Contract Rollover

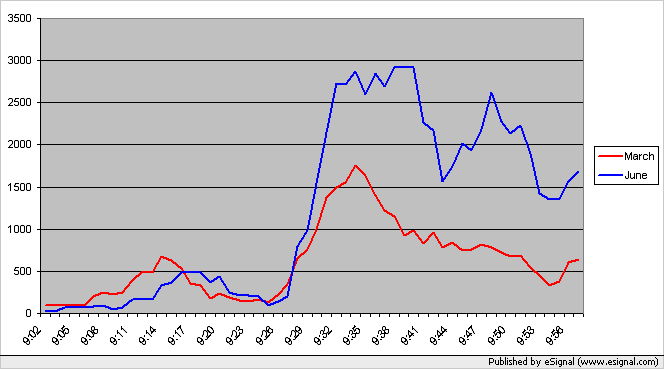

When does volume switch from one contract to another? The chart below shows the volume for the March and June 2005 contracts for the E-mini S&P500 between 09:00 and 10:00 EST. The volume for the old contract (March) dominates in the first 15 minutes and then again just before the open at 09:30 EST. Otherwise you can see that the volume in the new contract (June) have taken over. (The chart shows the 5 minute average volume for each minute. e.g. The volume on the 09:17 bar shows the average volume per minute from 09:15 to 09:19 inclusive.)

More information about rollover day can be found on this page: Rollover Days

More information about rollover day can be found on this page: Rollover Days

Official Contract Rollover is on Thursday 6/7/2012.

Contracts roll from June 2012 (M12) to September 2012 (U12).

However, as per the previous discussion the volume might still be in the June contract until Monday 6/11/2012 so trade the most appropriate contract for what you're trading. i.e. If you're going to close the position on the same day and the volume is higher and the spread tighter in the old contract then it might be the better one to trade until volume transfers.

Contracts roll from June 2012 (M12) to September 2012 (U12).

However, as per the previous discussion the volume might still be in the June contract until Monday 6/11/2012 so trade the most appropriate contract for what you're trading. i.e. If you're going to close the position on the same day and the volume is higher and the spread tighter in the old contract then it might be the better one to trade until volume transfers.

Closing Market Profile values on 6/6/2012

For June 2012 contract:

For September 2012 contract:

Note that if you're using the Market Profile Daily Values page then the values showing for 6/6/2012 will be for the June contract and from 6/7/2012 onwards will be the September contract.

For June 2012 contract:

ES NQ YM DJIA

VAH 1311.00 2551.25 12421 12413

POC 1308.00 2536.25 12333 12341

VAL 1300.50 2527.25 12289 12269

For September 2012 contract:

ES NQ YM DJIA

VAH 1309.25 2545.50 12346 12413

POC 1301.25 2530.00 12260 12341

VAL 1296.75 2521.00 12218 12269

Note that if you're using the Market Profile Daily Values page then the values showing for 6/6/2012 will be for the June contract and from 6/7/2012 onwards will be the September contract.

Official contract rollover is on Thursday 9/13/2012.

Rollover is on Thursday 7/March/2013

Tomorrow is the day. Rollover your contracts from June (M contract) to September (U contract). Can you believe that half the year has almost gone?

It seems to be taking longer for the volume to flow to the new contract than it historically did. The CME still has the official rollover date as 8 days before expiration:

http://www.cmegroup.com/trading/equity-index/rolldates.html

Does anybody know why volume flow to the new contract is taking longer than before?

From the CME:

http://www.cmegroup.com/trading/equity-index/rolldates.html

Does anybody know why volume flow to the new contract is taking longer than before?

From the CME:

CME Group Equity Index futures contracts users may roll their futures positions from one quarterly futures contract month (e.g.. June) to the next quarterly futures contract month (e.g.. September) at any time they choose.

However, the trading floor convention is to roll the expiring quarterly futures contract month eight calendar days before the contract expires for most of our Equity Index futures contracts. This is known as the Rollover date. Note that Nikkei 225 contracts historically have a Rollover date of the Monday before expiration.

This actually started a few years ago. It began to occur in the ES when the electronic contract's dollar weighted volume exceeded the the pit. It now takes the thousands of electronic traders and participants a day or so to figure it out. Before, it only took an hour or two for the electronic traders to match the relatively small number of guys in the pit, who all knew when to switch and didn't want to be left behind.

It is a classic case of the tail becoming the dog. A shift caused by technology.

It is a classic case of the tail becoming the dog. A shift caused by technology.

beyondMP - that makes a lot of sense except the timing. The ES volume overtook the SP/pit volume 11 years ago around 2002: http://www.mypivots.com/articles/articles.aspx?artnum=42&page=2

Did you adjust for difference in contract size?

Yes, if you read the text on that page you'll see that it says "The volume in the ES has been adjusted by a factor of 5 to make it exactly comparable to the SP."

This is rollover week.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.