ES Tuesday 2-11-14

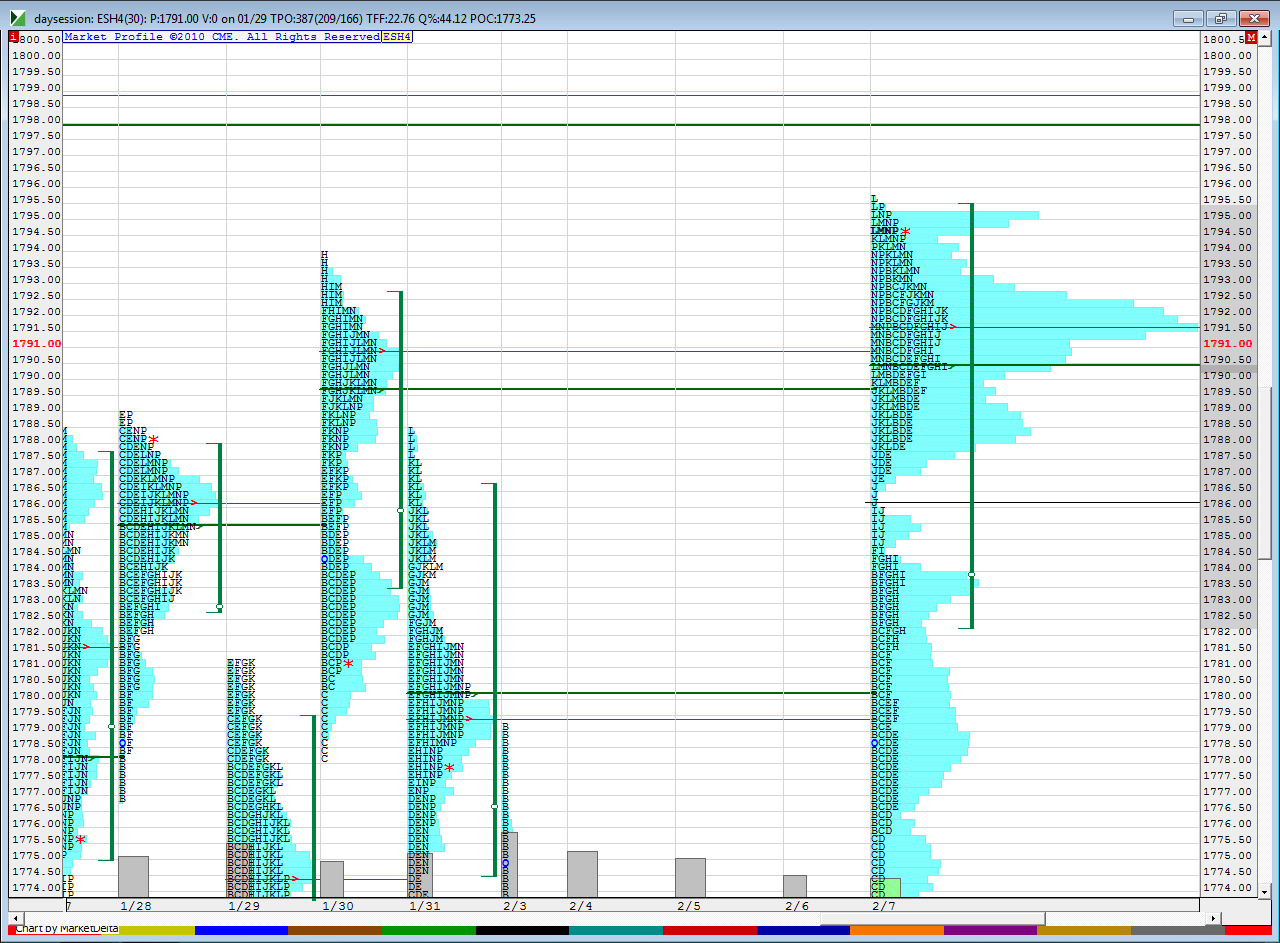

Yesterday had most of its range inside to friday and it was a lower volume day, so I combined the two days to make a nice symetric bell curve...note the LVn at 86 ...that is a single print area and part of the "Complex " area I mentioned yesterday.

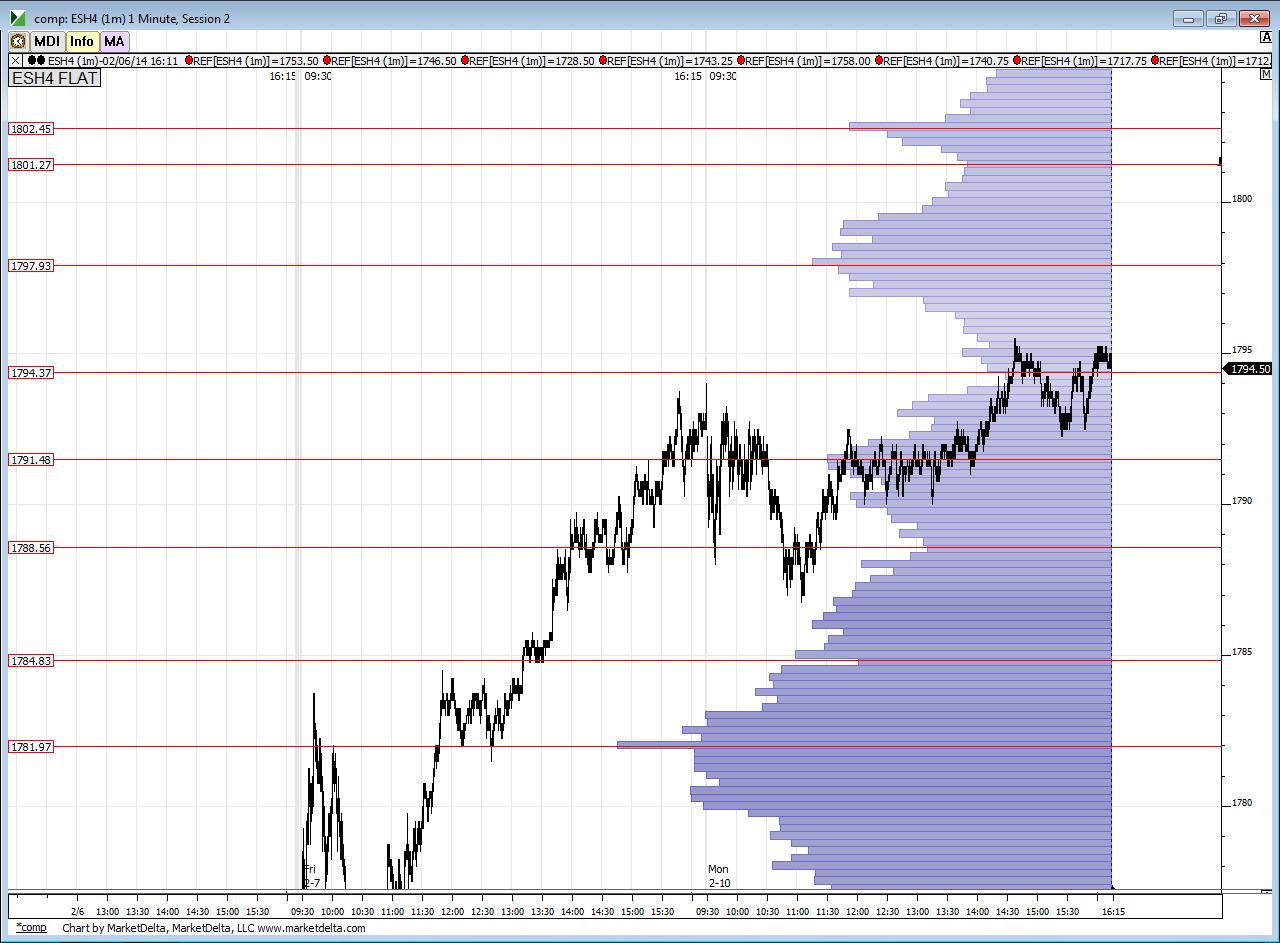

next we have the one minute composite ..this is good for an overall view but I still prefer to use day to day area

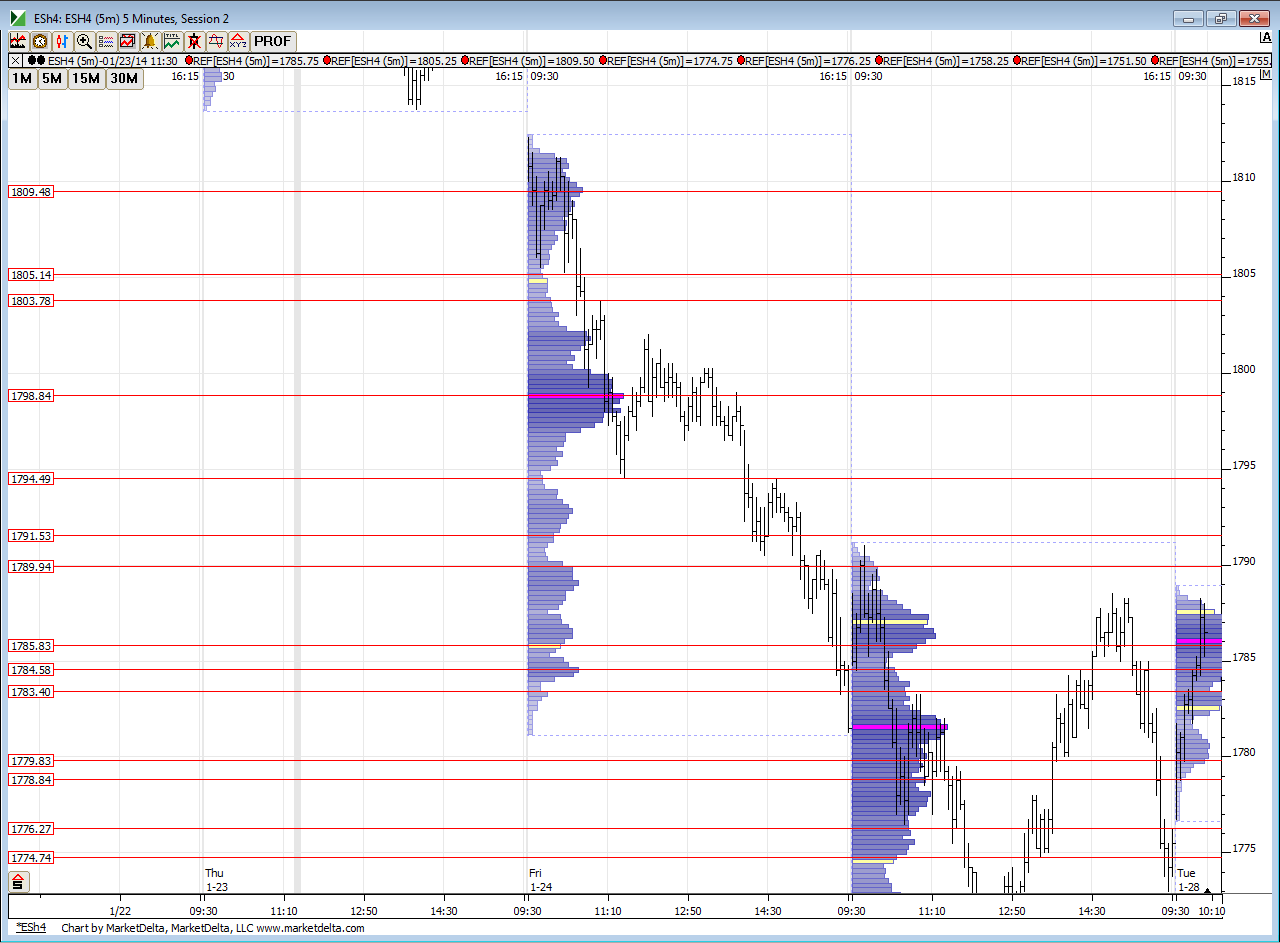

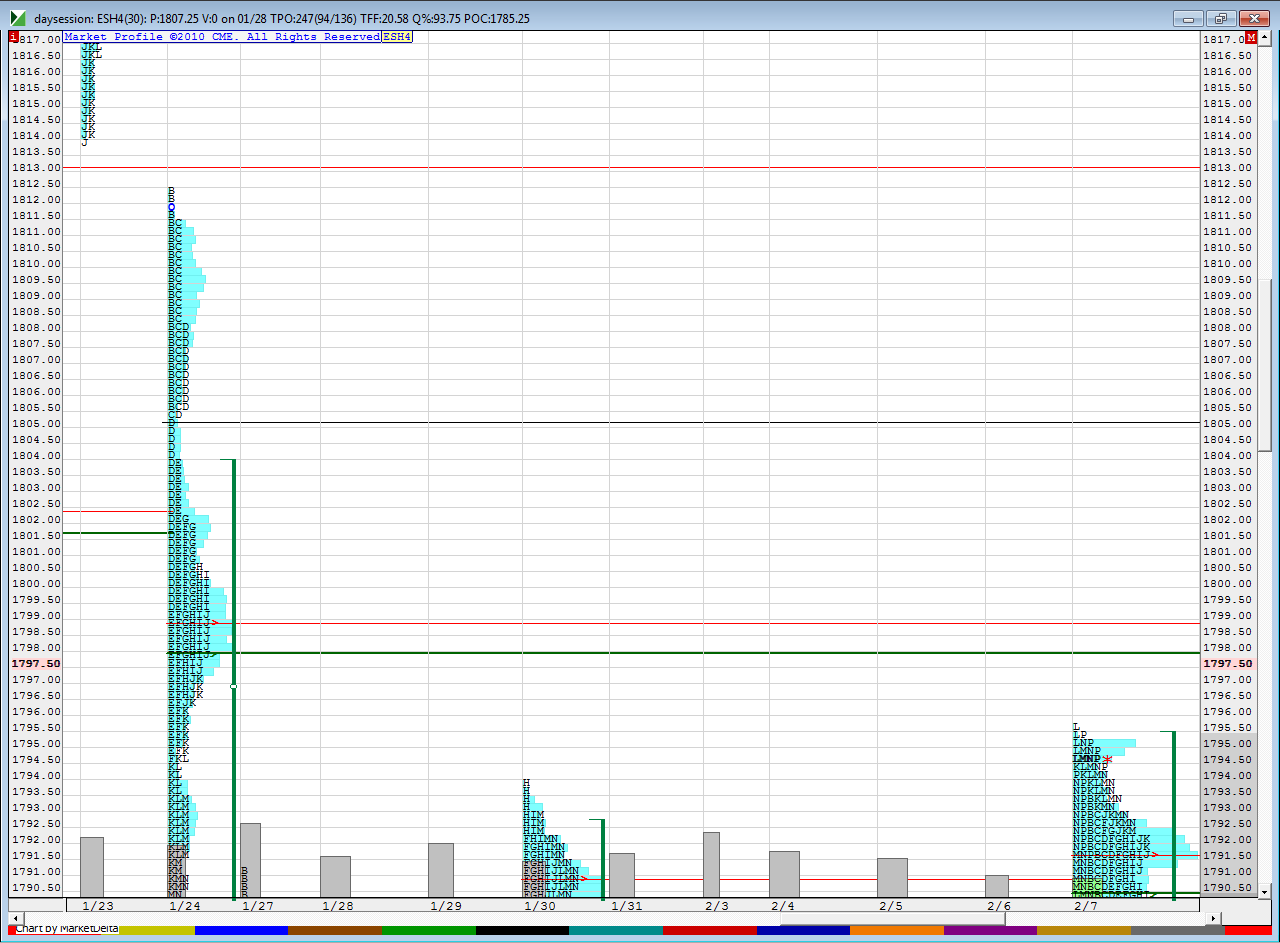

next we have a close up of what happened on Friday 1-24-14 because we rallied up here in the O/N session

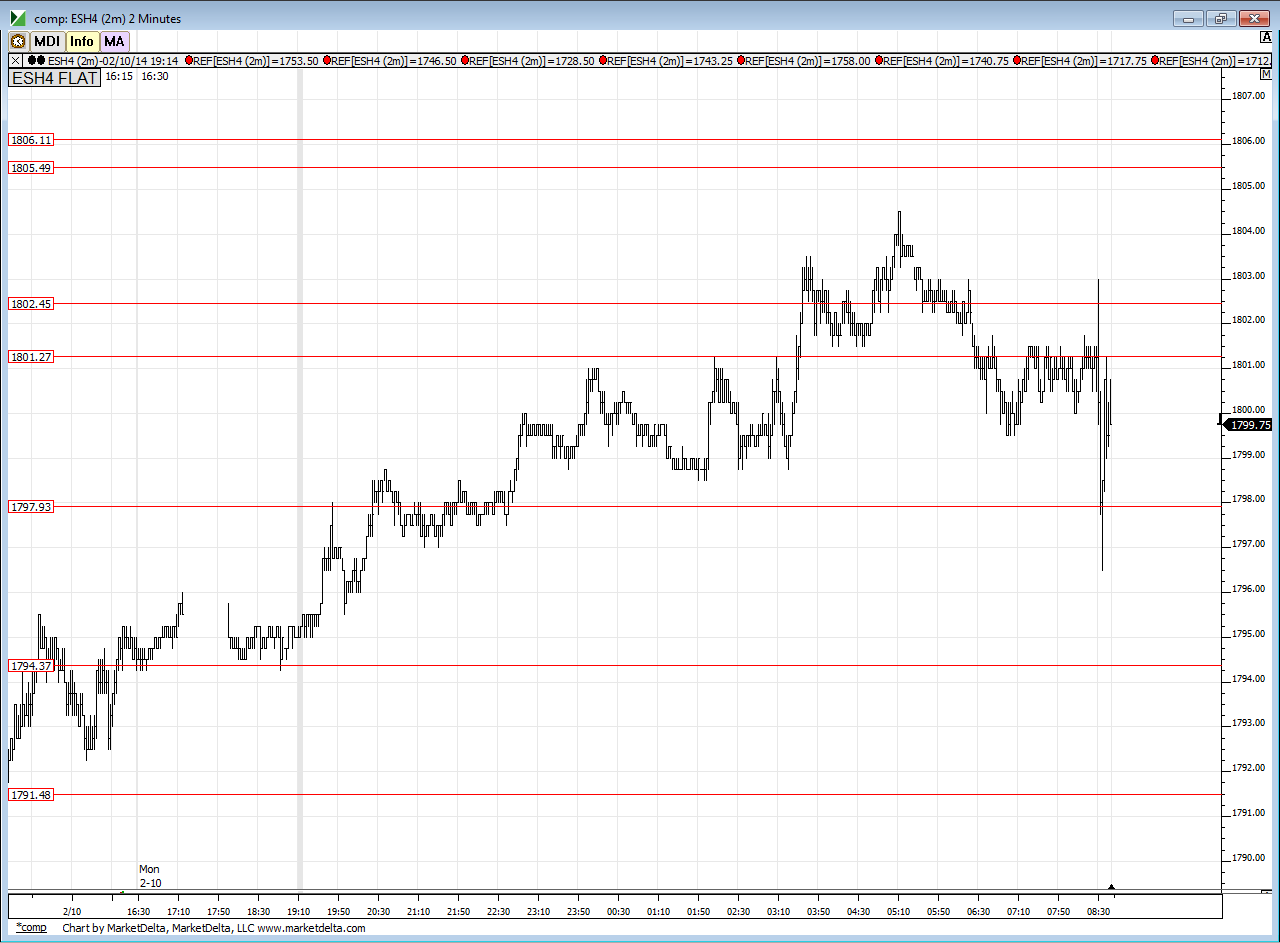

and finally we have the composite chart with the overnight data on it...as I type we can see that the 1801-1802 area ( there is a previous O/N session high there too) and the 97 - 98 will be our keys area. so far......this chart doesn't show it but the O/N high stopped right in our zone from the 1-24-14 chart above....

.

I will be watching what happens at the 97 - 98.....as that is the bulk of volume from 1-24....holding that would target in the overnight high where the single prints are and VA high is from 1-24...failure in there will probably run it back to the center of our bell curve below in the 91- 92 area with a few bumps along the way....here is Friday 1-24...you can see on the very left side that the 1801 - 1802 is an old POC/VPOC......I'm not crsytal clear on that particular area yet but the O/N has played off it...and above you can see the VA high and single prints in the 04 - 05 area..so this will all be about which side of the 1-24 bell curve we open on and then to see if the center of that becomes support or resistance...if we have low volume today then we should mean revert

next we have the one minute composite ..this is good for an overall view but I still prefer to use day to day area

next we have a close up of what happened on Friday 1-24-14 because we rallied up here in the O/N session

and finally we have the composite chart with the overnight data on it...as I type we can see that the 1801-1802 area ( there is a previous O/N session high there too) and the 97 - 98 will be our keys area. so far......this chart doesn't show it but the O/N high stopped right in our zone from the 1-24-14 chart above....

.

I will be watching what happens at the 97 - 98.....as that is the bulk of volume from 1-24....holding that would target in the overnight high where the single prints are and VA high is from 1-24...failure in there will probably run it back to the center of our bell curve below in the 91- 92 area with a few bumps along the way....here is Friday 1-24...you can see on the very left side that the 1801 - 1802 is an old POC/VPOC......I'm not crsytal clear on that particular area yet but the O/N has played off it...and above you can see the VA high and single prints in the 04 - 05 area..so this will all be about which side of the 1-24 bell curve we open on and then to see if the center of that becomes support or resistance...if we have low volume today then we should mean revert

95.75 is also daily vwap 2 dev number.

runners stopped at 0.75...looks like longs are taking it.....will look for small fade only once we get above 03.50.....

I'm trying to sell above 03.50....up into 05 too...don't want to see this above 07 at any time for me..will take multiple small tries up here...a good day so far with only one win and one loss...don't want to screw it up....will target 01.50 if I can get the 03.50 on...if selling from the 05 then will use 03 as first target...hoping that all the buyers who want the O/N high start to sell out to fuel some kind of selling up here

with the IB in and it's high right at edge of this single print zone I am not convinced my 03.50 is gonna work...seems like the better fade will come once/ if they push out the IB high...I can even getthe 01.50 on this reaction...

taking something at 01.25.....how are we suppose to trade for much when zones are so close ?? ridiculous ...that 01 - 02 was a questionable zone from my first post today and then 03.75 started the next zone.....that's just too close to work with really ! we can't have zones 1.5 points apart....that's too tight

so far we have a failed break of the IB into just the beggining of the single prints from 1-24..those singles run from 03.75 - 05.25 if u look at a bar chart..

trying one more small trade now that O/N high is run out..so on the 04.75..........if this upper zone can turn into support then they can run all the way to 08 - 09 today..so I am aware of that....target on any trade now is 02.75

90 minutes are up so this last trade is small and will come all out and have no runners working if it actually does drop down

Bruce thank you for taking the time to post. Your guidance has helped my trading tremendously.

that's the show for me...levels worked but runners didn't do much today in general..

I think a good failure up here will get us back to 05.50.....that is single print they blew through and all sellers got trapped.....out of my preferred time zone but good luck and catch up with ya tomorrow...

glad to hear it helps somewhat radyk

glad to hear it helps somewhat radyk

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.