ES Tuesday 3-10-15

57.75 is final for me..this is real close to VA low from 2-11...don't trust it !! and it's after 11....I'm off to my overtraders anonymous meeting !!

you made a pretty penny so make sure to take the doughnuts to the meeting!

Originally posted by BruceM

....I'm off to my overtraders anonymous meeting !!

same here its been a violent day

Nasdaq hit its 21ema for first time today that's what that 5min sell off was hahaha

on the 15min chart.

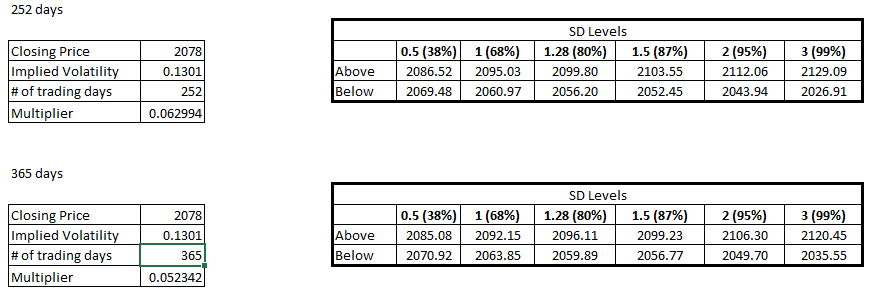

Joe...Es has hit it's 3 atr band off keltner channel using the 21 period as it's base..so we either base here and start going back up or run the risk of riding the rail down...LOL....weekly has hit it's .5 SD band on downside so I just sold puts on spx that expire on Friday ..sold the 2005 and bought the 1995 just to be safe and have some protection.....I find that when we drop to a .5 weekly band we do not usually drop another complete standard deviation down from there in the same week...

beautiful I just bought some qqqq and spy wk calls. It appears to be building a bowl shape on the 15min. Ill avg down if needed. but I think this is at least a short term bottom

Also loaded up on usdjpy these have not sold off today. the dollar was strong all day. is the index crash=usdjpy crash over? anyways targeting 122.30ish on that. avg in 121.3o something.

Bruce hows the selling options been? Do you prefer that to just buying calls?

i still do not understand what is the difference between selling puts versus buying calls? Your assumption still is that the market will move up, correct? so then how are the 2 strategies different?

Crude has a picture perfect abc wedge almost to its 21ema on the hourly if anyone's still trading. Im trying to decide if the euro is going to take a breather tonight or continue its 50-80 pip overnight slide.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.