ES 6-2-11

Numbers from todays trade for reference

1320.50-21.50 POC as per time, low volume , volume spikes

25 - 27.50 ****closing vwap, low volume, volume spikes

29.75 High volume

36 - 37.50 low volume zone and volume spike

tomorrow will be MATD trading....hoping for a higher open and a first move up to sell. No other 30 minute bars traded back to the open print today. We'll see what happens over night.

1320.50-21.50 POC as per time, low volume , volume spikes

25 - 27.50 ****closing vwap, low volume, volume spikes

29.75 High volume

36 - 37.50 low volume zone and volume spike

tomorrow will be MATD trading....hoping for a higher open and a first move up to sell. No other 30 minute bars traded back to the open print today. We'll see what happens over night.

Adding to Bruce's view, from an additional angle (read: trust bruce's numbers - ha) Resistance areas above current market as of this post:

1325 area is PASR (and a 382 fib rtc)

1329-30 50% rtc (currently) from yday's high (all trading hours) plus confluence w/another fib rtc level ... also have several Volume Profile charts showing this area as HV too

1333-34 area is PASR plus 682 rtc from yday's high

(fyi, not a big fib rtc fan unless coincides with PASR levels or some other confirmation)

PASR at 1308 and then 1302 (1302 also Daily S1 as per TS pivots) as potential support below market

1325 area is PASR (and a 382 fib rtc)

1329-30 50% rtc (currently) from yday's high (all trading hours) plus confluence w/another fib rtc level ... also have several Volume Profile charts showing this area as HV too

1333-34 area is PASR plus 682 rtc from yday's high

(fyi, not a big fib rtc fan unless coincides with PASR levels or some other confirmation)

PASR at 1308 and then 1302 (1302 also Daily S1 as per TS pivots) as potential support below market

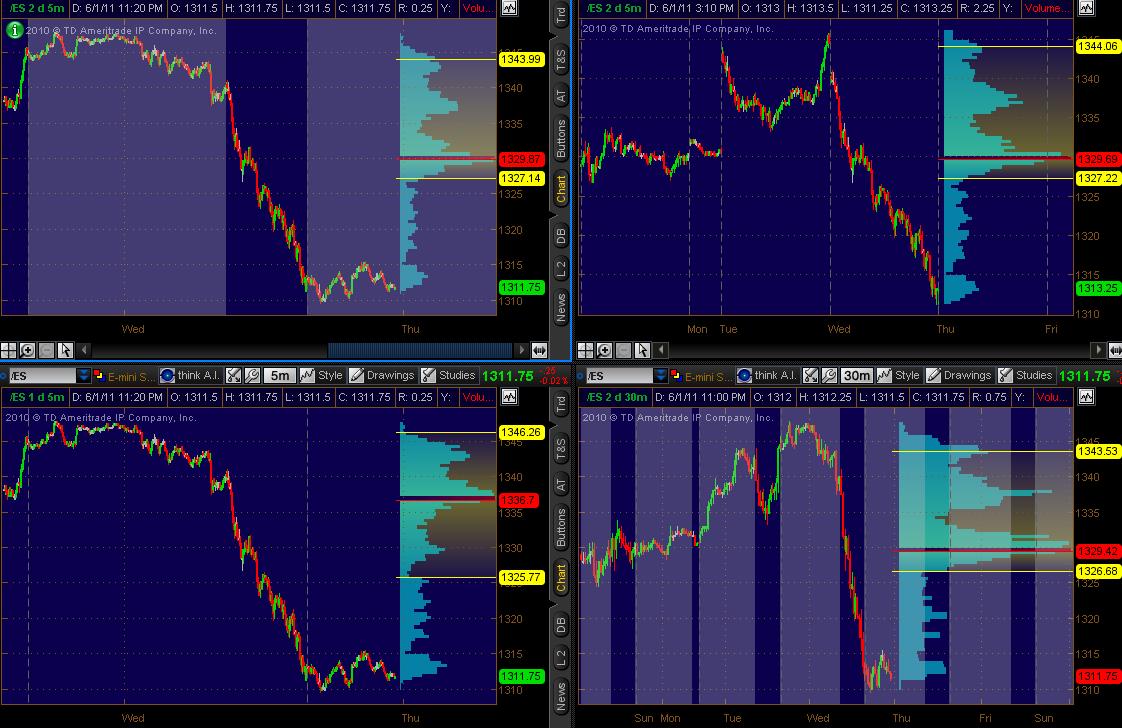

ES Volume Profile charts (thinkorswim)

Top Left: 5min chart of 2 days data ATH

Top Right: 5min chart of 2 days data RTH

Bottom Left: 5min chart of 1 days data ATH

Bottom Right: 30min chart of 2 days data ATH

Hope some find this helpful!

Top Left: 5min chart of 2 days data ATH

Top Right: 5min chart of 2 days data RTH

Bottom Left: 5min chart of 1 days data ATH

Bottom Right: 30min chart of 2 days data ATH

Hope some find this helpful!

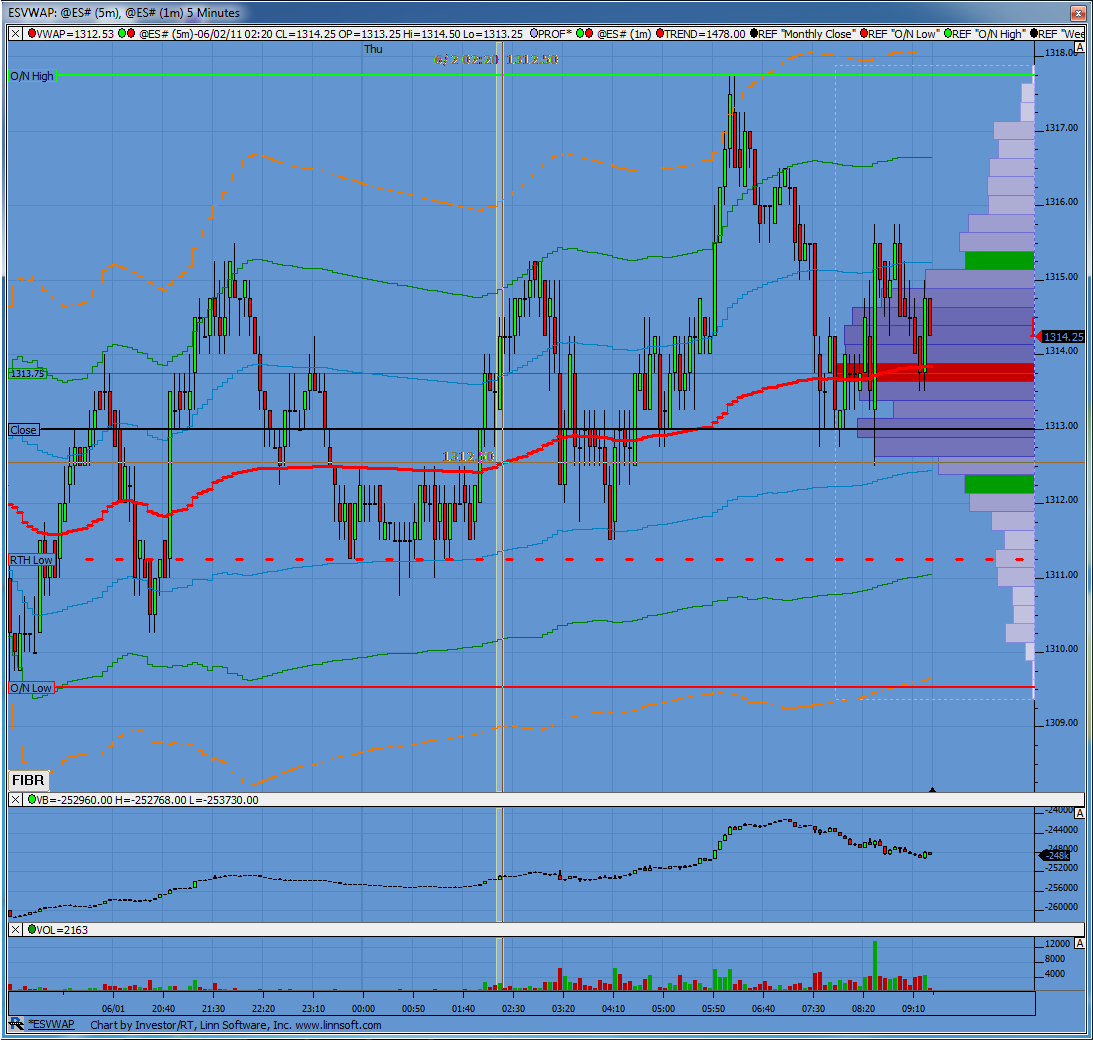

The overnight has respected the VA low at 1317.50 so that needs to be added to our numbers...8:30 reports coming up and a report at 10 a.m

If I had to pick other key lows it would be that low at 1306.50 and the low at 1302.50...real close to the ones MM mentioned...I don't mention the most immediate key numbers but we ALWAYS have the previous days RTH lows and highs and the O/N lows and highs on our radar. Those are alwyas watched..

Developing RTH V profile for the week. You can see the orderly distribution of volume throughout the range with a couple heavy spots, indicating prices were getting accepted all the way down.

with the volume and A/D ratios at oversold levels after YD I'd prefer to find BUYS if we opened lower in RTH....doesn't look is going to happen based on the O/N session.....

Volume is building in the 1312.50 - 1313 area as Lorn shows so that needs to also be put on our radar...

We don't usually just open higher and trend higher after big down days....so I will trade what the market offers...so if we need to be sellers then so it is but will not overstay my welcome on the down side....looking for two 30 minute bars to trade thorugh the open print today

Volume is building in the 1312.50 - 1313 area as Lorn shows so that needs to also be put on our radar...

We don't usually just open higher and trend higher after big down days....so I will trade what the market offers...so if we need to be sellers then so it is but will not overstay my welcome on the down side....looking for two 30 minute bars to trade thorugh the open print today

USD appears weak in the morning today and is likely to support the market if is remains so. Going long @1318 (O/N hi) for a 5 point move to 1323.

my basic plan is as follows:

Anyone who buys the breakout above the O/N high will try and push to the 20 - 21 area...we as faders need to keep those targets in mind for adds if they happen...I'm using the 12.50 - 13.75 area as the central volume magnet....with long and short fades...that becomes the central pull

those who are selling the breakout down from On lows will try to push for the 06.75 - 08 area... I want to be below those O/N lows...all witrh proper context...wathc the volume etc...Lorns CD can help too..

we can make these numbers better using the pitbull numbers based on the open print....how often do we move 10 points off the open without any retrace....? Could somebody who only likes to trade one contract buy or sell a plus or minus 4 - 5.5 number and make money with a 5 point stop ?....big for most but we need to have a disaster stop.

just spome ideas...good luck today///report at 10 !!

Anyone who buys the breakout above the O/N high will try and push to the 20 - 21 area...we as faders need to keep those targets in mind for adds if they happen...I'm using the 12.50 - 13.75 area as the central volume magnet....with long and short fades...that becomes the central pull

those who are selling the breakout down from On lows will try to push for the 06.75 - 08 area... I want to be below those O/N lows...all witrh proper context...wathc the volume etc...Lorns CD can help too..

we can make these numbers better using the pitbull numbers based on the open print....how often do we move 10 points off the open without any retrace....? Could somebody who only likes to trade one contract buy or sell a plus or minus 4 - 5.5 number and make money with a 5 point stop ?....big for most but we need to have a disaster stop.

just spome ideas...good luck today///report at 10 !!

O/N Profile. You can see the bell curve shape indicating neutral or range bound trade so far. As Bruce suggests, will that spill into the early RTH? The 5-day average range has expanded to 20 points. So far we only have 7.25.

an open at 14 puts key ranges atthe pitbull numbers

Was looking back at some of the oldest posts for the fun of it and came across this one. Some inspiration is always useful.

http://www.mypivots.com/board/topic/499/1/its-not-whether-you-win-or-lose

http://www.mypivots.com/board/topic/499/1/its-not-whether-you-win-or-lose

It's how you play the game that counts

this post is not about MAs or MP or money management or stop losses. this post is about playing a good game.

i've been involved in sports since i was five years old and have heard the old "It's not whether you win or lose ..." saying dozens, maybe hundreds or thousands of times. it didn't take long to get the message, but it did take a while to 'get' the message. in fact, i got it today.

short version of today: i dug a hole, got out, dug another, got out, and finished profitable but played crappy most of the day. it wasn't whether i won or lost, but how i played the game. i finished the day profitably, but was disappointed with my performance. and not in the vein of "Man, i left money on the table ..." or the like. the result was not disappointing, it was the journey that was a disappointment.

i've said it along that i don't trade for the money and i have always meant it. obviously, i don't do it for free, but it is the game itself that i enjoy. the whole process is a kick to me. lately though, the profit/loss aspect has become decreasingly important. the game has become increasingly important. i told my wife that today really tied that notion together for me. i was actually encouraged that i was disappointed with my win. a funny thing about today was that i have had much better worse days - in other words, i have had bigger up days on much worse trading days. regardless, today was my epiphany, my lightbulb, my ah ha!, my eureka!

will i trade flawlessly the rest of my career? no. that's not even a goal or expectation. what i do expect is to play my game and continually strive to improve my game. i'm convinced that internalizing this perspective will be the factor that sets me apart from the masses. it may not be tomorrow or next week or this year, but it will happen. i will continue to play my game, the game of trading.

game on!

take care

omni

BTW: keep in mind i am a discretionary trader. the strategy of game may be less of an issue for true automatic/systems traders. dunno.

take care and good trading -

Derek

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.