ES 5-3-13

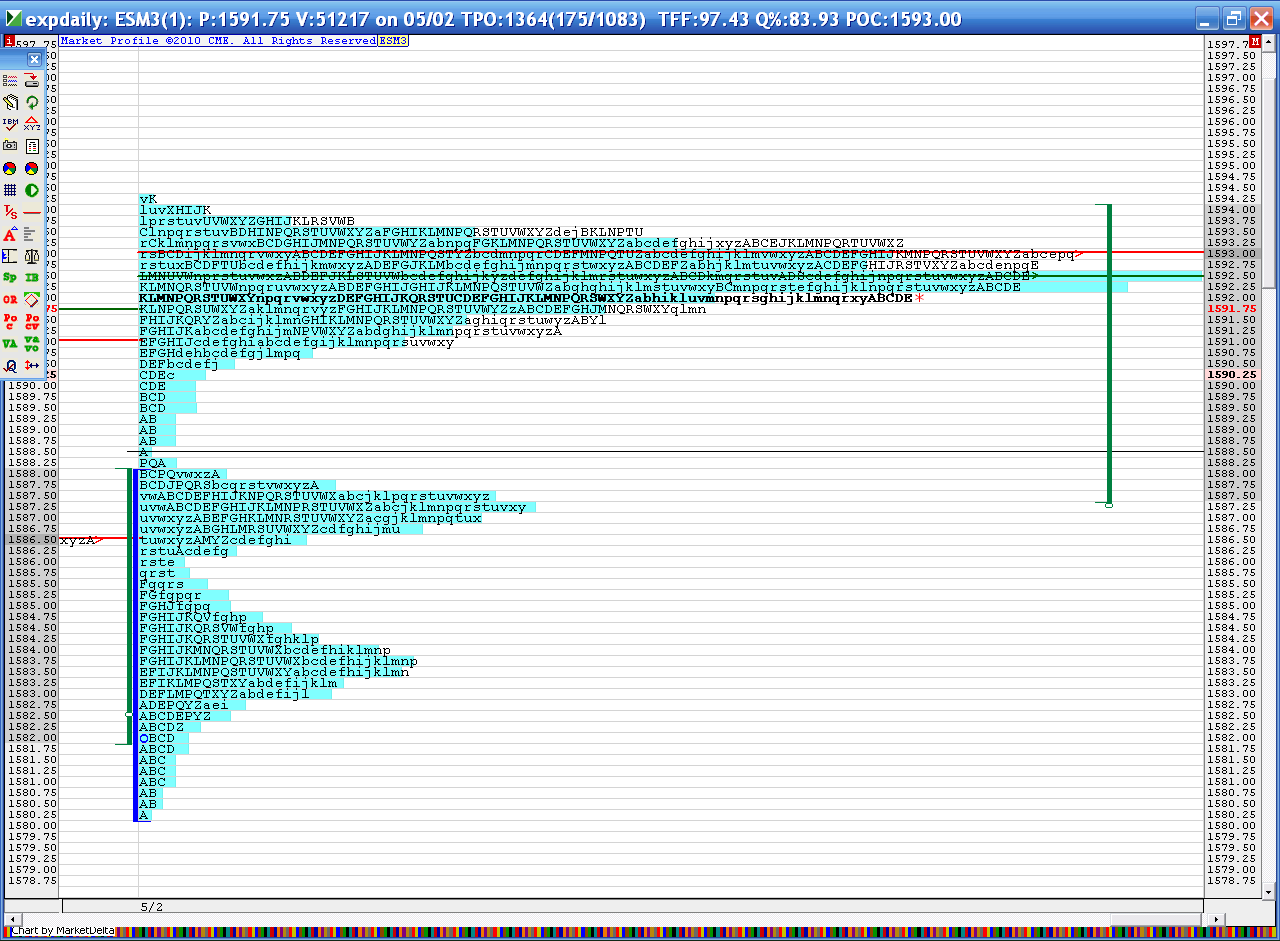

The super secret chart from yesterdays day session.

87 - 88 and the 92.50 are the biggest numbers to watch. Report at 8:30 may change all this.

There is also a low volume area and single print at 85.75...so if we open in Value and drop down we have two key buy points. Or just snap a line at 86 - 88 and use that as a zone

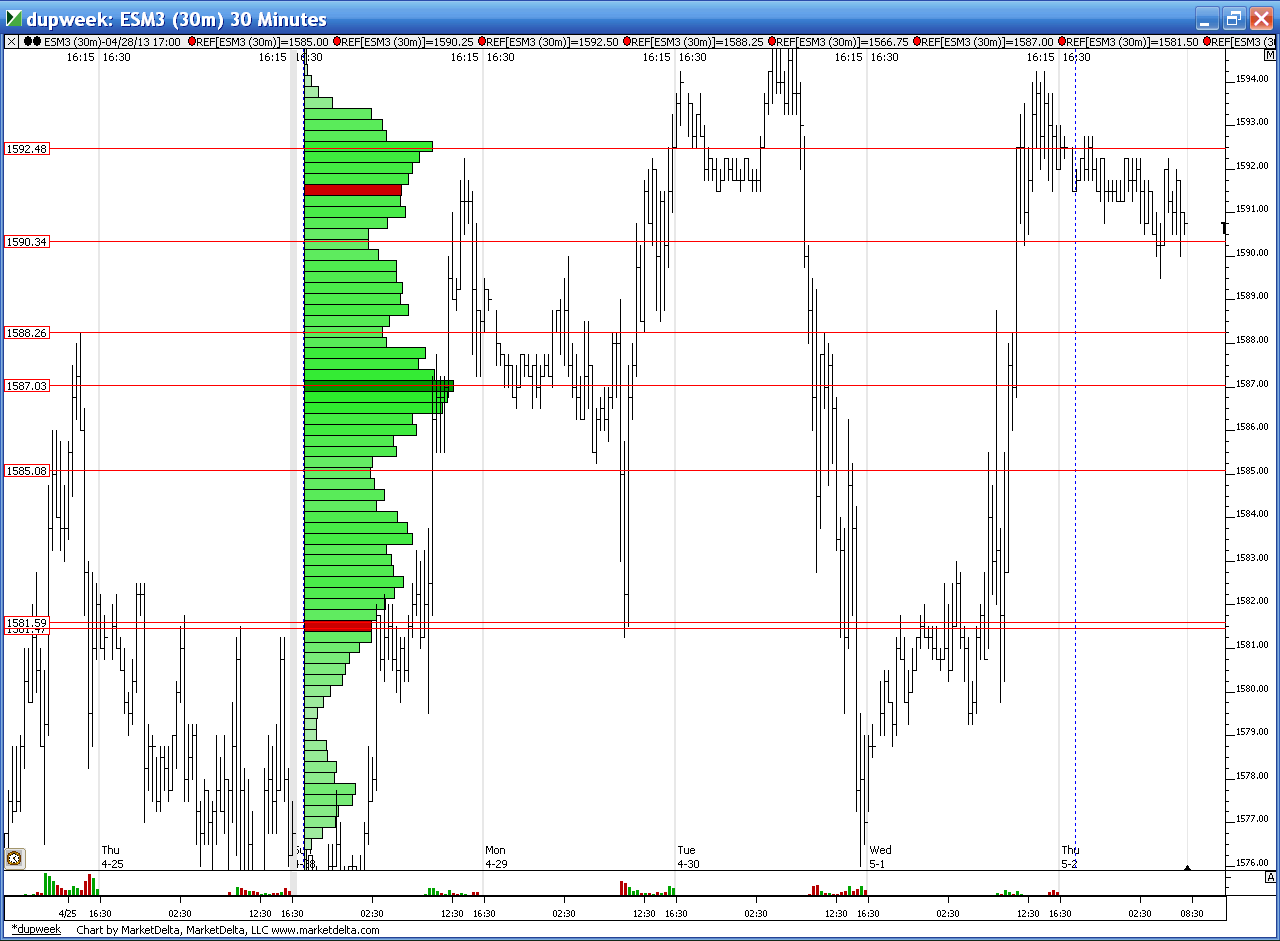

here is how the weekly looks so far..note the low / high volume combination at 87 - 88.25 this week..

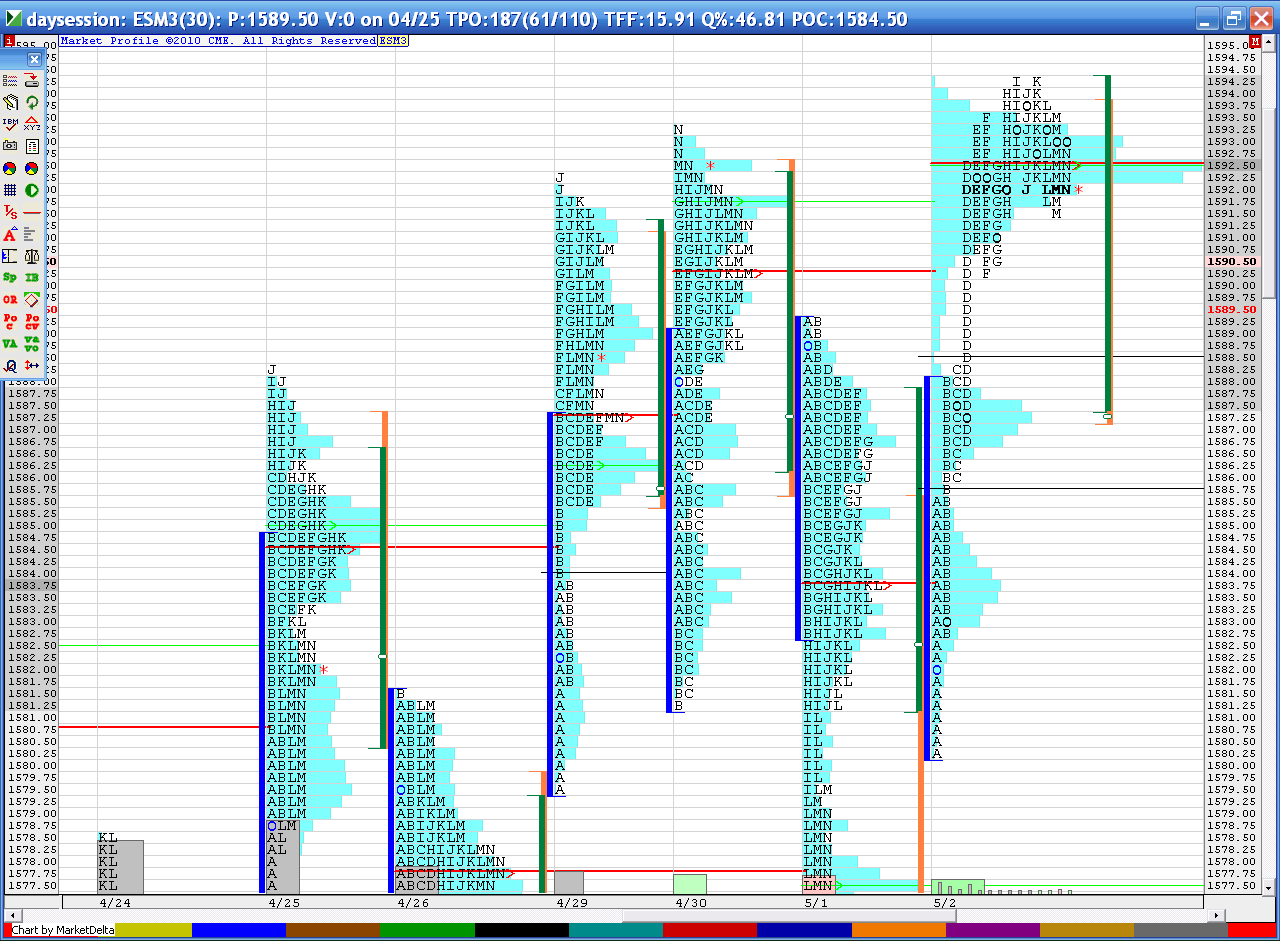

and here is traditional MP chart

87 - 88 and the 92.50 are the biggest numbers to watch. Report at 8:30 may change all this.

There is also a low volume area and single print at 85.75...so if we open in Value and drop down we have two key buy points. Or just snap a line at 86 - 88 and use that as a zone

here is how the weekly looks so far..note the low / high volume combination at 87 - 88.25 this week..

and here is traditional MP chart

I'll cover Overnight after report hits...u can see all the low volume in the 88.50 - 90.50..from the classic Mp chart in "D" period...a wide band of low volume....the Overnight is respecting that so far

other numbers upside is the 95.50 from yesterday and then we can look towards 1600

I had a volume error yesterday - it ended up being the lightest volume day of the week

other numbers upside is the 95.50 from yesterday and then we can look towards 1600

I had a volume error yesterday - it ended up being the lightest volume day of the week

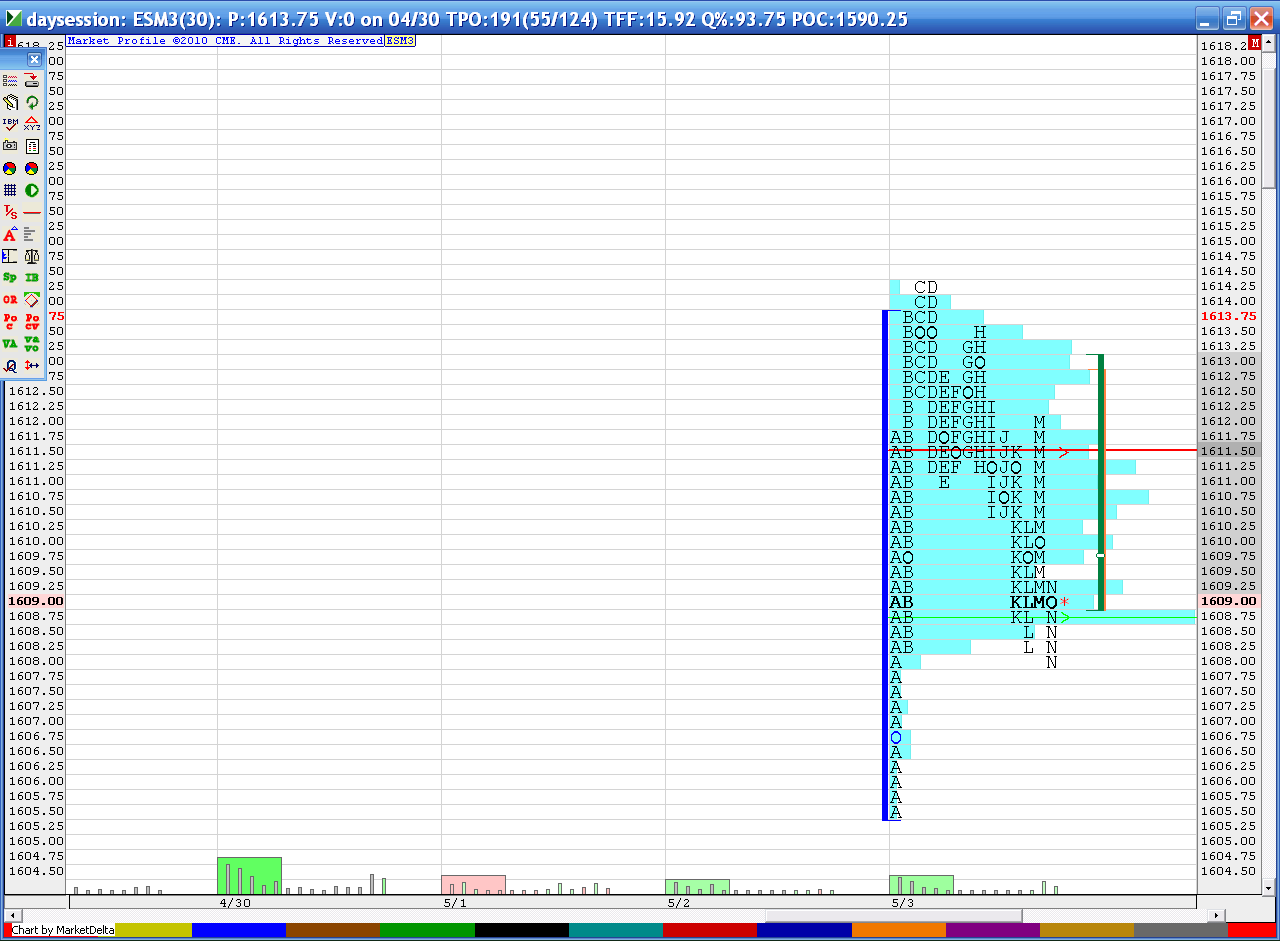

now that the report is in I am looking for short trades for the 1599 - 1600.75 retest...volume came in there

we were at the 92.50 BEFORE the report hit and they like to test those areas....not always on the same day but soon after...just more evidence for our POC price from yesterday to get retested

so I am starting to pick at short side up at 1605.25 and will take a few small tries..

I'll need this to settle before coming up with a better plan for day session trade

we were at the 92.50 BEFORE the report hit and they like to test those areas....not always on the same day but soon after...just more evidence for our POC price from yesterday to get retested

so I am starting to pick at short side up at 1605.25 and will take a few small tries..

I'll need this to settle before coming up with a better plan for day session trade

What a ride! 13 points in 5-10 minutes. Knew i shoulda taken that long at 92 before the report...

Hopefully RTH brings this back into perspective so we can find some reasonable entries on the long side.

Hopefully RTH brings this back into perspective so we can find some reasonable entries on the long side.

keep in mind that any open in RTH above the 93's will give us a gap open outside of a major bracket high....so my plan will be to be more selective on shorts in RTH

if u like gambling then sure...suppose it was 13 points down and you were long??

fun stuff as long as u realize it's just gambling

fun stuff as long as u realize it's just gambling

Originally posted by aumadvisor

What a ride! 13 points in 5-10 minutes. Knew i shoulda taken that long at 92 before the report...

Hopefully RTH brings this back into perspective so we can find some reasonable entries on the long side.

stopped at B/E..will try again above the 06.25 rat!...peak volume is at 03.75 and will be my magnet price now up here

How long will u wait to see if we have acceptance at these prices before switching to long side? IB or sooner?

I just trade off the areas....so I will look for shorts using the 03 - 04 as a target but I'm also looking at the LVN at 1601.50 as a possible support point...to buy but that will be less aggressive

when we make new highs we don't have great numbers.....so I am only trading what I see and am short term only...and I won't trade too heavy today because of this gap outside of value..

Prefer RTH shorts above that O/N high...1612.50 is a RAT if needed

when we make new highs we don't have great numbers.....so I am only trading what I see and am short term only...and I won't trade too heavy today because of this gap outside of value..

Prefer RTH shorts above that O/N high...1612.50 is a RAT if needed

I'd like to see a plus 4- 5.5 zone hit ...so the 1610 - 1612.50 is my prefered sell zone

I like the concepts you and Thomas are talking about. The only thing that concerns me is that we have a poor high from Friday - Look at that double top in "C" and "D" periods...that doesn't show aggressive sellers. The other concern is that the Monthly R1 level comes in exactly at 1614.25 and look where Fridays high is.

Hopefully the overnight session will give us some clues.

Here is a quick look at that double top

Hopefully the overnight session will give us some clues.

Here is a quick look at that double top

Originally posted by aumadvisor

Just curious of everyone's thoughts, but in my mind the chart from Friday looks promising to set up an island pattern. We have a huge runup with high volume and rounds out on the top. If Sunday opens with a gap down I think we have a good chance of hitting 92.5 as early as mon, Tuesday at the latest. Bull and bear swings typically end with a sign of "excess" such as this. This week should be interesting.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.