Trading ABC, part 2

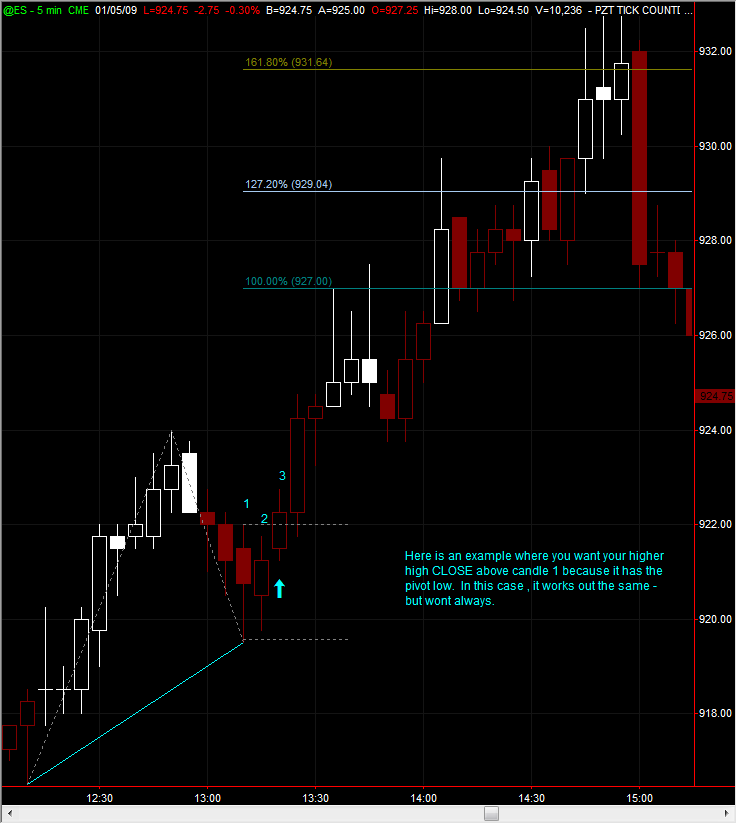

Aside from the standard way of waiting for a break above the B or #2 point, how do you scalpers enter at a slightly better price?

Thanks, VO. As always, your sharing of knowledge is greatly appreciated.

Few more questions:

Following an ABC pattern, how long will you wait for a higher high before you deem the setup no longer valid? Eventually you'll get a higher high or lower high (which I assume invalidates the setup); will you trade a higher high at any time provided the price doesn't dip below C?

How are you and PT determining your extended fib numbers? Aside from the 100/127.2/168.1/268.1, I'm seeing a few other numbers. Are you manually setting these after the fact or do you routinely watch for these numbers (e.g. 224.0% or 333%)?

Few more questions:

Following an ABC pattern, how long will you wait for a higher high before you deem the setup no longer valid? Eventually you'll get a higher high or lower high (which I assume invalidates the setup); will you trade a higher high at any time provided the price doesn't dip below C?

How are you and PT determining your extended fib numbers? Aside from the 100/127.2/168.1/268.1, I'm seeing a few other numbers. Are you manually setting these after the fact or do you routinely watch for these numbers (e.g. 224.0% or 333%)?

Thanks for sharing VO!

quote:

Originally posted by culsu

Thanks, VO. As always, your sharing of knowledge is greatly appreciated.

Few more questions:

Following an ABC pattern, how long will you wait for a higher high before you deem the setup no longer valid? Eventually you'll get a higher high or lower high (which I assume invalidates the setup); will you trade a higher high at any time provided the price doesn't dip below C?

How are you and PT determining your extended fib numbers? Aside from the 100/127.2/168.1/268.1, I'm seeing a few other numbers. Are you manually setting these after the fact or do you routinely watch for these numbers (e.g. 224.0% or 333%)?

An ABC remains valid until the pivot low (C) is taken out or price reaches 423.6%. At either of those two I then take it off the chart.

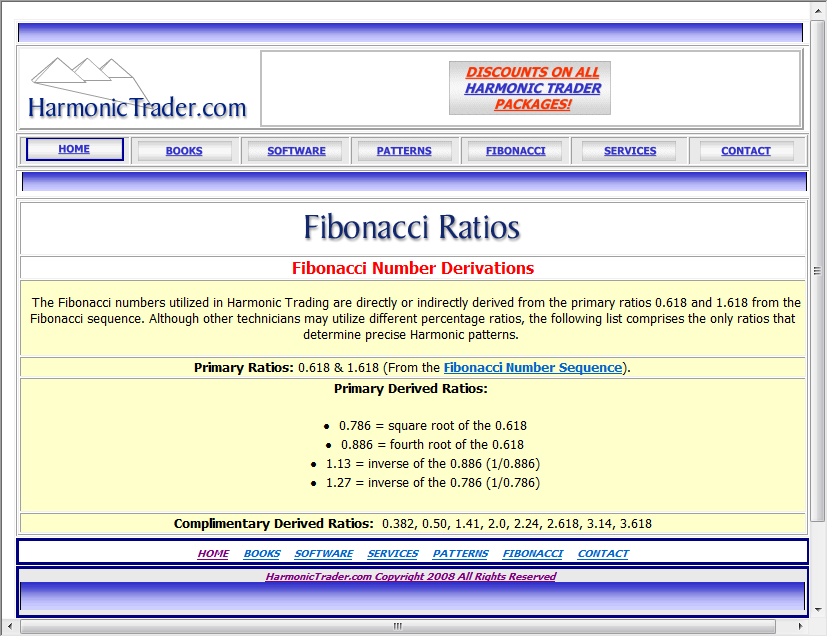

Culsu, the only other fib number I use that is not listed above is 423.6%. I also really don't find myself using the 141.4% (square of 200%) or the 112.8% (square of 127.2%) as much as I used to. As for PT's 333%, I'm not familar with that so he will have to answer. Hope this helps.

The Fibonacci numbers traders use are actually a ratio of the golden number phi = 1.618. The sequence of these ratio numbers makes up what is called an additive sequence which is termed the "golden series". The golden series is constructed by multiplying phi by each subsequent number in the series. Thus the next number in the series is phi raised to the second power 1.618 x 1.618 = 2.618, the next number is phi raised to the third power = 4.236, and so forth. The retracement numbers traders use are simply the reciprocal of these ratio numbers, for example the reciprocal of 2.618 = 0.382.

The golden series out to the forth power of phi is: 1.618, 2.618, 4.236, and 6.854. The reciprocal of the golden series is: 0.618, 0.382, 0.236 and 0.146.

Note: some numbers are missing, for example, where is 0.786 ? Its not in the golden series. How about 1.272 ? Not there either. Begging einstein's original question, where do these "other" numbers come from ?

These other numbers are found in two new additive sequences derived from the golden series. Each number in the new series is the square root of the number in the golden series. For example, the number 1.272 is the square root of phi, the reciprocal of which is 0.786. The 3.330 extension ratio is the square root of phi raised to the 5th power. The next ratio in the series is 4.236 which is the square root of phi raised to the 6th power.

As I understand it, the fibnoacci sequence is calculated by taking the first number and dividing by the next in the series and the other way around. For example: n / (n + 1), n / (n + 2), n / (n + 3) as well as the inverse of (n + 1) / n, (n + 2) and so on. These numbers can also be calculated by taking the ratio and raising it to the power of n or 1/n, as you mentioned. Using my method, I didn't come across the "other" numbers, though I didn't go out to the 5th power.

My question is which ones are most significant? Your 1.618 and 2.618 appear to be very important in relation to the others. What about the others numbers? How do you know which ones to load into your fib extension tool (given that NT only allows 10)?

My question is which ones are most significant? Your 1.618 and 2.618 appear to be very important in relation to the others. What about the others numbers? How do you know which ones to load into your fib extension tool (given that NT only allows 10)?

Start with the golden series itself, and add a couple others in:

extension tool: 161.8, 261.8, 423.6

retracement tool: 38.2, 61.8, 78.6

Carolyn Boroden adds: 23.6, 50.0, 100.0, 127.2

EWI uses the additive sequence I described above, which picks up the golden series as well as the "in-between" levels (1.272, 3.330 are a couple "in-between's" I like).

extension tool: 161.8, 261.8, 423.6

retracement tool: 38.2, 61.8, 78.6

Carolyn Boroden adds: 23.6, 50.0, 100.0, 127.2

EWI uses the additive sequence I described above, which picks up the golden series as well as the "in-between" levels (1.272, 3.330 are a couple "in-between's" I like).

quote:

Originally posted by culsu

As I understand it, the fibnoacci sequence is calculated by taking the first number and dividing by the next in the series and the other way around. For example: n / (n + 1), n / (n + 2), n / (n + 3) as well as the inverse of (n + 1) / n, (n + 2) and so on. These numbers can also be calculated by taking the ratio and raising it to the power of n or 1/n, as you mentioned. Using my method, I didn't come across the "other" numbers, though I didn't go out to the 5th power.

My question is which ones are most significant? Your 1.618 and 2.618 appear to be very important in relation to the others. What about the others numbers? How do you know which ones to load into your fib extension tool (given that NT only allows 10)?

Culsu, the fibo sequence is calculated by taking the first number and adding it to the second.

0+1=(1)+1=(2)+1=(3)+2=(5)+3=(8)+5=(13)+8=(21)+13=(34)+21=(55)+34=(89)+55=(144) ect.ect.

I suggest googling "Fibonacci" and you can read about the mathmatical aspects of the sequence to your hearts delight (perhaps on one of those nights where you can't sleep )

Which numbers (ratios) are important? I use these for retracements (corrections) .382, .50, .618, .786, .886. For multiples (expansion) I use 1, 1.272, 1.618, 2, 2.236, 2.618, 3.14, 3.618 and 4.236.

This is what I use, other people will use different numbers (ratios). You can choose to do your own homework and come up with what you feel are important numbers (ratios) in your trading or use the experience and knowledge of others. I chose both. People way smarter and way before me determined that there was a precise mathmatical relationship that occurs with price. This isn't to say that I don't do my own research. I am involved in work now to determine what relationships exist between the fib ratios and how that relates to the specific wave structures. My suggestion to you is to do the same. Take the work of others and see if you can improve upon it.

Thanks to you both for the responses. I've got the calcs of the core fibo numbers and the ratios down, but your 224.0% and 333.0% threw me. It seems you're using a hybrid of "pure" numbers and those you've found through experience that work well with some degree of reliability. It's that experience I'm trying to make sense of.

It's easy to read too much into these numbers and forget they're used to forecast possible targets - not predict the future with 100% certainty, though sometimes their accuracy is downright spooky. With that said, should you ever run across a number greater than 0 that hits with 100% probability, please pass it along.

It's easy to read too much into these numbers and forget they're used to forecast possible targets - not predict the future with 100% certainty, though sometimes their accuracy is downright spooky. With that said, should you ever run across a number greater than 0 that hits with 100% probability, please pass it along.

Thank you, VO!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.