Here goes...

Hi, guys!

So, having introduced myself, I want to share with you my trading strategy. For those who didn´t see my introduction, here´s a brief bio of mine:

- I´m 31 years old and been studing the markets in the past 2 years. So, 4 months ago I started to trade commodities CFDs (US Crude Oil) more precisely.

Here´s some information:

- Starting Money: €3000

- Best profit: €487

- Worse loss: -€507

- Balance: -€622

- Current Money: €2378

Well, I made mistakes, but fortunately I´ve learned! I´m much better controling my fear and my greed aswell. Some of them were...childish, plain unfucosed behavior. That´s why in those 4 months, I stoped for one and a half.

My strategy:

- (Short period) trend following;

- Chart analisys;

- Pay attention to max and min;

- 350 to 500 barrels per order - that will depend of the situation;

- Since I have not many money, I aimed for small profits, so my objective is to profit €100 to €150 per trade, with a maximum of €200 loss. As soon as I have about €5000, I´ll invest more per trade;

- I always use stop losses;

- Maximum of 3 trades per day;

- Try to keep informed about oil news (mainly at CNBC site);

- Recently I added MACD and MACD Histogram to my charts;

I learn more things, everyday.

So, feel free to comment my trading plan. It would be great to learn from you guys! :)

Thanks!

So, having introduced myself, I want to share with you my trading strategy. For those who didn´t see my introduction, here´s a brief bio of mine:

- I´m 31 years old and been studing the markets in the past 2 years. So, 4 months ago I started to trade commodities CFDs (US Crude Oil) more precisely.

Here´s some information:

- Starting Money: €3000

- Best profit: €487

- Worse loss: -€507

- Balance: -€622

- Current Money: €2378

Well, I made mistakes, but fortunately I´ve learned! I´m much better controling my fear and my greed aswell. Some of them were...childish, plain unfucosed behavior. That´s why in those 4 months, I stoped for one and a half.

My strategy:

- (Short period) trend following;

- Chart analisys;

- Pay attention to max and min;

- 350 to 500 barrels per order - that will depend of the situation;

- Since I have not many money, I aimed for small profits, so my objective is to profit €100 to €150 per trade, with a maximum of €200 loss. As soon as I have about €5000, I´ll invest more per trade;

- I always use stop losses;

- Maximum of 3 trades per day;

- Try to keep informed about oil news (mainly at CNBC site);

- Recently I added MACD and MACD Histogram to my charts;

I learn more things, everyday.

So, feel free to comment my trading plan. It would be great to learn from you guys! :)

Thanks!

Well you lost 20% of your account balance (working capital) in 4 months, which is probably on average for someone just starting out in the commodities markets.

For that 4 month effort: what is your Win%, Loss%, Avg Win $ and Avg Loss $

The CL is way way out of my league, I will stay in the ES wading pool where I know I won't hurt myself.

For that 4 month effort: what is your Win%, Loss%, Avg Win $ and Avg Loss $

The CL is way way out of my league, I will stay in the ES wading pool where I know I won't hurt myself.

Originally posted by day trading

Canis Lupus,

This page has a bunch of contracts that the traders on this site mostly focus on:

http://www.mypivots.com/dailynotes

Thanks a lot!

Couldn't agree more PT....too many traders spend years understanding a market and then get enticed by the volatility of another and stop trading the one they really understand. They see big ranges and big swings and think they can rule a new market....and perhaps they can over time.

My feeling is that one needs to stay focused like a freakin laser and when volatility dries up then trade more contracts in the contract you know best.

Now if you are trading poorly in a contract then it pays to hunt around until you find one that suits your account size and personality......

My feeling is that one needs to stay focused like a freakin laser and when volatility dries up then trade more contracts in the contract you know best.

Now if you are trading poorly in a contract then it pays to hunt around until you find one that suits your account size and personality......

Originally posted by pt_emini

Well you lost 20% of your account balance (working capital) in 4 months, which is probably on average for someone just starting out in the commodities markets.

For that 4 month effort: what is your Win%, Loss%, Avg Win $ and Avg Loss $

The CL is way way out of my league, I will stay in the ES wading pool where I know I won't hurt myself.

Well guys, recently MACD and MACD Histogram turned out to be...unreliable!

I have a 5 min chart and there are few cases that MACD and MACD Histogram confirm the trend with the bullish and/or bearish crossover. In fact, in some cases it shows just the opposite.

I have a 5 min chart and there are few cases that MACD and MACD Histogram confirm the trend with the bullish and/or bearish crossover. In fact, in some cases it shows just the opposite.

If you stick at this trading business for any length of time you'll find that most trend following indicators are unreliable at best. That's not to say trend following indicators aren't useful, indeed they are but only after years of experience with them and combining them with other more important principles of trading such as price action, volume analysis and proportion of both price and time.

Originally posted by Canis Lupus

Well guys, recently MACD and MACD Histogram turned out to be...unreliable!

I have a 5 min chart and there are few cases that MACD and MACD Histogram confirm the trend with the bullish and/or bearish crossover. In fact, in some cases it shows just the opposite.

Originally posted by Lorn

If you stick at this trading business for any length of time you'll find that most trend following indicators are unreliable at best. That's not to say trend following indicators aren't useful, indeed they are but only after years of experience with them and combining them with other more important principles of trading such as price action, volume analysis and proportion of both price and time.

Yeah! However, CL doesn´t allow to see Volume, so I guess I´ll stick for Momentum...

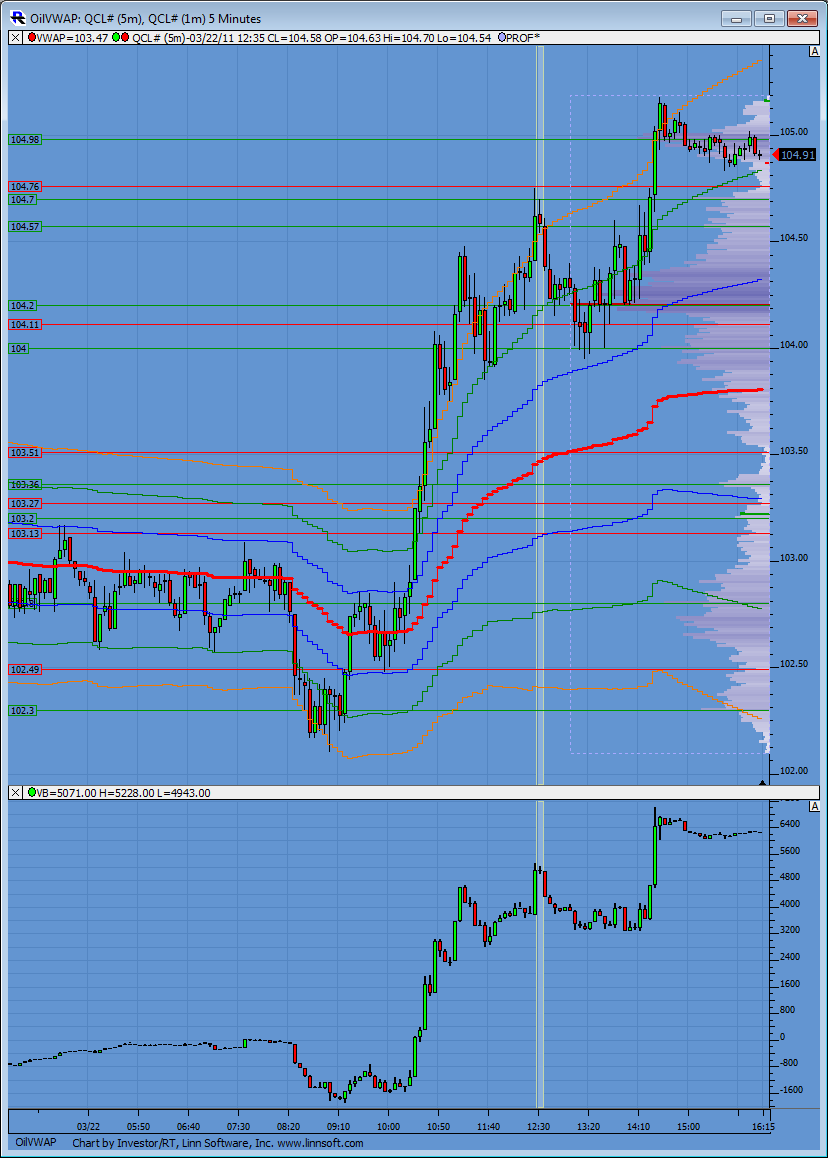

hmmm, how are you trading CL? Volume is indeed available. Take a look at this chart of CL from today showing a volume profile on the right side of the chart vertically, a volume weighted average line called VWAP (thick red line) and a delta line on the bottom which is the difference between volume being traded at the bid price (buyers) and volume being traded at the ask price (sellers).

Originally posted by Canis Lupus

Yeah! However, CL doesn´t allow to see Volume, so I guess I´ll stick for Momentum...

Well, unfortunately my broker doens´t have Volume option (any kind) for CFD trading...:(

Originally posted by Canis Lupus

Well, unfortunately my broker doens´t have Volume option (any kind) for CFD trading...:(

well, that'd pretty much turn anyone into a one-legged man in an ass kicking contest

perhaps ask around here for other traders that may have some different/additional data feeds or sources that might help you put some more tools in that box

What kind of charting software are you using, if any?

Originally posted by Canis Lupus

Well, unfortunately my broker doens´t have Volume option (any kind) for CFD trading...:(

Thanks for you help, guys!

Well, I have most of these books. I´ll research more about these matters!

Thanks

Well, I have most of these books. I´ll research more about these matters!

Thanks

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.