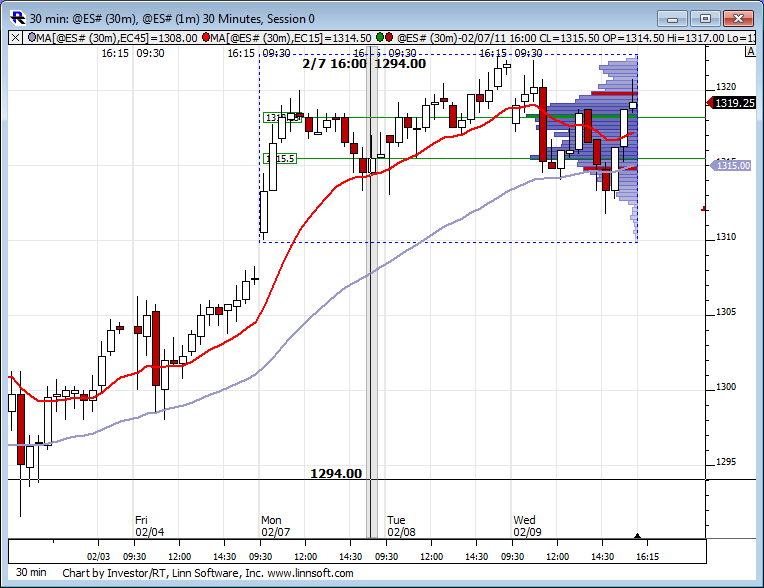

ES Short Term Trading 02-10-2011

Here we are again. Like deja vu from yesterday. Notice the weekly profile still sporting the bell curve shaped profile. As Bruce said yesterday, it was a neutral day. That curve proves it, even with the wild up down moves in price. And I also think this shows true trending action happens even less then 20% of the time as Bruce and others have mentioned. I recall the great Paul Tudor Jones in Market Wizards stating trending action happens less then 15% of the time so he always wanted to fade new highs and lows.

Great retest,great looking cycle bowl formed, very positive price action in my view, as we appear to be forming a nice little short term bottom!.. at least thats what i keep telling myself! LOL

WHOOP THERE IT IS!...out at 1317.25, plus 2.5 on the runner so i can sleep! Text book day! Good trading all!!!

I sure do appreciate all the info and posts kool,bruce,lorn and all. Thank you A student with some scars.

Scars my friend we all have em!

The most important thing for any trader to learn is how to play defense. We all will have losing days. The question is how big will those losing day be. Protecting both your capital and your emotions will place you in a position to grow your account when you are trading well.

Learn to sense when you a trading poorly and cut your size and quantity of trades during those periods. Learn and have confidence in when you are trading well so you can increase your size and/or quantity of trades to make the most profits during the best times.

I realize this sounds kind of pie in the skyish but stick with it, keep a journal of both trades and the emotions/thoughts running through your head while trading as well as just watching. Pay attention to patterns not just on the charts but in yourself.

Its a process, not an event, which makes a trader. The biggest problem is most new traders don't have enough capital to make it far enough along the process to actually make money consistently.

Glad to see you posting.

The most important thing for any trader to learn is how to play defense. We all will have losing days. The question is how big will those losing day be. Protecting both your capital and your emotions will place you in a position to grow your account when you are trading well.

Learn to sense when you a trading poorly and cut your size and quantity of trades during those periods. Learn and have confidence in when you are trading well so you can increase your size and/or quantity of trades to make the most profits during the best times.

I realize this sounds kind of pie in the skyish but stick with it, keep a journal of both trades and the emotions/thoughts running through your head while trading as well as just watching. Pay attention to patterns not just on the charts but in yourself.

Its a process, not an event, which makes a trader. The biggest problem is most new traders don't have enough capital to make it far enough along the process to actually make money consistently.

Glad to see you posting.

Originally posted by bbrad63

I sure do appreciate all the info and posts kool,bruce,lorn and all. Thank you A student with some scars.

hey Lorn..is that you doing all that selling to go get my ledge...?

welcome to crazy town!!

Just how many bars will trade back through the 60 minute high today....? Gheesh

welcome to crazy town!!

Just how many bars will trade back through the 60 minute high today....? Gheesh

quite a quick move eh? Some real battling going on up here in the 20's.

Originally posted by BruceM

hey Lorn..is that you doing all that selling to go get my ledge...?

welcome to crazy town!!

Just how many bars will trade back through the 60 minute high today....? Gheesh

how about that...they ran my ledge in the first 1/2 hour of the O/N session...a five point drop.......who are these people???

Marther Farkers!!!

HA!

Marther Farkers!!!

HA!

Originally posted by sij

may iask > that prc bands on kool's graphs are these the same as cog?

No there not the same I personally like starc bands better 15/144/2.618 on a 1min time frame....

Hey Joe, can you pop up some charts for us when u have time..? I'd like to see those....thanks

Originally posted by CharterJoe

Originally posted by sij

may iask > that prc bands on kool's graphs are these the same as cog?

No there not the same I personally like starc bands better 15/144/2.618 on a 1min time frame....

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.