ES Tuesday 5-3-16

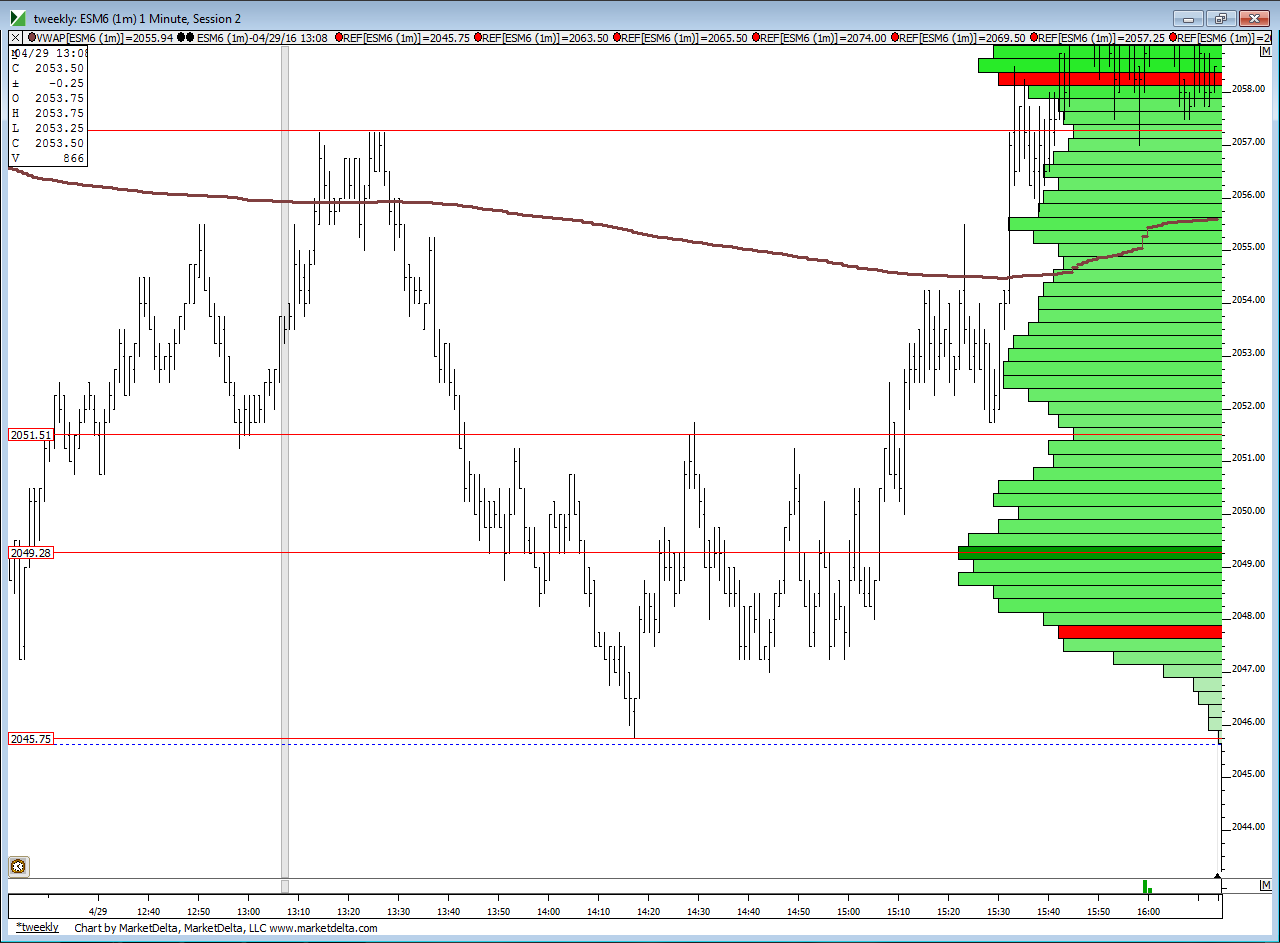

Here is how I am framing this out today...there is no SITYS daily number today due to the large gap and we missed the weekly number by one tic yesterday so we still have 78 and 39.25 as those weekly numbers and one will eventually print this week. Also the Overnight repaired the Weekly VA low retest that I was expecting yesterday afternoon but my statistics pertain to just the day session data and I have some conflicts on that idea...a second short video on that will be edited on to this post

some things to keep in mind : Yesterdays VA low goes well with the 4 pm close of friday, the 1 SD band for today ..also the 58 number we talked about yesterday...so 57 - 59 is thee critical zone for me this morning so far....will this be the day the O/N midpoint fails ? I don't know but we can expect one failure per week...55 is a POC but there are only so many numbers I can trade from so I prefer the 57 - 59 zone...then further down is 51 - 52 and that is also the 1.5 band

keep in mind where your standard pivots are. we have numbers at 52.50 and 63.50....what is the split between them.....? 58 - so that is right in our zone !! also monthly pivot is at 64 so that goes well with our target zone and the pivot today...

I will add a second quick video in a bit but here is the frame out and other ramblings

conflict video I added on to this post which covers the VA low on the weekly concept and why I have some hesitations about that retest now ...

some things to keep in mind : Yesterdays VA low goes well with the 4 pm close of friday, the 1 SD band for today ..also the 58 number we talked about yesterday...so 57 - 59 is thee critical zone for me this morning so far....will this be the day the O/N midpoint fails ? I don't know but we can expect one failure per week...55 is a POC but there are only so many numbers I can trade from so I prefer the 57 - 59 zone...then further down is 51 - 52 and that is also the 1.5 band

keep in mind where your standard pivots are. we have numbers at 52.50 and 63.50....what is the split between them.....? 58 - so that is right in our zone !! also monthly pivot is at 64 so that goes well with our target zone and the pivot today...

I will add a second quick video in a bit but here is the frame out and other ramblings

conflict video I added on to this post which covers the VA low on the weekly concept and why I have some hesitations about that retest now ...

now the traders who are trading will still be thinking in terms of probabilities with a good signal.....will they be able to close below a 1.5 standard deviation band...? Only 5 - 10 % of the time that happens...so many will still be looking for longs under 2051.50......

this is subtle but important it's the old bell curve...many know that I have been posting about these for years in the Es threads but look at thursday. Can you see the Bell curve defined by Thursdays low, the high time price at 49.25 and then the low time price at 51.50.........the best trades come at the low time prices followed by the center of the bells ( higher risk because that is where acceptance took place) but each area can be traded it's just at the centers you should trade a bit lighter....anyway, u will see these everyday.

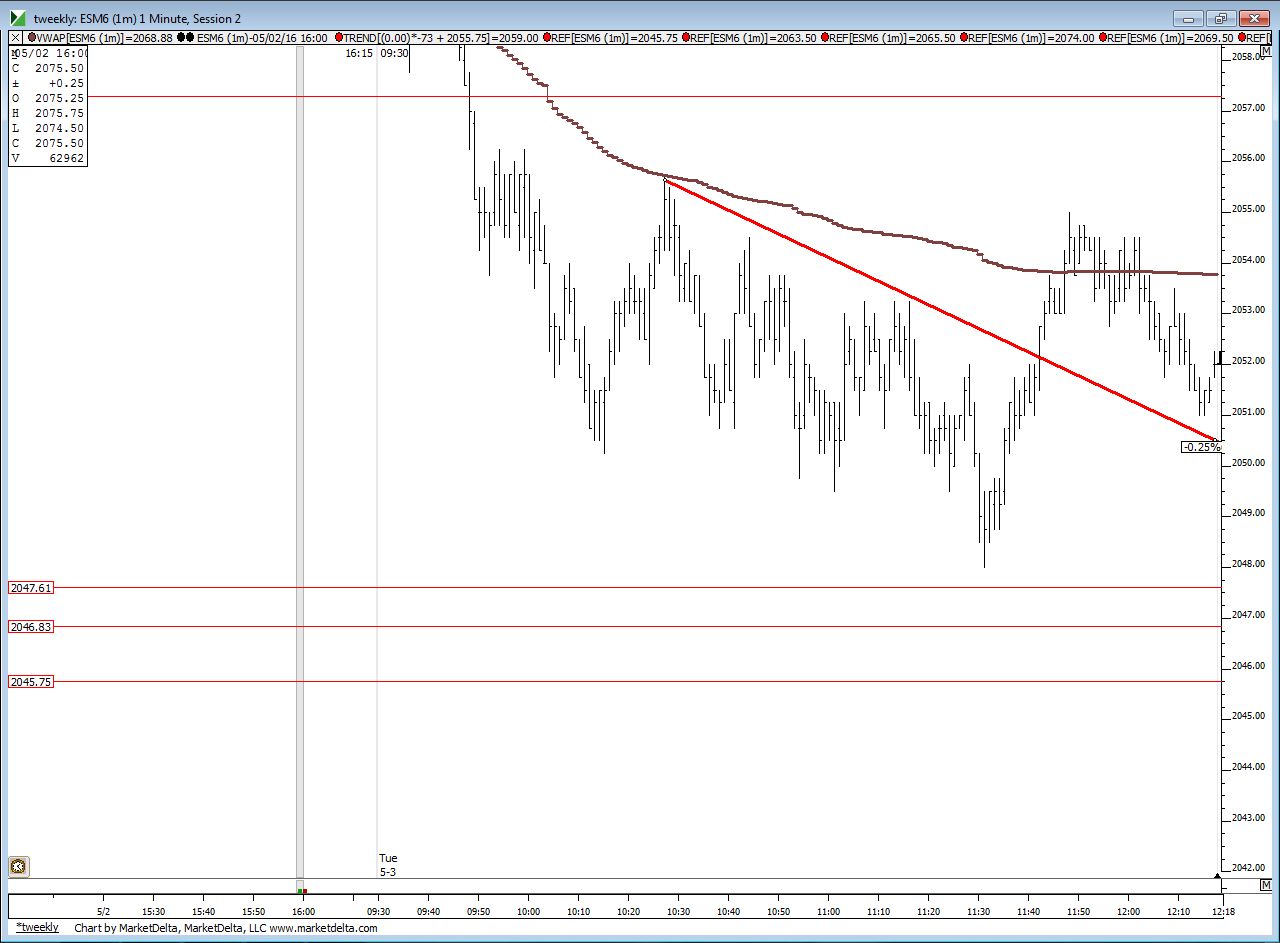

It will be interesting to come and look later to see if those who like channel breaks are buying now in the 51 area....we broke out of the top of the channel and now we have retraced 50% of that ..........anyway here is Thursdays lower bell for those who may not have seen it

It will be interesting to come and look later to see if those who like channel breaks are buying now in the 51 area....we broke out of the top of the channel and now we have retraced 50% of that ..........anyway here is Thursdays lower bell for those who may not have seen it

here is channel break and now we have gone slightly beyond 50% back from that 55 high area to the current days low so this goes well with the 51.50 area too.......read about this from Haggerty some years ago..ok nuff said ...good luck to u lunchtime traders....and be sure you aren't trying to catch every squiggle and turn in this market....leave that to the paper trading pros

wow that was some lift off and even tagged the 30 minute VPOC and came one tic shy of the s1 so far ........cool stuff even if all that happened without me on board...it seems like 57 - 59 will hold the key for any direction now and I would think longs would want that area to hold as support....58.75 is the 4 pm close on Friday to match up with the cash session and obviously the Overnight low is at 57 and now a low time spot....

remember - Dr . Brett..."failure to hold outside the overnight range tires to target the overnight midpoint" - a core principle I try to work from but it doesn't mean we shouldn't try to take pieces off along the way........hey, doesn't he sell books ? Gotta run.......hope u did well if u are still at it.....getting lots of things done on this non rainy day and it feels good....now if only I could make better weekly options earnings trades...learning tons from tasty trade channel.....I like the recaps but can't sit and watch the shows...just too much for me.

remember - Dr . Brett..."failure to hold outside the overnight range tires to target the overnight midpoint" - a core principle I try to work from but it doesn't mean we shouldn't try to take pieces off along the way........hey, doesn't he sell books ? Gotta run.......hope u did well if u are still at it.....getting lots of things done on this non rainy day and it feels good....now if only I could make better weekly options earnings trades...learning tons from tasty trade channel.....I like the recaps but can't sit and watch the shows...just too much for me.

Originally posted by BruceM

wow that was some lift off and even tagged the 30 minute VPOC and came one tic shy of the s1 so far ........cool stuff even if all that happened without me on board...it seems like 57 - 59 will hold the key for any direction now and I would think longs would want that area to hold as support....58.75 is the 4 pm close on Friday to match up with the cash session and obviously the Overnight low is at 57 and now a low time spot....

remember - Dr . Brett..."failure to hold outside the overnight range tires to target the overnight midpoint" - a core principle I try to work from but it doesn't mean we shouldn't try to take pieces off along the way........hey, doesn't he sell books ? Gotta run.......hope u did well if u are still at it.....getting lots of things done on this non rainy day and it feels good....now if only I could make better weekly options earnings trades...learning tons from tasty trade channel.....I like the recaps but can't sit and watch the shows...just too much for me.

Tom and Tony don't really make money on their earnings trades overall. They have admitted as much, they just like the rush. So don't feel too bad that you aren't killing earnings.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.