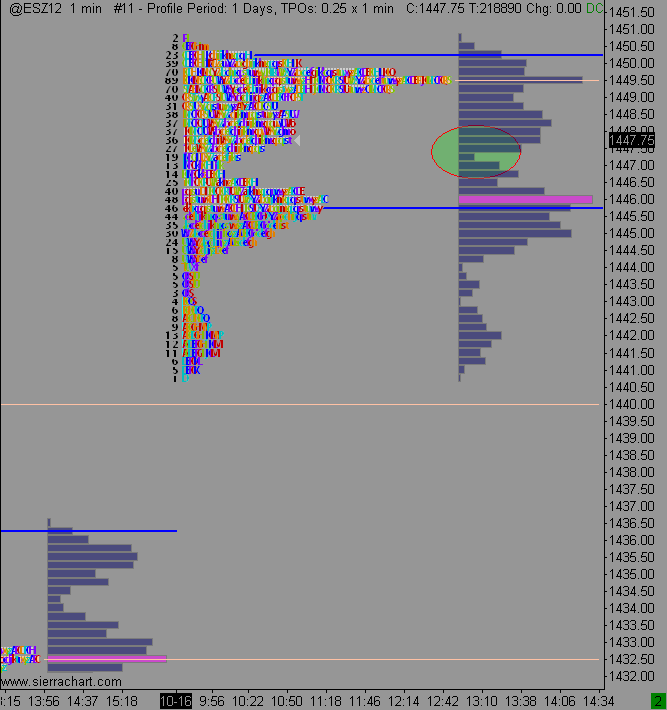

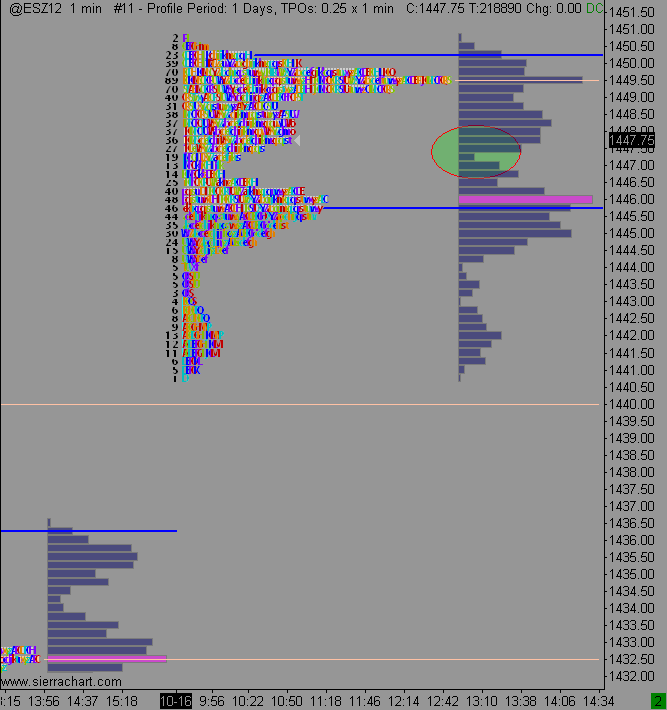

ES 10-16-12

Weekly R1 not mentioned is 1443.50 and another Vpoc up near 1448.50 - 1450 just in case they keep pushing..prefer the 1439 area as a magnet first though.. ..1437 - 1439 is also first critical support point

SO FAR ONLY TWO BIG AREAS AS PER VOLUME Spikes...the 1445 and now 1448.25..so those are the key areas as price attractors today...my plan is still to hold shorts and sell using the 45.25 and 48.25 as initial magnets..so even if we go higher, as long as we don't attract big volume above the 48.25 we WILL come back to it...

lets hope the plan becomes reality.

lets hope the plan becomes reality.

i have 52.5 and 55 above

each 30 minute bar has less volume then the previous as we enter this old VPOC....so my creed for today is :

"I may be wrong, I may lose money... but the market structure is saying that longs are tired up here and i will not get long"

It will be interesting to see if they want to hold up this strength given the debate tonight...it seems that it is unlikely that folks will want to hold in front of this political event.

many small losses and only one good trade so far today...50- 52 is my last sell zone and will use 48.25 as target...above there and I am not trading anymore and I'll have to accept defeat !

"I may be wrong, I may lose money... but the market structure is saying that longs are tired up here and i will not get long"

It will be interesting to see if they want to hold up this strength given the debate tonight...it seems that it is unlikely that folks will want to hold in front of this political event.

many small losses and only one good trade so far today...50- 52 is my last sell zone and will use 48.25 as target...above there and I am not trading anymore and I'll have to accept defeat !

Strange price action today.

that 1445 volume was created at about 10:26 EST....look how often price went back to it after that....I think the same will be true of the 48.25...it is not a matter of IF it will come back to it but WHEN...

so selling higher is still prefered as long as we haven't come back for it too often...it is these spikes that eventually create the VPOCs and vpoc shifts...so enough time spent back and forth at 48.25 would shift vpoc up to that price..

so selling higher is still prefered as long as we haven't come back for it too often...it is these spikes that eventually create the VPOCs and vpoc shifts...so enough time spent back and forth at 48.25 would shift vpoc up to that price..

according to my data this current 30 minute bar has volume higher than the previous bar...the only bar to do that today...i would really like to see a weak close at 12:30

now there are three areas but as long as we don't come back for a third test of 49.75 then we have a chance at the 45.25 retest ..the rest of this is just noise !!

47.25 was a decent lvn created this morning so a fight is being put in this area...45-46 below will also make it difficult for bears to run with the ball, and o/n high lies at 44, where another lvn was created this morning

there are huge data errors sometimes in the IB data..and I donot always confirm the differences in my DTN data and IB data....while the DTN data had 1446 and 45.75 as the big volume players the IB data showed 45.50...upon doing a refresh the IB data then matches

I mention this because I hope that nobody is following my exact numbers posted here...and why should you..or anybodies..the point is that there are usually only 3 - 4 big volume areas where big players utilize each day...then everyone else - us small players gravitate around and form these vpocs right near these........

I guess I am just making sure everyone does their own work ....as I don't want to feel bad for posting a number that might be off by a few tics

I mention this because I hope that nobody is following my exact numbers posted here...and why should you..or anybodies..the point is that there are usually only 3 - 4 big volume areas where big players utilize each day...then everyone else - us small players gravitate around and form these vpocs right near these........

I guess I am just making sure everyone does their own work ....as I don't want to feel bad for posting a number that might be off by a few tics

see where vpoc flipped too...? 1448....that volume came in hours ago at around 11:25 EST...you had that area to use a long time ago before anyone noticed it!!

NICKP,

On a day like Tuesday (Bear trap and squeeze) I think the VWAP for the day is the critical factor. On Tuesday, every time the VWAP was tested, buyers emerged (bears with short positions established over the prior 3 trade days who wanted to exit?).

Maybe some day I will write code to get the RTH intraday print of a Monday extension up .618 and see whether VWAP is critical support for an extension to full extension on that same day. I know I used to use the H of the previous day as important support for a shot at full extension once the 618 extension had been printed. maybe the vwap is more important.

On a day like Tuesday (Bear trap and squeeze) I think the VWAP for the day is the critical factor. On Tuesday, every time the VWAP was tested, buyers emerged (bears with short positions established over the prior 3 trade days who wanted to exit?).

Maybe some day I will write code to get the RTH intraday print of a Monday extension up .618 and see whether VWAP is critical support for an extension to full extension on that same day. I know I used to use the H of the previous day as important support for a shot at full extension once the 618 extension had been printed. maybe the vwap is more important.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.