ES 5-1-13

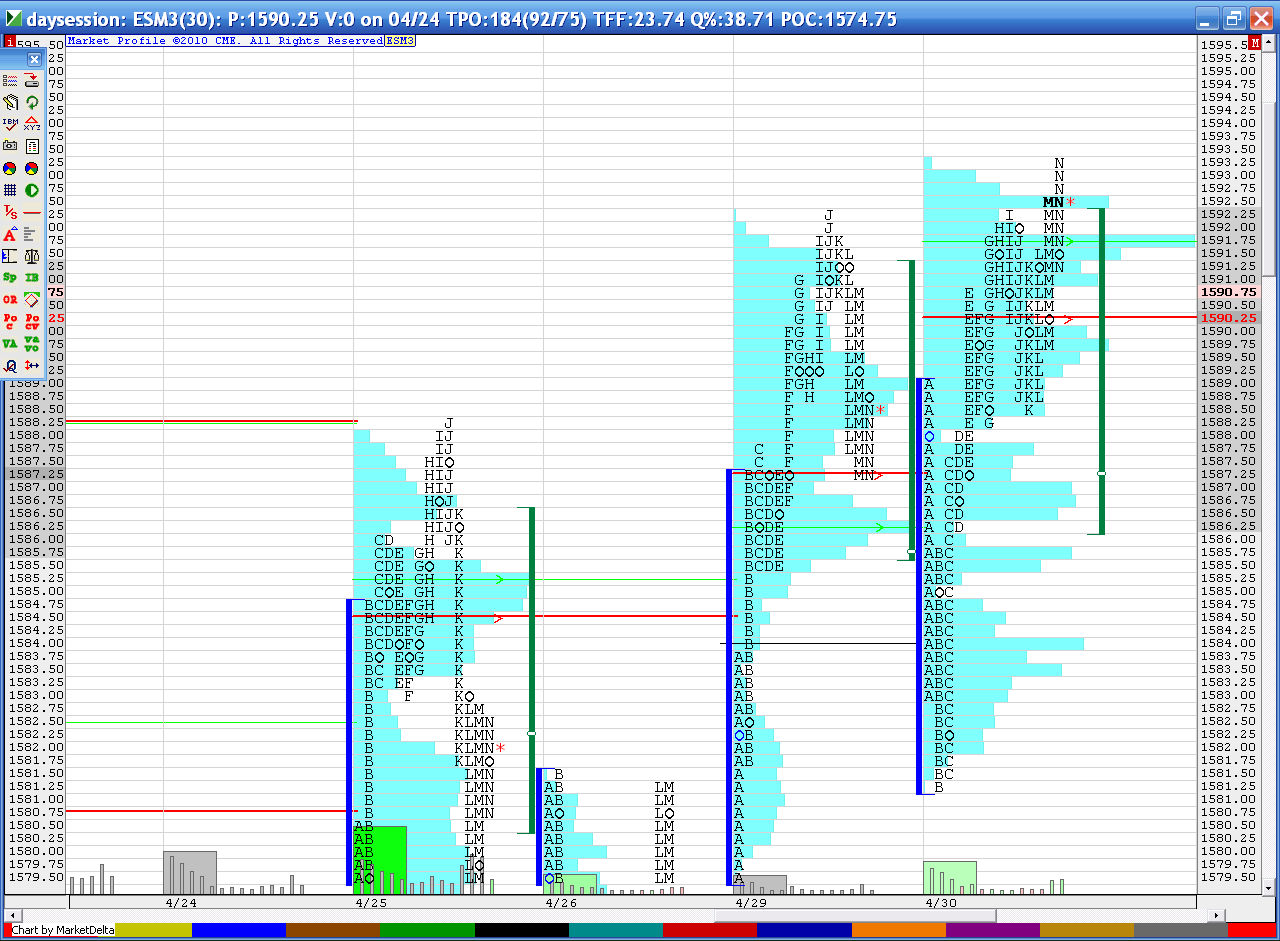

Good volume yesterday but most of it happened in the first half of the day. The second half just consolidated creating a nice bell curve with 93 at the upper end and 1588 ( last weeks high area ) for the low.

If you look on my chart you will see some nice swing lows at "G" and "K" period right into low volume at 1588. So still a critical spot today. Below there is another low volume spot that I thought would get tested yesterday but didn't at 85 and the VA low is at 86...

It all depends were we open today. I'm hoping we open inside yesterdays VA so we can try and sell above 93 ( VPOC of the O/N is 93.75 as I type) or buy at either 1588 or under 1586 closer to 85 if possible. In both cases I like the POC of 90.25 as a first target. Ideally we like to initiate trade 2.5 points below or above that price if possible.

R1 is at 97.25 today and s1 is at 84.25...reports today and fed announcement. All eyes are still watching that 93 high area to see if we can get a break out with good volume. So far big volume hasn't shown up yet

If you look on my chart you will see some nice swing lows at "G" and "K" period right into low volume at 1588. So still a critical spot today. Below there is another low volume spot that I thought would get tested yesterday but didn't at 85 and the VA low is at 86...

It all depends were we open today. I'm hoping we open inside yesterdays VA so we can try and sell above 93 ( VPOC of the O/N is 93.75 as I type) or buy at either 1588 or under 1586 closer to 85 if possible. In both cases I like the POC of 90.25 as a first target. Ideally we like to initiate trade 2.5 points below or above that price if possible.

R1 is at 97.25 today and s1 is at 84.25...reports today and fed announcement. All eyes are still watching that 93 high area to see if we can get a break out with good volume. So far big volume hasn't shown up yet

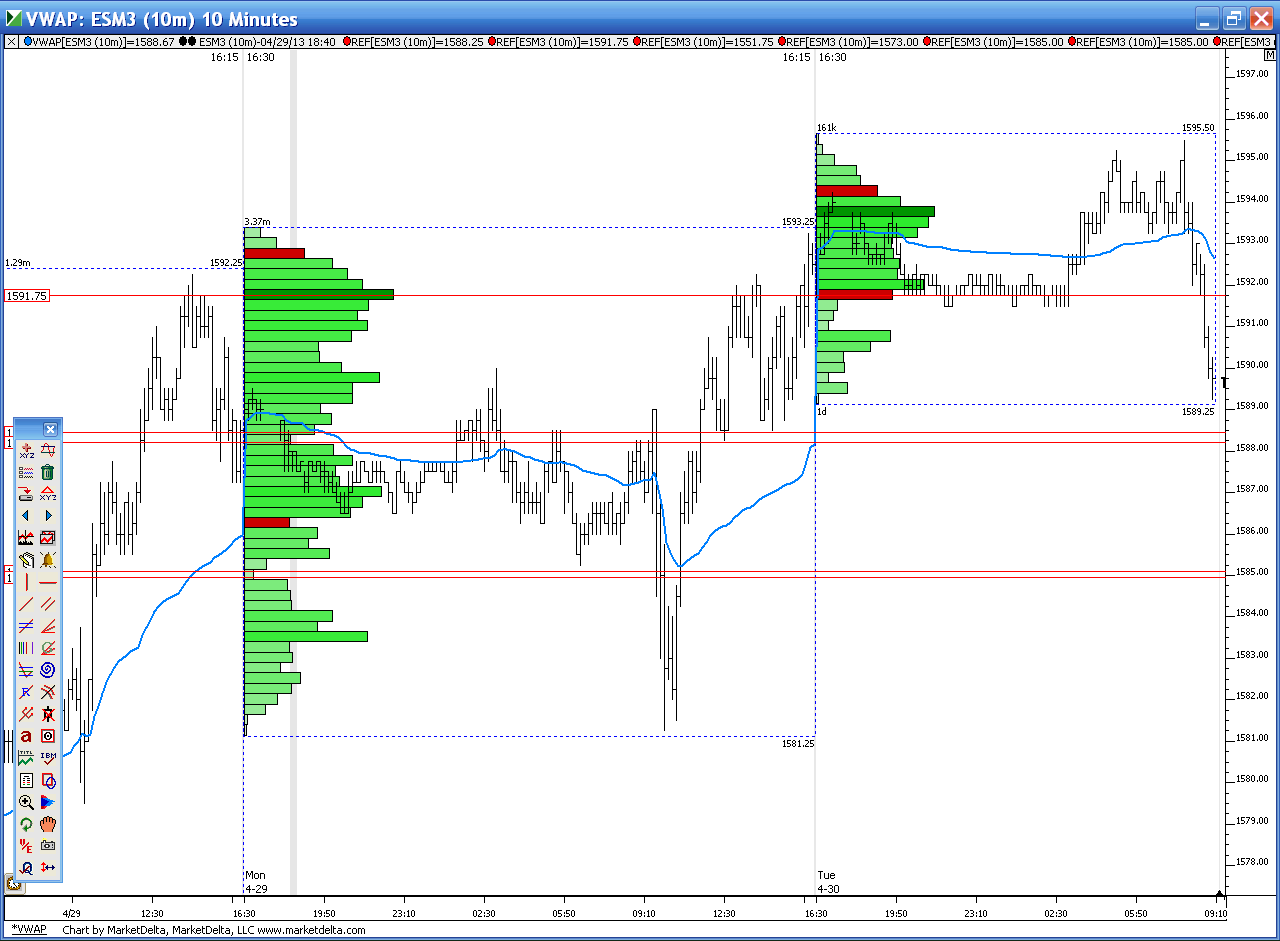

here is one more chart...left histogram is what happened for ALL of yesterday....note the low volume areas. On the right side is what happened since yesterdays day session closed..

Overnight market has sold off now approaching our first LVN at the 88 area....currently at 89.25....just posting so some have an additional visual

these combined Overnight charts get labelled funny...so the label of Tuesday is really what happened in Tuesdays Overnight session. the label of Monday is what happened in Mondays overnight and Tuesdays day session combined

Overnight market has sold off now approaching our first LVN at the 88 area....currently at 89.25....just posting so some have an additional visual

these combined Overnight charts get labelled funny...so the label of Tuesday is really what happened in Tuesdays Overnight session. the label of Monday is what happened in Mondays overnight and Tuesdays day session combined

more important issue bruce is how are the sick kids?

any buys for me down here in the 88 - 89 area will use 91.50 as a target based on what I see happened in the overnight...look at last chart posted ..we want to be out in front of that as we had a ledge there in O/N and it may turn into resistance

that was an open and drop to the minus 2.5 which hit the VA low of yesterday to the tick !!

Back to the open as it should and with any luck it will go get the 91's

Back to the open as it should and with any luck it will go get the 91's

thanks for asking Duck..it started out with one sick...now all three are sick...so I type instead of record so they can sleep more

made one mistake so far and that was not scaling out heavier when we got back into the 88 - 89 low volume area...sloppy on my part

most days I like to see some movement off the open...so I couldn't buy the open because we didn't MOVE to the 88 - 89///...we opened there instead..

big difference and hope some will understand that..I can't see something slow down if it isn't moving first

most days I like to see some movement off the open...so I couldn't buy the open because we didn't MOVE to the 88 - 89///...we opened there instead..

big difference and hope some will understand that..I can't see something slow down if it isn't moving first

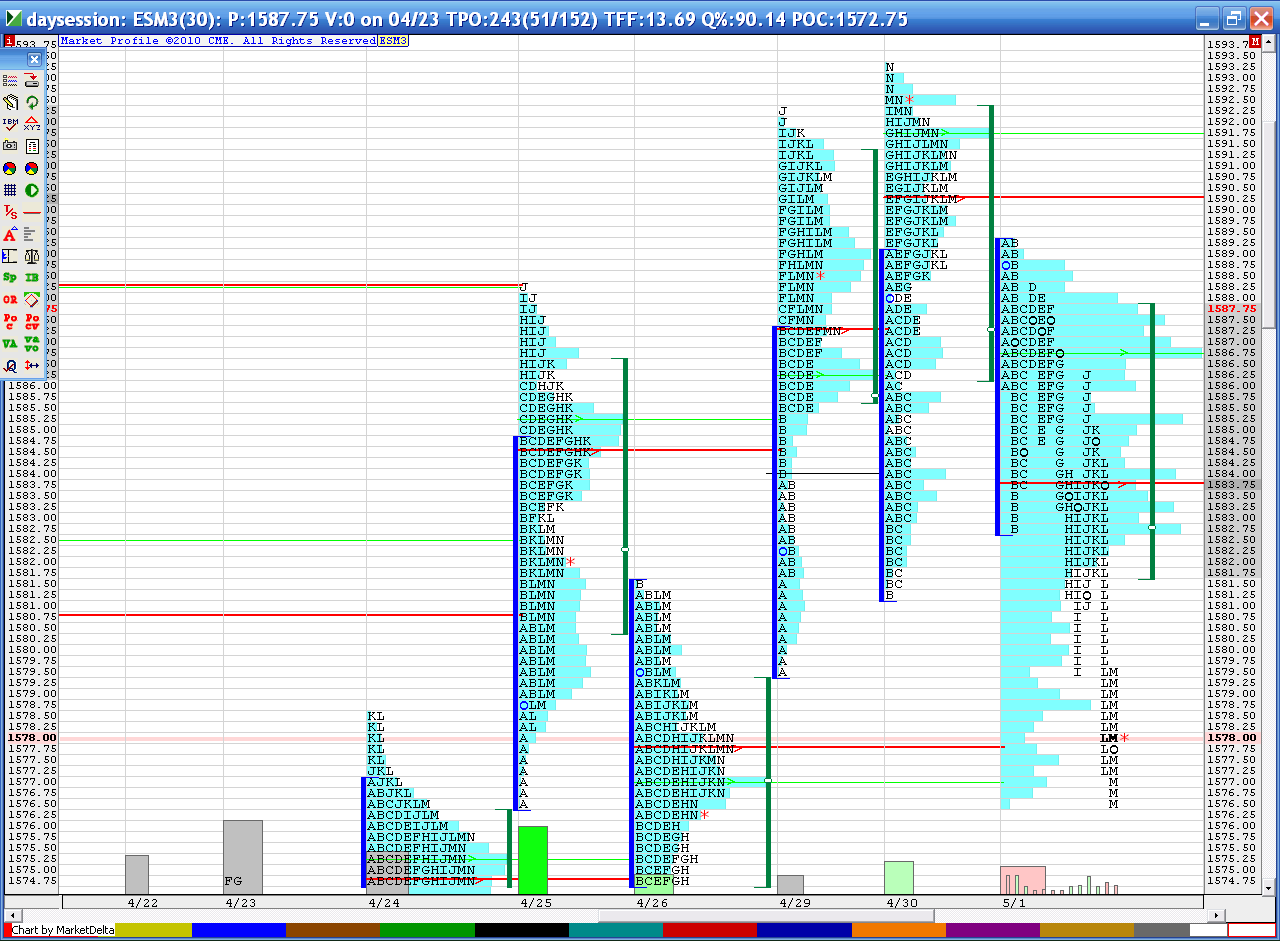

we need to see this 85 - 86 turn into support to try and target that double top of the IB...can't expect too much as volume will start drying up soon and the dreaded pre fed trade begins

always so cool to see the reversing roles of low volume/time prices...see how 88 - 89 has become resistance and 85 is trying to hold as support..?

I think those reading who are low funded should trade for tests of low volume after they blow through them by 2 points or more the first time they trade....

based on my observations these LVN's from the smaller time frames do only two things....1)they either hold the fist time touched or they get blown through and take out stops - then they come back to get tested..

an old concept I've mentioned before but powerful....this idea is only in reference to those formed from previous days....not ones forming intraday

today the open blew through the 88 and that got retested...then they did that with the 85 later...same concept

based on my observations these LVN's from the smaller time frames do only two things....1)they either hold the fist time touched or they get blown through and take out stops - then they come back to get tested..

an old concept I've mentioned before but powerful....this idea is only in reference to those formed from previous days....not ones forming intraday

today the open blew through the 88 and that got retested...then they did that with the 85 later...same concept

just a heads up to keep track of the price right before the 2:15 announcement. Often we will revisit that price the same day....either way a good price to keep track of for a future target

one can really learn a lot about the markets if you realize that the market is always trying to figure out ranges and Value. So we always need to monitor both the Value areas and ranges of previous days.

Notice in today's "J" period high post report they stopped at yesterdays VA low. Note how "I" and "M" period used the VA highs from Friday..4/26 ...first as support then as resistance

I always ask myself "Can they hold above or below a VA line ? Can they hold above or below a range ?" The VA lines will give you better results but both are important

ok..enough rambling for today..there is the close gap filled and here is my chart for reference

Notice in today's "J" period high post report they stopped at yesterdays VA low. Note how "I" and "M" period used the VA highs from Friday..4/26 ...first as support then as resistance

I always ask myself "Can they hold above or below a VA line ? Can they hold above or below a range ?" The VA lines will give you better results but both are important

ok..enough rambling for today..there is the close gap filled and here is my chart for reference

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.