ES Thu 8-4-11

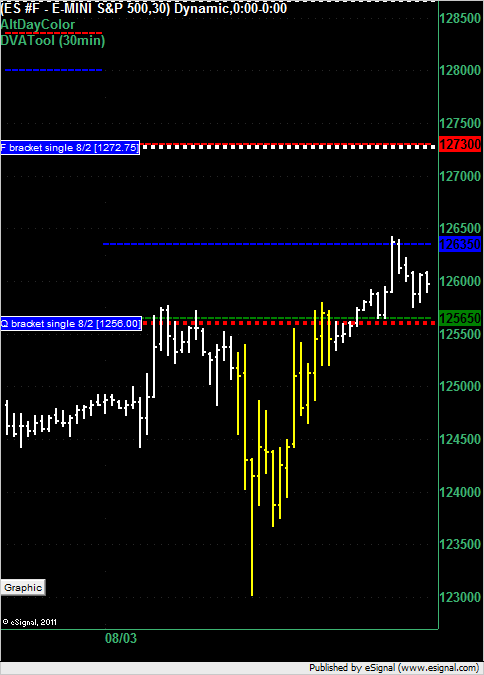

Depending on how you used Tuesday's single print at 1256.00 in Wednesday's trading you wouldn't have lost money had you used it to short late in the day but you wouldn't have made much either. Had you shorted at 1256 even you would have had a draw down of 2 points and a best run up of 4 points.

Had you used it as a target from a long during the day then you would have been golden as it was 2 points off the high. That single print is no longer in play but the F bracket from Tuesday at 1272.75 is still above us and is a target and a reversal point.

Had you used it as a target from a long during the day then you would have been golden as it was 2 points off the high. That single print is no longer in play but the F bracket from Tuesday at 1272.75 is still above us and is a target and a reversal point.

love it tells you alot

LisaP,

Could you expound a bit more on how you are using this as a trading system? Stops? Targets? Etc.

I'm trying to get an understanding of Market Delta but I see Mr. Big Wig enter around 9:45 CT which went 3 points the other way before eventually getting a short trade in the green.

Thanks in advance.

Could you expound a bit more on how you are using this as a trading system? Stops? Targets? Etc.

I'm trying to get an understanding of Market Delta but I see Mr. Big Wig enter around 9:45 CT which went 3 points the other way before eventually getting a short trade in the green.

Thanks in advance.

Originally posted by prestwickdrive

Originally posted by ayn

thanks for the explanation, what chart time frame are you using to measure the initial up projection ?

Originally posted by prestwickdrive

Originally posted by prestwickdrive

The other day I mentioned the value of using Kools Tools price projections off of major market moves. Any up projection based on the favorable jobless claims number was negated by the reaction to Trichet's comments which broke the ES below the pre-claims level. Those comments brought a move from 1248.75-1239 before a green candle. That move gives an initial projection of 1233.0 and a full projection of 1223.25. If it gets down there I would expect a tradable bounce in the 1233 area. If 1248.75 is touched again these down projections will have failed. I find Kools Tools projections work about 85% of the time. No guarantees ... just probabilities as in this market anyuthing is possible.

We got to the 1233 so watch for the length move of the initial up move from 1232.25 to do an up projection. If the downtrend is intact we should not appreciably exceed the initial up projection which would indicate a decent chance for a short targeting the 1223.25 area unless 1248.75 is taken out. Again, no guarantees.

I am using a 1 minute candle chart for this but I will use a 3 minute sometimes. Note that the up projection off of 32.25 gave an initial of 41.75 and a full of 46.0. The break below 32.25 negated those giving us a stronger message that the market still wants lower. The move from the cycle high of 38.5 to the first decent retrace of 34.75 now gives us an initial of 32.5 which was hit and a full of 28.75 until 38.5 is taken out. The longer term projection to 23.25 is still valid too. The bounce from that initial 32.0 area was pretty sick.

We got the 23.25. If you are like me you would have doubted that projection, especially when we retraced to 47.75, as I used to but I have seen them hit way too often to ignore any more. Those projections also work really well for crude oil and natural gas on inventory days which is where I primarily use them.

thank you lisa lets say they have 4 point stop 22. 23 was there stop

Originally posted by Big Mike

LisaP,

Could you expound a bit more on how you are using this as a trading system? Stops? Targets? Etc.

I'm trying to get an understanding of Market Delta but I see Mr. Big Wig enter around 9:45 CT which went 3 points the other way before eventually getting a short trade in the green.

Thanks in advance.

Mike,

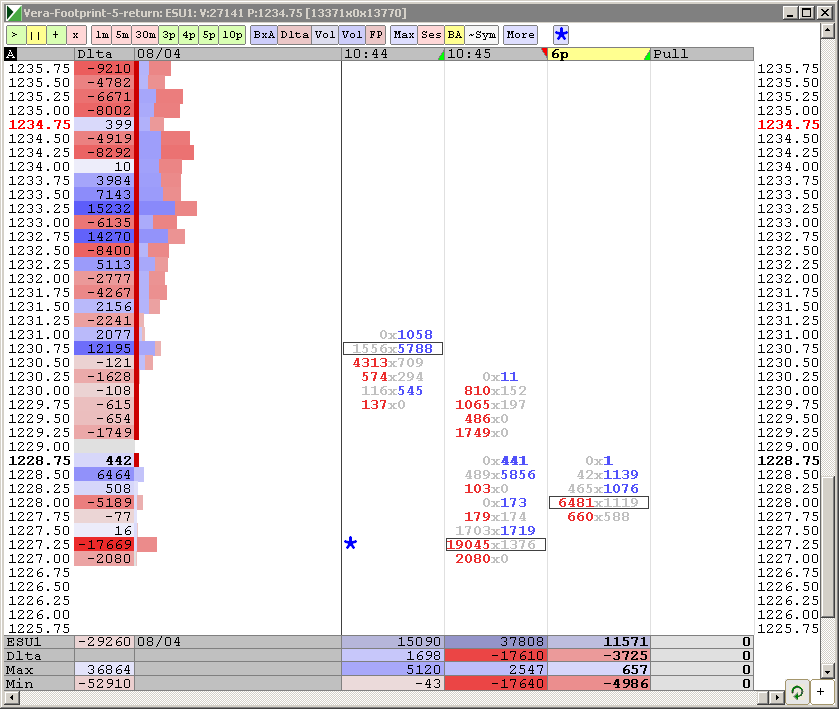

Entries. I try to enter when I see a big order flush on my Footprint chart. I watch for it at levels that I mark "significant levels". When I see such big order (say one at time 10:45 ET @ price 1227.25 for 19045 contracts, see chart above )I do not know if this is an "initiating" short order or a long "resting" order left/placed there before market gets to that level by a big party that I call Mr. BigWig. I have to make that decision based on the chart and price action. If I am wrong, my stop is small.

Direction. Iusually trade long above VWAp and short below VWAP. Considering that we are severely oversold on daily, that I have 1240 SPX as a support, there were no bad news in US, earnings are good, etc. This morning action was on low volume, see charts I posted and my comments, so I assumed that 1240 SPX would hold and they are hunting stops. As for that big order, I assumed that Mr. BigWig placed a long orderafter wiping out stops. I was wrong. However I did not take my stop, as NQ was near its support.

Stops. My usual stops on such trades are small 4-6 ticks. Today I stayed longer and took a loss on that trade after I read on Reuters that EuroZone tanked about 3% on Italian worries. That is in spite of their PM assurances, that country finances and banks are good and liquid; and bond traders are bad boys. After wrapping my own knackles, I re-read my own Trading Plan and highlighted

Rule #0 - "Take original stops"

Rule #1 - "Do not trade against the trend"

Rule #2 - "trade with the Trend"

Tonight I am going to read a chapter on discipline.

Targets. I like "single print" targets, "low-volume node" targets, VWAP targets. I also makr high volume entries, like the one we discussed as I noticed that they are often re-tested, sometimes long after - what I think are residual orders.

Now at 11:30 ET EuroZone is closed and I hope US market will stabilize. We will see.

BTW, today I am in the red as I took a big loss.

Hope this helps, Let me know if I missed anything

Originally posted by della

thank you lisa lets say they have 4 point stop 22. 23 was there stop

Della, I think EuroZone screwed us today and we rolled past technical supports on SPX and COMPQ. Now INDU is at support on daily at 11,500. I hope we will bouce here, but... we will see.

Here is INDU probing below support

looking at weekly 1215 on spx may bouse from there a bit this afternoon employment tomorrow front running news

Lisa - Thank you for all your work - and today's detailed explanation. For clarification, you were long at 10:45?

Thanks again, and continued success (better than today!)

Thanks again, and continued success (better than today!)

Ross. Yes, I went long at time 10:45 and doubled at time 11:05, when price rose again to that 1227.25 level. I thought Mr. BigWig had a resting order there in the first place and remained in the game after he wiped stops on lower volume - so I added at that price. The bounce was on a good volume, so I entrenched in my conviction.

Of course, I was wrong, twice. Or maybe I was right, but he (and I) got overpowered. It happens. As I said, tonight I am going to read about discipline, trading with the trend and following one's trading plan. Sigh.

Of course, I was wrong, twice. Or maybe I was right, but he (and I) got overpowered. It happens. As I said, tonight I am going to read about discipline, trading with the trend and following one's trading plan. Sigh.

1196 and 1190 1st 2 sub 1200 targets

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.