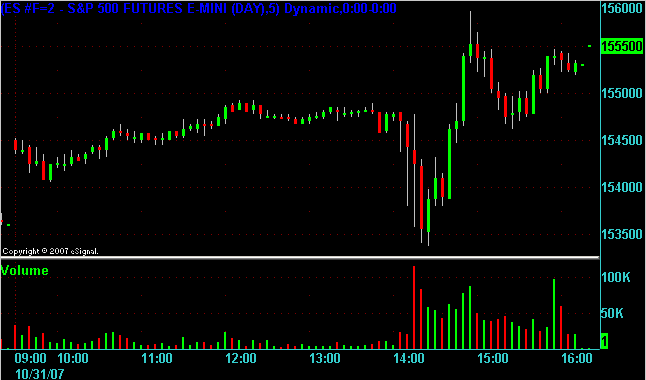

FOMC Fed Day 31 October 2007

The next FOMC interest rate announcement will be on the 31 October 2007.

More details and charts about Fed Days

More details and charts about Fed Days

In advance of next week's Federal Open Market Committee meeting on October 30-31, the CME Group will be reporting daily rate change probabilities in the FOMC's federal funds target rate, as indicated by the 30-Day Federal Funds futures contract. The 30-Day Federal Funds futures contract is a key benchmark interest rate barometer that reflects the forward overnight effective rate for excess reserves that are traded among commercial banks in the U.S. federal funds market.

Based upon the October 26 market close, the 30-Day Federal Funds futures contract for the November 2007 expiration is currently pricing in a 100 percent probability that the FOMC will decrease the target rate by at least 25 basis points from 4-3/4 percent to 4-1/2 percent at the FOMC meeting on October 31.

In addition, the 30-Day Federal Funds futures contract is pricing in an 8 percent probability of a further 25-basis point decrease in the target rate to 4-1/4 percent (versus a 92 percent probability of just a 25-basis point rate decrease).

Summary Table

October 24: 86% for -25 bps versus 14% for -50 bps.

October 25: 86% for -25 bps versus 14% for -50 bps.

October 26: 92% for -25 bps versus 8% for -50 bps.

October 29: 2% for No Change versus 98% for -25 bps.

October 30: 6% for No Change versus 94% for -25 bps.

October 31: FOMC decision on federal funds target rate.

Based upon the October 26 market close, the 30-Day Federal Funds futures contract for the November 2007 expiration is currently pricing in a 100 percent probability that the FOMC will decrease the target rate by at least 25 basis points from 4-3/4 percent to 4-1/2 percent at the FOMC meeting on October 31.

In addition, the 30-Day Federal Funds futures contract is pricing in an 8 percent probability of a further 25-basis point decrease in the target rate to 4-1/4 percent (versus a 92 percent probability of just a 25-basis point rate decrease).

Summary Table

October 24: 86% for -25 bps versus 14% for -50 bps.

October 25: 86% for -25 bps versus 14% for -50 bps.

October 26: 92% for -25 bps versus 8% for -50 bps.

October 29: 2% for No Change versus 98% for -25 bps.

October 30: 6% for No Change versus 94% for -25 bps.

October 31: FOMC decision on federal funds target rate.

For immediate release

The Federal Open Market Committee decided today to lower its target for the federal funds rate 25 basis points to 4-1/2 percent.

Economic growth was solid in the third quarter, and strains in financial markets have eased somewhat on balance. However, the pace of economic expansion will likely slow in the near term, partly reflecting the intensification of the housing correction. Today’s action, combined with the policy action taken in September, should help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets and promote moderate growth over time.

Readings on core inflation have improved modestly this year, but recent increases in energy and commodity prices, among other factors, may put renewed upward pressure on inflation. In this context, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

The Committee judges that, after this action, the upside risks to inflation roughly balance the downside risks to growth. The Committee will continue to assess the effects of financial and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Charles L. Evans; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; William Poole; Eric S. Rosengren; and Kevin M. Warsh. Voting against was Thomas M. Hoenig, who preferred no change in the federal funds rate at this meeting.

In a related action, the Board of Governors unanimously approved a 25-basis-point decrease in the discount rate to 5 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of New York, Richmond, Atlanta, Chicago, St. Louis, and San Francisco.

The Federal Open Market Committee decided today to lower its target for the federal funds rate 25 basis points to 4-1/2 percent.

Economic growth was solid in the third quarter, and strains in financial markets have eased somewhat on balance. However, the pace of economic expansion will likely slow in the near term, partly reflecting the intensification of the housing correction. Today’s action, combined with the policy action taken in September, should help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets and promote moderate growth over time.

Readings on core inflation have improved modestly this year, but recent increases in energy and commodity prices, among other factors, may put renewed upward pressure on inflation. In this context, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

The Committee judges that, after this action, the upside risks to inflation roughly balance the downside risks to growth. The Committee will continue to assess the effects of financial and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Charles L. Evans; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; William Poole; Eric S. Rosengren; and Kevin M. Warsh. Voting against was Thomas M. Hoenig, who preferred no change in the federal funds rate at this meeting.

In a related action, the Board of Governors unanimously approved a 25-basis-point decrease in the discount rate to 5 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of New York, Richmond, Atlanta, Chicago, St. Louis, and San Francisco.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.