ES Thursday 8-28-14

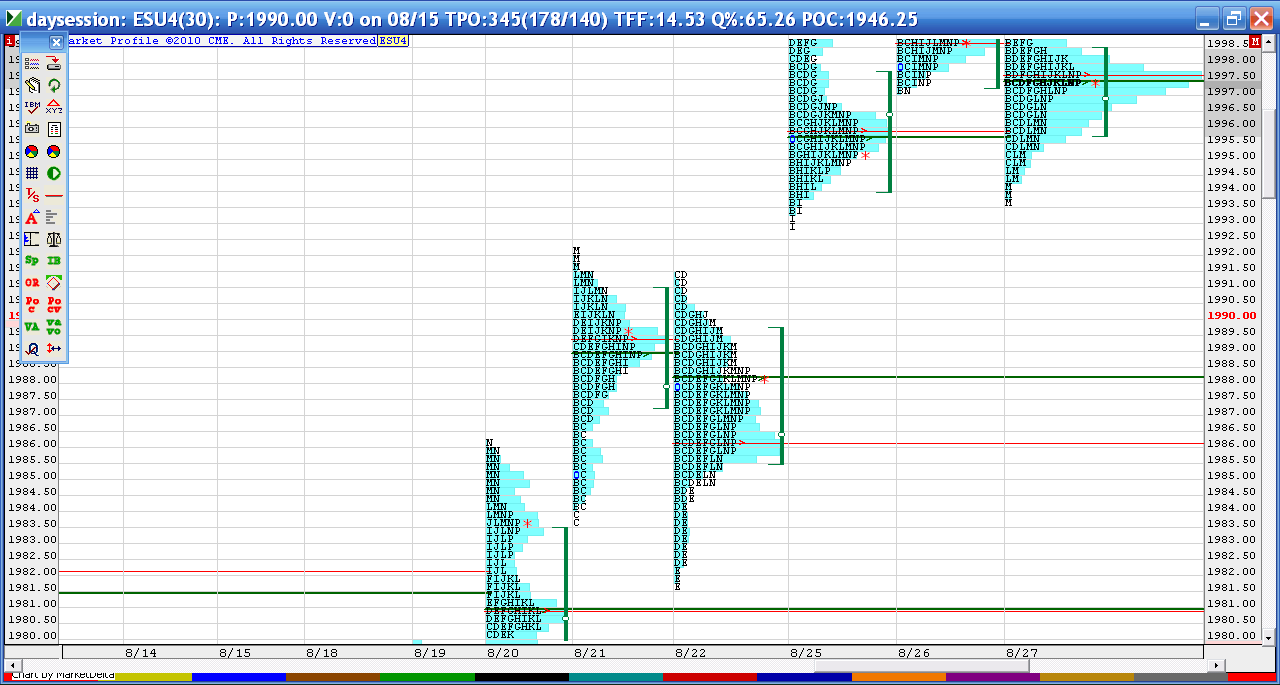

Levels as I see it I think they will need to test the LVN from opening under and O/N midpoint....risk today is that we have had three days of consolidation so if everyone starts giving up on the 2000 level then real selling could enter....so for me I will be taking longs at slightly lower numbers of contracts today....On the 90.25 long now but will watch closely

and a day session only chart but really focusing on lower levels just in case

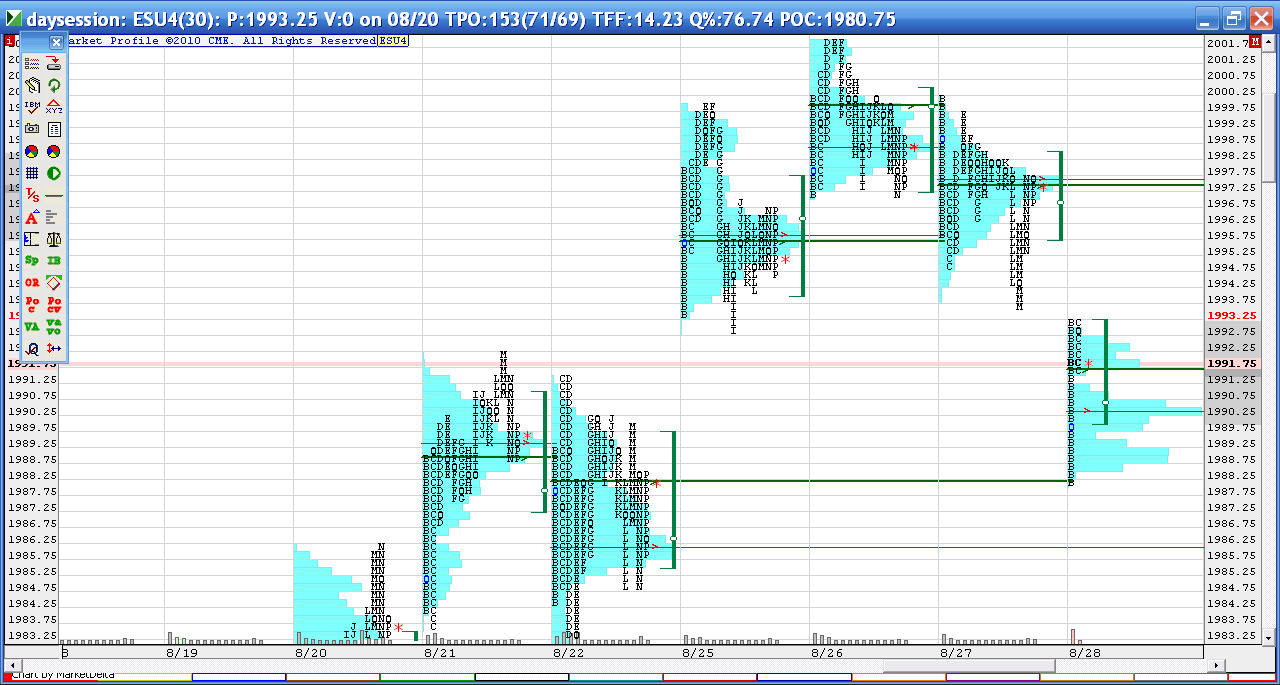

and a day session only chart but really focusing on lower levels just in case

so watch the profile from 8-22 closely this morning for clues as to what may happen....us buyers need to reject out of there fast in RTH and the sellers want to see price stay inside that bell curve from 8- 22/////it really is that simple...the hard part is pulling the trigger and being able to hang on through all that crappy back and fill the ES does.....the last thing us buyers want to see is a 30 minute close under the 84.50 - 86 area...it doesn't mean we can't try longs down at 81 - 82.50 but getting under VA lows of 8-22 and ledge lows would be bad

if I have to buy under On lows in the 84.50 - 86 area then O/N Vpoc is target and I will take the loser on my small O/N long position....I'd rather get out then be stubborn to hold for the price point I entered longs in O/N which was 90.25...so I won't mind taking a loss on a gamble O/N trade initiation as long as my RTH trade makes more.....that is why i go super small in any O/N trade....I am wrong a lot in that session

I'm using 92.25 as a target if this long is going to work off the open......I do not trust that LVN area and think sellers may show up near there

starting RTH longs at 88.50...I know O/N low is nearby...so plan would be to be more aggressive once/ IF On low is broken

this is all higher risk because we are inside the range and under the VA high of 8-22 trade ...and we couldn't get out of those highs on the first drive up so far...so not gonna be too foolish here

coming out heavy at 90.50...this gives me two points and gets rid of that crappy O/N initiation......still trying for 92.25 but doubt my patience will hold out ..ideal would be to see them stay above open print and O/N vpoc

we still can't get out of the 8-22 highs...!! gotta get out of there if long side is to have any chance now

that's me done at 92.50 on final...On midpoint and LVN edge is here......no more trades for me today but if buyers are real lucky then you may get the O/N high today back into poc of YD rth

A tour de force.

Thanks for your comments and insights.

Thanks for your comments and insights.

every once in a while somebody starts voting down my posts...LOL....so today I guess they just suck or my past vendor buddies are out for revenge...here is what it looked like on that last trade

well the hour is up and value has built lower and we have rejected the LVN so far.......I mention it only because I know many like to fade IB highs and lows.....I think today the context tells us it is dangerous to be buying if we get an IB low breakout........time to go outside and watch paint dry...really that's what I'm going to do ...go paint to get a lead on these harsh VT winters and do something physical...94.50 is another smaller key spot as it is single print ( almost ) and a breakdown point from the overnight ( it was vpoc before the flip down)....so be mindful of that if you are shooting long for that 97 - 98 area....

either way I hope it goes the way u need

either way I hope it goes the way u need

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.