ES Monday 12-1-2014

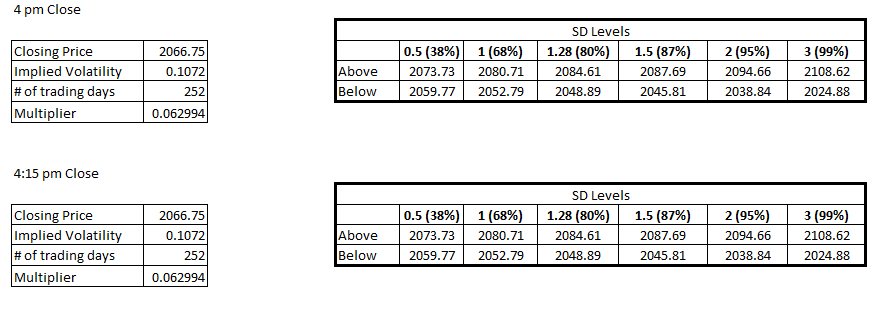

Today's volatility numbers based on Friday's trading. I am not sure how much emphasis to place on these today since Friday was a short trading day as well as such a thin volume day but here it is anyways.

The entire RTH range for last week was only 10.50.

this is small small small.

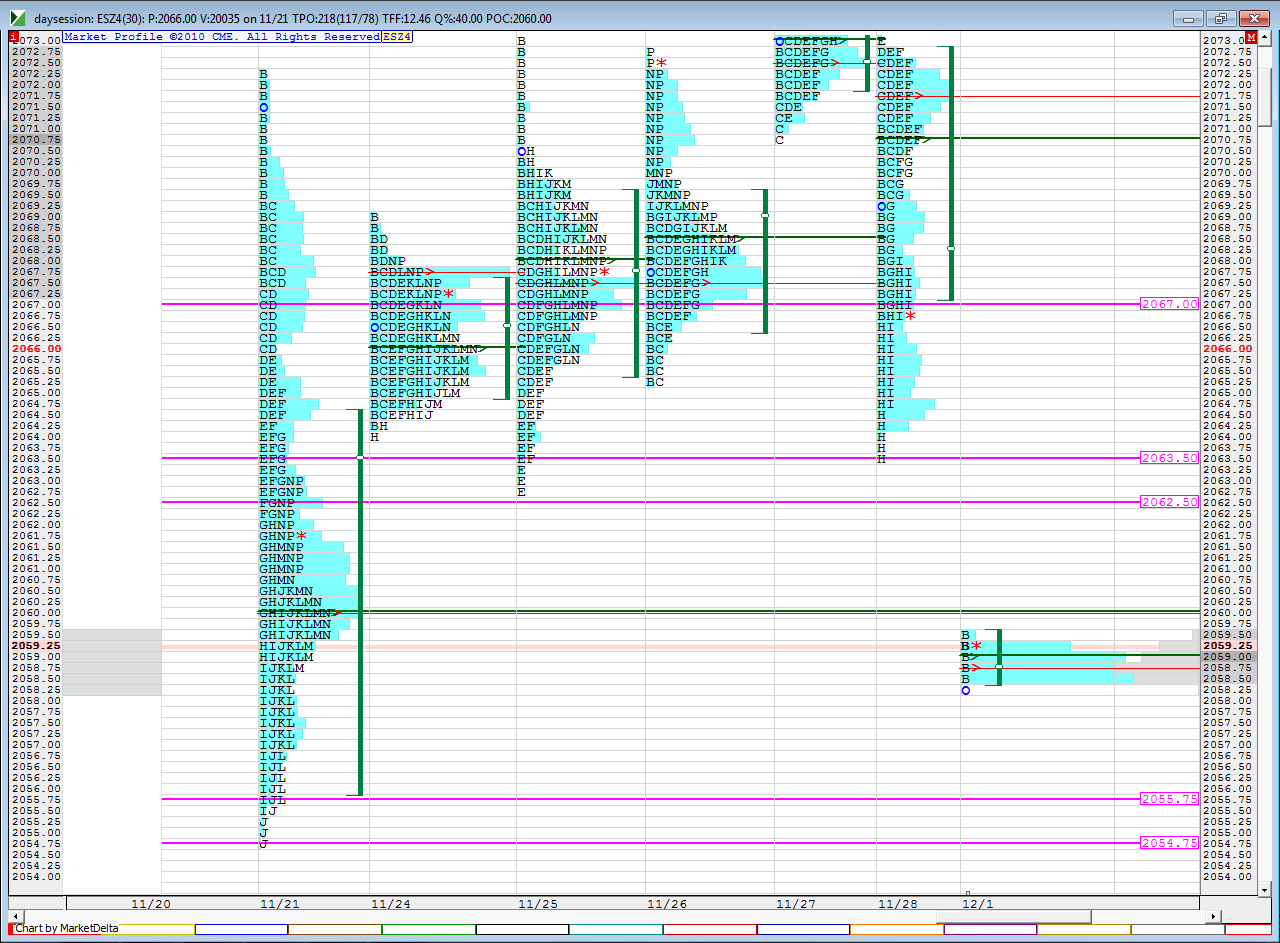

Overnight low filled gap created by 11/21 jump up.

WHere's BRUCE???

is a move up to last week's LOW (63.50) a place to look for short?

Look at this week (just starting versus the prior 2 weeks... profile is filling in 61 down to 53 (narrow profile from week begin 11/16.

Ohhhhh, BRUCE, where are you?

One thing I don't think he would want to play with at all is the prominent POC created in the overnight. look to the edges...

this is small small small.

Overnight low filled gap created by 11/21 jump up.

WHere's BRUCE???

is a move up to last week's LOW (63.50) a place to look for short?

Look at this week (just starting versus the prior 2 weeks... profile is filling in 61 down to 53 (narrow profile from week begin 11/16.

Ohhhhh, BRUCE, where are you?

One thing I don't think he would want to play with at all is the prominent POC created in the overnight. look to the edges...

working on the assumption that they will test that bell at 2060 from 11-21 and then if lucky Fridays lows

in general that is true Paul but since that is also S2 today I am using it for longs but prefer to see us push out under the 55 area...bulls need to take over that 60 to get anything to really work today...it seems everywhere we turn at 2 point increments there is another area to watch for ...and that sucks

In O/N they stopped at 52, which was the week before last week's VAH. I think they would try to fill in the air bubble at 54..

weekly S2 at 56.5. another place where prices could stall

I think today they might go for that prominent POC at 2050.00 (11/20).

And then fill in those single prints from that day (11/20).

And then fill in those single prints from that day (11/20).

buying into 49.75...so if we can get a test of LVn edge back to 52 ...first rth trade was a loser......luckily I realized the 60 had already tested so went in lite

how i see it now...blowing through an LVN is a no-no...so expecting test back up into it.....what they do is they know people buy those so they blow through, take out the stops and then come back up into them...

DT the forum is SLOW and posting videos......

DT the forum is SLOW and posting videos......

I hope they will play nice today....

Now it is time to divert my attention to today's live webinar by Jim Dalton: How to combat overtrading.

Have a nice day, everyone.

Now it is time to divert my attention to today's live webinar by Jim Dalton: How to combat overtrading.

Have a nice day, everyone.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.