ES Tuesday 5-3-16

Here is how I am framing this out today...there is no SITYS daily number today due to the large gap and we missed the weekly number by one tic yesterday so we still have 78 and 39.25 as those weekly numbers and one will eventually print this week. Also the Overnight repaired the Weekly VA low retest that I was expecting yesterday afternoon but my statistics pertain to just the day session data and I have some conflicts on that idea...a second short video on that will be edited on to this post

some things to keep in mind : Yesterdays VA low goes well with the 4 pm close of friday, the 1 SD band for today ..also the 58 number we talked about yesterday...so 57 - 59 is thee critical zone for me this morning so far....will this be the day the O/N midpoint fails ? I don't know but we can expect one failure per week...55 is a POC but there are only so many numbers I can trade from so I prefer the 57 - 59 zone...then further down is 51 - 52 and that is also the 1.5 band

keep in mind where your standard pivots are. we have numbers at 52.50 and 63.50....what is the split between them.....? 58 - so that is right in our zone !! also monthly pivot is at 64 so that goes well with our target zone and the pivot today...

I will add a second quick video in a bit but here is the frame out and other ramblings

conflict video I added on to this post which covers the VA low on the weekly concept and why I have some hesitations about that retest now ...

some things to keep in mind : Yesterdays VA low goes well with the 4 pm close of friday, the 1 SD band for today ..also the 58 number we talked about yesterday...so 57 - 59 is thee critical zone for me this morning so far....will this be the day the O/N midpoint fails ? I don't know but we can expect one failure per week...55 is a POC but there are only so many numbers I can trade from so I prefer the 57 - 59 zone...then further down is 51 - 52 and that is also the 1.5 band

keep in mind where your standard pivots are. we have numbers at 52.50 and 63.50....what is the split between them.....? 58 - so that is right in our zone !! also monthly pivot is at 64 so that goes well with our target zone and the pivot today...

I will add a second quick video in a bit but here is the frame out and other ramblings

conflict video I added on to this post which covers the VA low on the weekly concept and why I have some hesitations about that retest now ...

using 62.25 as a first target if given the chance...This will get me out in front of the official pivot number......still early so this is all aggressive trade and not suggested...best to wait for the day session in most cases but being below the One SD band is/was attractive

I agree that the odds of hitting 2063.5 today are pretty high and I too was looking to get long in the 59/60 area.

I expect resistance in the 63.5/65.5 zone like Bruce said as well as 69/70 is the key LVN zone from YD.

ON inventory is very short (not 100%) so one would expect at least a small bounce at RTH open again bringing the 63.5-65.5 zone into the picture.

I would like to do a study where we study the O/N range with respect to previous day's RTH range, a 20 period ADR and then look at which quartile of the O/N range we open in, to test the viability of the O/N mid test. But that is a project for another day

I expect resistance in the 63.5/65.5 zone like Bruce said as well as 69/70 is the key LVN zone from YD.

ON inventory is very short (not 100%) so one would expect at least a small bounce at RTH open again bringing the 63.5-65.5 zone into the picture.

I would like to do a study where we study the O/N range with respect to previous day's RTH range, a 20 period ADR and then look at which quartile of the O/N range we open in, to test the viability of the O/N mid test. But that is a project for another day

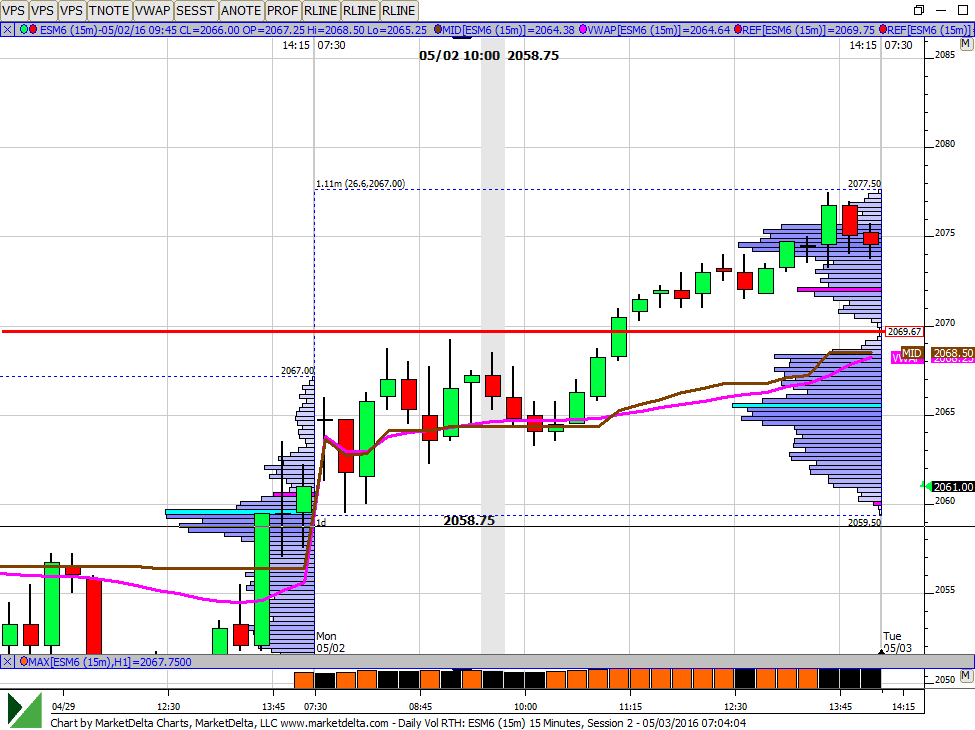

Here is a picture showing the LVN zone from YD in the 69 area. We can also see YD's RTH mid and VWAP are also in the 68.5 area. More confluence with the pivot being at 70.5 and I expect this zone to be pretty resistive.

staring small longs at 58 with plan to add under O/N lows if they come down.....keeping this small as my Overnight trade ( which rarely work..LOL) worked well today and don't won't to be too far on the wrong side of this if they decide to just drop it down today without any retraces up

scaling at open print of 60.50 on my MD charts.......would like to see new highs and the pivot from here but they may jerk us around some more

good call on unloading your O/N trade at 62.25. They sure are jerking this around. So far, struggling to get into YD's range

thanks....I got stopped on runners but will try one more time on long side..

ok buying 54 and will add at 52.50 if needed but hope that POC might do something and we had an Overnight swing low there too...targets will be 57 as that is O/N low from last night...dangerous trade but keeping probabilities in mind...I don't mind having losing days 10 - 16 % of the time based on the SD bands

60 even is the 30-min VPOC so far and I don't see that changing in the next 7 minutes.

revising first target if given it to 56.75 as that will be in front of last nights low

Originally posted by BruceM

wow that was some lift off and even tagged the 30 minute VPOC and came one tic shy of the s1 so far ........cool stuff even if all that happened without me on board...it seems like 57 - 59 will hold the key for any direction now and I would think longs would want that area to hold as support....58.75 is the 4 pm close on Friday to match up with the cash session and obviously the Overnight low is at 57 and now a low time spot....

remember - Dr . Brett..."failure to hold outside the overnight range tires to target the overnight midpoint" - a core principle I try to work from but it doesn't mean we shouldn't try to take pieces off along the way........hey, doesn't he sell books ? Gotta run.......hope u did well if u are still at it.....getting lots of things done on this non rainy day and it feels good....now if only I could make better weekly options earnings trades...learning tons from tasty trade channel.....I like the recaps but can't sit and watch the shows...just too much for me.

Tom and Tony don't really make money on their earnings trades overall. They have admitted as much, they just like the rush. So don't feel too bad that you aren't killing earnings.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.