Es short term trading 7-19 -10

Numbers I'm watching on the upside

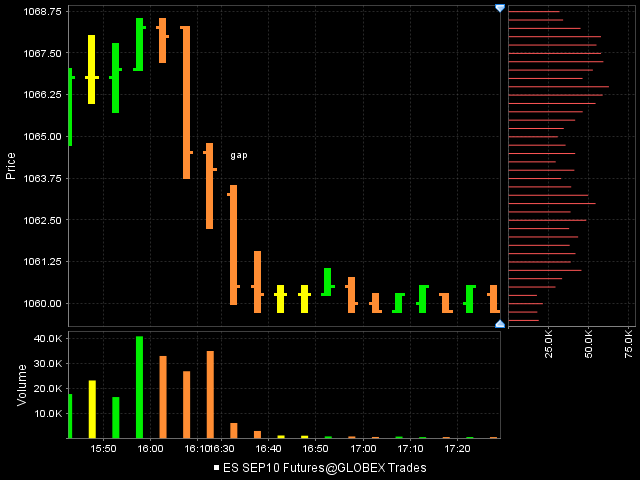

1069 Low Volume as per histogram

1073 - 1075 Pivot, High volume key number

1081 volume spike and 15 minute air pocket

downside numbers

I'm hoping to sell rallies with high $ ticks in the am..that's the plan if we open above Fridays close...but trade down into key numbers BELOW 1061 will be buys for me on low $ tick readings

61 - 62 lots of volume

47 - 50 key number previous volume

39 - 41 key breakout point

Hoping to revise these after I fire up my IRT charts

1069 Low Volume as per histogram

1073 - 1075 Pivot, High volume key number

1081 volume spike and 15 minute air pocket

downside numbers

I'm hoping to sell rallies with high $ ticks in the am..that's the plan if we open above Fridays close...but trade down into key numbers BELOW 1061 will be buys for me on low $ tick readings

61 - 62 lots of volume

47 - 50 key number previous volume

39 - 41 key breakout point

Hoping to revise these after I fire up my IRT charts

next longs will be at 55 for a new campaign if they stop us...so I wont be rebuying 58 now..

well.i chickened out at 60.25 for 4 ticks total...watching

stopped and watching the reaction to the 58 number...if any....nothing to stoip 55 from printing

long 58 and light again..

early I think..

don't like 5 minute reversal looking bars in down trends...

Well, lets see... daily range for 5 and 10 day is around 23 handles.. Friday was an expansion of range on a down day (negative ). BUT IF WE JUST GO TO NORMALCY THEN 1069.25-23=1046.25...heres a look at the longer term picture (still thinking 1037 ish by WED at a minimum)...

first target is 60.25....then will try to hold two ..for that 62.50 and 64.75....

buyers defending 1057, could be LoD.

MAN, mr market is confusing us all again! Although im bearish this week, especially into wed, i would have sworn we'd see a rebound up to that 1172 level at least, with an outside chance of 1081...suppose we still could (1057+ 23= 1080.25) ,but it doesnt look good so far!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.