ES Thursday 11-3-11

Hey Bruce, I just hope you are a good sport and keep posting the way you always have!

I know I said that I will not post any more but NickP got me going with he's reverse psychology.

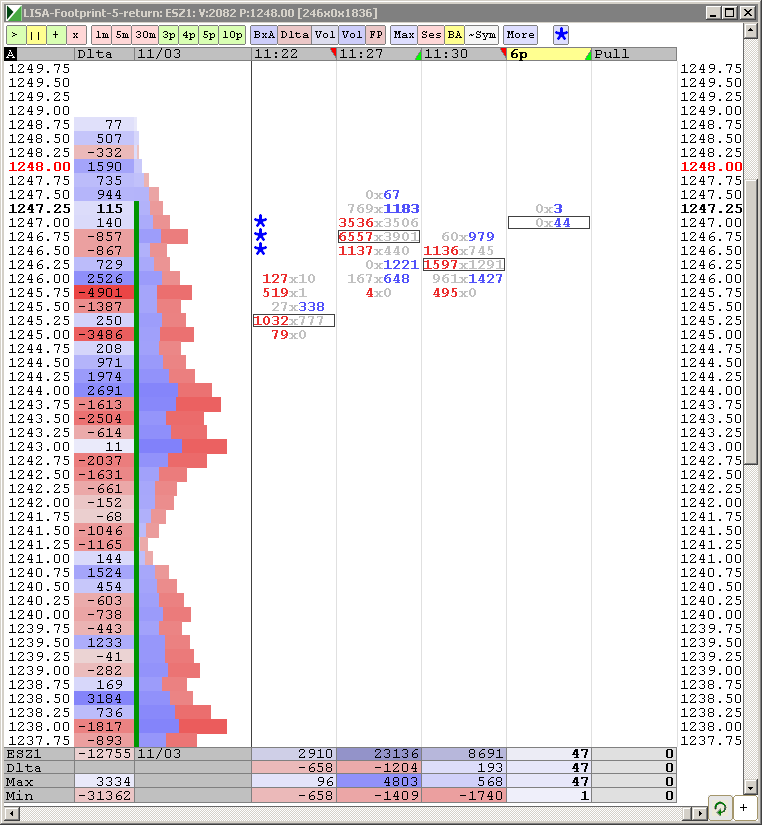

Basically today, I pointed out and trade from the 1237.00 area bc it is 38% Fibonacci retrace from 1283.50 high made on 10/28 at 16:01 and 1208.50 low made 11/01 at 08:52.

1237 area is also a Fibonacci 23.8% and it's acting as resistance. If you look at your intraday charts, you will see that the ES tested that area many times including late this afternoon in the O/N and was not able to find support.

Now ES is moving back down to test the next support area again, at 1214.50. Failure here will target 1204.00 and possibly 1178, same objectives as previously. Stops started above today's high now at B.E. 1236.00. Will see where it takes me.

Below is the same daily chart I had posted for some time now, last time was yesterday at 02:00.

Right now, next hours, next days, next weeks, next months and next years to come, I see for you the same I see for my self: Having the very best of luck, fun, awesome, incredibly profitable trading experience!!

I know I said that I will not post any more but NickP got me going with he's reverse psychology.

Basically today, I pointed out and trade from the 1237.00 area bc it is 38% Fibonacci retrace from 1283.50 high made on 10/28 at 16:01 and 1208.50 low made 11/01 at 08:52.

1237 area is also a Fibonacci 23.8% and it's acting as resistance. If you look at your intraday charts, you will see that the ES tested that area many times including late this afternoon in the O/N and was not able to find support.

Now ES is moving back down to test the next support area again, at 1214.50. Failure here will target 1204.00 and possibly 1178, same objectives as previously. Stops started above today's high now at B.E. 1236.00. Will see where it takes me.

Below is the same daily chart I had posted for some time now, last time was yesterday at 02:00.

Right now, next hours, next days, next weeks, next months and next years to come, I see for you the same I see for my self: Having the very best of luck, fun, awesome, incredibly profitable trading experience!!

Lorn, what is the significance of 600MA on 5 min, please?

INDU is back from the point it fell from this morning. SO big guys did not lose anything from the sudden news

It behaves like a 200MA on a daily chart.

Originally posted by Lisa P

Lorn, what is the significance of 600MA on 5 min, please?

Grrrrr-rrr.

I here you lisa

Just like yesterday, caught all the tops and bottoms and can't hold... Today, I shorted 47@ the opening, covered@45, shorted it again@ 46 and covered@44... what the heck.... I bought the bottom@31 and shorted 47.25 several times and out with a few points.. We're likely i a 2 sided market so this upper range should be a short... today is news driven though so odd things can happen too take your stops... and I got stopped out several times shorting 46...

Still no challenge of either 60min edge. Interesting to watch prices consolidate above that developing 1241.25 LVN. 600MA is certainly a challenge to get above. Shorts should be tried as close to 48 as your risk allows but be aware of the potential upside surprise.

Lorn, I agree with shorting as close to 48 as possible.. When it does break, the break should be worthwhile.. hopefully, I'll get in around 47 again and ride it to around the 41-39 level.. being 2 sided, I may also look for longs lower down around that same level.. DX wants to goo higher, yet, ADD/VOLD/TICK are trending higher.. The combined signals tells you there will be volatility and choppiness.. A day where your stops are likely to get hit..

doing battle at that 1262.25 this EARLY a.m. ..

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.