ES Short Term Trading for 4-25-11

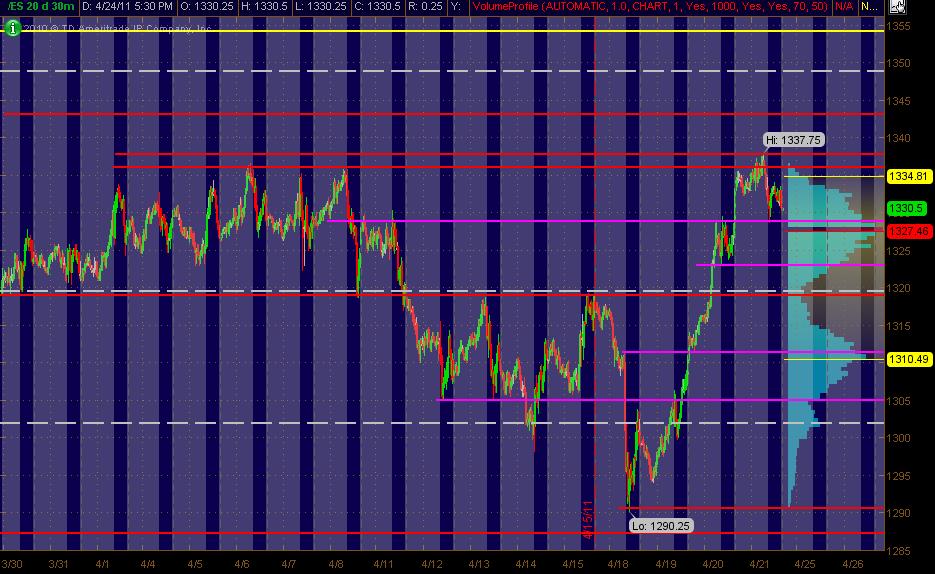

Here's my MonkeyMap of the ES 30min chart of 20 days. The Gray background is the "overnight" trading. The right vertical axis shows the 20-days worth of Volume at Price in Light Blue. The Red lines are my PASR "zones" of potential S/R with the Magenta potential semi-significant. The White dashed lines are the Weekly Pivots. Have a Yellow line above the current market that looks like a potential significant Fib cluster area to me. I've adjusted some of the lines/levels/zones from mid-week last week. Hope some folks find this helpful as a MAP!

MM, thanks for the chart.

Your POC=1327.50 is reached. Do or die for the sellers.

Your POC=1327.50 is reached. Do or die for the sellers.

I know this is after-the-fact ... and considering that was a VolProfile of 20 days ... had most POC's on 5min and 15min charts of past day or two of price date (both RTH and ATH) showing 32 area. It pushed down to the "trailing monthly" POC per volume. Perhaps the bigger time frames aren't accepting price lower ... as it pushed right back up. Just an observation I'm seeing (along with PASR levels I've still got on the MAP). Yeah, we're up against signif daily resistance. But it's "holding UP". We've rested for a couple of days up here with NR days (including overnight trading). Smells like a higher percentage breakout move to the long side (at least to me) based on that type of price activity and volume. Let's put it this way ... I've been thru 2000 equity charts so far this evening ... and I'm writing down my long stock picks for Tuesday to be ready just in case ... for an UP move in the next day or two. Not predicting ... just reading-anticipating-preparing. Simply wished to share my "read" after your post fwiw

Btw, have not yet re-reviewed mkt internals or psych indicator/components yet ... brain's kinda melting as I'm working on some new and adjusted TC2000 techno-fundamental type scans I've got and visually evaluating 'em. Maybe I'll have some equity "long stock picks" I can post that are worthwhile to function as an INDICATOR (as I've described before) or as decent equity long trades if/when the market moves up. At this point I'm blathering ... but what would really piss me off is if the market trades up significantly overnight for a big gap up open. I'll simply crack a beer at 8:30:01am CST and be a spectator for a while.

Btw, have not yet re-reviewed mkt internals or psych indicator/components yet ... brain's kinda melting as I'm working on some new and adjusted TC2000 techno-fundamental type scans I've got and visually evaluating 'em. Maybe I'll have some equity "long stock picks" I can post that are worthwhile to function as an INDICATOR (as I've described before) or as decent equity long trades if/when the market moves up. At this point I'm blathering ... but what would really piss me off is if the market trades up significantly overnight for a big gap up open. I'll simply crack a beer at 8:30:01am CST and be a spectator for a while.

Here's what I've come up with for 4-26 ... posted on another thread/topic for anyone interested:

http://www.mypivots.com/board/topic/6641/1/equity-list-for-potential-longs-4-26

http://www.mypivots.com/board/topic/6641/1/equity-list-for-potential-longs-4-26

How is that beer MM?

lol ... Which one? The first one or the current one? The main scenario that'd turn me into a spectator this morning - decent mkt gap up. Go figger

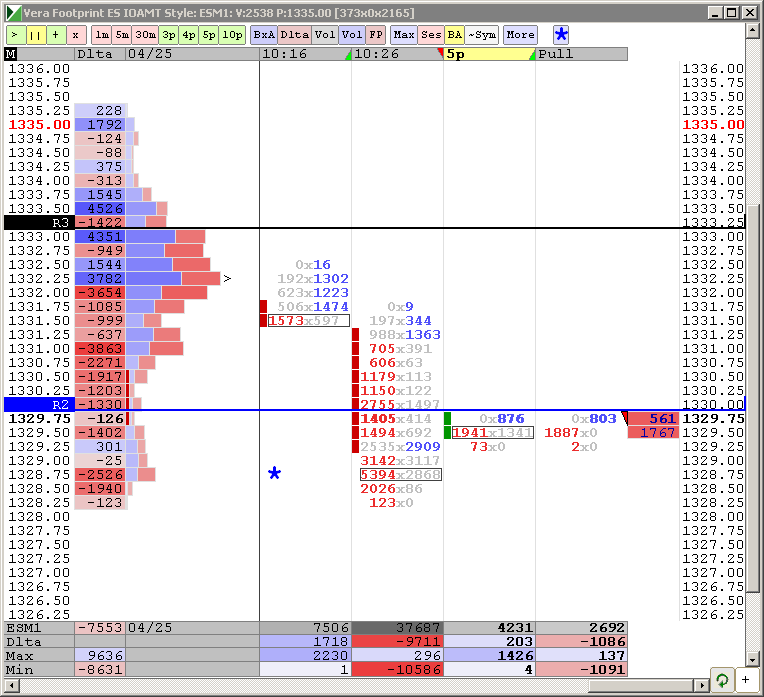

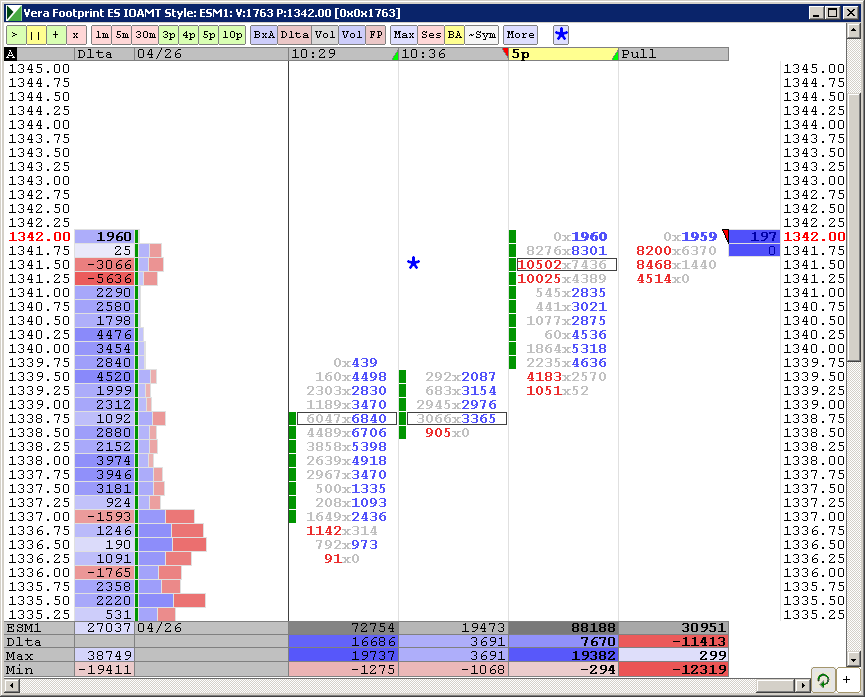

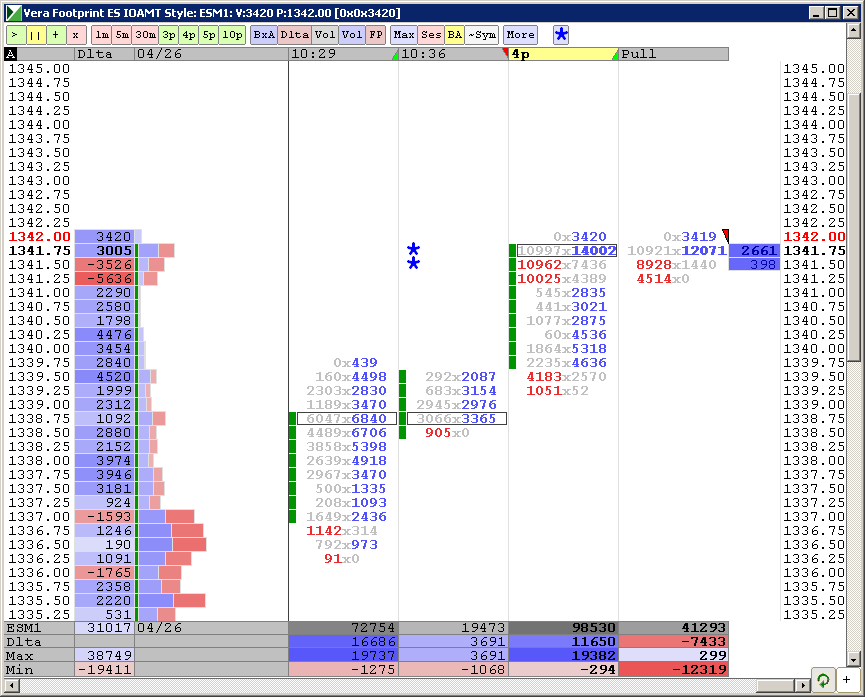

Hope someone is recording these levels and I am not posting for nothing. If anyone here wants these posts, pls let me know

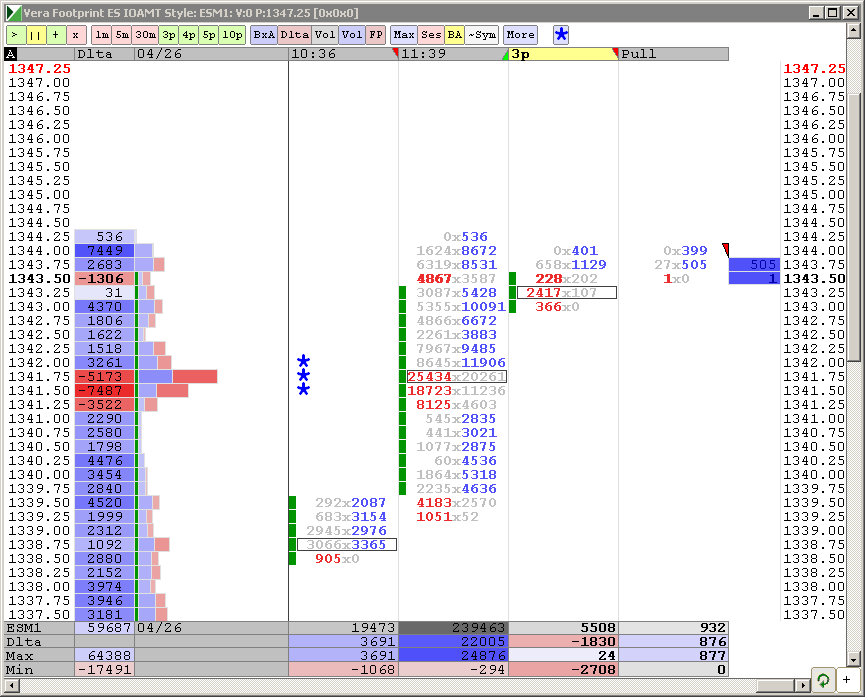

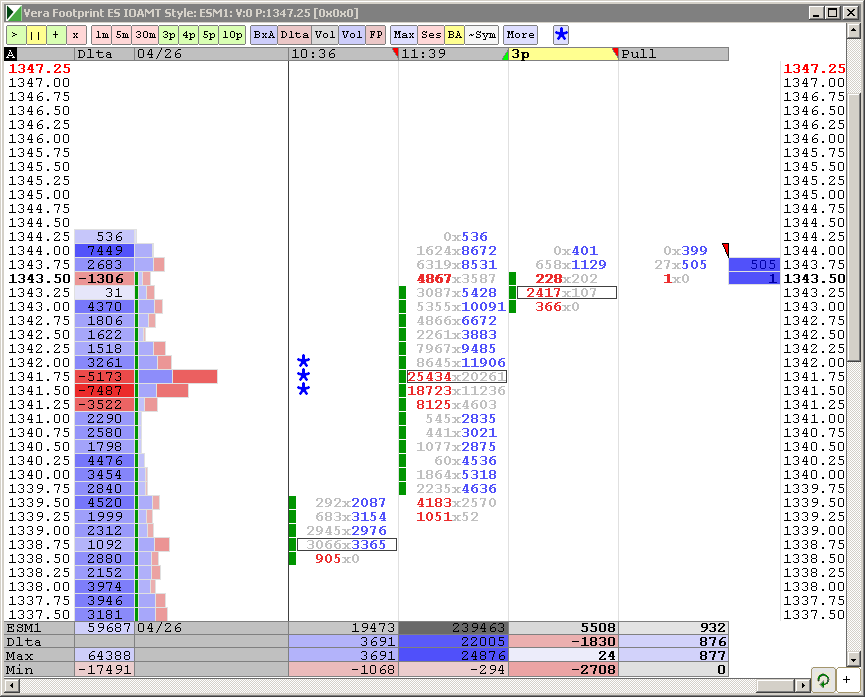

20,000 more hit the bid at 1344

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.