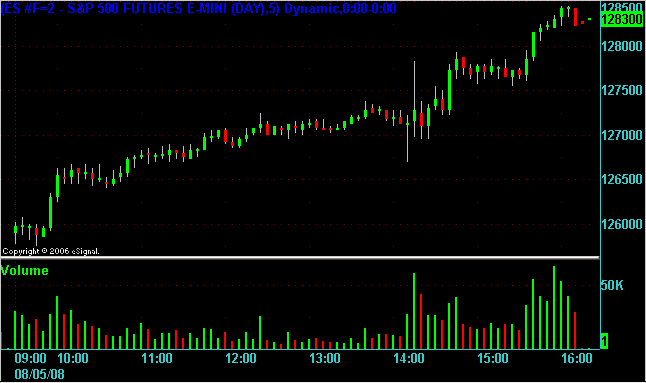

FOMC Fed Day 5 August 2008

The next FOMC interest rate announcement will be on the 5 August 2008.

More details and charts about Fed Days

More details and charts about Fed Days

Thanks for your timely reminders. I knew it was coming but it is nice to have the warning regardless.

I have come to learn that trading is like sailing. In sailing when the skies are clear and the wind is steady it is an enjoyable experience. When there is a storm you stay away, and when it is becalmed you also lower the sails and motor to port. The fed days become becalmed for the 2 hours before the announcement, then go into storm mode after....Better to wait for the clear skies and steady wind. I think I`ll take the day day off and go sailing tomorrow.

I have come to learn that trading is like sailing. In sailing when the skies are clear and the wind is steady it is an enjoyable experience. When there is a storm you stay away, and when it is becalmed you also lower the sails and motor to port. The fed days become becalmed for the 2 hours before the announcement, then go into storm mode after....Better to wait for the clear skies and steady wind. I think I`ll take the day day off and go sailing tomorrow.

Excellent choice! I know a lot of traders who do that. Enjoy!

Release Date: August 5, 2008

For immediate release

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 2 percent.

Economic activity expanded in the second quarter, partly reflecting growth in consumer spending and exports. However, labor markets have softened further and financial markets remain under considerable stress. Tight credit conditions, the ongoing housing contraction, and elevated energy prices are likely to weigh on economic growth over the next few quarters. Over time, the substantial easing of monetary policy, combined with ongoing measures to foster market liquidity, should help to promote moderate economic growth.

Inflation has been high, spurred by the earlier increases in the prices of energy and some other commodities, and some indicators of inflation expectations have been elevated. The Committee expects inflation to moderate later this year and next year, but the inflation outlook remains highly uncertain.

Although downside risks to growth remain, the upside risks to inflation are also of significant concern to the Committee. The Committee will continue to monitor economic and financial developments and will act as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Elizabeth A. Duke; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh. Voting against was Richard W. Fisher, who preferred an increase in the target for the federal funds rate at this meeting.

For immediate release

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 2 percent.

Economic activity expanded in the second quarter, partly reflecting growth in consumer spending and exports. However, labor markets have softened further and financial markets remain under considerable stress. Tight credit conditions, the ongoing housing contraction, and elevated energy prices are likely to weigh on economic growth over the next few quarters. Over time, the substantial easing of monetary policy, combined with ongoing measures to foster market liquidity, should help to promote moderate economic growth.

Inflation has been high, spurred by the earlier increases in the prices of energy and some other commodities, and some indicators of inflation expectations have been elevated. The Committee expects inflation to moderate later this year and next year, but the inflation outlook remains highly uncertain.

Although downside risks to growth remain, the upside risks to inflation are also of significant concern to the Committee. The Committee will continue to monitor economic and financial developments and will act as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Elizabeth A. Duke; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh. Voting against was Richard W. Fisher, who preferred an increase in the target for the federal funds rate at this meeting.

Here's an email exchange between myself and Raymond Dziedzic, a member of this forum and web site.

quote:

Raymond wrote

Thank you for this heads up;

Please consider posting "Fed Announcement Alerts" one day prior to the actual meeting/announcement so we all can get a leg up;

Surely, if you look back at the record, the afternoon of the Monday prior to scheduled Fed Announcements/Meetings prove to be lucrative trading sessions . . .

quote:

day trading wrote:

I was not aware that the day prior to Fed announcements was better than average for trading. Do you mind if I post your comment on the forum to see if other traders have experienced the same? Also, what type of entry/exit signals do you use that make this particular day better than average?

quote:

Raymond wrote:

Please use my comments and kindly credit me with them;

I trade the ES and follow the YM, NQ and AB to seek confirmation on perceive Buy or Sell Signals;

As for Signals, I use FutureSource WorkStation with Bollinger Bands (2 Stnd Devs) and a Slow Stochastic superimposed upon the streaming 1 minute CandleSticks with Volume Bars in a lower pane superimposed with a standard MACD;

On a split screen, I have a 3 minute CandleStick set up with a 9-min, 16-min, 20-min, and 50-min MA superinposition upon Price looking for turns or cross-overs;

Below that split screen, I have a Volume Pane with a MACD superimposition with a different Pane for an Oscillation used to gain a sense for Momentum . . .

One more thing, I also set horizontal lines at the 80% and 20% levels to see when Price enters into an Overbought or Oversold position . . .

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.