ES Fri 8-19-11

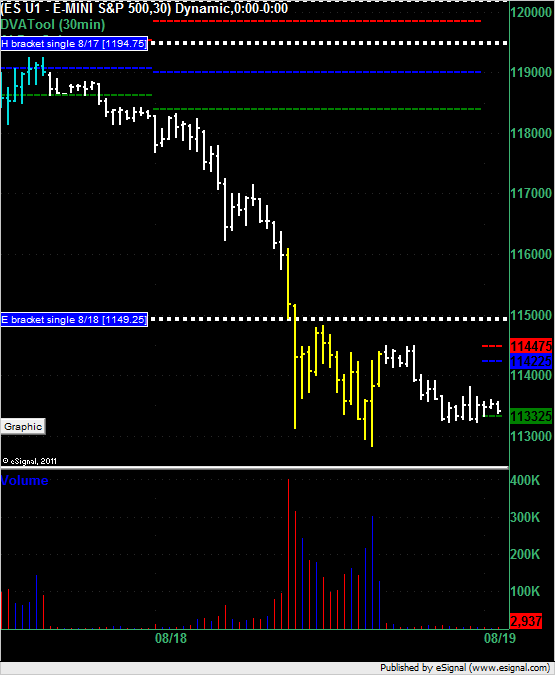

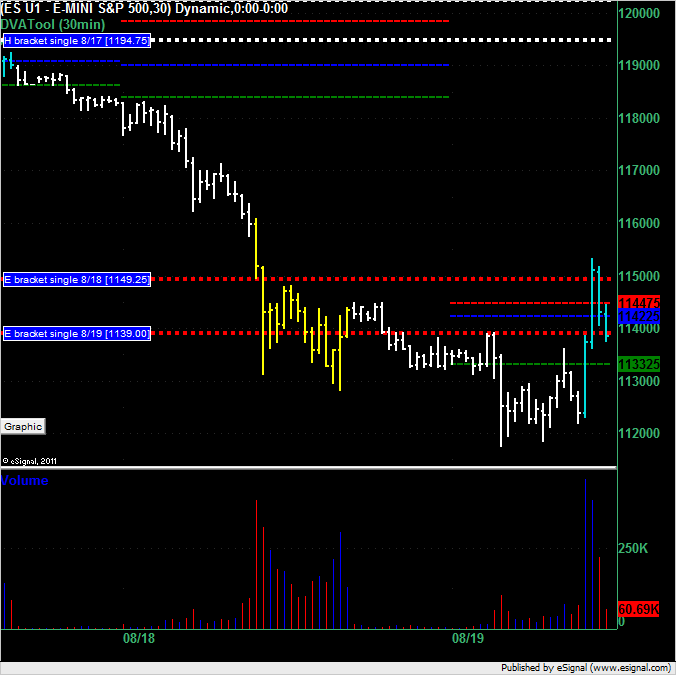

Thursday's trading left a single print at 1149.25 which was a place to get short and I mentioned that on the forum and tweeted it at http://twitter.com/mypivots however the market got back up to a high point of 1148.25 later around midday but was shy the short trigger price by 1 point. That single print still remains valid if the market opens below it for today's (Friday's) trading session. There is also the H bracket single print at 1194.75 left from Wednesday but I don't see that coming into play today.

Safe and profitable trading everyone!

Safe and profitable trading everyone!

Big Mike if u r here:

I prefer to use the low volume from the current developing day as targets and I'm not very good at initiating in those zones. It is better to use the previous days low volume to find entries and fades as it gives many players time to study and find the levels after the market closes

The single print players would be wise to see how the NQ peaked it's head above it's single print level before we rolled over in the ES

I prefer to use the low volume from the current developing day as targets and I'm not very good at initiating in those zones. It is better to use the previous days low volume to find entries and fades as it gives many players time to study and find the levels after the market closes

The single print players would be wise to see how the NQ peaked it's head above it's single print level before we rolled over in the ES

That single print short at 1149.25 had a 4 point draw down had you taken it. The move up the high of 1153.25 formed another single print at 1139.00 which could have been a target for that single short assuming that your stop wasn't tighter than 4 points and you were still in it.

Awesome trading Bruce! My best advice for anyone reading this is to read what Bruce has written on this forum.

Im with you day trading BLOW BY

bruce was the 33.00 and 36.00 from todays lows and highs

Originally posted by BruceM

Big Mike if u r here:

I prefer to use the low volume from the current developing day as targets and I'm not very good at initiating in those zones. It is better to use the previous days low volume to find entries and fades as it gives many players time to study and find the levels after the market closes

The single print players would be wise to see how the NQ peaked it's head above it's single print level before we rolled over in the ES

Just got in from Dr. appt and catching up. It is making sense and you have been very helpful, generous and insightful. Much appreciated. Outstanding information!

yes.....only the RTH session.....also the 33 was the va low....

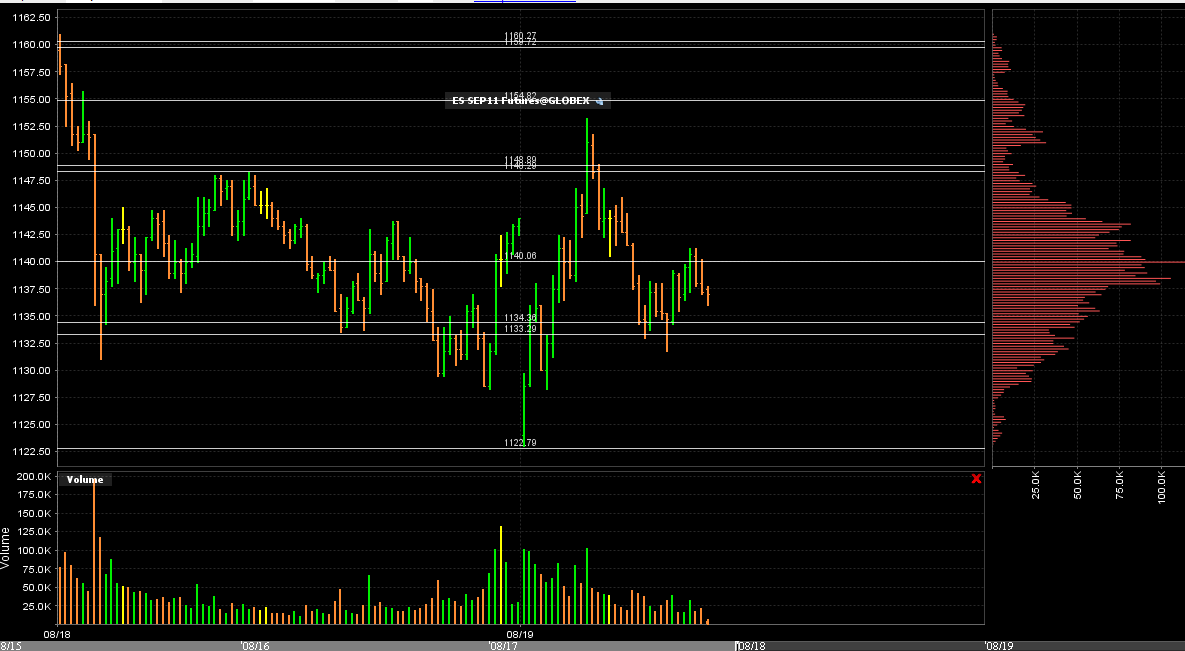

here is a snapshot of the huge big bell shape curve that spans today and yesterdays trade with the 1140 as the peak volume....many traders will be buying below and selling above expecting trade back into the center.....eventually this will break either up or down and we will establish new value at higher or lower levels....my guess is lower levels......for me I am sitting all this out on a Friday afternoon and enjoying some of the last weekends of summer...I hope some do the same

here is a snapshot of the huge big bell shape curve that spans today and yesterdays trade with the 1140 as the peak volume....many traders will be buying below and selling above expecting trade back into the center.....eventually this will break either up or down and we will establish new value at higher or lower levels....my guess is lower levels......for me I am sitting all this out on a Friday afternoon and enjoying some of the last weekends of summer...I hope some do the same

Originally posted by della

bruce was the 33.00 and 36.00 from todays lows and highs

thanks DT...it seems like many classic MP trades do much better after the classic stop points are run out....that being about 2 - 3 points above or below the key numbers in the ES

Originally posted by day trading

Awesome trading Bruce! My best advice for anyone reading this is to read what Bruce has written on this forum.

good call bruce right back below the open

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.