Dom's notes

Despite having been hammered for posting my sincere feedback re. ATW in the appropriate thread (or may-be, because of ...) I am starting this thread for the benefit of all waanabee traders.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

- Reversal system : 1 loss (3co) / 1 BE (1co) ; net -850.

- CL always-in : 12 win / 4 losses / 1 BE ; net +5305, which includes +615 of realized P&L on the long that was rolled-over today at 2:30pm. The system had a pretty good week, and finally made a new P&L peak, recovering from a 11k DD.

This week I passed the 100 live-trades mark on this system, on a realized P&L of +5575 at the close of that 100th trade (actually the P&L peak at that time), recovering from a -8600 drawdown (april 17). The avg/trade (+58) is less than 1/2 of the backtesting, but given this period saw the largest DD in over 3 years, I am finding that avg actually pretty decent.

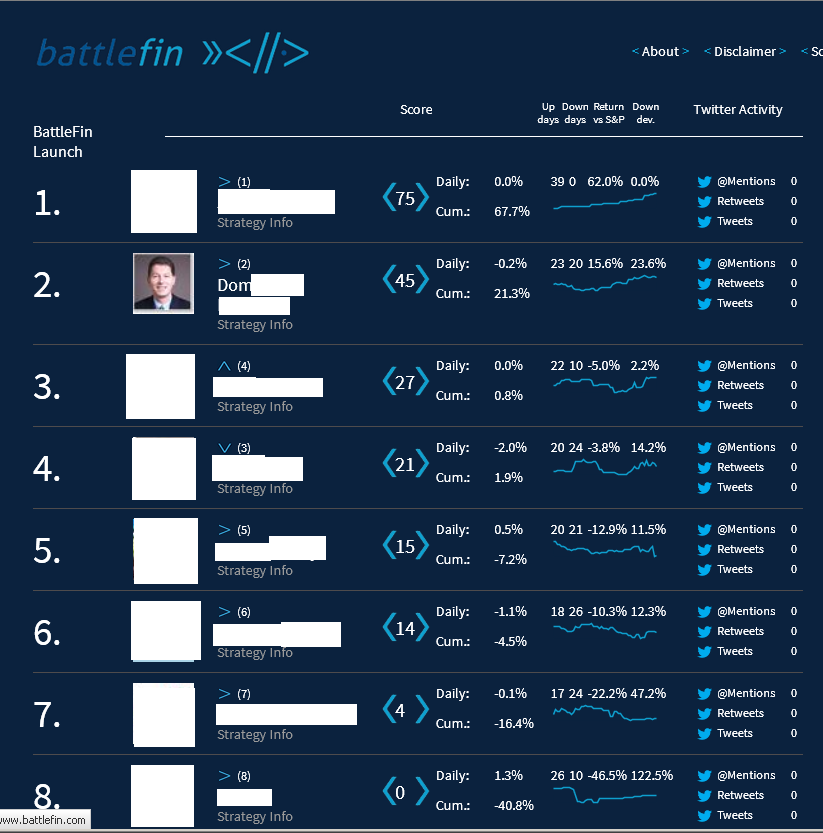

Still #2 in the BattleFin #4 Launch tournament, +17.9% as of this morning ... the #1 had another perfect week, he is now up +42.3% with 31 up-days / 0 down-day - amazing.

I just discovered that I have 1 (!) trial-subscriber on Collective2, this person started his trial end of March, just before the big drawdown ... he is apparently still on-board, since April 1st my live account is up +9.7k, despite a -6.6k dive right at the beginning of April, so hopefully he/she is a happy camper. That trial subscription should be ending now (45 days trial), I am curious to see what he/she will do now.

No R&D for myself this week, all focused on my contract work.

Have a great week-end!

- CL always-in : 12 win / 4 losses / 1 BE ; net +5305, which includes +615 of realized P&L on the long that was rolled-over today at 2:30pm. The system had a pretty good week, and finally made a new P&L peak, recovering from a 11k DD.

This week I passed the 100 live-trades mark on this system, on a realized P&L of +5575 at the close of that 100th trade (actually the P&L peak at that time), recovering from a -8600 drawdown (april 17). The avg/trade (+58) is less than 1/2 of the backtesting, but given this period saw the largest DD in over 3 years, I am finding that avg actually pretty decent.

Still #2 in the BattleFin #4 Launch tournament, +17.9% as of this morning ... the #1 had another perfect week, he is now up +42.3% with 31 up-days / 0 down-day - amazing.

I just discovered that I have 1 (!) trial-subscriber on Collective2, this person started his trial end of March, just before the big drawdown ... he is apparently still on-board, since April 1st my live account is up +9.7k, despite a -6.6k dive right at the beginning of April, so hopefully he/she is a happy camper. That trial subscription should be ending now (45 days trial), I am curious to see what he/she will do now.

No R&D for myself this week, all focused on my contract work.

Have a great week-end!

Last week-end I decided to restart trading my AC15, as its results since the beginning of the year seem to indicate that market inefficiency is still there, despite the long drawdown (about 10 months, from May 2012 to March 2013). To maintain my risk level, I decided to stop trading configs #1 & #3 for the reversal system, which is now down to 1 contract on config #2.

- AC15 : 1 win / 2 losses ; net +5.

- Reversal system : 1 win / 1 loss ; net -140.

- CL always-in : 10 wins / 8 losses ; net +150.

Too bad the beginning of the week was very good for CL always-in, by early Tuesday my account was up +10,200, the remainder of the week wasn't good for that system, with a number of large losses. Anyway, current drawdown from P&L peak is -2350.

Not much contract work this week, so I resumed my investigations re. a medium frequency trading system for CL. But no luck finding repetitive patterns with a decent edge (so far). However, that pushed me to pay attention to one more datapoint, which I am now trying to use in CL always-in (without much success so far, although, really, +6% on P&L & improved P/F Sharpe & reduced DD when trading all signals - but I was hoping for more than this after statistical analysis).

The #1 trader on the Battlefin Launch tournament was up 59.5% as of this morning, still no down-day, I am VERY impressed. That being said, there was 1 Forex trader selected by RAPACapIntro who blew his account a couple weeks ago, after about 1 year 1/2 of flawless performance (very rare & small drawdowns). But it turns out he was (like many in Forex) using a Martingale position sizing, which of course is a disaster waiting to happen. And it is impossible to make the difference between good trading & martingale trading, unless the P&L is marked to market on a daily basis, which isn't the case currently for RAPACapIntro nor for Battlefin.

Have a great week-end!

Not a great trading week:

- Reversal system: 2 wins / 2 losses ; net -170

- AC15 : 1 win / 2 losses ; net -795

- CL always-in : 6 wins / 3 losses / 1 BE ; net +950. Unfortunately, the unrealized P&L on the current open-trade (-1200) gives next week a tough start.

I have decided to stop trading my reversal system. Not that it reached its max drawdown (far from it, actually), but given its current counter-performance, and the fact CL always-in already trades those reversals (different entries & trade-management, better filters I believe), I see no point in keeping it alive - I would much rather increase position size on CL always-in, but for this I will really wait to at least double that account before increasing position size. I am down -4635 on the reversal system this year, which is pretty much what I made last year with it (+4230).

I made significant progress on CL always-in backtesting performance, it took me some time to get there using that new datapoint, anyway P&L +25% & reduced drawdown on the 6 years backtest, much better improvement for this year so far at +56% (which isn't part of the statistical analysis nor backtesting, I try to only use it as forward testing). I am turning it live this week-end.

The BattleFin tournament is over. There was no major change as of Friday morning.

Have a great week-end!

- Reversal system: 2 wins / 2 losses ; net -170

- AC15 : 1 win / 2 losses ; net -795

- CL always-in : 6 wins / 3 losses / 1 BE ; net +950. Unfortunately, the unrealized P&L on the current open-trade (-1200) gives next week a tough start.

I have decided to stop trading my reversal system. Not that it reached its max drawdown (far from it, actually), but given its current counter-performance, and the fact CL always-in already trades those reversals (different entries & trade-management, better filters I believe), I see no point in keeping it alive - I would much rather increase position size on CL always-in, but for this I will really wait to at least double that account before increasing position size. I am down -4635 on the reversal system this year, which is pretty much what I made last year with it (+4230).

I made significant progress on CL always-in backtesting performance, it took me some time to get there using that new datapoint, anyway P&L +25% & reduced drawdown on the 6 years backtest, much better improvement for this year so far at +56% (which isn't part of the statistical analysis nor backtesting, I try to only use it as forward testing). I am turning it live this week-end.

The BattleFin tournament is over. There was no major change as of Friday morning.

Have a great week-end!

Thats a kool dude there .. .. as far as I know, only you, me and Bruce have posted a pic in here

Congratulations Dom on placing second in that competition. Great result!

Another "not a great trading-week":

- AC15 : 3 losses ; net -1475 (it seems I always start or restart trading a system to immediately see it get into drawdown!)

- CL always-in : 4 wins / 4 losses / 1 BE ; +1615. Unfortunately, the unrealized P&L on the open-trade is about -2200. I am particularly sad about that trade, because its entry decision was based on one of the new patterns part of the v35 which I turned live last week-end. Anyway, that account made a new P&L peak at +11240 on Thursday, before giving back -845 then the current open-trade.

I had a bunch of personal issues to deal with this week, so essentially no R&D.

Have a great week-end!

Another "not a great trading-week":

- AC15 : 1 loss ; net -65

- CL always-in : 4 wins / 6 losses / 1 BE ; net -375. The unrealized P&L on the open-trade is about +2200, which on a NAV basis makes Friday a new P&L peak - but this is just to feel good, what I pay attention to is the realized P&L, and on this basis, I am still -1220 from last P&L peak. Monday was certainly a bad day for this system, booking the 6 losses of the week (-3030) ... again, the prior version of the system would have done better this week (even excluding the 1st loss which technically was entered last week).

I still had some personal issues to address, so limited R&D for the week.

Have a great week-end!

- AC15 : 1 win ; net +305

I decided mid-week to stop trading the AC15 (again!). I just don't need that psychological distraction, and I want to focus my energy, time, money & psyche on CL always-in. I lost -2000 this year on the AC15, too bad I re-started it just at the wrong time, and for the wrong reasons.

- CL always-in : 10 wins / 4 losses ; net +5270. The system made a new P&L peak on Thursday (+15715 on my trading account), then got caught long a good part of Friday, giving back a good chunck, before getting 2/3 of that back in 2 trading-decisions 10min apart in the close. Drawdown on realized P&L as of the last trade closed: -425.

Unfortunately, things were not smooth on the operations side. I had Thursday a discrepancy between my back-up PC reversing to long, and the VPS staying short. A deep look at both charts revealed some minor differences in data, I reloaded manually on both sides, no change :( ... I did more investigation, pin-pointing some missing data on the VPS between 3am-3:37am, then I thought of using the Historical Data Manager to reload, instead of CTRL+SHIFT+R ... and it worked (I knew it immediately, as the strategy reversed to long right there and then, as it is supposed to do). I then spent a lot of time, during the day, overnight (until 4am) and today, slowly narrowing the issue, which turns out to be affecting CTRL+SHIFT+R (and its underlying API, which I use in my own software) when there is a strategy active on a chart :( I am in contact with NinjaSupport, hopefully this time their R&D team will be more cooperative than in the past, else it is going to be very difficult for me to workaround this one.

I have had a few new trials subscribers joining on Collective2 this past couple of weeks - went from 1 to 6, of which 4 through the US website. I have made the trial period (45 days) long enough for people to compare the performance on a simulated account, vs the official Collective2 record, and get a feel for the size of the ups & down this system will give them.

As I reached 3 months of live trading on Tuesday evening, I made a 3 month comparison of my fills at IB, vs the simulated fills on Collective2. Very interesting to see that the average difference of P&L per trade due to fills is 2/10th of a tick, while the st-dev is just over 2-ticks per trade. I am not surprised by the st-dev, which is very understandable given the transmission delays, but I was pleasantly surprised by the avg, as it seems to indicate that these transmission delays have a statistically negligible impact on the long-term performance of the system.

Have a great week-end

Dominique

Good stuff! I am new here and will look forward to your updates!

- CL always-in : 12 wins / 5 losses ; net + 2005

The system had a long winning streak Monday to Wednesday noon ( 9 wins / 1 loss ; net +2550), making a new P&L peak in my account at +17,840. Then it got caught short until Thursday evening, erasing -1415 in 1 loss. Overnight & Friday was hit & miss (3 win / 3 loss ; net +850 ; unrealized P&L -300).

Current drawdown from P&L peak: -545 (realized P&L only).

I spent Saturday evening then all day Sunday (really, from 5am to 5pm) working on that historical reload issue, first narrowing the issue to what it is, and this is:

1. Ninja CTRL+SHIFT+R (and underlying API) does NOT reload the chart data after successfully downloading the required historical data, when 2+ timeframes are in use on that chart (either directly on the chart, or through a strategy - my situation).

2. Ninja HistoricalDataManager / Reload All History doesn't do any better job in the same situation.

3. Ninja HistoricalDataManager / Download Historical Data, luckily, doesn't have that problem (but it triggers a f***g modal confirmation box if any strat is running on minute-bars or tick-bars, luckily again for me, strategies running on volume/range/second-bars are ignored).

I duly documented those findings (1 & 2) for the Ninja support team, and started right away working on using the HistoricalDataManager / Download Historical Data through Reflection, to at least have a workaround in place while Ninja fixes issue #1, or gives me a better workaround (why do I have that old Supertramp tune playing in my head right now : "Dreamer, you're nothing but a dreamer, ..."). By Sunday 5pm I had a workaround waiting for live market for final testing, and by Monday evening that workaround was deployed on my VPS.

I had another operation issue this week, no harm but it triggered me to change one of Ninja's Data options to "Save chart data as historical" on the VPS.

I had a couple more trial-subscribers joining on C2, and as of tonight the system has 2 subscribers trading live accounts. Of course, I wish them all the best.

I did some R&D this week on that contract I have, completing its Phase 2 ...

... and I caught a severe cold, not feeling well at all for the last couple of days.

Have a great week-end,

Dominique

Dom that equity curve looks too good to be true so I'd be scared but hope it trades like that in real time....what became of your trading contest...? how did Chuck Huges do ? He wants me to spend almost 4 k on options recomendations

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.