ES Thursday 2-6-14

well I spent at least 1/2 hour trying to put together 3 videos for Wednesdays trade and it seems few are interested....that's ok as I don't want to waste my time or anyone else's so if nobody is getting anything out of them then there is no reason to make them...I'm cool with that...It's actually faster and easier to just post a chart or nothing at all....

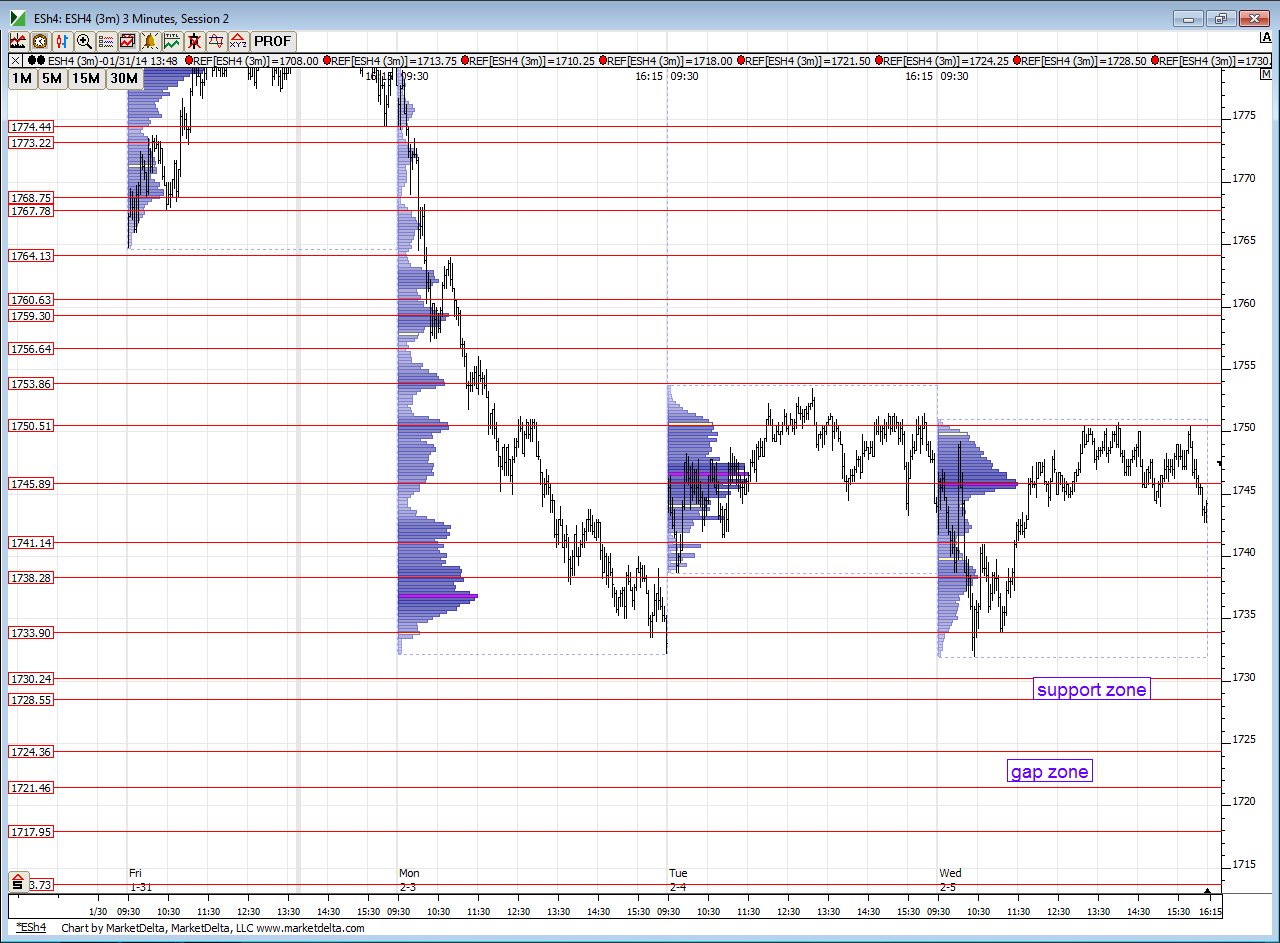

this isn't about votes or any of that...I just don't want to put in the time if nobody has feedback ( good or bad) or can contribute to the ideas....so we'll keep it to just a chart for Thursdays trade.....well compare these levels in the morning..two days have created some volume at 45.50 so we need to be aware of that.

this isn't about votes or any of that...I just don't want to put in the time if nobody has feedback ( good or bad) or can contribute to the ideas....so we'll keep it to just a chart for Thursdays trade.....well compare these levels in the morning..two days have created some volume at 45.50 so we need to be aware of that.

your welcome Duck..

closing it out at 60.75...concern is that an IB breakout will go the 64 area...so getting out and will trade the 64 if it comes

staring new small shorts at 62.50 with plan to go in heavier if they hit 64....targets will be 60 and that 58.25.

so far it's been one small loss, one break even and now we'll see what this one can do...watching IB highs closely...revising add point to 63.75 if it prints...and target to 60.25 first

took the loss at 65....luckily we don't trend often...but that's trading...blowing through this zone is a no- no ....so the lvn at 64.25 needs testing....will try once more above the 65's if I can find a low risk short spot... I feel they are just running stops up here now.....above 66 would really shake many out and then come back to the 64.25.

short from 65.50 delta divergence at these levels

out small profit, poor trade management on my part

if I can get this to test 61.50 then I have a break even day...new highs makes me slightly more of a loser....as a fader , the best you can when we trend early is to limit your losses and battle it out the next day

short from 64.75 small delta divergence again

notice we haven't traded back to any zone from a higher zone......the 56- 57 never got back to the 54...the 61 didn't go back to 56 - 57......so will the 64 turn into resistance and go back down towards 61 area ? that's what I am hoping for...usually they don't push through three zones that are 3 points apart without the retests back...so NOT trading back to the 61 zone would be the third failure...so far we have had 2 failures and pushing to 68 - 70 would make it a third failure if we don't test back to the 61 zone.....hope that make sense...

I agree ...that's when it becomes real important to see what happened with good old fashioned price action.......it can make a big tail or any large single print area a bit more manageable...also a great question to also ask your self is " are we able to hold in or out of value from previous days ?"...the time Value area high from monday was 59.50...so blowing through there and leaving a single print behind is sending a message.....which is always easier to see in hindsight...but might help if you trade outside the first 90 minutes etc..

Originally posted by sharks57

thx for clarifying Bruce, those profile tails still baffle me somewhat.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.