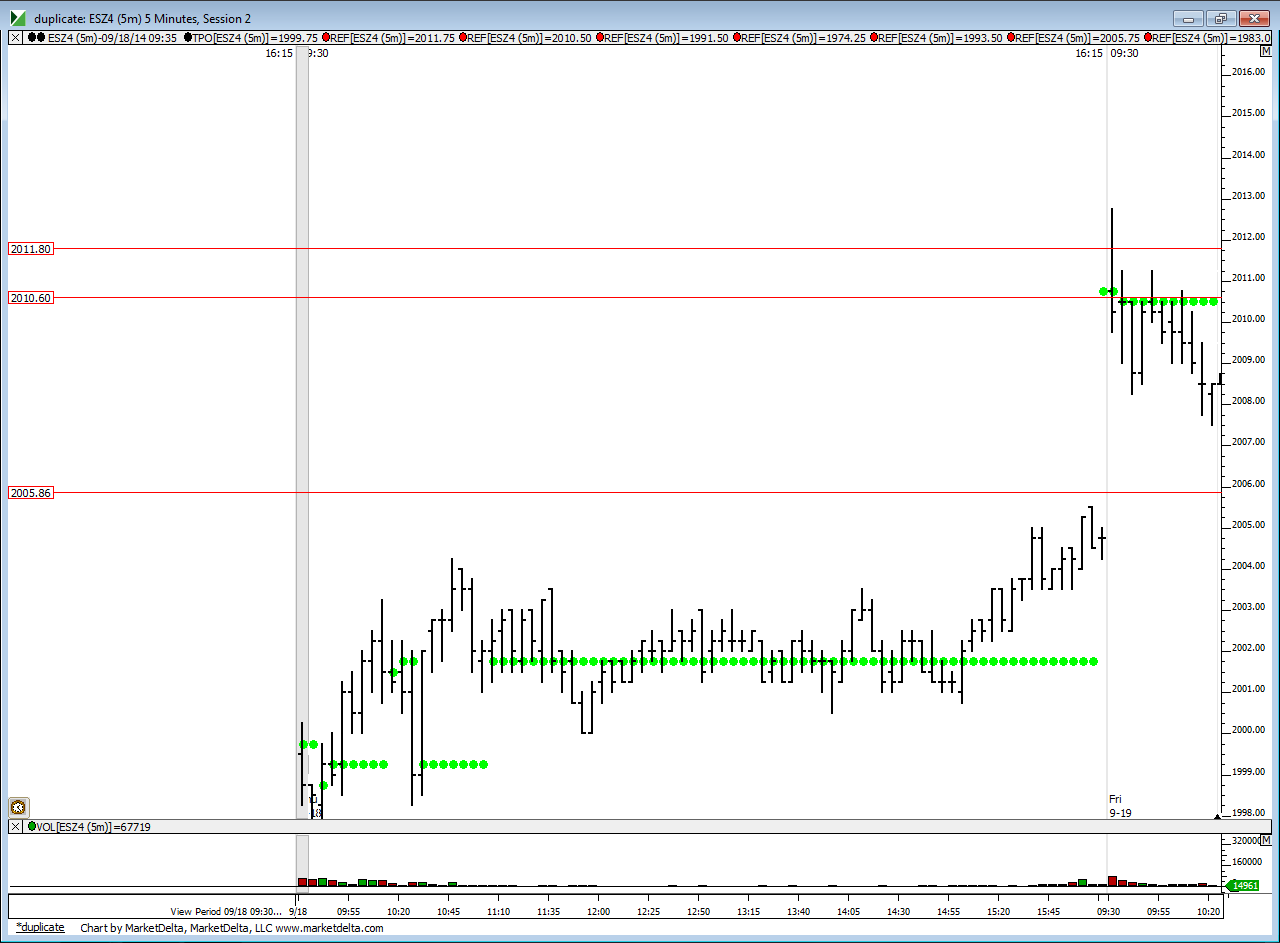

ES Friday 9-19-14

along with my babble on the video , gap guy say shorts have a higher probability of filling in today too ...my records for fridays ( however brief) show a generic 78% chance of gap fill and as always a 80- 82 % chance of a half gap fill...this is options expiration friday...something to keep in mind....

here is the rest of my world and I hope it all goes well today....

for reference I have small shorts at 2010.25 and will add in On at 2012.50........I know some like to see my trades posted and most don't care....but that is my plan...as usual this is all kept small and I am more active once rth opens....I'll be using 2008 as a first target unless I need to add at the 2012.50 number ...then I would target original entry point...nuff said

here is the rest of my world and I hope it all goes well today....

for reference I have small shorts at 2010.25 and will add in On at 2012.50........I know some like to see my trades posted and most don't care....but that is my plan...as usual this is all kept small and I am more active once rth opens....I'll be using 2008 as a first target unless I need to add at the 2012.50 number ...then I would target original entry point...nuff said

I don't know whether this is a factor today or not... but ...I'm going to mention it anyway...the markets might be in a holding pattern until Alibaba actually opens and starts trading.

the longer we stay hovering at a pivot number like the R2 the more I do not like the fade......so in these cases I am always much more watchful......and have higher stress levels ...doesn't mean the trade is a lemon but I like to see rejection of these areas faster......so lets get a move on it will ya ?

with all the noise they could easily trade above that 10.50...for me I'd be more concerned if we start taking out the single prints and the VA high of the O/N session..up near 12.25.....but I also know that the 10.50 can also act as a magnet even if they do that ...so it doesn't mean I wouldn't short again if I saw the pace slow down...that 14 - 16 is a nice spot.....

luckily as I type we are hitting 08 so I am taking something here........and will try to hold again

luckily as I type we are hitting 08 so I am taking something here........and will try to hold again

Originally posted by Aladdin

By reject do you mean: not trade above 2010.50?

perfect hit on that r1...so we gotta crack that...I really want to see what happens at 06.....c'mon...press it down...IB is gonna complete in 8 minutes....

here is how my chart looks..I have a line snapped at 06 only because my O/N data had a VPOC there...I can do this because I only have runners to hopefully get lucky with...the green is where all the volume is...u r looking at today against yesterday

i posted this earlier Bruce, u may have missed it

Originally posted by apk781

nice video Bruce, thanks....i don't have that volume at 06 that u show in the o/n fyi....i have the bulk at 07.5 (before it moved up to 11-11.5) which makes sense with where we made that swing low abt an hour ago...in any case, i know u trust your ib data but just wanted to bring that up

gl today

that was 1/2 gap fill too....fyi

all my volume is at 9.5...

I saw it apk but I have r1 at 07.75....but so far your 07.50 stopped the decline perfectly....another reason I want to see what happens at 06.......these data issues are frustrating but as long a s we have some key references I guess that's all we need.......

Originally posted by apk781

i posted this earlier Bruce, u may have missed it

Originally posted by apk781

nice video Bruce, thanks....i don't have that volume at 06 that u show in the o/n fyi....i have the bulk at 07.5 (before it moved up to 11-11.5) which makes sense with where we made that swing low abt an hour ago...in any case, i know u trust your ib data but just wanted to bring that up

gl today

Thanks Bruce.

I have a short 2010.75 (R2) and Genie said to exit at 2005.75 (dayhigh)

I have a short 2010.75 (R2) and Genie said to exit at 2005.75 (dayhigh)

thanks apk

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.