ES Thu 8-4-11

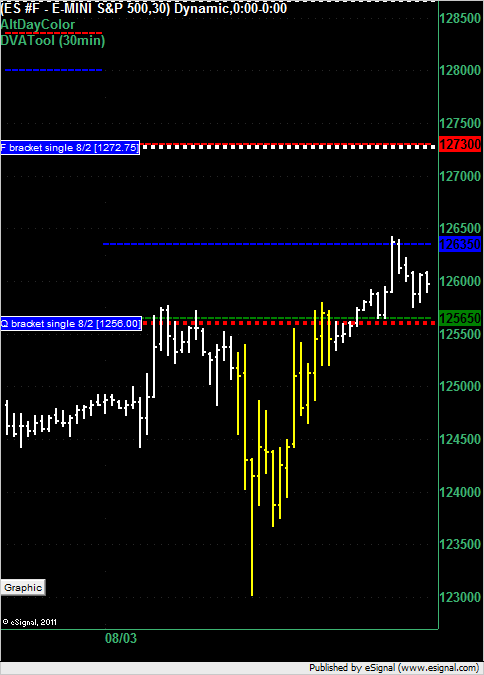

Depending on how you used Tuesday's single print at 1256.00 in Wednesday's trading you wouldn't have lost money had you used it to short late in the day but you wouldn't have made much either. Had you shorted at 1256 even you would have had a draw down of 2 points and a best run up of 4 points.

Had you used it as a target from a long during the day then you would have been golden as it was 2 points off the high. That single print is no longer in play but the F bracket from Tuesday at 1272.75 is still above us and is a target and a reversal point.

Had you used it as a target from a long during the day then you would have been golden as it was 2 points off the high. That single print is no longer in play but the F bracket from Tuesday at 1272.75 is still above us and is a target and a reversal point.

LisaP. Been there done that.

Just to clarify, you went long @ 1227ish with a typical 4-6 tic stop. (My read would have been short and I would have been stopped out quickly)

The trade immediately went 3+ points in the green. Trade reversed and went 4 points in the red and you added as it came back around 1227.50ish.

It then went 2 points in the green on all contracts. From a learning perspective, how did this become a "big loss" for you?

I feel your pain, tomorrow's another and thanks again for all the info you provide!

Just to clarify, you went long @ 1227ish with a typical 4-6 tic stop. (My read would have been short and I would have been stopped out quickly)

The trade immediately went 3+ points in the green. Trade reversed and went 4 points in the red and you added as it came back around 1227.50ish.

It then went 2 points in the green on all contracts. From a learning perspective, how did this become a "big loss" for you?

I feel your pain, tomorrow's another and thanks again for all the info you provide!

Mike, sorry stepped out for a bite.

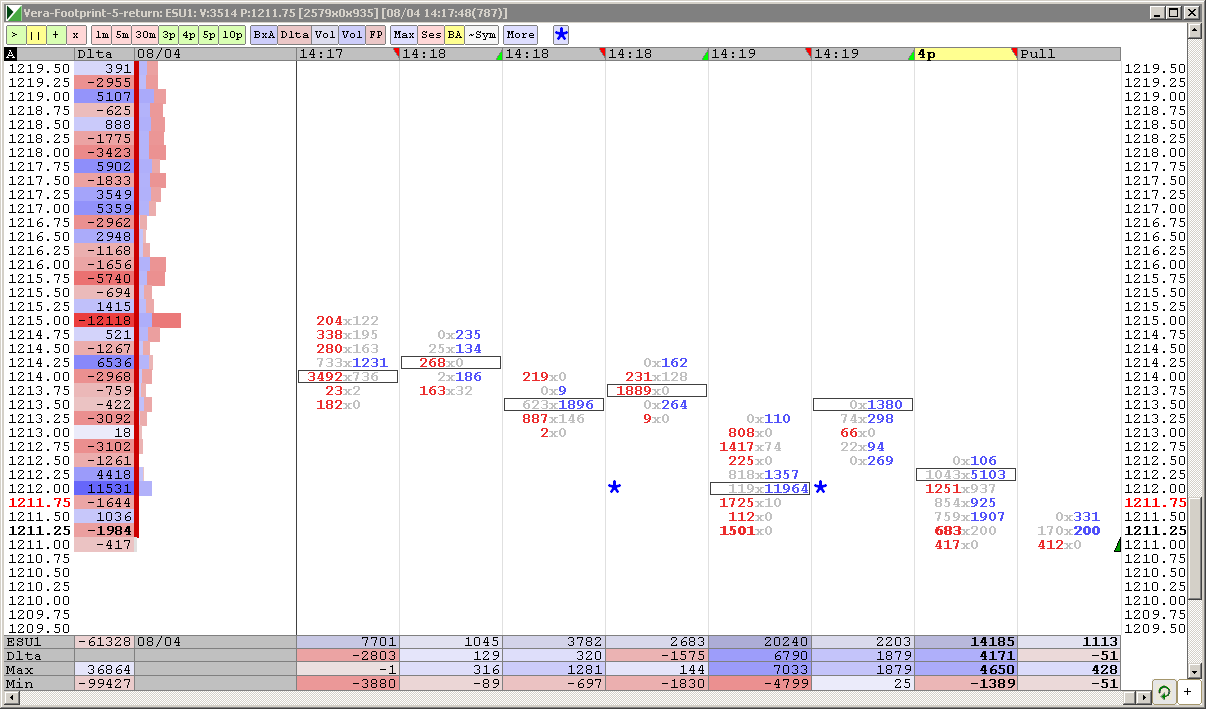

Please take a look at your 1-min chart. I fought the urge to take a stop from 11:25 to 11:33. After that, not seeing big volume, I entrenched in the long view and did not take stop there, hoping for a bounce after that mini-fight.

Shortly after I looked at the Reuter's news about the EuroZone bloodbath and damped the trade, albeit too late. CAC closed almost 4% down, DAX 3.5% down.

I think US market is going to stabilize after Europe closing, but my mood is grim.

Please take a look at your 1-min chart. I fought the urge to take a stop from 11:25 to 11:33. After that, not seeing big volume, I entrenched in the long view and did not take stop there, hoping for a bounce after that mini-fight.

Shortly after I looked at the Reuter's news about the EuroZone bloodbath and damped the trade, albeit too late. CAC closed almost 4% down, DAX 3.5% down.

I think US market is going to stabilize after Europe closing, but my mood is grim.

MIke, my long entries were at 10:45 and 11:04. You can see why I was hopeful. Probe lower came back, though there were good efforts to push the price down. So I remained hopeful and when price rose to 1227.25 again, I doubled.

Guys,

1 Thanks for letting me know you are interested in Footprint charts.

2. Remember I said high volume entries are often revisited? I guess Mr. BigWig has kahunas to wait and exit on bounce to 1227.25, at least with some of his enry contracts. He has kahunas and I have a lot to learn from him.

Guys,

1 Thanks for letting me know you are interested in Footprint charts.

2. Remember I said high volume entries are often revisited? I guess Mr. BigWig has kahunas to wait and exit on bounce to 1227.25, at least with some of his enry contracts. He has kahunas and I have a lot to learn from him.

Originally posted by Lisa P

Mike, sorry stepped out for a bite.

Please take a look at your 1-min chart. I fought the urge to take a stop from 11:25 to 11:33. After that, not seeing big volume, I entrenched in the long view and did not take stop there, hoping for a bounce after that mini-fight.

Shortly after I looked at the Reuter's news about the EuroZone bloodbath and damped the trade, albeit too late. CAC closed almost 4% down, DAX 3.5% down.

I think US market is going to stabilize after Europe closing, but my mood is grim.

Thank you Lisa, grim indeed. Better fortunes are around the corner!

prestwick, i am curious, after the 23 level did you have any projections that fell around the 12 area? also, what level did you use to measure the projection up after the bounce from 12.25? any rules you follow on the extension of the move up or down you use to measure the fib extensions?

thank you

thank you

Originally posted by prestwickdrive

We got the 23.25. If you are like me you would have doubted that projection, especially when we retraced to 47.75, as I used to but I have seen them hit way too often to ignore any more. Those projections also work really well for crude oil and natural gas on inventory days which is where I primarily use them.

1211 would make it 30 points from HOD....

not my day

I have 1202 and 1209 as possible targets

1196 and 1190 1st 2 sub 1200 targets

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.