Merged Profile

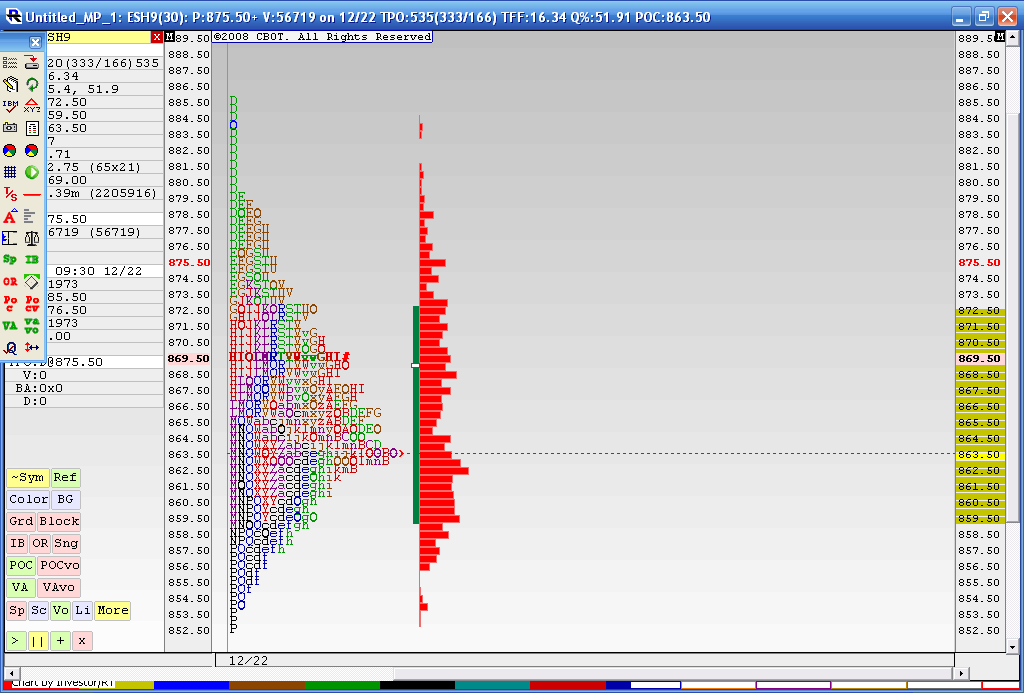

Below is the result from a 4 day merged profile as this is where we most recently have consolidated during holiday trade. The Value area high of this merge is 872.50 and the Value area low is 59.50. You may also notice that the 863.50 price has had the most trade through so far. This chart doesn't include today's trading. I think that 59.50 - 63.50 is the area we need to beat for any upside to take hold as we have the Va low and that Volume node. Current overnight high is 73.50 so it was fairly close to the merged VA high of 72.50.

In today's trading we have single prints created to the downside and through that high volume node. I'm skeptical because of the holidays and low volume but as most know we will trend many times after consolidations. I'm not sure if this counts. Anyway it's been fun firing up the old MP software for a change.

To make a long story longer: That 859.50 - 863.50 is the critical zone to watch.

In today's trading we have single prints created to the downside and through that high volume node. I'm skeptical because of the holidays and low volume but as most know we will trend many times after consolidations. I'm not sure if this counts. Anyway it's been fun firing up the old MP software for a change.

To make a long story longer: That 859.50 - 863.50 is the critical zone to watch.

quote:

Originally posted by dafydd

An eigth of what you may ask. An eigth of the VA - if the VAH is 860.00 and the VAL is 852.00 then the VA area is 8.00 points; and eigth would be 1.00 point. So in a roational market Jones suggests short at 859.00 or long at 853.00.

Thanks D.W.

I used the eight theory this morning @ 7:55am est. The volume spike on the 5min. confirmed it.

BTW; the 5min. RSI was also oversold

seems like we should start a thread called "Bias indicators" and put Kools Tick and other stuff there.....till then I'll just put this here

I noticed Ticks closed at minus 854 and the Trin at 5.84.......seems like we can't expect too much more selling today......I'm expecting some nice two sided trading off the open price....

I noticed Ticks closed at minus 854 and the Trin at 5.84.......seems like we can't expect too much more selling today......I'm expecting some nice two sided trading off the open price....

I like the idea......seems like these wide value area would do well to be split up in general...a 30 point VA...so we have about 3.75 points for octants...so key areas may be

24.25

28

31.75

35.5

39.25

43

46.75

interesting where overnight high and lows are so far...

well done Red!!

24.25

28

31.75

35.5

39.25

43

46.75

interesting where overnight high and lows are so far...

well done Red!!

quote:

Originally posted by redsixspeed

quote:

Originally posted by dafydd

An eigth of what you may ask. An eigth of the VA - if the VAH is 860.00 and the VAL is 852.00 then the VA area is 8.00 points; and eigth would be 1.00 point. So in a roational market Jones suggests short at 859.00 or long at 853.00.

Thanks D.W.

I used the eight theory this morning @ 7:55am est. The volume spike on the 5min. confirmed it.

It seems there is a little interest in the use of 1/8s or octants as Don Jones refers to them. He offers a simple MP based trade for rotational days. Bruce's comments regarding today's expectations I think are likely correct and so looking for rotational or responsive opportunities is very much our job today.

So here is a summary of the use of octants on rotational or responsive days:

1) Price moving above the Upper Octant or below the Lower Octant is considered as an alert

2) A short trade is entered as the price crosses back below the Upper Octant

3) A long trade is entered as the price crosses back above the Lower Octant

4) The target exit is the middle VA price or better

5) The protective stop is the appropriate Upper (for a short trade) or Lower (for a long trade) VA level

6) If neither stop nor target is hit, one exits on the close

Thanks Bruce for posting the 1/8s or octants for today. If this is old hat for everyone I apologize for wasting time & space.

So here is a summary of the use of octants on rotational or responsive days:

1) Price moving above the Upper Octant or below the Lower Octant is considered as an alert

2) A short trade is entered as the price crosses back below the Upper Octant

3) A long trade is entered as the price crosses back above the Lower Octant

4) The target exit is the middle VA price or better

5) The protective stop is the appropriate Upper (for a short trade) or Lower (for a long trade) VA level

6) If neither stop nor target is hit, one exits on the close

Thanks Bruce for posting the 1/8s or octants for today. If this is old hat for everyone I apologize for wasting time & space.

D.W.

We hit the 1/8 today "moving down" into the VAH & turned back up. Any stats how

offten this happens?

Thanks

We hit the 1/8 today "moving down" into the VAH & turned back up. Any stats how

offten this happens?

Thanks

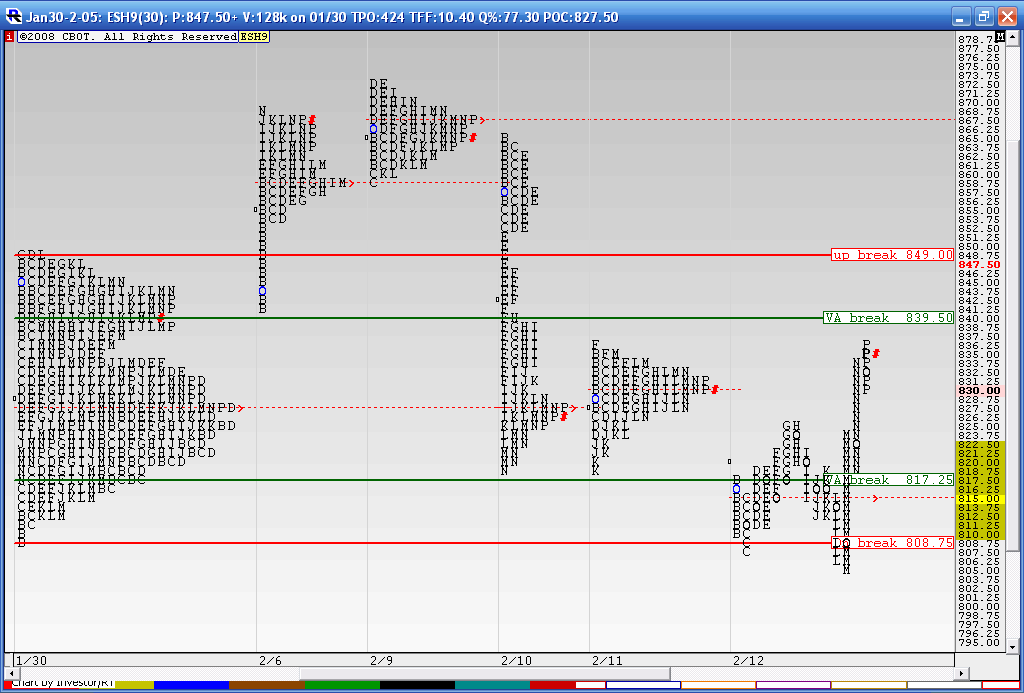

Here is something which may be of interest.....It shows that consolidation from 1/30 - 2/05 ( the one I've posted this week). On the chart are the Value area lines of that composite, the green lines and the red lines are the highs and lows of that composite.

On February 6th we broke out to the upside in the first period of the day ( The "B" period on my charts) with strong volume. Then on the 9th we consolidated and formed the dreaded "P" formation when you combine both days , the 6th and 9th. The selloff on the 10th brought us back into the Value area of the composite and look where we stopped.......at the VA low of the composite.....we consolidated on the 11th at the composites VA low.

Now what was cool about Thursdays trade is we opened right at the composites VA low and then Drove out of the low of the entire composite. Then we reversed the drive out and traded multiple times through the open price. They made one more attempt to drive it out in the late afternoon but failed only to have it close price back inside the Value area of the composite......

For those who follow the 80% rule concept you can apply the same logic to longer term trading. You may also look to compare how they drove it out from the composites highs much better then they did at the lows.....look at the amount of single prints and TIME spent above the composites highs or below it's lows on the break out day.... hope this at least interesting to some.....

On February 6th we broke out to the upside in the first period of the day ( The "B" period on my charts) with strong volume. Then on the 9th we consolidated and formed the dreaded "P" formation when you combine both days , the 6th and 9th. The selloff on the 10th brought us back into the Value area of the composite and look where we stopped.......at the VA low of the composite.....we consolidated on the 11th at the composites VA low.

Now what was cool about Thursdays trade is we opened right at the composites VA low and then Drove out of the low of the entire composite. Then we reversed the drive out and traded multiple times through the open price. They made one more attempt to drive it out in the late afternoon but failed only to have it close price back inside the Value area of the composite......

For those who follow the 80% rule concept you can apply the same logic to longer term trading. You may also look to compare how they drove it out from the composites highs much better then they did at the lows.....look at the amount of single prints and TIME spent above the composites highs or below it's lows on the break out day.... hope this at least interesting to some.....

Red,

There are a limited number of dstribution patterns that can occur on any given day. The least frequent is the trend day. Most of the others are some variation of a range day, the commonest being a range day with range extension, in one direction only, away from the VA of the previous session.

That said it infers that most days trading the pass back through the upper (or lower) octant should realize a profit. The intraday OBV (or more correctly the aggregate tick volume) should guide you to successfully recognize in which direction that range extension is going to occur.

I hope this is of help.

There are a limited number of dstribution patterns that can occur on any given day. The least frequent is the trend day. Most of the others are some variation of a range day, the commonest being a range day with range extension, in one direction only, away from the VA of the previous session.

That said it infers that most days trading the pass back through the upper (or lower) octant should realize a profit. The intraday OBV (or more correctly the aggregate tick volume) should guide you to successfully recognize in which direction that range extension is going to occur.

I hope this is of help.

D.W.

Thank you sir

Thank you sir

Over the past 4 weeks the 802.00 - 807.00 area has offered solid support and allowed buyers a low risk opportunity. All that changed yesterday. Buyers after the large gap down opening (Chicago hours) run into a brick wall at 802.00.

Unless buyers can immediately take prices back up above 802.00 then, as ever, previous support becomes resistance. Yesterday, closing virtually at the low, gave no hint that a buying tail is inviting buyers to take advantage of unfair lows. The over night high was a couple of ticks above the VAH for today. If we test that today it would likely be a gift for sellers.

Unless buyers can immediately take prices back up above 802.00 then, as ever, previous support becomes resistance. Yesterday, closing virtually at the low, gave no hint that a buying tail is inviting buyers to take advantage of unfair lows. The over night high was a couple of ticks above the VAH for today. If we test that today it would likely be a gift for sellers.

We had a break out up on yesterdays high Volume fed announcement.....now we need to see if we can attract Volume above...my feeling is that they will fail on this breakout and we will get daily closes back below 867.....Sure hope I'm wrong for the longer term players like myself....I'll get a chart later

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.