20 May 2005

Session Start: Fri May 20 08:36:14 2005

Session Ident: #t1

[08:56:00] <Heidi4> what has your success rate been with the new stuff?

[08:56:06] <guy> very good

[08:56:16] <guy> i'm using alpha and MP - fits my style of trading

[08:56:25] <Heidi4> you should keep it quiet, everyone finds out, then it won't work

[08:56:28] <guy> but some people prefer deltat stuff

[08:57:00] <guy> no - depends on the trader's style

[08:57:08] <guy> remember the turtle traders -

[08:57:18] <Heidi4> no

[08:57:25] <guy> plenty of people don't have the psych to follow some methods

[08:57:42] <guy> this might not be your style of trading so won't work for you

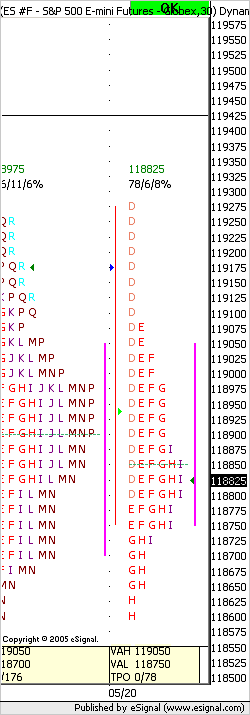

[08:57:55] <guy> BullnorBear: i only trade ER2 and ES

[08:58:15] <guy> but this is mainly an e-mini futures trading room so NQ and YM also traded by people in here

[08:58:21] <Heidi4> well, you are a techie type so you understand what's going on better than someone that's not involved in the development of the software

[08:58:39] <BullnorBear> k thanks guy

[08:59:07] <guy> y/w

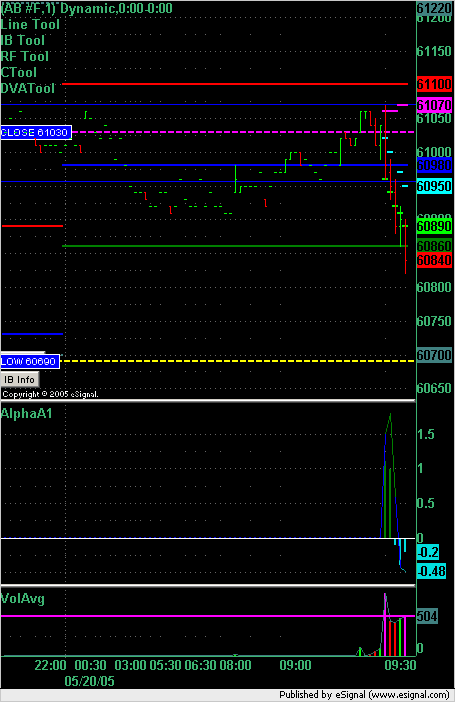

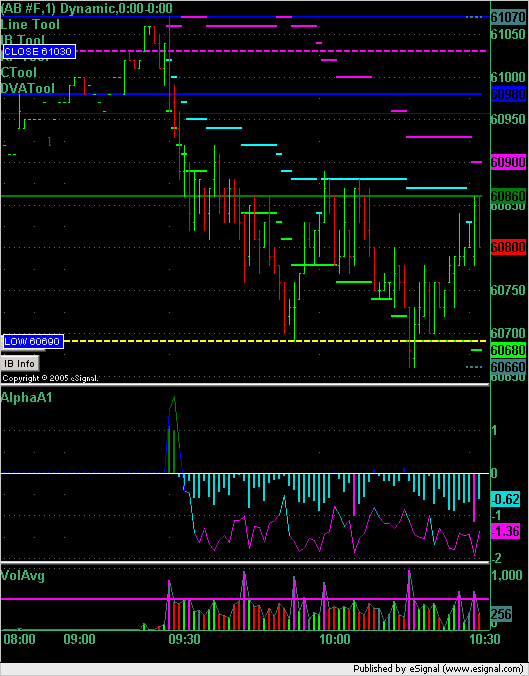

[09:31:44] <guy> Buys AB @ 609.6

[09:33:30] <guy> Exited all Long AB at 608.9 --> - 0.7

[09:35:23] <guy4>

[09:35:31] <guy> At VAL but no confirm from alpha so standing aside

[09:35:41] <guy> earlier trade was pure alpha

[09:45:06] <BullnorBear> nq fighting to hold 1520 pivot level..

[09:45:16] <BullnorBear> chips say down

[09:45:23] <guy> chips?

[09:45:45] <BullnorBear> semi's sorry

[09:45:59] <guy> ah - thanks

[09:46:15] <BullnorBear> semi's lead nq by the nose

[09:48:07] * qw shorts ym 79

[09:53:41] <guy> good short qw

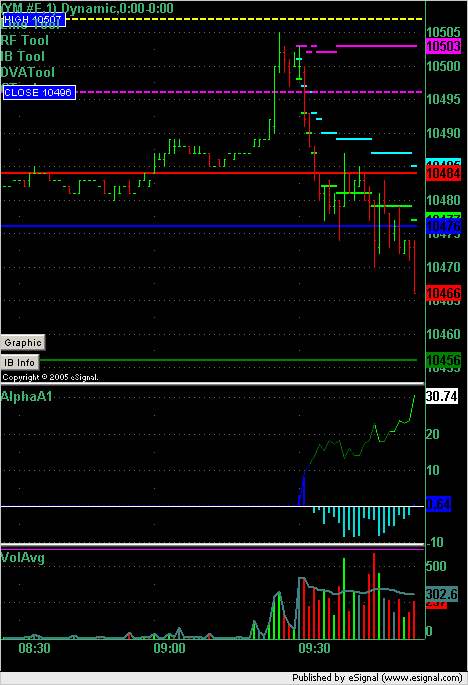

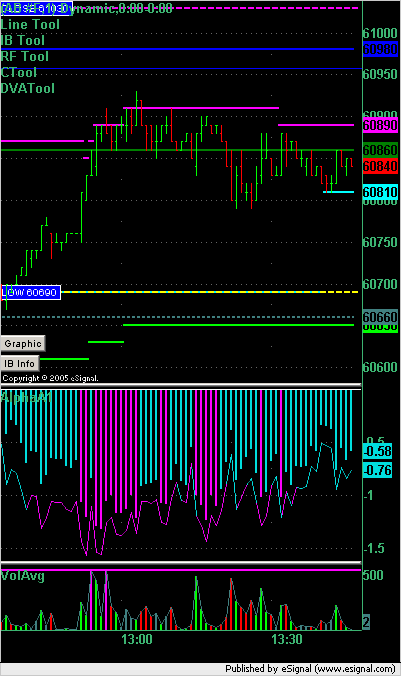

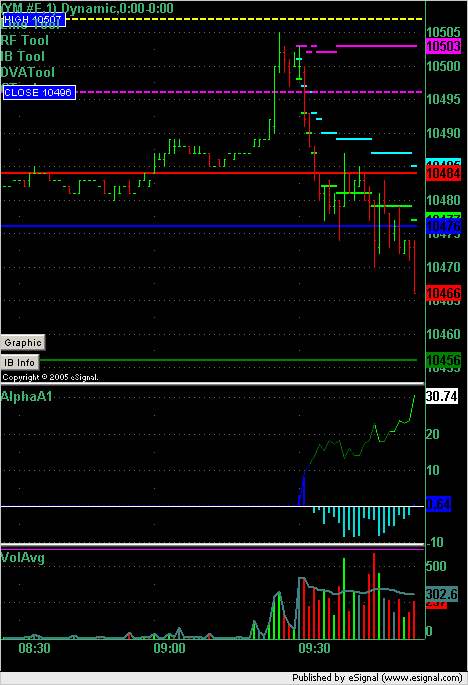

[09:54:04] <guy> qw here is YM with alpha:

[09:54:06] <BullnorBear> only 4 dow stocks green

[09:54:12] <guy5>

[09:55:40] <guy> nice qw

[09:55:47] <qw> thx

[09:55:55] <guy> well i was looking for a pop earlier to short ER2 but no such luck

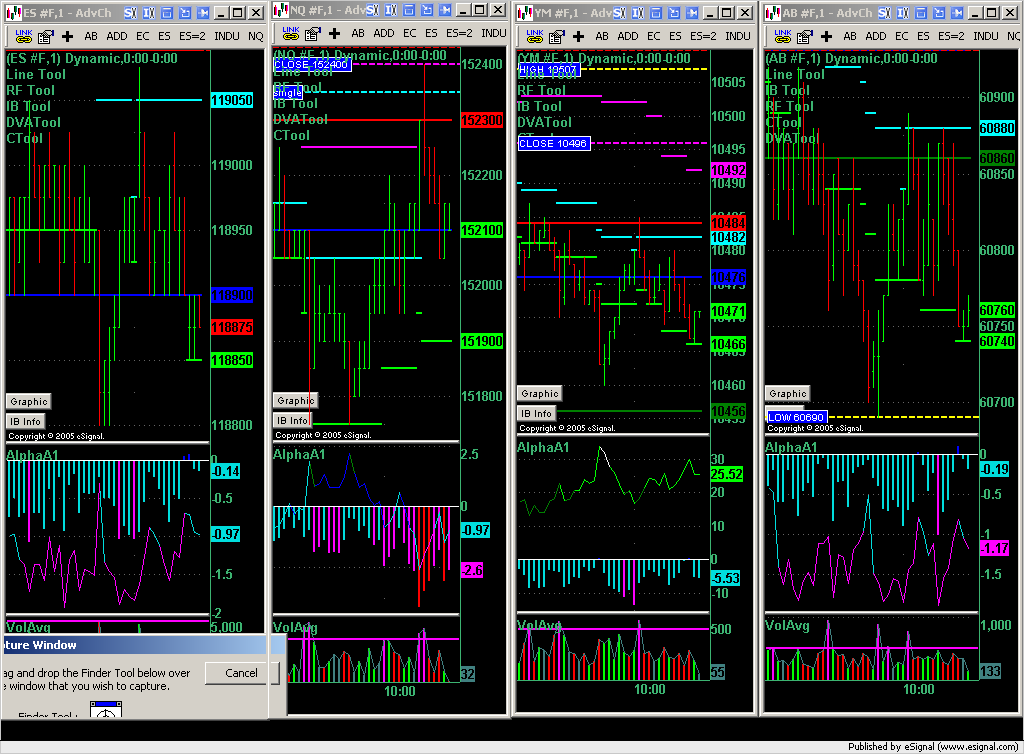

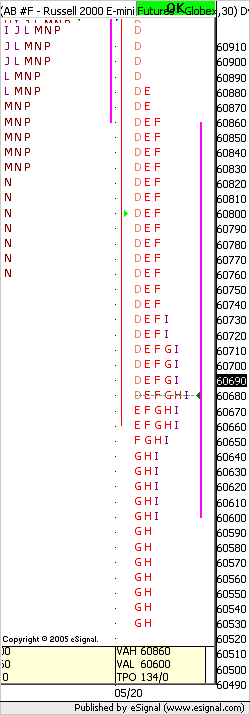

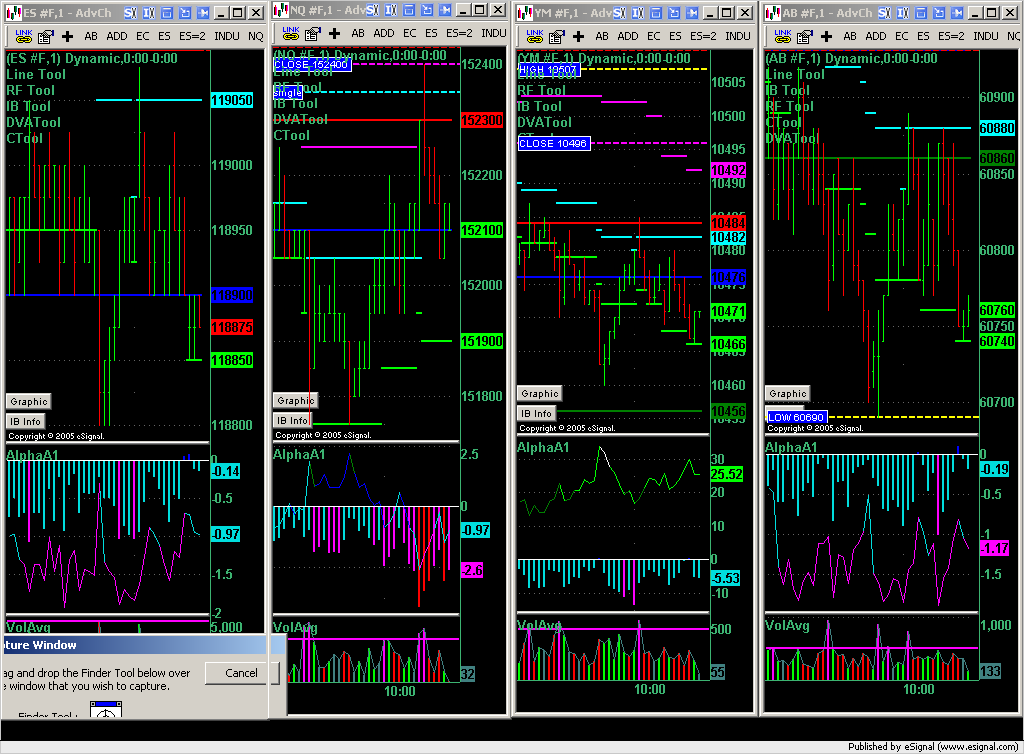

[10:14:18] <guy5>

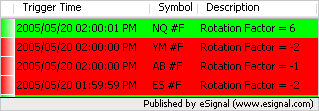

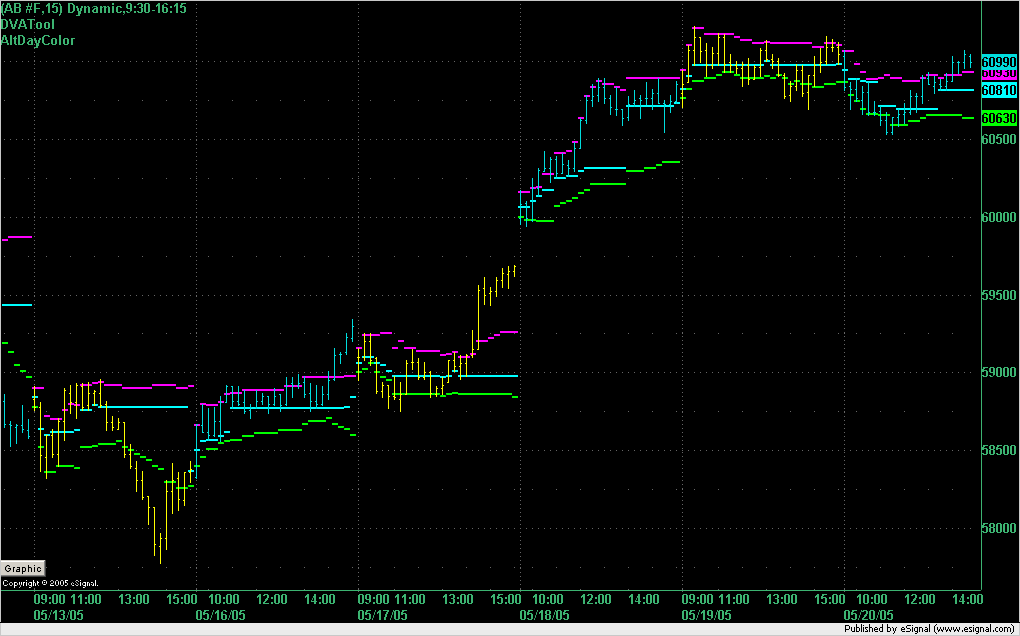

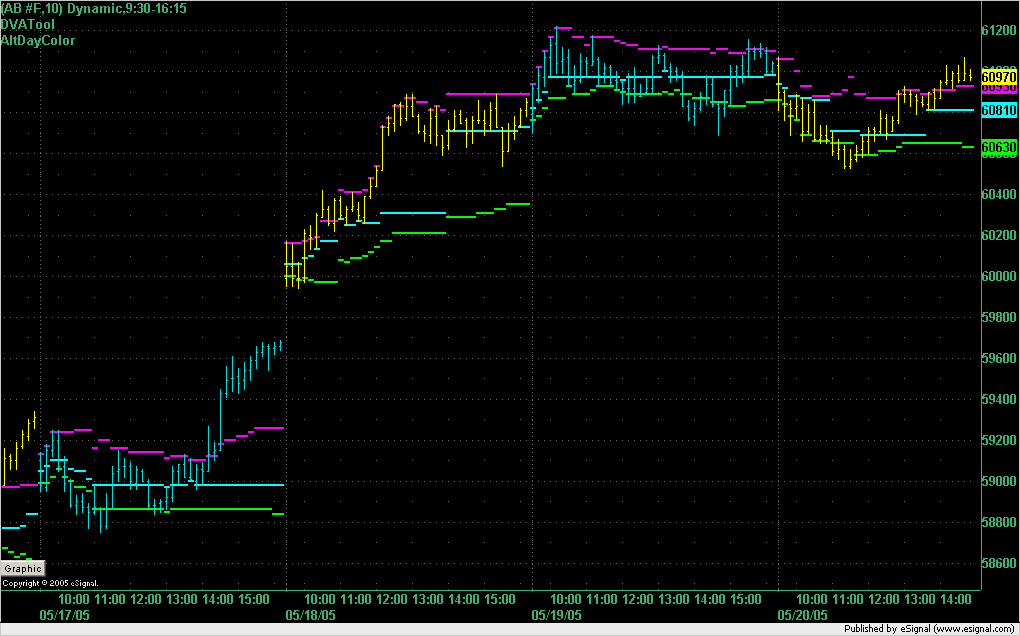

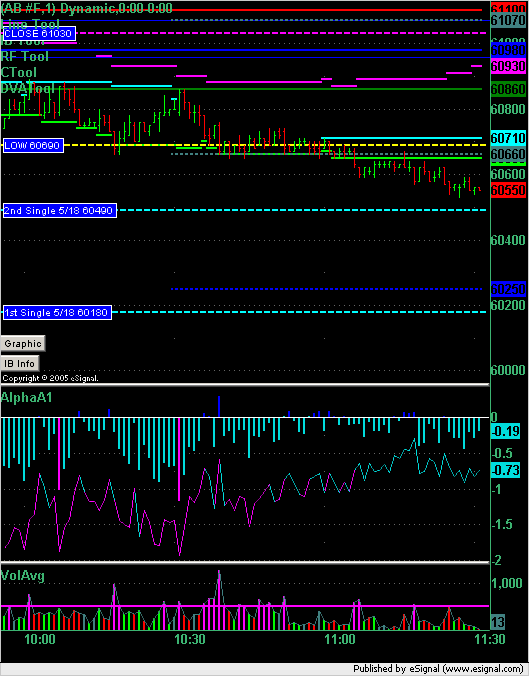

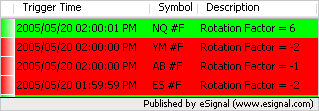

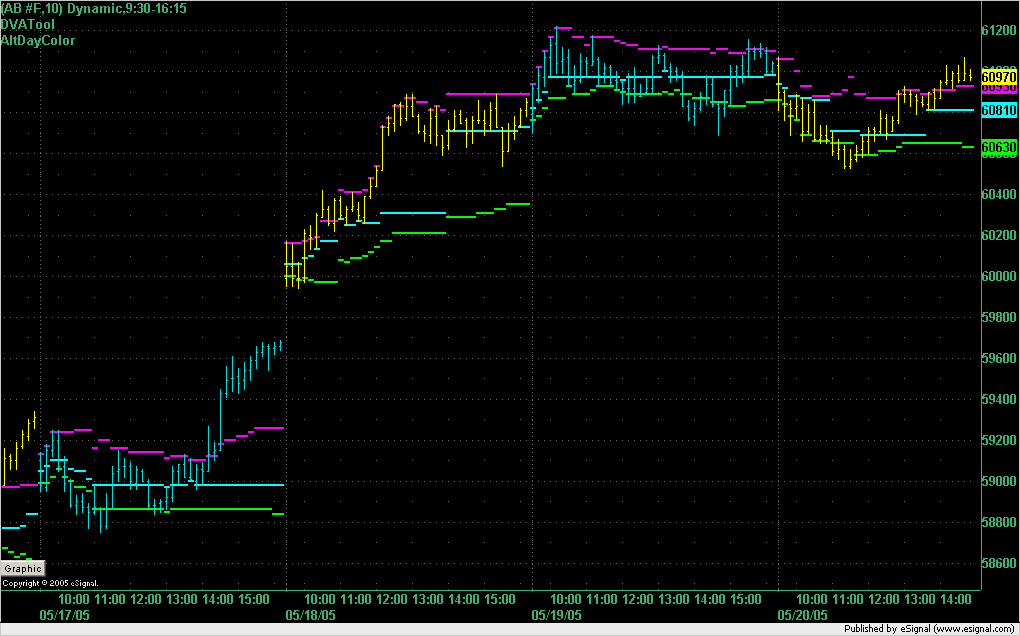

[10:14:26] <guy> images across 4 markets

[10:15:43] <mashhad> Hi Guy... Did Alpha advise to pass on that long buy at VAH trade this morning?

[10:16:09] <mashhad> ES i mean

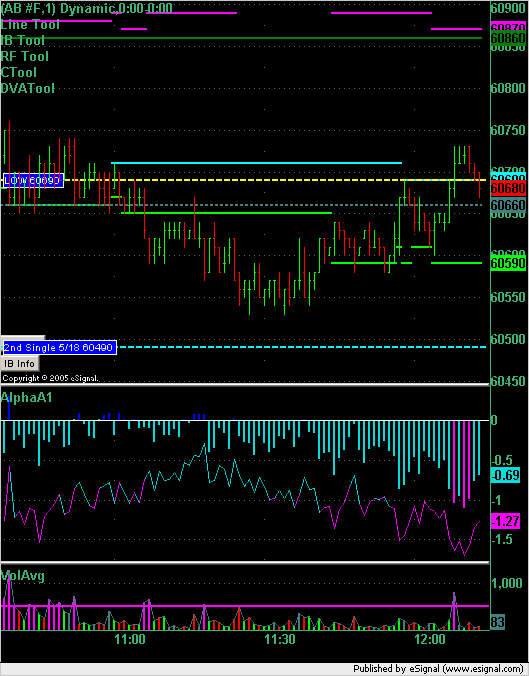

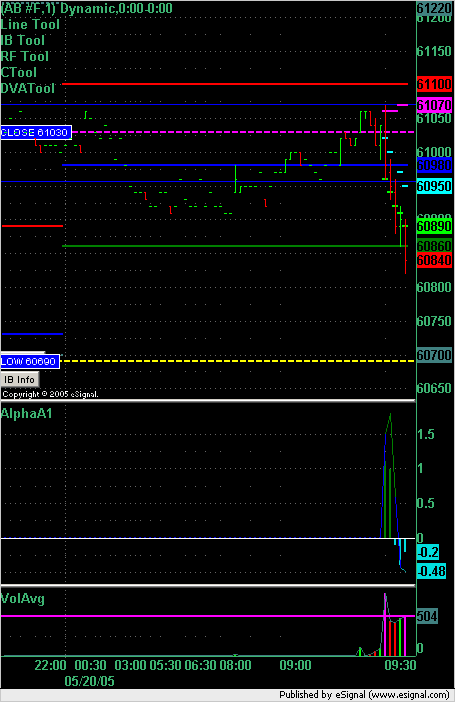

[10:17:06] <guy> mashad here's the chart:

[10:17:12] <guy5>

[10:17:19] <guy> it was touch and go because alpha was saying long for 1st bar

[10:17:25] <guy> but then dropped very fast

[10:17:44] <guy> and so using the 2 together you might have gone either way

[10:17:55] <guy> i tried a non-MP long on ER2 and lost money

[10:18:02] <guy> on the green alpha bars

[10:18:06] <guy> on the ER2

[10:19:50] <guy> well we're at the LOD on ER2 and alpha is saying short so i'm definitely staying out of long

[10:20:16] <guy5>

[10:20:20] <mashhad> what is that blue line at 89 on ES chart?

[10:20:47] <guy> that should be the POC

[10:20:55] <guy> put on there from the DVATool

[10:21:17] <mashhad> ok

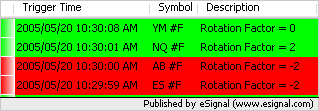

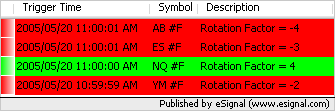

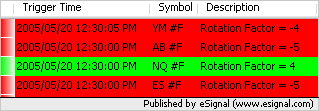

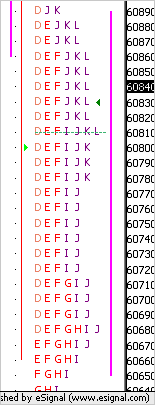

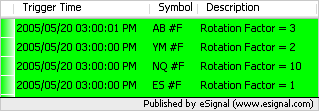

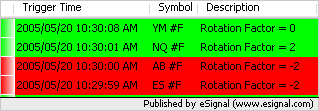

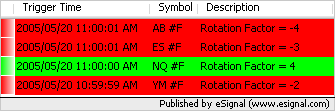

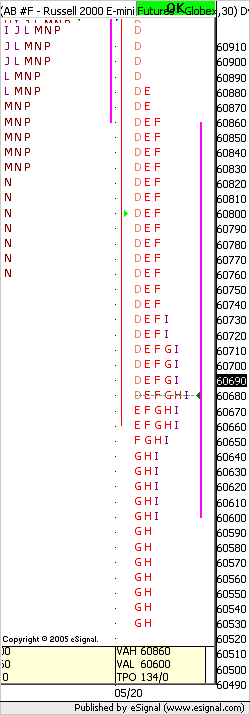

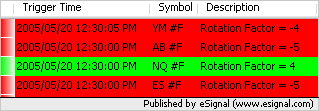

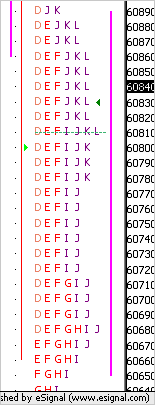

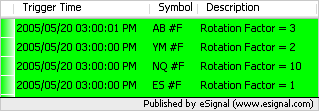

[10:30:42] <guy> rotation factors:

[10:30:48] <guy5>

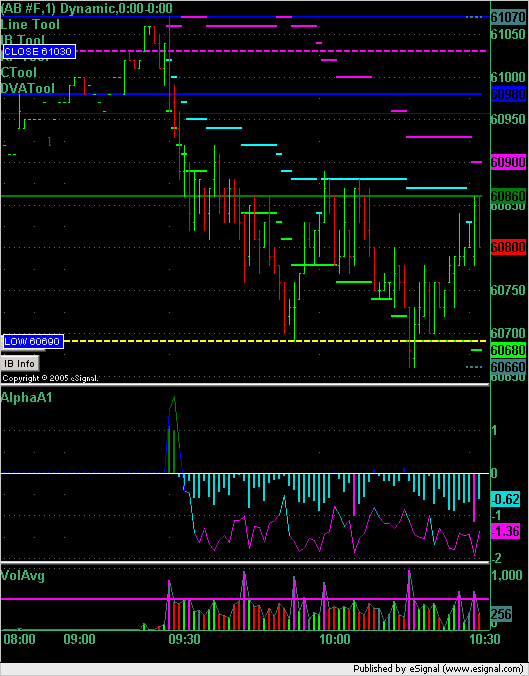

[10:32:35] <guy> Shorts AB @ 608.5

[10:33:03] <guy> based on VAL and alpha

[10:33:08] <guy5>

[10:34:02] <guy> exit stop set AB @ 609.5

[10:40:56] <guy> exit stop moved to breakeven AB @ 608.5

[10:42:19] <guy> mash: looking for RE down here in ER2

[10:42:32] <mashhad> good luck

[10:42:34] <guy> no RE in E yet

[10:42:40] <guy> are you flat?

[10:43:01] <mashhad> my charts are not updating at the moment

[10:43:15] <mashhad> so no trading

[10:43:30] <mashhad> flat

[10:44:01] <guy> one thing that worries me about this trade is that it looks like a low range day is going to develop

[10:44:20] <guy> that means that i could easily get stopped out at b/e here

[10:44:39] <guy> if we get some RE on the downside then I'll try and hang in as long as possible

[10:45:59] <guy> ....i'll hang in short as long as...

[10:48:23] <mashhad> be back

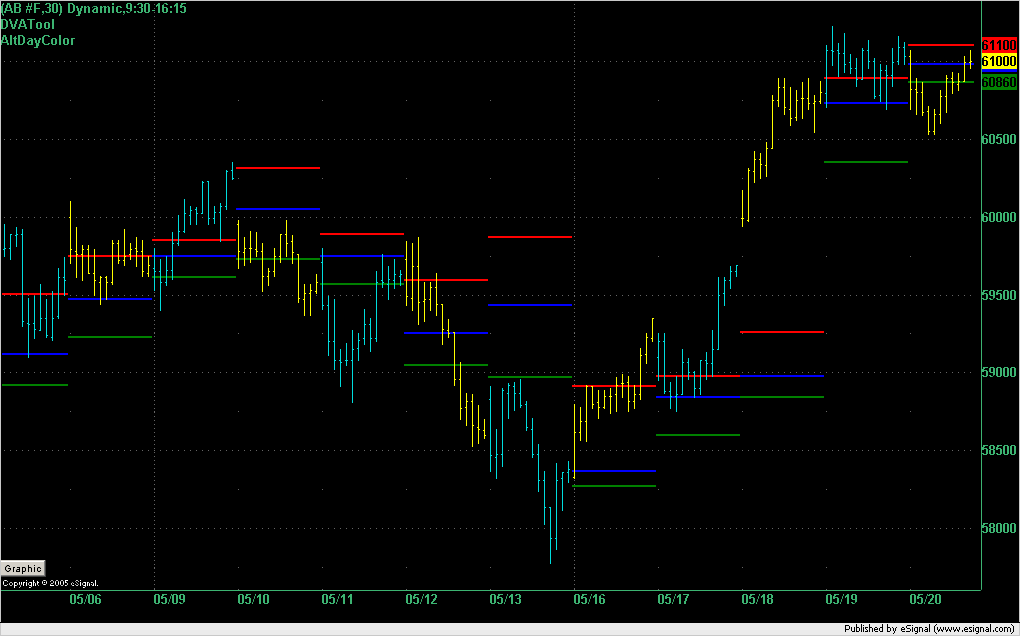

[11:00:31] <guy5>

[11:04:00] <guy> still looking for RE here in ER2

[11:09:07] <guy> Covered all Short AB at 606 --> + 2.5

[11:14:01] <mashhad> Are you still in that trade Guy?

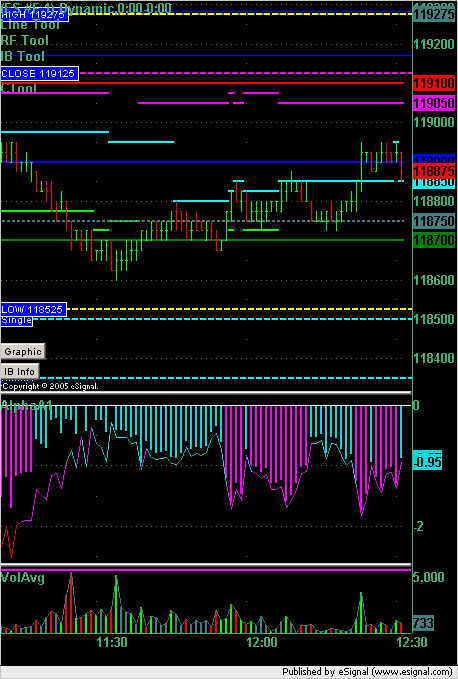

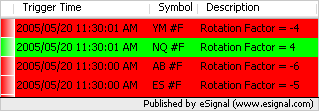

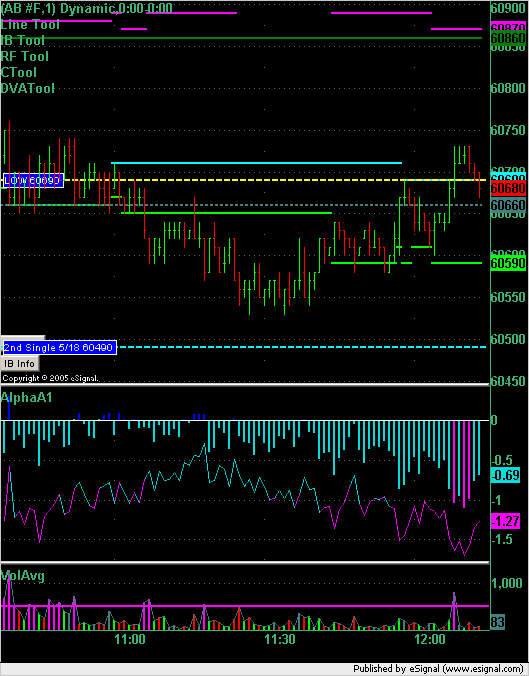

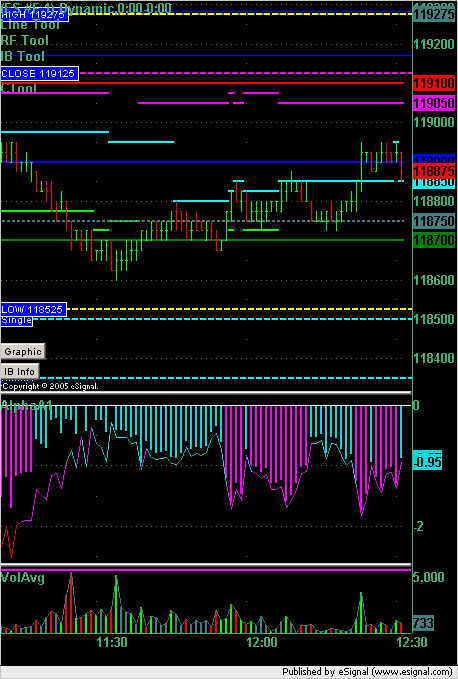

[11:16:47] <guy> this was the ER2 signal I took:

[11:16:47] <guy>

[11:16:47] <guy> see the pink sell signal at around 10:30

[11:16:47] <guy> on the alpha

[11:16:47] <guy> and that with the green VAL line at 608.6

[11:18:26] <mashhad> yes

[11:18:35] <mashhad> but are you still in or are you flat?

[11:19:16] <guy> i'm flat

[11:19:26] <gator3> guy what was wrong with the sale signal at 10:07

[11:19:54] <guy> nothing - it was an excellent signal - i was staring out the window instead of watching the road

[11:20:38] <gator3> lol ok

[11:20:49] <gator3> don't let that happen again on my watch

[11:22:42] <guy> okay :)

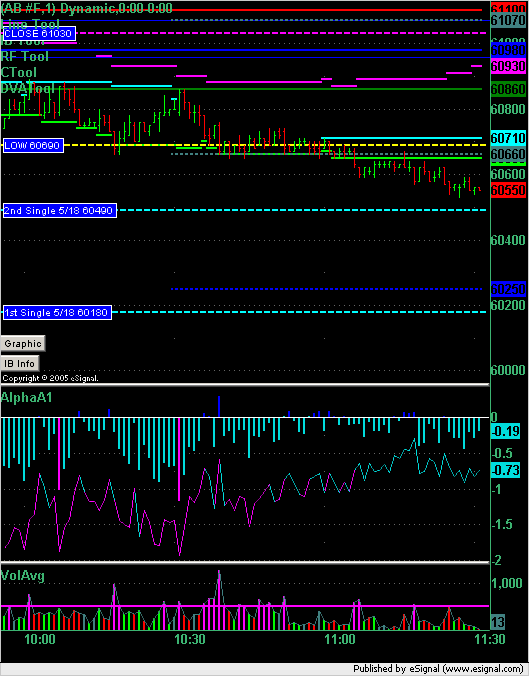

[11:29:47] <guy> singles at 604.9 on ER2 - i will take these long if alpha doesn't filter me out of the trade

[11:30:20] <guy> i'm looking for an alpha value between +1 and +2 when we hit that line

[11:30:38] <guy> if we don't have that kind of value on alpha then that will filter me out of that long trade

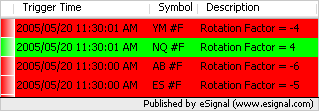

[11:31:06] <guy> here are the RF's:

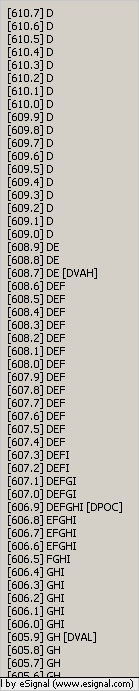

[11:31:34] <guy> and here are the singles and DIBL

[11:31:50] <guy>

[11:31:57] <guy>

[11:33:13] <guy> notice on the ER2 chart that we have singles at 604.9 and then a cluster at 602.5 and 601.8

[11:33:34] <guy> the cluster is a single (1st) and DIBL

[11:33:48] <guy> this is a long area if alpha doesn't filter the trade

[11:35:24] <guy> here is a clearer look at this possible long:

[11:35:26] <guy5>

[11:59:46] <mashhad> Guy, is 90.25 shortable if we get a alpha signal on ES?

[12:09:41] <guy> why 90.25 ?

[12:09:51] <mashhad> DVAH ES

[12:10:29] <guy> yes it is mash - my DVATool is showing DVAH at 90.5 but it might be wrong

[12:10:37] <guy> i don't have an MP chart up for ES

[12:10:57] <guy> is DVAH on eSignal's MP chart showing 90.25 atm?

[12:11:12] <tuna> not here

[12:11:13] <mashhad> it is 90.50 but since the last time we only made it to 90.25, i thought that was more realistic

[12:11:27] <guy> very good point

[12:11:38] <guy> yes - in F bracket

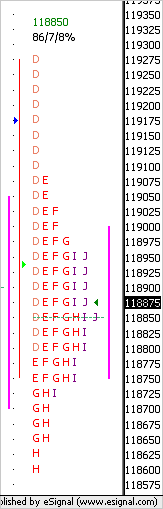

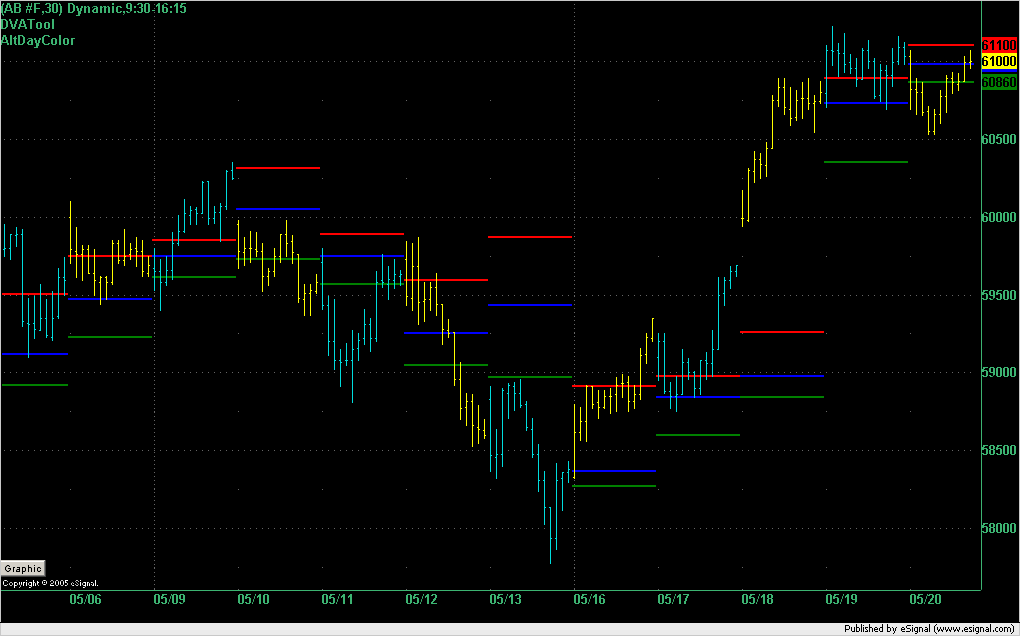

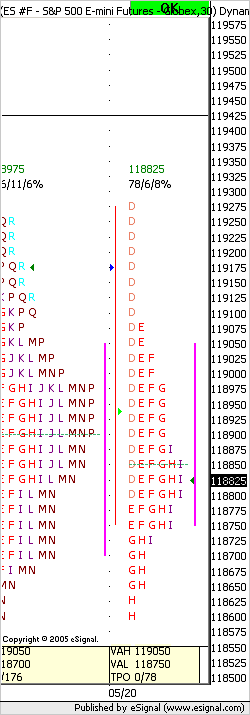

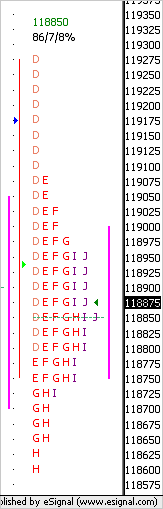

[12:12:00] <guy> i've brought up MP for ES:

[12:12:05] <guy5>

[12:12:53] <guy> yes - if you get a value of -1.5 to -2.5 in alpha and it hits DVAH i blieve that will be a good probability short

[12:13:07] <mashhad> ok

[12:13:46] <guy> i'm wanting to short ER2 here:

[12:13:48] <guy5>

[12:13:54] <guy> but can't find a good reason to do it against.

[12:14:24] <mashhad> i know i was looking for a MP signal, but none were present

[12:14:28] <guy> perhaps this DPOC should be given more weight when trading ER2

[12:14:54] <guy> it certainly seems to play a bigger part in the ER2 than it does in other symbols

[12:15:01] <mashhad> is your DPOC at 606.80?

[12:15:31] <guy> 606.9 atm

[12:15:50] <guy> but on the MP chart it's at 606.8

[12:16:01] <guy> using DVATool it's at 606.9

[12:16:09] <mashhad> i see

[12:17:04] <guy> the eSignal MP chart is wrong

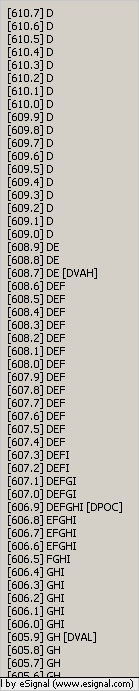

[12:17:22] <guy> at 606.8 there is a D bracket print on the eSignal MP chart right?

[12:17:39] <guy> Here:

[12:17:50] <guy5>

[12:18:02] <guy> Now go back and look at the D bracket today on a bar chart

[12:18:17] <guy> you will see that the low during the D brack (09:30 to 10:00 EST)

[12:18:30] <mashhad> y

[12:18:32] <guy> was 606.9

[12:18:44] <guy> so there shouldn't be a D print there

[12:19:37] <guy5>

[12:19:38] <guy> Have a look at this MP chart produced by DVATool

[12:20:12] <mashhad> yes, so E-signal is giving wrong info

[12:20:17] <mashhad> which is scary

[12:20:23] <tuna> my d bracket is at 606.9

[12:20:45] <guy> tuna: do you have a D bracket print at 606.8 as well?

[12:20:51] <tuna> no

[12:20:54] <mashhad> are you using AB #f or ab m5?

[12:20:58] <guy> are you using esignal?

[12:21:13] <tuna> ab #f

[12:21:19] <tuna> 7.8

[12:21:32] <guy> that's interesting...

[12:22:04] <mashhad> tuna, are you using alpha on 7.8?

[12:22:06] <guy> my DVATool is producing the same graphic that you're seeing using the same data that the esignal MP chart is producing incorrect graphic for

[12:22:17] <guy> alpha isn't available on 7.8

[12:22:30] <tuna> dang

[12:23:09] <guy> why don't you want to upgrade tuna?

[12:23:35] <guy> alpha uses the new features in esig 7.9

[12:23:47] <tuna> cuz everyone was having bond probs

[12:23:58] <guy> that's a fair point

[12:24:04] <guy> okay mash - watch this ES

[12:24:13] <guy> alpha says it's okay to short it

[12:24:40] <guy> i might try ER2 short at 608.5 again...

[12:25:03] <tuna> sounds like a plan

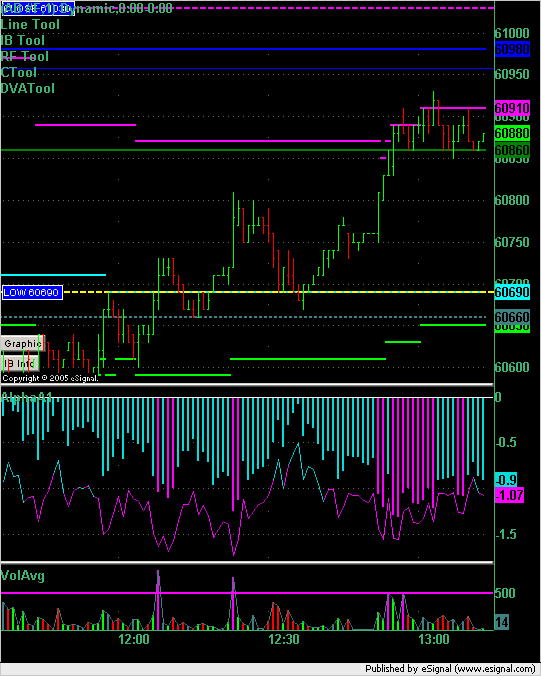

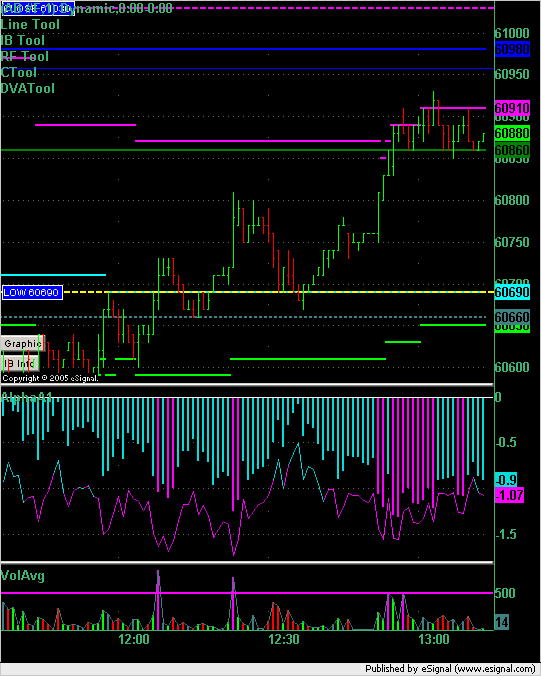

[12:25:08] <guy> short signal in YM here

[12:25:20] <guy5>

[12:28:14] <tuna> oh and folks seem to have screwy mp data too with 7.9 ;)

[12:29:20] <guy> :)

[12:29:33] <guy> do you have a second computer tuna?

[12:29:50] <guy> i always upgrade to my backup esignal computer

[12:29:51] <tuna> nope :(

[12:30:10] <guy> i have a backup esignal comp in case primary goes down

[12:30:29] <guy> and i use that to test next version of esig

[12:30:33] <guy5>

[12:30:36] <guy> before upgrading primary

[12:30:55] <mashhad> did ur dvah on es drop to 90.25?

[12:31:06] <mashhad> or 90.00 just now?

[12:31:19] <guy> no

[12:31:37] <guy> here is this ES chart

[12:31:41] <mashhad> what is your dvah on es?

[12:31:45] <guy5>

[12:31:47] <guy> the pink line is DVAH

[12:31:59] <tuna> 90 here

[12:32:08] <mashhad> on MP it dropped to 90

[12:32:09] <guy> and you can see that it hasn't changed from 90.5 for at least 20 min

[12:32:52] <guy> yes i see that

[12:33:01] <guy5>

[12:33:02] <guy> mp chart coming up

[12:36:41] <guy> the esignal cut-off formula is obviously slightly different from mine...

[12:38:16] <tuna> ive never been a big fan of esig

[12:38:48] <guy> which is the best for you tuna?

[12:39:43] <guy> i find that they are the best of a bad bunch

[12:39:44] <tuna> well for MP i dont have much choice

[12:40:16] <guy> i don't think that they are great either - but then i think that they are the best on the market of a poor selection

[12:40:16] <tuna> well put

[12:40:50] <tuna> needs a total rewrite imo

[12:41:32] <guy> i'd like to see it integrated into .NET and rewritten in C# and their formula language moved over to C#.NET

[12:41:42] <guy> then I think it could be a world class product

[12:43:25] <tuna> do it we'll call it guysignal,,and we'll sign up with u

[12:43:50] <guy> :)

[12:48:31] <guy> I'm being called for dinner - don't go losing money while i'm away

[12:49:35] <mashhad> :)

[12:52:27] <fspeculator> guy you here?

[12:57:41] <mashhad> s 608.50

[13:09:27] <mashhad> Guy are u back?

[13:11:25] <guy> yes

[13:11:40] <mashhad> i am short 608.50

[13:12:00] <guy> i see that

[13:12:00] <mashhad> Alpha went long on the ES for a bit

[13:12:24] <mashhad> do i need to worry about it, or just stick to ER chart?

[13:12:30] <guy> yes - just looking at that now as well

[13:12:37] <guy> stick to ER chart

[13:12:46] <guy> basically don't short the ES now

[13:12:52] <guy> but short on ER2 is okay now

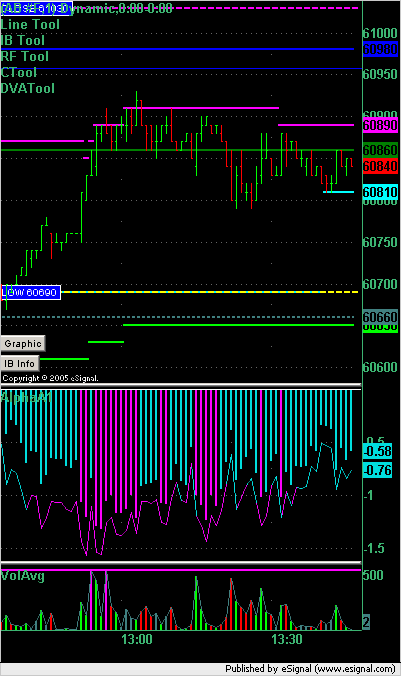

[13:14:20] <guy5>

[13:14:49] <guy> DVAH on ER2 is exapnding up on us

[13:14:54] <guy> which is great

[13:15:03] <guy> and is keeping us in DVA on ER2

[13:15:11] <guy> alpha is supporting here

[13:15:38] <guy> IMO - you're looking for a rotation to DVAL

[13:15:48] <guy> so I would target 606.5

[13:18:28] <mashhad> too scared to MacG

[13:19:40] <guy> i agree - no macG in this environment - market is moving too slowly

[13:20:08] <guy> My furtherest stop on this would be 610.1 which is 1 over current DVAH

[13:20:36] <mashhad> i have it at 610.00

[13:21:14] <tuna> 8.9 here

[13:21:28] <tuna> 608.9

[13:21:58] <guy> you short 8.9 tuna?

[13:22:07] <mashhad> break baby break!

[13:22:29] <tuna> dvah 608.9

[13:22:36] <mashhad> 88.50 is DPOC ES

[13:22:48] <mashhad> we went below it now

[13:23:01] <guy> good

[13:23:25] <guy> 2 targets in ER2 here: DPOC=6.9 and DVAL=6.5

[13:23:54] <mashhad> now ES has to go below DVAL

[13:24:19] <guy> dval and ibl are same at 87.5 in es right?

[13:24:26] <mashhad> y

[13:25:02] <guy> problem is that's a buy in ES because alpha is/was +1 at that point

[13:25:18] <guy> let's hope that it fails

[13:25:34] <mashhad> i know, this is making me think about getting out

[13:27:06] <guy> if i was worried like that, and i had multiple contracts on, then i would close half, and move the stop on rest to b/e

[13:27:38] <mashhad> only 1

[13:27:53] <tuna> your dvah is up around 610?

[13:28:30] <mashhad> dvah on er is 608.80

[13:28:39] <tuna> k

[13:28:44] <guy> no tuna 609.1

[13:28:57] <tuna> i musta missread the post

[13:30:57] <mashhad> if ER would have had done what ES already did, we would all be in the money now!

[13:32:33] <guy5>

[13:32:43] <guy> yes

[13:33:17] <guy> you will notice that the DVA and DPOC move about a lot just after the half hour passes because we move into a new bracket

[13:33:49] <guy> lack of patience is your worst enemy mash - in general: i'm not picking on you here - just a general statement

[13:33:56] <guy> you've done your job now

[13:34:27] <tuna> i think greenies speaking now

[13:34:29] <guy> accept that you might get stopped out at a $100 to $200 loss - that will always happen every now and then - say at least 40% of the time

[13:34:55] <mashhad> right

[13:35:07] <guy> but you're targetting $200 to $300/$400 and you will get that hopefully 50% of the time

[13:35:13] <guy> or even 40% of the time

[13:35:22] <guy> and only scratch say 20% of your trades

[13:35:29] <guy> so that is what you're trying to do

[13:35:40] <guy> KNOW that every 2nd trade will be a loser

[13:37:06] <guy> if alpha gives up on us here then we are justified in trying to scratch the trade

[13:37:12] <guy> but alpha is -.74

[13:38:26] <guy> wow - market is dead

[13:38:33] <guy> greenspan speaking right?

[13:38:57] <mashhad> not sure

[13:41:10] <mashhad> alpha is getting weaker

[13:41:16] <mashhad> on ER

[13:41:24] <guy> that's natural because of the little drop in price

[13:41:36] <guy> alpha is an opinion of how over/under valued ER2 is

[13:41:56] <guy> if it says -.7 and ER2 drops -.7 then alpha goes to 0

[13:42:06] <guy> until it recalculates about 20 seconds later...

[13:42:30] <guy> so after ER2 moves down watch if alpha then starts dropping after the move

[13:42:33] <guy> or moving up

[13:43:31] <tuna> dpoc popped up here

[13:45:29] <mashhad> is it 8.10?

[13:45:43] <tuna> y

[13:46:44] <guy> yes it did:

[13:46:52] <guy5>

[13:47:11] <guy> and this is why:

[13:47:23] <guy5>

[13:47:40] <guy> L bracket overlapped the K bracket making it the most TPOs near the center

[13:48:38] <tuna> ic

[13:55:14] <guy> mash - i'd start thinking about scratching this for 1 tick profit now

[13:55:34] <mashhad> why now?

[13:55:49] <guy> alpha no longer providing support

[13:56:04] <guy> but that's just me

[13:56:26] <mashhad> isn't your alpha still negative?

[13:56:37] <guy> yes - but not as strong as it was

[13:56:43] <guy> look back to 13:00 est

[13:56:56] <guy> see how convincing alpha was then

[13:57:07] <guy> and again at 13:15

[13:57:46] <guy> this trade may still work out but i believe that the risk/reward ratio has changed for the worse

[13:57:55] <guy> i.e. now more risk and less reward potentila

[13:57:56] <mashhad> it looks to me like ES is gonna rotate back down to DVAL

[13:58:47] <guy> that is true - i hope it does for you

[13:59:26] <guy> all i'm showing you is the relationship that alpha had at 13:00 to what it has now

[13:59:37] <mashhad> yes u r right

[13:59:39] <guy> and am wondering if you can see what i'm talking about

[13:59:45] <mashhad> i am just learning

[13:59:57] <guy> yes - i'm not criticising

[14:00:06] <guy> just showing you what alpha is telling me

[14:00:13] <guy> and why

[14:00:37] <guy5>

[14:06:58] <guy> Yesterday's edited transcript from this channel can be found here: Transcript

[14:07:14] <guy> And i'll hopefully post this one tomorrow

[14:47:18] <guy5>

[14:53:17] <guy5>

[14:55:27] <guy5>

[15:03:24] <guy5>

[15:32:58] <guy> Have an excellent weekend everyone!

Session Ident: #t1

[08:56:00] <Heidi4> what has your success rate been with the new stuff?

[08:56:06] <guy> very good

[08:56:16] <guy> i'm using alpha and MP - fits my style of trading

[08:56:25] <Heidi4> you should keep it quiet, everyone finds out, then it won't work

[08:56:28] <guy> but some people prefer deltat stuff

[08:57:00] <guy> no - depends on the trader's style

[08:57:08] <guy> remember the turtle traders -

[08:57:18] <Heidi4> no

[08:57:25] <guy> plenty of people don't have the psych to follow some methods

[08:57:42] <guy> this might not be your style of trading so won't work for you

[08:57:55] <guy> BullnorBear: i only trade ER2 and ES

[08:58:15] <guy> but this is mainly an e-mini futures trading room so NQ and YM also traded by people in here

[08:58:21] <Heidi4> well, you are a techie type so you understand what's going on better than someone that's not involved in the development of the software

[08:58:39] <BullnorBear> k thanks guy

[08:59:07] <guy> y/w

[09:31:44] <guy> Buys AB @ 609.6

[09:33:30] <guy> Exited all Long AB at 608.9 --> - 0.7

[09:35:23] <guy4>

[09:35:31] <guy> At VAL but no confirm from alpha so standing aside

[09:35:41] <guy> earlier trade was pure alpha

[09:45:06] <BullnorBear> nq fighting to hold 1520 pivot level..

[09:45:16] <BullnorBear> chips say down

[09:45:23] <guy> chips?

[09:45:45] <BullnorBear> semi's sorry

[09:45:59] <guy> ah - thanks

[09:46:15] <BullnorBear> semi's lead nq by the nose

[09:48:07] * qw shorts ym 79

[09:53:41] <guy> good short qw

[09:54:04] <guy> qw here is YM with alpha:

[09:54:06] <BullnorBear> only 4 dow stocks green

[09:54:12] <guy5>

[09:55:40] <guy> nice qw

[09:55:47] <qw> thx

[09:55:55] <guy> well i was looking for a pop earlier to short ER2 but no such luck

[10:14:18] <guy5>

[10:14:26] <guy> images across 4 markets

[10:15:43] <mashhad> Hi Guy... Did Alpha advise to pass on that long buy at VAH trade this morning?

[10:16:09] <mashhad> ES i mean

[10:17:06] <guy> mashad here's the chart:

[10:17:12] <guy5>

[10:17:19] <guy> it was touch and go because alpha was saying long for 1st bar

[10:17:25] <guy> but then dropped very fast

[10:17:44] <guy> and so using the 2 together you might have gone either way

[10:17:55] <guy> i tried a non-MP long on ER2 and lost money

[10:18:02] <guy> on the green alpha bars

[10:18:06] <guy> on the ER2

[10:19:50] <guy> well we're at the LOD on ER2 and alpha is saying short so i'm definitely staying out of long

[10:20:16] <guy5>

[10:20:20] <mashhad> what is that blue line at 89 on ES chart?

[10:20:47] <guy> that should be the POC

[10:20:55] <guy> put on there from the DVATool

[10:21:17] <mashhad> ok

[10:30:42] <guy> rotation factors:

[10:30:48] <guy5>

[10:32:35] <guy> Shorts AB @ 608.5

[10:33:03] <guy> based on VAL and alpha

[10:33:08] <guy5>

[10:34:02] <guy> exit stop set AB @ 609.5

[10:40:56] <guy> exit stop moved to breakeven AB @ 608.5

[10:42:19] <guy> mash: looking for RE down here in ER2

[10:42:32] <mashhad> good luck

[10:42:34] <guy> no RE in E yet

[10:42:40] <guy> are you flat?

[10:43:01] <mashhad> my charts are not updating at the moment

[10:43:15] <mashhad> so no trading

[10:43:30] <mashhad> flat

[10:44:01] <guy> one thing that worries me about this trade is that it looks like a low range day is going to develop

[10:44:20] <guy> that means that i could easily get stopped out at b/e here

[10:44:39] <guy> if we get some RE on the downside then I'll try and hang in as long as possible

[10:45:59] <guy> ....i'll hang in short as long as...

[10:48:23] <mashhad> be back

[11:00:31] <guy5>

[11:04:00] <guy> still looking for RE here in ER2

[11:09:07] <guy> Covered all Short AB at 606 --> + 2.5

[11:14:01] <mashhad> Are you still in that trade Guy?

[11:16:47] <guy> this was the ER2 signal I took:

[11:16:47] <guy>

[11:16:47] <guy> see the pink sell signal at around 10:30

[11:16:47] <guy> on the alpha

[11:16:47] <guy> and that with the green VAL line at 608.6

[11:18:26] <mashhad> yes

[11:18:35] <mashhad> but are you still in or are you flat?

[11:19:16] <guy> i'm flat

[11:19:26] <gator3> guy what was wrong with the sale signal at 10:07

[11:19:54] <guy> nothing - it was an excellent signal - i was staring out the window instead of watching the road

[11:20:38] <gator3> lol ok

[11:20:49] <gator3> don't let that happen again on my watch

[11:22:42] <guy> okay :)

[11:29:47] <guy> singles at 604.9 on ER2 - i will take these long if alpha doesn't filter me out of the trade

[11:30:20] <guy> i'm looking for an alpha value between +1 and +2 when we hit that line

[11:30:38] <guy> if we don't have that kind of value on alpha then that will filter me out of that long trade

[11:31:06] <guy> here are the RF's:

[11:31:34] <guy> and here are the singles and DIBL

[11:31:50] <guy>

[11:31:57] <guy>

[11:33:13] <guy> notice on the ER2 chart that we have singles at 604.9 and then a cluster at 602.5 and 601.8

[11:33:34] <guy> the cluster is a single (1st) and DIBL

[11:33:48] <guy> this is a long area if alpha doesn't filter the trade

[11:35:24] <guy> here is a clearer look at this possible long:

[11:35:26] <guy5>

[11:59:46] <mashhad> Guy, is 90.25 shortable if we get a alpha signal on ES?

[12:09:41] <guy> why 90.25 ?

[12:09:51] <mashhad> DVAH ES

[12:10:29] <guy> yes it is mash - my DVATool is showing DVAH at 90.5 but it might be wrong

[12:10:37] <guy> i don't have an MP chart up for ES

[12:10:57] <guy> is DVAH on eSignal's MP chart showing 90.25 atm?

[12:11:12] <tuna> not here

[12:11:13] <mashhad> it is 90.50 but since the last time we only made it to 90.25, i thought that was more realistic

[12:11:27] <guy> very good point

[12:11:38] <guy> yes - in F bracket

[12:12:00] <guy> i've brought up MP for ES:

[12:12:05] <guy5>

[12:12:53] <guy> yes - if you get a value of -1.5 to -2.5 in alpha and it hits DVAH i blieve that will be a good probability short

[12:13:07] <mashhad> ok

[12:13:46] <guy> i'm wanting to short ER2 here:

[12:13:48] <guy5>

[12:13:54] <guy> but can't find a good reason to do it against.

[12:14:24] <mashhad> i know i was looking for a MP signal, but none were present

[12:14:28] <guy> perhaps this DPOC should be given more weight when trading ER2

[12:14:54] <guy> it certainly seems to play a bigger part in the ER2 than it does in other symbols

[12:15:01] <mashhad> is your DPOC at 606.80?

[12:15:31] <guy> 606.9 atm

[12:15:50] <guy> but on the MP chart it's at 606.8

[12:16:01] <guy> using DVATool it's at 606.9

[12:16:09] <mashhad> i see

[12:17:04] <guy> the eSignal MP chart is wrong

[12:17:22] <guy> at 606.8 there is a D bracket print on the eSignal MP chart right?

[12:17:39] <guy> Here:

[12:17:50] <guy5>

[12:18:02] <guy> Now go back and look at the D bracket today on a bar chart

[12:18:17] <guy> you will see that the low during the D brack (09:30 to 10:00 EST)

[12:18:30] <mashhad> y

[12:18:32] <guy> was 606.9

[12:18:44] <guy> so there shouldn't be a D print there

[12:19:37] <guy5>

[12:19:38] <guy> Have a look at this MP chart produced by DVATool

[12:20:12] <mashhad> yes, so E-signal is giving wrong info

[12:20:17] <mashhad> which is scary

[12:20:23] <tuna> my d bracket is at 606.9

[12:20:45] <guy> tuna: do you have a D bracket print at 606.8 as well?

[12:20:51] <tuna> no

[12:20:54] <mashhad> are you using AB #f or ab m5?

[12:20:58] <guy> are you using esignal?

[12:21:13] <tuna> ab #f

[12:21:19] <tuna> 7.8

[12:21:32] <guy> that's interesting...

[12:22:04] <mashhad> tuna, are you using alpha on 7.8?

[12:22:06] <guy> my DVATool is producing the same graphic that you're seeing using the same data that the esignal MP chart is producing incorrect graphic for

[12:22:17] <guy> alpha isn't available on 7.8

[12:22:30] <tuna> dang

[12:23:09] <guy> why don't you want to upgrade tuna?

[12:23:35] <guy> alpha uses the new features in esig 7.9

[12:23:47] <tuna> cuz everyone was having bond probs

[12:23:58] <guy> that's a fair point

[12:24:04] <guy> okay mash - watch this ES

[12:24:13] <guy> alpha says it's okay to short it

[12:24:40] <guy> i might try ER2 short at 608.5 again...

[12:25:03] <tuna> sounds like a plan

[12:25:08] <guy> short signal in YM here

[12:25:20] <guy5>

[12:28:14] <tuna> oh and folks seem to have screwy mp data too with 7.9 ;)

[12:29:20] <guy> :)

[12:29:33] <guy> do you have a second computer tuna?

[12:29:50] <guy> i always upgrade to my backup esignal computer

[12:29:51] <tuna> nope :(

[12:30:10] <guy> i have a backup esignal comp in case primary goes down

[12:30:29] <guy> and i use that to test next version of esig

[12:30:33] <guy5>

[12:30:36] <guy> before upgrading primary

[12:30:55] <mashhad> did ur dvah on es drop to 90.25?

[12:31:06] <mashhad> or 90.00 just now?

[12:31:19] <guy> no

[12:31:37] <guy> here is this ES chart

[12:31:41] <mashhad> what is your dvah on es?

[12:31:45] <guy5>

[12:31:47] <guy> the pink line is DVAH

[12:31:59] <tuna> 90 here

[12:32:08] <mashhad> on MP it dropped to 90

[12:32:09] <guy> and you can see that it hasn't changed from 90.5 for at least 20 min

[12:32:52] <guy> yes i see that

[12:33:01] <guy5>

[12:33:02] <guy> mp chart coming up

[12:36:41] <guy> the esignal cut-off formula is obviously slightly different from mine...

[12:38:16] <tuna> ive never been a big fan of esig

[12:38:48] <guy> which is the best for you tuna?

[12:39:43] <guy> i find that they are the best of a bad bunch

[12:39:44] <tuna> well for MP i dont have much choice

[12:40:16] <guy> i don't think that they are great either - but then i think that they are the best on the market of a poor selection

[12:40:16] <tuna> well put

[12:40:50] <tuna> needs a total rewrite imo

[12:41:32] <guy> i'd like to see it integrated into .NET and rewritten in C# and their formula language moved over to C#.NET

[12:41:42] <guy> then I think it could be a world class product

[12:43:25] <tuna> do it we'll call it guysignal,,and we'll sign up with u

[12:43:50] <guy> :)

[12:48:31] <guy> I'm being called for dinner - don't go losing money while i'm away

[12:49:35] <mashhad> :)

[12:52:27] <fspeculator> guy you here?

[12:57:41] <mashhad> s 608.50

[13:09:27] <mashhad> Guy are u back?

[13:11:25] <guy> yes

[13:11:40] <mashhad> i am short 608.50

[13:12:00] <guy> i see that

[13:12:00] <mashhad> Alpha went long on the ES for a bit

[13:12:24] <mashhad> do i need to worry about it, or just stick to ER chart?

[13:12:30] <guy> yes - just looking at that now as well

[13:12:37] <guy> stick to ER chart

[13:12:46] <guy> basically don't short the ES now

[13:12:52] <guy> but short on ER2 is okay now

[13:14:20] <guy5>

[13:14:49] <guy> DVAH on ER2 is exapnding up on us

[13:14:54] <guy> which is great

[13:15:03] <guy> and is keeping us in DVA on ER2

[13:15:11] <guy> alpha is supporting here

[13:15:38] <guy> IMO - you're looking for a rotation to DVAL

[13:15:48] <guy> so I would target 606.5

[13:18:28] <mashhad> too scared to MacG

[13:19:40] <guy> i agree - no macG in this environment - market is moving too slowly

[13:20:08] <guy> My furtherest stop on this would be 610.1 which is 1 over current DVAH

[13:20:36] <mashhad> i have it at 610.00

[13:21:14] <tuna> 8.9 here

[13:21:28] <tuna> 608.9

[13:21:58] <guy> you short 8.9 tuna?

[13:22:07] <mashhad> break baby break!

[13:22:29] <tuna> dvah 608.9

[13:22:36] <mashhad> 88.50 is DPOC ES

[13:22:48] <mashhad> we went below it now

[13:23:01] <guy> good

[13:23:25] <guy> 2 targets in ER2 here: DPOC=6.9 and DVAL=6.5

[13:23:54] <mashhad> now ES has to go below DVAL

[13:24:19] <guy> dval and ibl are same at 87.5 in es right?

[13:24:26] <mashhad> y

[13:25:02] <guy> problem is that's a buy in ES because alpha is/was +1 at that point

[13:25:18] <guy> let's hope that it fails

[13:25:34] <mashhad> i know, this is making me think about getting out

[13:27:06] <guy> if i was worried like that, and i had multiple contracts on, then i would close half, and move the stop on rest to b/e

[13:27:38] <mashhad> only 1

[13:27:53] <tuna> your dvah is up around 610?

[13:28:30] <mashhad> dvah on er is 608.80

[13:28:39] <tuna> k

[13:28:44] <guy> no tuna 609.1

[13:28:57] <tuna> i musta missread the post

[13:30:57] <mashhad> if ER would have had done what ES already did, we would all be in the money now!

[13:32:33] <guy5>

[13:32:43] <guy> yes

[13:33:17] <guy> you will notice that the DVA and DPOC move about a lot just after the half hour passes because we move into a new bracket

[13:33:49] <guy> lack of patience is your worst enemy mash - in general: i'm not picking on you here - just a general statement

[13:33:56] <guy> you've done your job now

[13:34:27] <tuna> i think greenies speaking now

[13:34:29] <guy> accept that you might get stopped out at a $100 to $200 loss - that will always happen every now and then - say at least 40% of the time

[13:34:55] <mashhad> right

[13:35:07] <guy> but you're targetting $200 to $300/$400 and you will get that hopefully 50% of the time

[13:35:13] <guy> or even 40% of the time

[13:35:22] <guy> and only scratch say 20% of your trades

[13:35:29] <guy> so that is what you're trying to do

[13:35:40] <guy> KNOW that every 2nd trade will be a loser

[13:37:06] <guy> if alpha gives up on us here then we are justified in trying to scratch the trade

[13:37:12] <guy> but alpha is -.74

[13:38:26] <guy> wow - market is dead

[13:38:33] <guy> greenspan speaking right?

[13:38:57] <mashhad> not sure

[13:41:10] <mashhad> alpha is getting weaker

[13:41:16] <mashhad> on ER

[13:41:24] <guy> that's natural because of the little drop in price

[13:41:36] <guy> alpha is an opinion of how over/under valued ER2 is

[13:41:56] <guy> if it says -.7 and ER2 drops -.7 then alpha goes to 0

[13:42:06] <guy> until it recalculates about 20 seconds later...

[13:42:30] <guy> so after ER2 moves down watch if alpha then starts dropping after the move

[13:42:33] <guy> or moving up

[13:43:31] <tuna> dpoc popped up here

[13:45:29] <mashhad> is it 8.10?

[13:45:43] <tuna> y

[13:46:44] <guy> yes it did:

[13:46:52] <guy5>

[13:47:11] <guy> and this is why:

[13:47:23] <guy5>

[13:47:40] <guy> L bracket overlapped the K bracket making it the most TPOs near the center

[13:48:38] <tuna> ic

[13:55:14] <guy> mash - i'd start thinking about scratching this for 1 tick profit now

[13:55:34] <mashhad> why now?

[13:55:49] <guy> alpha no longer providing support

[13:56:04] <guy> but that's just me

[13:56:26] <mashhad> isn't your alpha still negative?

[13:56:37] <guy> yes - but not as strong as it was

[13:56:43] <guy> look back to 13:00 est

[13:56:56] <guy> see how convincing alpha was then

[13:57:07] <guy> and again at 13:15

[13:57:46] <guy> this trade may still work out but i believe that the risk/reward ratio has changed for the worse

[13:57:55] <guy> i.e. now more risk and less reward potentila

[13:57:56] <mashhad> it looks to me like ES is gonna rotate back down to DVAL

[13:58:47] <guy> that is true - i hope it does for you

[13:59:26] <guy> all i'm showing you is the relationship that alpha had at 13:00 to what it has now

[13:59:37] <mashhad> yes u r right

[13:59:39] <guy> and am wondering if you can see what i'm talking about

[13:59:45] <mashhad> i am just learning

[13:59:57] <guy> yes - i'm not criticising

[14:00:06] <guy> just showing you what alpha is telling me

[14:00:13] <guy> and why

[14:00:37] <guy5>

[14:06:58] <guy> Yesterday's edited transcript from this channel can be found here: Transcript

[14:07:14] <guy> And i'll hopefully post this one tomorrow

[14:47:18] <guy5>

[14:53:17] <guy5>

[14:55:27] <guy5>

[15:03:24] <guy5>

[15:32:58] <guy> Have an excellent weekend everyone!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.