Good strategies for beginners?

Hi everyone!

I read in another thread that it's a good idea for a beginning futures day trader to choose one simple strategy and learn it inside out. Does anyone have a straightforward system they could recommend to learn and practice?

Or could someone point me to a good source or website to start reading? There is quite a bit of information out there and a big challenge will be just trying to make heads or tails of it. I think the best approach for my learning at this stage is to find a basic starting point from which I can slowly plow forward.

Thanks!

Marcus

I read in another thread that it's a good idea for a beginning futures day trader to choose one simple strategy and learn it inside out. Does anyone have a straightforward system they could recommend to learn and practice?

Or could someone point me to a good source or website to start reading? There is quite a bit of information out there and a big challenge will be just trying to make heads or tails of it. I think the best approach for my learning at this stage is to find a basic starting point from which I can slowly plow forward.

Thanks!

Marcus

“One thing keeps your eyes open. Do Swot analysis before any transaction. There is nothing as direct to reach where you want to be

Trading strategies in the Forex market are as numerous as the traders themselves. Beginners who enter the market have many perceptions of their own about how trading should be conducted. Although this is the case every beginner develops his own style of market evaluation and trading strategies in the profitable Forex market.

I have found this web site to have some excellent information. www.surinotes.com. His book "Trade Chart Patterns Like The Pros" has a huge amount of trade setups. He gives the Entry, Exit for profit, and Stop for Protection with each particular "Setup". The book is Cheaper on Amazon.

Do you have anyone that lives nearby that trades futures?

If so that actually makes money trading?

If you can answer yes to both of those then it would be great if that person would be willing to help you out.

The CME has really good FREE material that can get you going.

Your idea of sticking to one pattern and or one market is a good way to start. Start basic and work your way up and don't be to eager to start risking money. Getting a trading simulator that allows you to replay market data is a great way as you can play back trading days at your leisure.

If so that actually makes money trading?

If you can answer yes to both of those then it would be great if that person would be willing to help you out.

The CME has really good FREE material that can get you going.

Your idea of sticking to one pattern and or one market is a good way to start. Start basic and work your way up and don't be to eager to start risking money. Getting a trading simulator that allows you to replay market data is a great way as you can play back trading days at your leisure.

Hi there

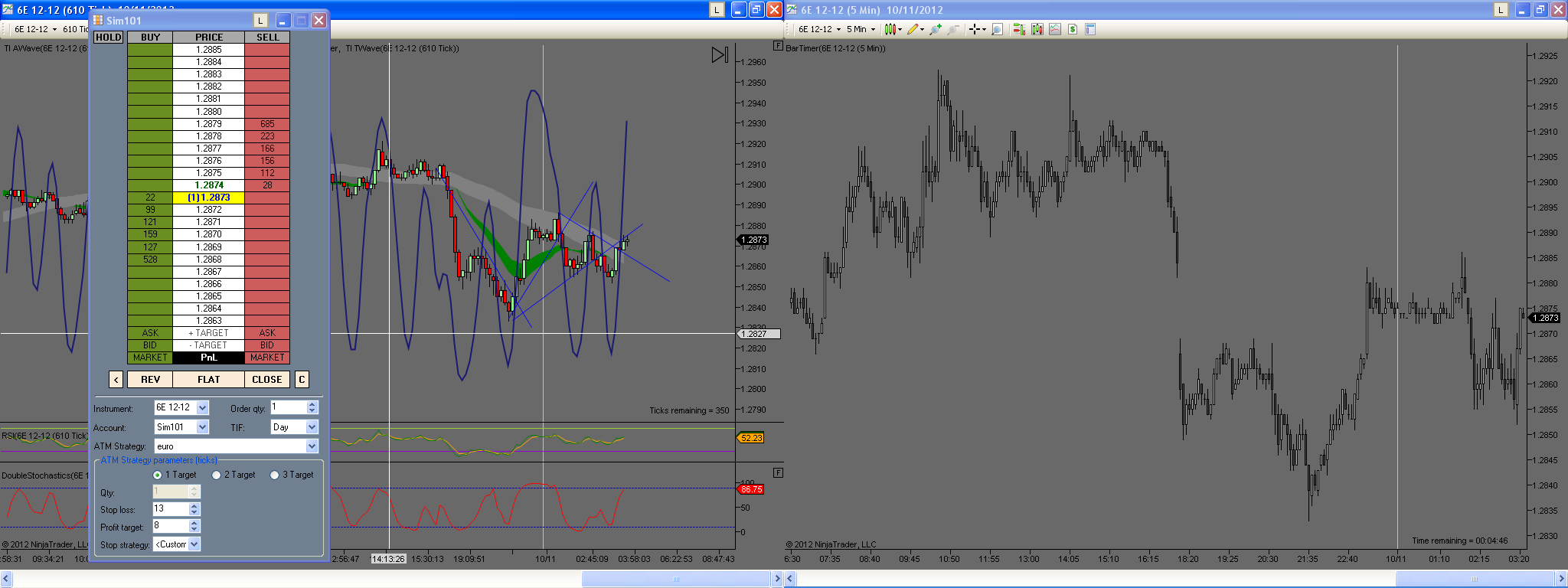

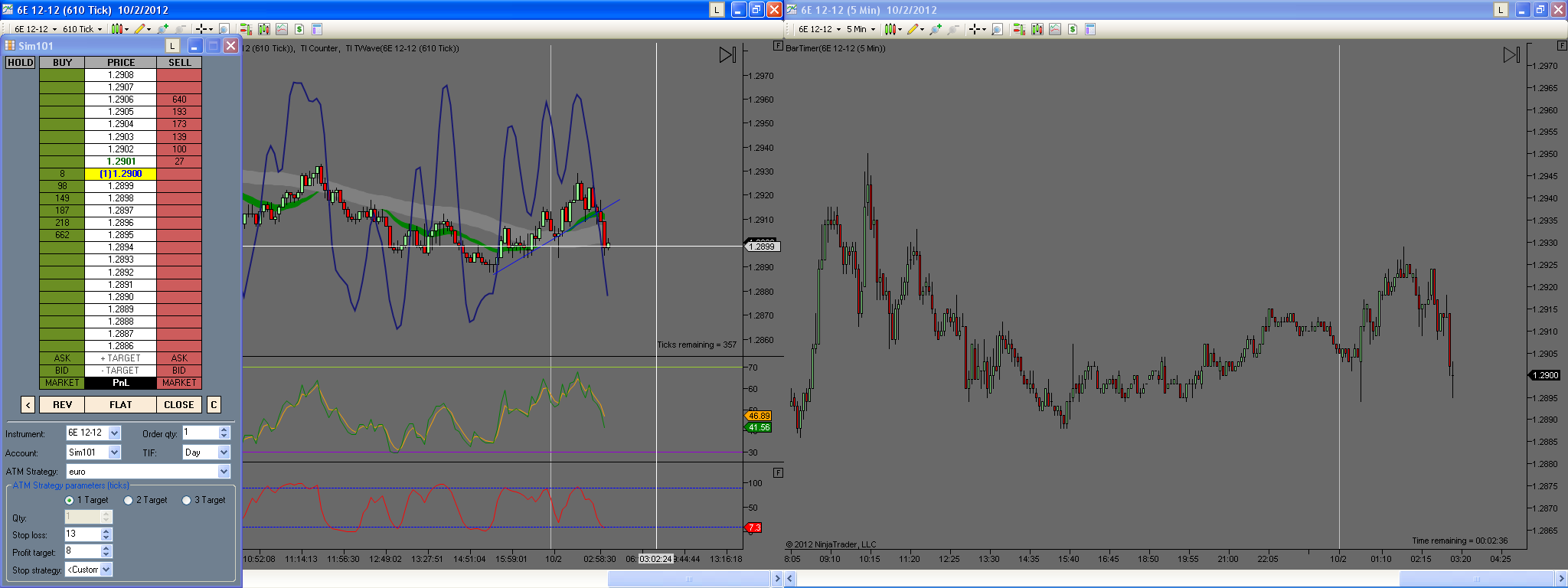

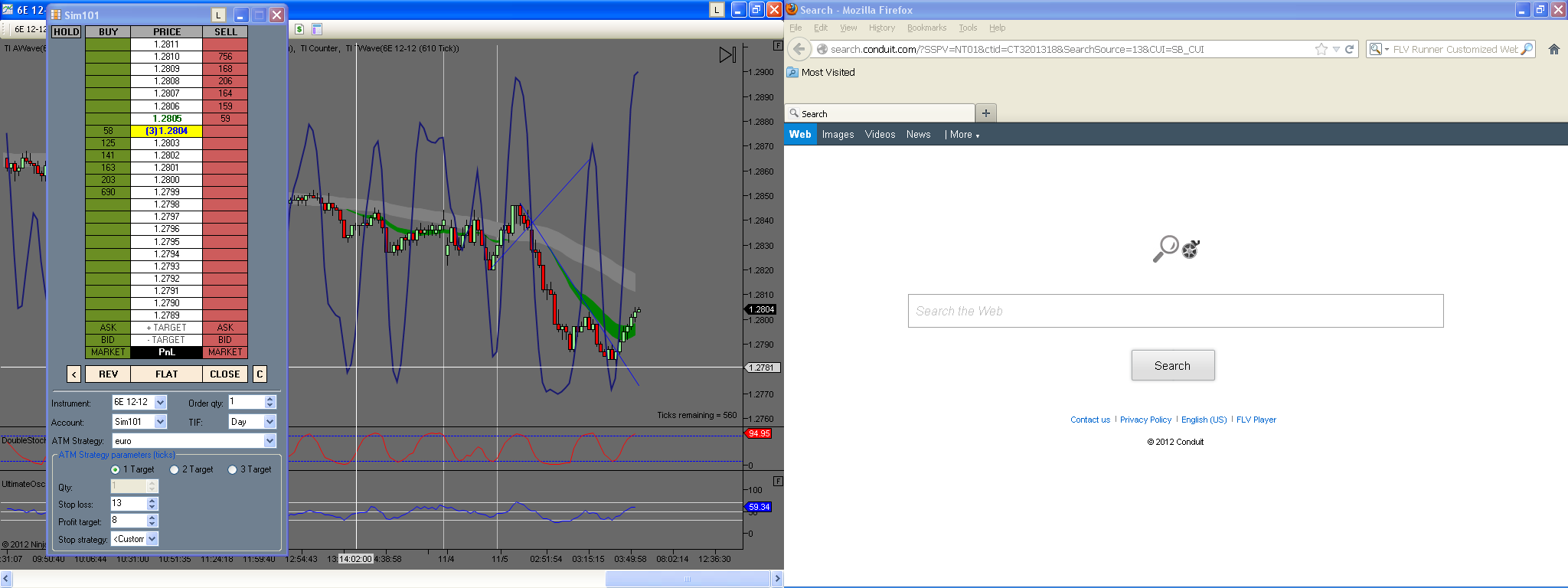

I trade ES and Euro currency

and the strateies i use is divergence and convergence between th eprice and stochastics

i use 5mins chart to find support and resistance and tick charts for divergnce,when these strategies are fulfilled then i take the signal

so a)support and resistance in 5 mins

b)divergence in tick charts

I trade ES and Euro currency

and the strateies i use is divergence and convergence between th eprice and stochastics

i use 5mins chart to find support and resistance and tick charts for divergnce,when these strategies are fulfilled then i take the signal

so a)support and resistance in 5 mins

b)divergence in tick charts

The first thing to do is not a trading strategy but a piece of advice. You should only trade with money you are comfortable losing. If you open up a Futures account with $20,000, then to you $20k is marked for disposal. This should be obvious, but you shouldn't be trading until you get your head around that. Secondly, never inject more funds into your account unless of course those additional funds are earmarked for disposal as well. If you lose your initial $20k, there's no point in putting in another $20k unless you feel comfortable losing that too.

Now that's not your question and I'm sure you didn't want to hear that. On to trading strategies. Your strategy needs to consistently make money. You do this either by either taking a series of small losses and make up for them by one or more bigger wins, or you have enough money and margin where you can ride out bigger losses until you make them up.Regardless of which approach you take, you need to cover all bases. Your method needs account for all possible scenarios including those days where there are 500-tick moves in one direction, or those days where there's a lot of bouncing around in a tight range. Whatever the price action, you need to handle it.

That's harder than it sounds, because most people are going to develop a strategy that may only work in one or two situations. But we all know there's not just one or two kinds of price actions. Anything under the sun can happen. So how do you deal with it? I'll let you chew on it....

Your strategy also needs to make sure you never run out of margin so that you are *always* able to trade without answering margin calls.

Now that's not your question and I'm sure you didn't want to hear that. On to trading strategies. Your strategy needs to consistently make money. You do this either by either taking a series of small losses and make up for them by one or more bigger wins, or you have enough money and margin where you can ride out bigger losses until you make them up.Regardless of which approach you take, you need to cover all bases. Your method needs account for all possible scenarios including those days where there are 500-tick moves in one direction, or those days where there's a lot of bouncing around in a tight range. Whatever the price action, you need to handle it.

That's harder than it sounds, because most people are going to develop a strategy that may only work in one or two situations. But we all know there's not just one or two kinds of price actions. Anything under the sun can happen. So how do you deal with it? I'll let you chew on it....

Your strategy also needs to make sure you never run out of margin so that you are *always* able to trade without answering margin calls.

I truly believe the key to trading is not finding some so-called "system" to blindly follow no matter what market you are trading, but rather to understand the markets in general. The best way to do this is through a mentor...someone that has seen it all and can answer your questions, go over trades with you, give advice, etc. I figured I could teach myself and I would lose a little bit of money at first and then I would be making money consistently. Yeah, that's not exactly what happened. What happened is that I have struggled for a very, very long time. I've jumped from candlestick charts with moving averages to ATR to RSI, Stochastics, Bollinger Bands, pitchfork, gann retracements, and a few others. Not only did I not find any consistency using any of these indicators, but I would get stopped out at or close to the highs and lows. Very frustrating indeed. I spent so much time looking for one thing that worked on a chart that I never actually understood the market. When I say understand, I mean, why price reacts the way it does in various market conditions. I finally came across OFA (orderflow analytics) and its creator DB Vaello. I am not a salesman nor do I ever want to be one but he has been an absolutely godsend for me. Am I killing it trading right now, no. Am I finally on the right path to consistency...YES! He embodies the term "mentor." The volume analysis through his charts has been eye opening to say the least. So much so that I rarely if ever focus on candlestick charts and if I do, they have absolutely no indicators on them. The only thing you can ask for these days in the trading profession is to find honest people that truly care about teaching the art of trading...that is DB. Not only that, I have also learned a great deal from the other and more elder traders that have been taught by DB. Now if only I would have found him sooner...

I truly believe the key in trading, is understanding that:

1) it is a negative sum game

2) one needs to find a statistical edge, large enough to overcome bid-ask spread/commissions/slippage and then some

3) one then needs to systematically exploit that edge, letting the law of large numbers do the rest - but this requires discipline & the financial ability to keep trading during drawdowns, so some financial planning ahead of time is mandatory.

I truly believe people fail because not understanding this ... believing that X / Y / Z (mentor / teacher) will make them profitable is just believing in free money. Can they give tools that can be useful to exploit an edge ? Sometimes. But the key, again, is in finding a statistical edge ... that cannot be given to you, you have to do the work & prove it to yourself ... this is the only way to trust yourself trade after trade.

A final comment ... with over 80% of the trading volume coming from computer systems, do you really believe in the "art" of trading ?

1) it is a negative sum game

2) one needs to find a statistical edge, large enough to overcome bid-ask spread/commissions/slippage and then some

3) one then needs to systematically exploit that edge, letting the law of large numbers do the rest - but this requires discipline & the financial ability to keep trading during drawdowns, so some financial planning ahead of time is mandatory.

I truly believe people fail because not understanding this ... believing that X / Y / Z (mentor / teacher) will make them profitable is just believing in free money. Can they give tools that can be useful to exploit an edge ? Sometimes. But the key, again, is in finding a statistical edge ... that cannot be given to you, you have to do the work & prove it to yourself ... this is the only way to trust yourself trade after trade.

A final comment ... with over 80% of the trading volume coming from computer systems, do you really believe in the "art" of trading ?

How do you know that 80% comes from computer systems ?

I believe in the art and do not buy into the HFT, computer driven hype....if I did I probably would quit trading like I do and have to find another style

So I'd like to see some statistics on the 80 % you mention.

Thanks

I believe in the art and do not buy into the HFT, computer driven hype....if I did I probably would quit trading like I do and have to find another style

So I'd like to see some statistics on the 80 % you mention.

Thanks

Originally posted by dom993

A final comment ... with over 80% of the trading volume coming from computer systems, do you really believe in the "art" of trading ?

Originally posted by BruceM

How do you know that 80% comes from computer systems ?

I've read articles that place the figure more around 70% but don't remember the exact source.

Nanex is an organization that is pretty vocal about reporting and exposing HFT abuses. I've seen quite a bit of evidence out of of them.

I did read something recently that claimed that HFT was on the decline or at least slightly declining.

You could try a search on ZeroHedge if you're interested. I think most of the news I've seen came from there.

Funniest story I saw was about how one of the Headline reading algos (yes they have computers that read the Headlines) read the first half of the headline which sounded like bad news and shorted only to reverse itself after reading the rest of the headline and realizing the news was actually good it was just a poorly written headline.

For an investment of only a couple hundred million dollars you too can jump on the HFT bandwagon, there are companies that will set you up with everything you need.

There are a lot of abuses within the HFT industry and yet the SEC does nothing. One trick they employ is to stuff quotes just under the limit that would cause a circuit breaker stop and create latency in the data and then capitalize on the arbitrage between the real price and the latency induced quotes.

Why is this stealing permitted? I have two theories. The first being that the regulatory agencies enjoy the fines they impose if and when they catch someone in the act, plus it helps justify their existence and since the fines is probably minimal compared to what the violator raked in they are happy to pay them. The problem with this theory is that I haven't heard of any fines levied.

The second is that the agencies just don't know what they're doing of posses the equipment capable of catching this type of fraud. I reached this conclusion after hearing the head of the SEC say while investigating the Flash Crash a couple of Mays' ago that "you don't want to look at any data faster than 1 second because all that is is noise". WHAT? WHAT? These trades are taking place in a millionth of a second how can you tell whats happening by ignoring that and looking only at data in one second intervals. That's like trying to scalp using a yearly chart. BTW if you look at the faster time frame you see that is was not Wadell Reed's fat finger trade (which the SEC blamed)that caused the crash as their shorts were all done after upticks, it was other trades that followed and jumped the spread.

Of the two theories I prefer the later as I have learned that you should never underestimate the ineptness of Governmental agencies. Another example of this was the issue with Toyota's sticking accelerator. The DOT got all over this yet by their own admission they did not have the equipment to even test the vehicles to see if there was indeed a problem. That didn't seem to stop them from issuing, fines, proclamations and threats to Toyota.

How does HFT trading affect us? I don't know. Is it responsible for the exodus of retail traders? Don't know that either. To me it just means that being in the market for any longer than you absolutely have to is risky, but I already held that belief.

Since the strategies are related to the characters, you can do the same moves with someone who suits you and work backtest

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.