ES Fri 9-9-11

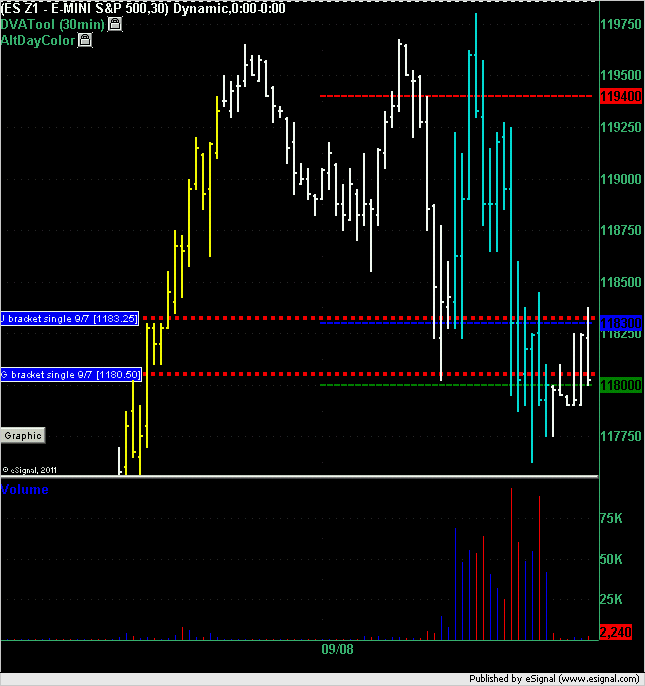

Market Profile summary from Thursday action. Note that you are looking at the December contract on this chart and not the September or continuous contract. i.e. the single prints you see on this chart that were generated on Wednesday you would not have seen on Wednesday because you would have been looking at the September contract.

The market opened above the Wednesday's J bracket and traded down to it triggering a long at 1183.25. Draw down on this trade was 1 point to 1182.25 in the following bracket which was then followed by a best run-up of 14.75 points to the high of day of 1198 even.

The market dropped through that single later on in the day and hit the second single which triggered a long at 1180.50 which had a draw down of 4.25 points to the low of the day of 1176.25 and a best run up of 5.5 points to 1186 even. Using a 4 point stop and a target greater than 5.25 points would have made that trade a loser. Note however that the run-up of 5.5 points happened before that 4.25 point draw down so most traders would have trailed a stop to breakeven by then.

The market opened above the Wednesday's J bracket and traded down to it triggering a long at 1183.25. Draw down on this trade was 1 point to 1182.25 in the following bracket which was then followed by a best run-up of 14.75 points to the high of day of 1198 even.

The market dropped through that single later on in the day and hit the second single which triggered a long at 1180.50 which had a draw down of 4.25 points to the low of the day of 1176.25 and a best run up of 5.5 points to 1186 even. Using a 4 point stop and a target greater than 5.25 points would have made that trade a loser. Note however that the run-up of 5.5 points happened before that 4.25 point draw down so most traders would have trailed a stop to breakeven by then.

yes...I switched this morning..

Originally posted by Lisa P

Bruce, are those Dec contract numbers?

nice projection on the 69 Prestwick...!!

Originally posted by BruceM

nice projection on the 69 Prestwick...!!

TY Bruce but the credit goes to KB. We just hit the 54.0 which was valid as 85.5 didn't get taken out.

seems way too early to be trading on both sides of the IB...outside of the 57.50 I mentioned earlier I have no good area I like until 45 - 47...but that doesn't mean we can't work for the retest of 57.50 from below it

Originally posted by prestwickdrive

Originally posted by BruceM

nice projection on the 69 Prestwick...!!

TY Bruce but the credit goes to KB. We just hit the 54.0 which was valid as 85.5 didn't get taken out.

Also, the initial move off 69.5 was to 60.0. With a projection hit it is good to take a counter projection. The size of that move was a warning that a much lower low was probable. The initial projection was 54.0 which had confluence with that earlier projection and said it was a decent place for a counter (perhaps respite) move as it also gives a full projection of 1144.5 unless 69.5 is taken out.

are you looking for 49.5 if 54 gets taken out ?

Originally posted by prestwickdrive

Originally posted by BruceM

nice projection on the 69 Prestwick...!!

TY Bruce but the credit goes to KB. We just hit the 54.0 which was valid as 85.5 didn't get taken out.

the 49.5 coming of course from the 85.5-71.75 move

Originally posted by ayn

are you looking for 49.5 if 54 gets taken out ?

Originally posted by prestwickdrive

Originally posted by BruceM

nice projection on the 69 Prestwick...!!

TY Bruce but the credit goes to KB. We just hit the 54.0 which was valid as 85.5 didn't get taken out.

Originally posted by ayn

the 49.5 coming of course from the 85.5-71.75 move

Originally posted by ayn

are you looking for 49.5 if 54 gets taken out ?

Originally posted by prestwickdrive

Originally posted by BruceM

nice projection on the 69 Prestwick...!!

TY Bruce but the credit goes to KB. We just hit the 54.0 which was valid as 85.5 didn't get taken out.

Yes as a place for some sort of a counter move but still looking for 44.5. Watch Bruce's levels too with the confluence of his 45 and the 44.5.

chris

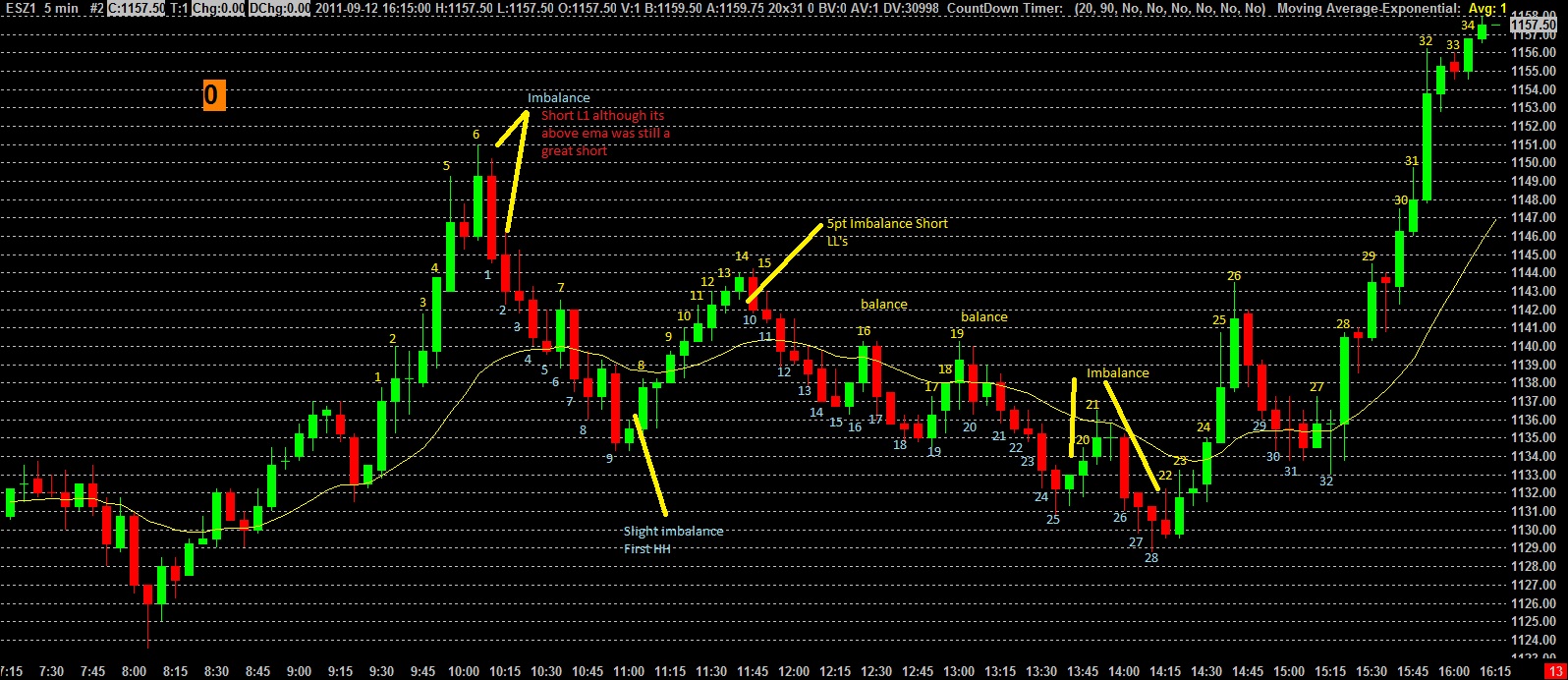

Just trading price action (correctly) is all anyone has to do to make a good living. The concept is bulls and bears only have so many opportunities to push the market in there direction are they doing a good job or wasting there HH's on a one tick

Just trading price action (correctly) is all anyone has to do to make a good living. The concept is bulls and bears only have so many opportunities to push the market in there direction are they doing a good job or wasting there HH's on a one tick

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.