Dom's notes

Despite having been hammered for posting my sincere feedback re. ATW in the appropriate thread (or may-be, because of ...) I am starting this thread for the benefit of all waanabee traders.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

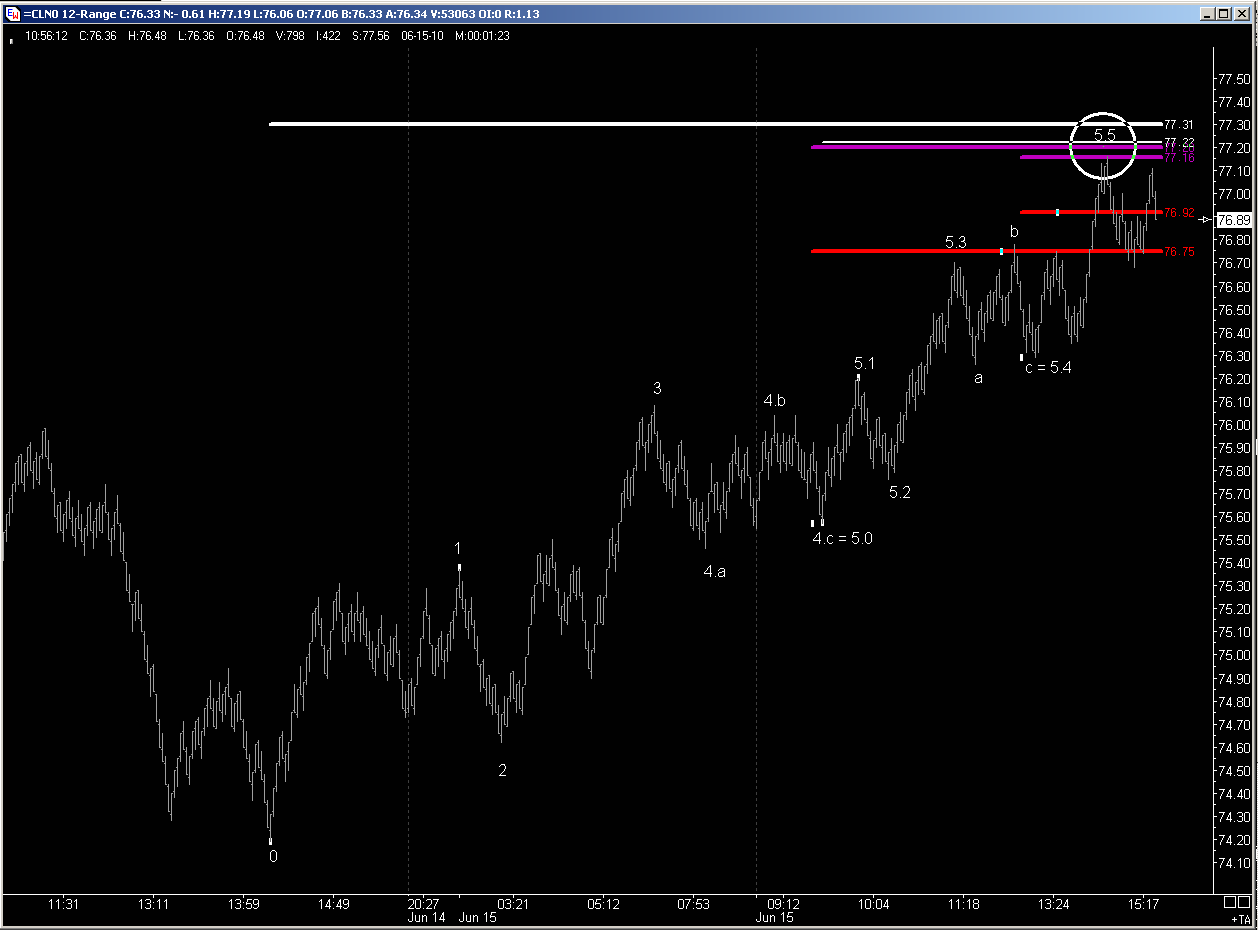

Day's summary

CL live : no trade (2 no-fill / 1 entry-error)

Today's price action didn't offer me much opportunities - and I passed on the only one that would have been a win. The error is less on passing the "standard" entry (for valid reasons) than on missing a key confluence of levels a few ticks beyond that "standard entry".

Also a bit disappointed that CL made its HoD 10-t before my short LMT, which was in the upper-end of a densely populated area of price projections (ranging from 77.03 to 77.35, short LMT was 77.26, HoD 77.16) - mainly, a 5th wave completion target and its '5th-of-5th' completion target

CL live : no trade (2 no-fill / 1 entry-error)

Today's price action didn't offer me much opportunities - and I passed on the only one that would have been a win. The error is less on passing the "standard" entry (for valid reasons) than on missing a key confluence of levels a few ticks beyond that "standard entry".

Also a bit disappointed that CL made its HoD 10-t before my short LMT, which was in the upper-end of a densely populated area of price projections (ranging from 77.03 to 77.35, short LMT was 77.26, HoD 77.16) - mainly, a 5th wave completion target and its '5th-of-5th' completion target

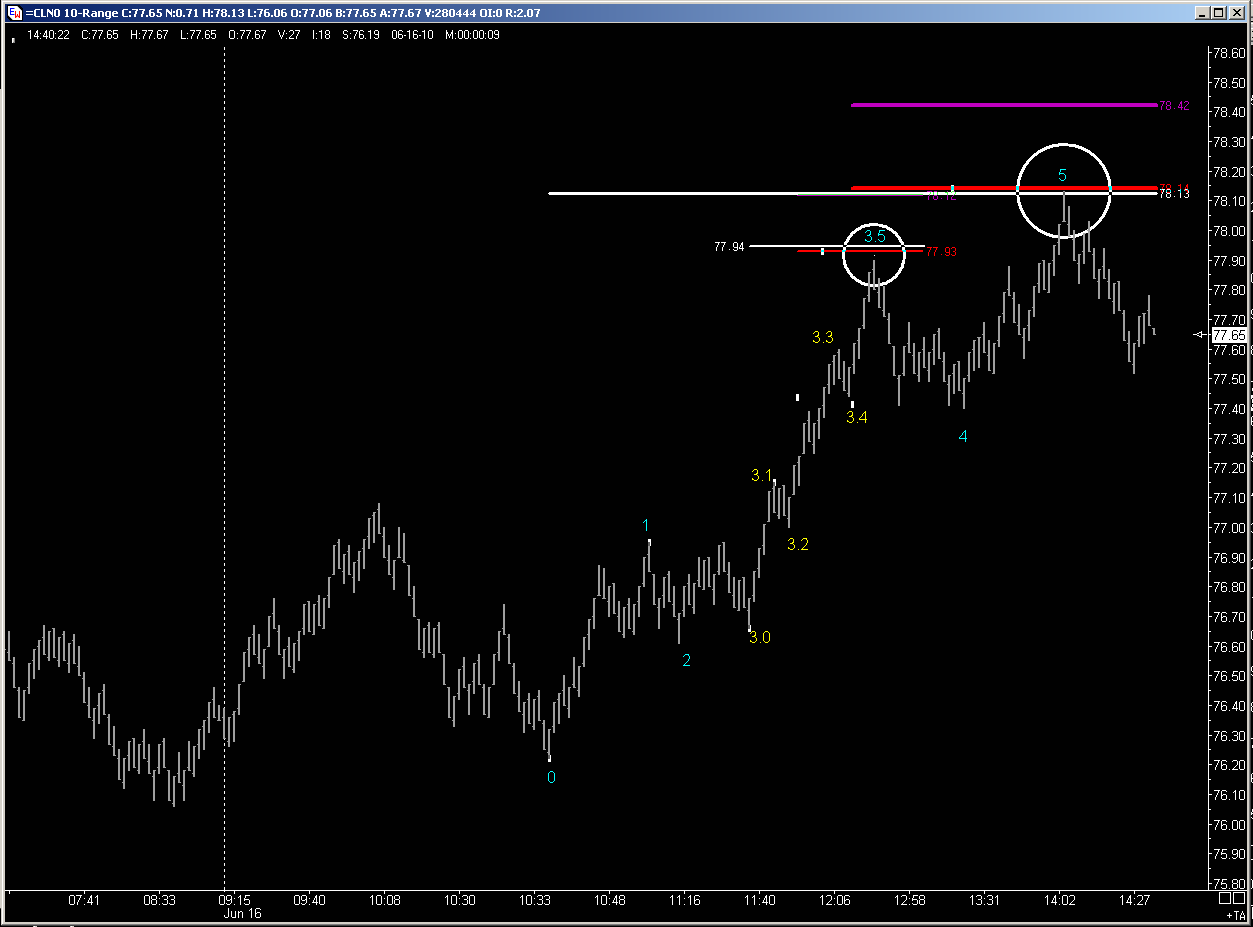

Day's summary

CL live : 1 no-fill / 1 entry-error / 1 trade-management-error (+6-t)

Another poor day IMO ... I passed on a Long setup at 10:50 EST because of its confusing context (better safe than sorry ?), then when CL finally broke up it was a slow grind with tiny shallow pullbacks, nothing for my trading plan.

At some point I started to focus on the developing 5W move from the 11:35 low, that 5W move is marked 3.0 .. 3.5 (in yellow) on the chart. The waves 2 and 4 are almost invisible on this 10-range chart, but quite clear on a 1-min chart. I decided for a CT short at 77.93 (primary completion target), and was very disappointed to miss this one by 3-t :(

I passed on a long in the main wave 4, entry-error for sure - but to be honest at that point I had not realized yet the larger possible 5W move (in blue). Too bad, that would have been a very low-heat trade...

Then I focused on a CT short at the main 5W move primary completion target, got in 1-t from the HoD, and <<Bang>> trade-management error, I bailed out for a tiny win (+6 t) with no reason at all except FEAR I guess.

CL live : 1 no-fill / 1 entry-error / 1 trade-management-error (+6-t)

Another poor day IMO ... I passed on a Long setup at 10:50 EST because of its confusing context (better safe than sorry ?), then when CL finally broke up it was a slow grind with tiny shallow pullbacks, nothing for my trading plan.

At some point I started to focus on the developing 5W move from the 11:35 low, that 5W move is marked 3.0 .. 3.5 (in yellow) on the chart. The waves 2 and 4 are almost invisible on this 10-range chart, but quite clear on a 1-min chart. I decided for a CT short at 77.93 (primary completion target), and was very disappointed to miss this one by 3-t :(

I passed on a long in the main wave 4, entry-error for sure - but to be honest at that point I had not realized yet the larger possible 5W move (in blue). Too bad, that would have been a very low-heat trade...

Then I focused on a CT short at the main 5W move primary completion target, got in 1-t from the HoD, and <<Bang>> trade-management error, I bailed out for a tiny win (+6 t) with no reason at all except FEAR I guess.

Day's summary

CL live: 1 entry-error / 1 no-fill / 1 tiny-win (+4-t)

Another "not my day" day ... I passed on 1st opportunity (long after the open), entry-error rooted in too superficial analysis, 2nd opportunity no-fill, then I passed on the 3rd opportunity (10:20 short) (well, I suppose I really didn't like what I saw at that time, ie. a possible Low-Failure a few ticks above overnight low, in a market that was acting stronger than ES & Euro since 8:30am EST).

Then I failed to recognize and act on a "Trader Vic 123 reversal" (1min chart) just around noon - but this isn't part of my trading plan, so not a "true" error.

And to finish, I failed to analyze correctly price action at 2pm (that last leg up was a wave 5 past its extended completion target, just waiting for a deep pullback), got long on an ultra-aggressive entry, bailed-out w/ a small win for whatever wrong reason (honestly, that saved the trade from a loss, but it was error after error...)

CL live: 1 entry-error / 1 no-fill / 1 tiny-win (+4-t)

Another "not my day" day ... I passed on 1st opportunity (long after the open), entry-error rooted in too superficial analysis, 2nd opportunity no-fill, then I passed on the 3rd opportunity (10:20 short) (well, I suppose I really didn't like what I saw at that time, ie. a possible Low-Failure a few ticks above overnight low, in a market that was acting stronger than ES & Euro since 8:30am EST).

Then I failed to recognize and act on a "Trader Vic 123 reversal" (1min chart) just around noon - but this isn't part of my trading plan, so not a "true" error.

And to finish, I failed to analyze correctly price action at 2pm (that last leg up was a wave 5 past its extended completion target, just waiting for a deep pullback), got long on an ultra-aggressive entry, bailed-out w/ a small win for whatever wrong reason (honestly, that saved the trade from a loss, but it was error after error...)

Day's summary

No live trade today. Last day of "active" trading for the front-month, but CL volume was evenly split between CLN0 & CLQ0, and my tools historically do not perform well on that day.

I practiced on SIM, mostly using a 5-t stop and 2 contracts, 9 win / 8 loss / net P&L +320, not as good as it seems, P&L oscillated a few times between -200 & +250 (it is fairly easy to be "right" on the direction yet stopped out using 5-t stop on CL)

No live trade today. Last day of "active" trading for the front-month, but CL volume was evenly split between CLN0 & CLQ0, and my tools historically do not perform well on that day.

I practiced on SIM, mostly using a 5-t stop and 2 contracts, 9 win / 8 loss / net P&L +320, not as good as it seems, P&L oscillated a few times between -200 & +250 (it is fairly easy to be "right" on the direction yet stopped out using 5-t stop on CL)

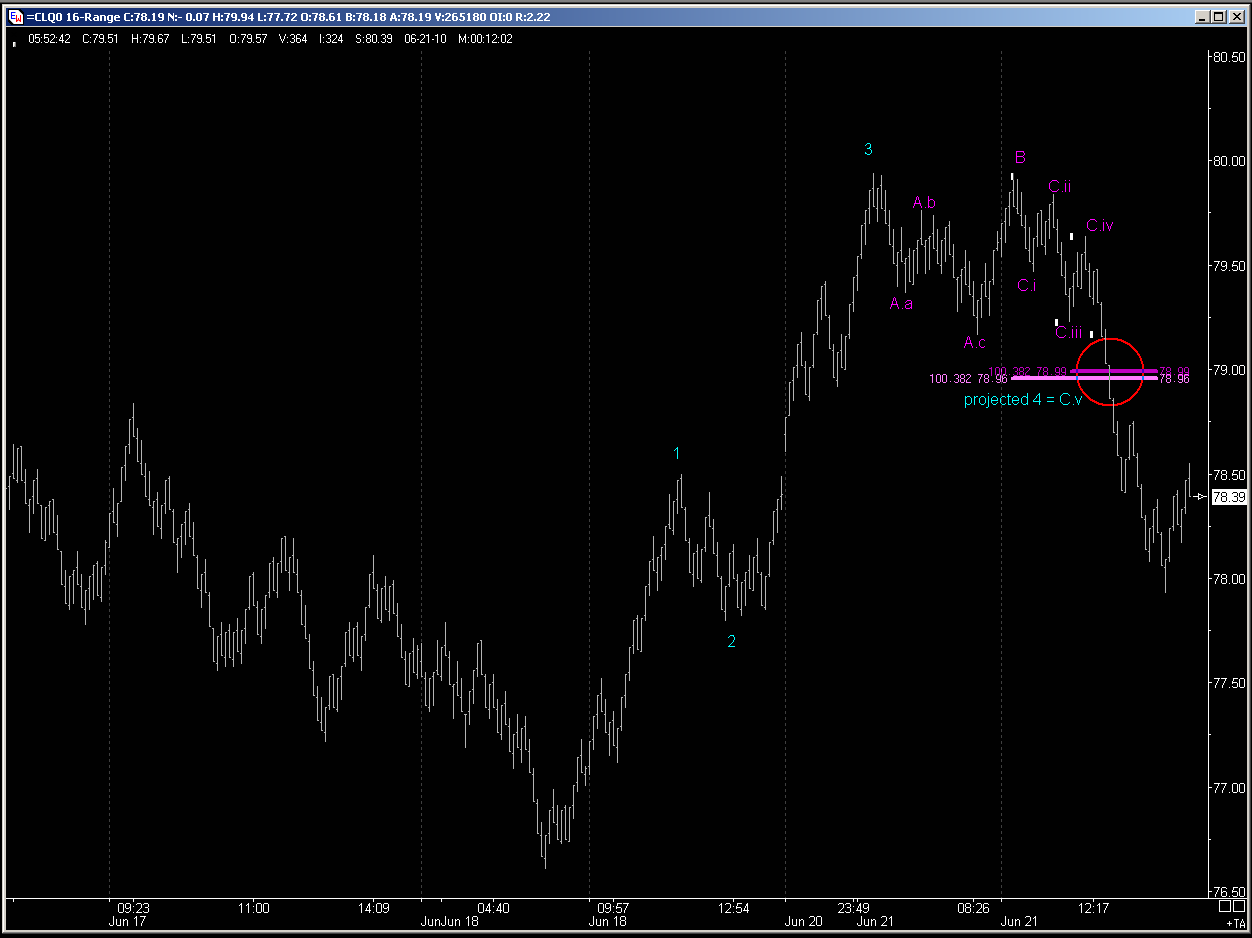

Day's summary

CL Live : 1 loss (-23t) / 1 win (+16t)

I avoided trading this morning, as volume was somewhat low and there wasn't really anything for my trading plan. But CL was making what appeared like an ABC from the overnight high, "A" sub-dividing in 3 waves and "C" in 5 waves ... that C wave projection target was matching a higher timeframe 4th wave extended target (for a long), there were plenty of CFs right there so I took this CT long, with a slightly extended stop (18-t vs regular 16-t) to cover all projected levels in that area. Too bad, at 12:39pm CL broke - hard -, and stopped me in 29 seconds with 5 ticks slippage on the exit.

At that point though, we had a big breakdown on huge volume, so took an aggressive entry for a short, extended my target from 15-t to a full retest of the low (making it a 27-t target), took 5-t heat, then after a good start price hesitated, headed back up some and I stupidly moved my target up (to the current low), taking only 16-t when I could actually have taken at least 27 (actually, over 60) :(

Then I stupidly (again) passed on the 2nd pullback for another short (the strong volume up on the 1st up bar after the low discouraged me to use a LMT order to enter, but then volume became real low and price stalled for about 5min just under last BkD level, no justification for not jumping short there, except that logical stop would have been above prior pullback high, a good 40-t above a potential entry short).

I later missed another short (ABC) by 5-t, then passed on the pullback after the last push down at 1:40pm (would be win, but I don't like these bounces on the next 1-min bar immediately following a BreakOut/BreakDown)

Pretty frustrating P&L for the day, but once more I shot myself by not sticking to the plan (on that 2nd trade).

CL Live : 1 loss (-23t) / 1 win (+16t)

I avoided trading this morning, as volume was somewhat low and there wasn't really anything for my trading plan. But CL was making what appeared like an ABC from the overnight high, "A" sub-dividing in 3 waves and "C" in 5 waves ... that C wave projection target was matching a higher timeframe 4th wave extended target (for a long), there were plenty of CFs right there so I took this CT long, with a slightly extended stop (18-t vs regular 16-t) to cover all projected levels in that area. Too bad, at 12:39pm CL broke - hard -, and stopped me in 29 seconds with 5 ticks slippage on the exit.

At that point though, we had a big breakdown on huge volume, so took an aggressive entry for a short, extended my target from 15-t to a full retest of the low (making it a 27-t target), took 5-t heat, then after a good start price hesitated, headed back up some and I stupidly moved my target up (to the current low), taking only 16-t when I could actually have taken at least 27 (actually, over 60) :(

Then I stupidly (again) passed on the 2nd pullback for another short (the strong volume up on the 1st up bar after the low discouraged me to use a LMT order to enter, but then volume became real low and price stalled for about 5min just under last BkD level, no justification for not jumping short there, except that logical stop would have been above prior pullback high, a good 40-t above a potential entry short).

I later missed another short (ABC) by 5-t, then passed on the pullback after the last push down at 1:40pm (would be win, but I don't like these bounces on the next 1-min bar immediately following a BreakOut/BreakDown)

Pretty frustrating P&L for the day, but once more I shot myself by not sticking to the plan (on that 2nd trade).

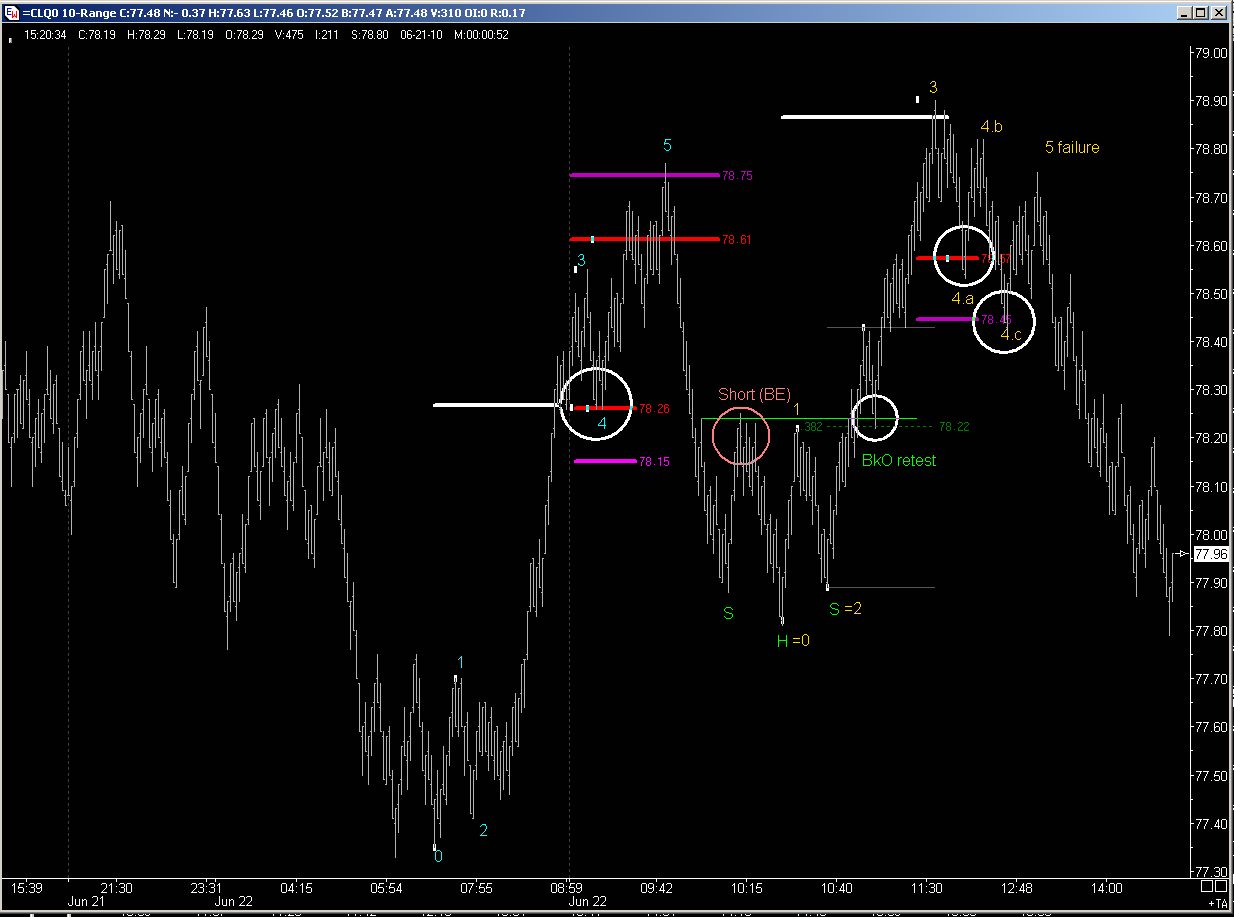

Day's summary

CL live : 3 entry-errors / 1 BE

CL traded most of the day on low-volume, grinding back & forth higher and lower, which literally de-focused me ... I just passed on TWO relatively strong 5th wave setups (I could argue for some excuses on the 2nd one at noon, but clearly I have NO excuse for passing the 1st one at 9:15 EST), and I also passed on a textbook inverse H&S breakout+retest.

The only trade I took (short the pullback at 10:10 EST) ended-up break-even, after been 12-tick in the green (missed the 15-t target by 3 ticks). A correctly managed trade (ie., per my plan) that didn't reward me for staying disciplined :(

CL live : 3 entry-errors / 1 BE

CL traded most of the day on low-volume, grinding back & forth higher and lower, which literally de-focused me ... I just passed on TWO relatively strong 5th wave setups (I could argue for some excuses on the 2nd one at noon, but clearly I have NO excuse for passing the 1st one at 9:15 EST), and I also passed on a textbook inverse H&S breakout+retest.

The only trade I took (short the pullback at 10:10 EST) ended-up break-even, after been 12-tick in the green (missed the 15-t target by 3 ticks). A correctly managed trade (ie., per my plan) that didn't reward me for staying disciplined :(

Day's summary

CL live : 3 no-fill / 1 entry-error

The only setup that would have been filled today, my brain managed to miss it (would be BE after +13-t, same story as yesterday).

At 10:34 EST I called the 2nd tier double DAlt at 76.70-76.80, which turned out to be the afternoon high, unfortunately I found no CF coming off LoD, so I just passed on that level (the 1st tier double DAlt I had called was 76.25-76.35, this one I had a CF from LoD at 76.23 but CL stopped at 76.17 :(

CL live : 3 no-fill / 1 entry-error

The only setup that would have been filled today, my brain managed to miss it (would be BE after +13-t, same story as yesterday).

At 10:34 EST I called the 2nd tier double DAlt at 76.70-76.80, which turned out to be the afternoon high, unfortunately I found no CF coming off LoD, so I just passed on that level (the 1st tier double DAlt I had called was 76.25-76.35, this one I had a CF from LoD at 76.23 but CL stopped at 76.17 :(

Dom that equity curve looks too good to be true so I'd be scared but hope it trades like that in real time....what became of your trading contest...? how did Chuck Huges do ? He wants me to spend almost 4 k on options recomendations

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.