trading.

Great stuff Bruce, showing us how the mind of a trader works.

Bruce, you worry too much about others who have no guts to ask LOL Sorry but have to say it!

Bruce, I try to study your way of seeing and find it interesting, usually read all of your posts so I can learn your ways. However, I keep doing my work the same way as before, so when I post, there's some what of a contrast. If we are congruent, coming from different angles of seeing, then the probabilities for success have increase in our favor.

I think that most readers are looking just for that, congruency in what they see, then there are the others who are looking for the free trade and don't want to do the work or learn, they usually get burn.

Bruce, I try to study your way of seeing and find it interesting, usually read all of your posts so I can learn your ways. However, I keep doing my work the same way as before, so when I post, there's some what of a contrast. If we are congruent, coming from different angles of seeing, then the probabilities for success have increase in our favor.

I think that most readers are looking just for that, congruency in what they see, then there are the others who are looking for the free trade and don't want to do the work or learn, they usually get burn.

Thanks iHunter....it's great to have the contrast..that is important..

I'm not really "worried" but I don't want to be wasting my time or anybody elses. So if there isn't any interest in my posts or they can't be understood than that would be wasteful. So far based on the vote count I'm assuming that folks reading just can't be bothered giving feedback or don't really " get it " . Perhaps they have no desire. I can understand that . Thanks again for your input.

I'm not really "worried" but I don't want to be wasting my time or anybody elses. So if there isn't any interest in my posts or they can't be understood than that would be wasteful. So far based on the vote count I'm assuming that folks reading just can't be bothered giving feedback or don't really " get it " . Perhaps they have no desire. I can understand that . Thanks again for your input.

Bruce,

I find your ideas very interesting although way too detailed and complicated for me.

To keep all the things that you use coordinated is amazing. I prefer simple but will keep reading and enjoying.

Thanks!

I find your ideas very interesting although way too detailed and complicated for me.

To keep all the things that you use coordinated is amazing. I prefer simple but will keep reading and enjoying.

Thanks!

Bruce

I find you to be one of the two finest live posters of trades anyone will ever have the pleasure of reading on the internet. Mr Kool being the other. With that said, it is really the responsibility of any trader to do his own thing. I only read this site as I find too much info a detrimental to my trading. I look to see what areas you and Kool are interested in trading at. Kools reasons I can always understand as his formula is simple and well documented. You do confuse me at times as to why the area is important. I will give you one example and leave it at that. In your first chart you call the ledge trips. I only see two. In the second chart I do see a third ledge there. Irregardless I am responsible for my own trades and appreciate seeing what levels you are trading at.

Best regards and good trading to all David

I find you to be one of the two finest live posters of trades anyone will ever have the pleasure of reading on the internet. Mr Kool being the other. With that said, it is really the responsibility of any trader to do his own thing. I only read this site as I find too much info a detrimental to my trading. I look to see what areas you and Kool are interested in trading at. Kools reasons I can always understand as his formula is simple and well documented. You do confuse me at times as to why the area is important. I will give you one example and leave it at that. In your first chart you call the ledge trips. I only see two. In the second chart I do see a third ledge there. Irregardless I am responsible for my own trades and appreciate seeing what levels you are trading at.

Best regards and good trading to all David

Thanks for the feedback Mike. I think "complicated " may be a relative term when it comes to trading. The person who simply buys at trendline support for example would most likely think Market profile etc is too complicated but the person who writes fancy algo's and stuff might think differently.

What I'm really hoping is that some can find use in the different components of my trading. With no intent on my part to have them trade like me. Most of my stuff is fairly simple ( to me at least) and fairly visual. If we think about triples, air pockets, single prints and volume spikes then I would think that most can see those things on a chart. They may not be able to use it like me or somebody else, but in time, if they like the potential, then perhaps they will find a way to incorporate it into their trading plan.

Like I said before, 90% of my trades are fades and usually happen near previous highs and lows of the RTH session, the overnight session and other key chart points. Again a very visual thing.

With that said I also understand how you might think it is complicated. This particular trade had many different ideas which lead me to believe that some selling might come in. I'm just pointing out the things I see that accumulated as we went higher. Some might just want to trade for triples or even better the air pockets. If you study today's chart ( Friday, January 14th ) and the chart above you will see many cool differences and perhaps you will see why my fades in the later part of today didn't go anywhere.

My advice to anyone would be to stick with the things that come easy. If you have a proven method that you enjoy then just stick with that.

I think it is real difficult to incorporate new ideas while day trading and let me give a personal example. Two things that I used many years ago were the weekly open and the 50% mark on ranges. About four moths ago I started to "remember" them again. So I try to think about the ideas while I'm trading and here is the key point:

Some days I will remember to be aware of those areas in the morning before trading and by the time the afternoon has come I have forgotten about them. I get caught up in the movement of the market and ideas that I'm currently more familiar with. So I basically have trouble remembering my own stuff...all within a few hours..

Thanks so much for the reply..I appreciate your comments.

What I'm really hoping is that some can find use in the different components of my trading. With no intent on my part to have them trade like me. Most of my stuff is fairly simple ( to me at least) and fairly visual. If we think about triples, air pockets, single prints and volume spikes then I would think that most can see those things on a chart. They may not be able to use it like me or somebody else, but in time, if they like the potential, then perhaps they will find a way to incorporate it into their trading plan.

Like I said before, 90% of my trades are fades and usually happen near previous highs and lows of the RTH session, the overnight session and other key chart points. Again a very visual thing.

With that said I also understand how you might think it is complicated. This particular trade had many different ideas which lead me to believe that some selling might come in. I'm just pointing out the things I see that accumulated as we went higher. Some might just want to trade for triples or even better the air pockets. If you study today's chart ( Friday, January 14th ) and the chart above you will see many cool differences and perhaps you will see why my fades in the later part of today didn't go anywhere.

My advice to anyone would be to stick with the things that come easy. If you have a proven method that you enjoy then just stick with that.

I think it is real difficult to incorporate new ideas while day trading and let me give a personal example. Two things that I used many years ago were the weekly open and the 50% mark on ranges. About four moths ago I started to "remember" them again. So I try to think about the ideas while I'm trading and here is the key point:

Some days I will remember to be aware of those areas in the morning before trading and by the time the afternoon has come I have forgotten about them. I get caught up in the movement of the market and ideas that I'm currently more familiar with. So I basically have trouble remembering my own stuff...all within a few hours..

Thanks so much for the reply..I appreciate your comments.

Originally posted by Big Mike

Bruce,

I find your ideas very interesting although way too detailed and complicated for me.

To keep all the things that you use coordinated is amazing. I prefer simple but will keep reading and enjoying.

Thanks!

I need a dictionary to read your post, thanks for providing it.

Originally posted by nkhoi

I need a dictionary to read your post, thanks for providing it.

I've been working with Bruce and other forum members to auto-link words in posts to our dictionary to give readers a reference point to understand what is being talked about on the forum. If there's anything specific that you don't understand then let me know and I'll try and have it defined for you.

One technique that can be useful in order to augment the way one lets a trade breath is to enter the market 2-4 seconds before the close of a one minute candle and at that point "Join Bid/Offer” instead of a market order. This gives an extra 1-2 tick advantage and prevents slippage that may occur while placing market orders.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.