Es short term trading 7-19 -10

Numbers I'm watching on the upside

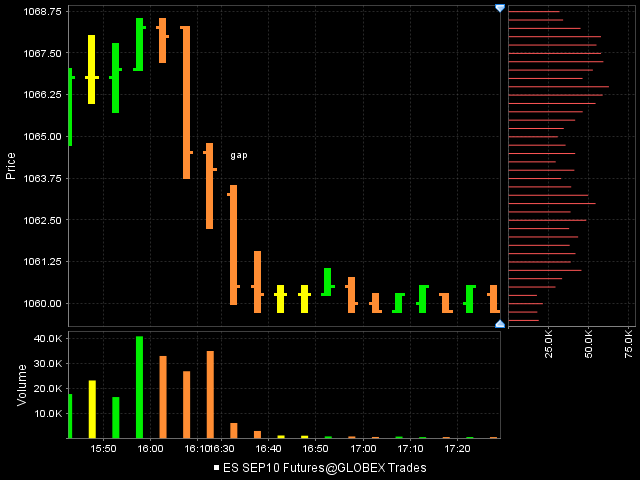

1069 Low Volume as per histogram

1073 - 1075 Pivot, High volume key number

1081 volume spike and 15 minute air pocket

downside numbers

I'm hoping to sell rallies with high $ ticks in the am..that's the plan if we open above Fridays close...but trade down into key numbers BELOW 1061 will be buys for me on low $ tick readings

61 - 62 lots of volume

47 - 50 key number previous volume

39 - 41 key breakout point

Hoping to revise these after I fire up my IRT charts

1069 Low Volume as per histogram

1073 - 1075 Pivot, High volume key number

1081 volume spike and 15 minute air pocket

downside numbers

I'm hoping to sell rallies with high $ ticks in the am..that's the plan if we open above Fridays close...but trade down into key numbers BELOW 1061 will be buys for me on low $ tick readings

61 - 62 lots of volume

47 - 50 key number previous volume

39 - 41 key breakout point

Hoping to revise these after I fire up my IRT charts

instead of selling again I pulled the stop on last...good high $ticks but I am not adding to short as I keep thinking that the more we consolidate then the greater the chance we may break out and trend

so now that 64.75 is tested do they need to go get 67 even ( didn't actually hitthe volume POC but hit time POC)or back down to that double bottom and the 59 volume? I would add at 67 if it goes and I see Ticks weakening...

so the trends leave th 60 minute poc's behind...like the 58 this morning...so lets not assume they all fill in on the same day

so now that 64.75 is tested do they need to go get 67 even ( didn't actually hitthe volume POC but hit time POC)or back down to that double bottom and the 59 volume? I would add at 67 if it goes and I see Ticks weakening...

so the trends leave th 60 minute poc's behind...like the 58 this morning...so lets not assume they all fill in on the same day

note how the 1063.25 fib level matches up with your chart?

I have 1064.75 as the open. see if it holds this time.

Note the triangle pattern if it doesn't break out to a high above here

I have 1064.75 as the open. see if it holds this time.

Note the triangle pattern if it doesn't break out to a high above here

agree ...lots of stops geared to that and if we are wrong they will run it 8 - 10 points from there so 68 - 70 is possible if this trade fails

Originally posted by Lorn

Yes sir, spot on interpretation. I see lots of volume building in the 1061-1063 area, as you've been pointing out. 1060 looks like a good place for prices to visit and say hi to a bunch of stops, don't you think?

Originally posted by BruceM

so Lorn that low voluem should be good for us consolidtaion folks as it would take high volume to move it away and hold it away from Vwap...is that how u see it...?

Dave I was just thinking of that possible triangle pattern pointing down. Must see a breakout to the upside or its a real possibility as per Bruce's 59 challenge.

i sure would be more comfortable holding this last contract if they could close it under 64.75 at 2:30

Bear market mondays tend to be positive. we'll see.

How about right on it?

Originally posted by BruceM

i sure would be more comfortable holding this last contract if they could close it under 64.75 at 2:30

triples at 1065.75.

But since price is already there now, is it of any significance ?

But since price is already there now, is it of any significance ?

Originally posted by phileo

Originally posted by phileo

lots of wicks under 1062, a break above 1063 targets today's open 1065

ABCD move today:

1057-1063 => AB

1060.5 - 1066.5 => CD

so, a potential measured move target for this current up sequence would be 1067.5

There's my 1067.5, but again, I only caught a few ticks of this move.... not even worth reporting here.

Next stop is dbl top 1069.25

no, not good enough for me as we closed above the time POC of this 60 minute and last 60 minute

BUT...this idea is experimental and still needs work....it isn't a core idea ...yet ...but workable..I also exited because I was short originall from there...

short now 69.25...!!gotta get below 67 and quickly///!

BUT...this idea is experimental and still needs work....it isn't a core idea ...yet ...but workable..I also exited because I was short originall from there...

short now 69.25...!!gotta get below 67 and quickly///!

Originally posted by Lorn

How about right on it?

Originally posted by BruceM

i sure would be more comfortable holding this last contract if they could close it under 64.75 at 2:30

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.