Chart of the day

Here is a gap and triples so up here at 1227 is my sell...look at the gap in between the white lines...just couldn't hold long with that looming

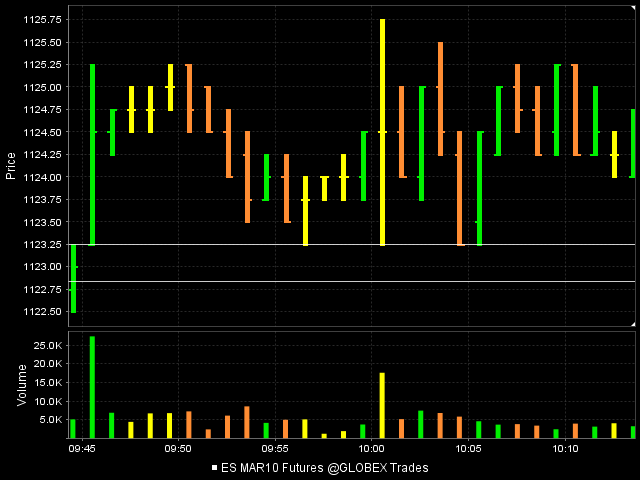

no surprise that 1122.50 - 1126 is the highest volume of the day per the one minute....( and the key zone to attract price)see page one of this thread for that key area....I'm glad they finally hit that number..a relief as my Carpal Tunnel has been destroying me lately and I feel all these ideas have been beaten to death by me....hopefully somebody was able to get something from all these ramblings...the basic ideas that evolved here are:

the gaps in the data

the triples

the volume tests

the ability to hit a plus or minus 4 everyday

How we knew not to follow up the long side....normally 75% of my trades are shorts......My bias ( although delayed) was to the downside and over 90% of my trades were shorts for the past three weeks...all because of that 1123 area that needed to be cleaned up

How a bias can hurt us....the trend days!! ouch

same stuff, different week.....the only real surprise was how long it took to finally get that target....Look at the 5 minute range and where we opened...a key zone..when price finally broke we were below the open and the key zone...heading to the minus 4....not always easy when to know to be a breakout player...tricky stuff

Bruce

the gaps in the data

the triples

the volume tests

the ability to hit a plus or minus 4 everyday

How we knew not to follow up the long side....normally 75% of my trades are shorts......My bias ( although delayed) was to the downside and over 90% of my trades were shorts for the past three weeks...all because of that 1123 area that needed to be cleaned up

How a bias can hurt us....the trend days!! ouch

same stuff, different week.....the only real surprise was how long it took to finally get that target....Look at the 5 minute range and where we opened...a key zone..when price finally broke we were below the open and the key zone...heading to the minus 4....not always easy when to know to be a breakout player...tricky stuff

Bruce

the triples were at 1115...I have two left and if not stopped out I'm trying to get all the way to 1121...may take a small miracle

13.75 - 11.50 is the second highest volume of the day....new lows with volume would not be a long trade I would take....if they accept that volume

then the 1122 volume should get tested

then the 1122 volume should get tested

13.75 - 11.50 is the second highest volume of the day....new lows with volume would not be a long trade I would take....if they accept that volume

then the 1122 volume should get tested

then the 1122 volume should get tested

pulled one at 19 even...that was a cool test of the lower volume...got one left for 21 ......stop at 14.75 only because I have no good spot for it...risk 5 points to make an extra 2 is quite stupid...I KNOW THAT....if volume comes in then I may try for 24...will have to monitor this

flat at 16.25...it was a good try!!

don't like buying second tests of volume....this could get real ugly and I'm not fighting you short players now...would rather join ya for the down move if it comes

the only good thing about today is that it's forming the "b" pattern as per volume.....so somebody will be trying to buy this....escpecially if they gap them lower in the overnight....the "p" pattern is what stopped and alerted us that

the up move MIGHT be dying at the beginging of this thread....now all we need is a way to TIME the buys.....

Error earlier on that volume spike...it actually falls in the 13.75 - 16 area....not the 11 area as previously mentioned

the up move MIGHT be dying at the beginging of this thread....now all we need is a way to TIME the buys.....

Error earlier on that volume spike...it actually falls in the 13.75 - 16 area....not the 11 area as previously mentioned

Low 1094.50 at 10:22CT

I think they want to hold the 1100 today.....still need to go get the gap at 1107.50 in the data.....then hopefully test to new highs...but they may test up into 1113 - 1116 first....folks will try to sell that....I hope!!!

I don't think the volume is an issue but it is just something I have observed. I personally would not look at 1 - 4 minute etc..you'd drive yourself crazy and find too many areas of consolidation. For me it's on the 5 minute or else I don't look for them.

Obviously they are not perfect and you can see 5 (5 minute bars) in a row down near the 988 area that have held.....those folks got rewarded but most times the triples give folks the false impression of being rewarded only to get run out later.

There are some who think that the floor or larger traders don't gun for stops.....while they may not gun for my SPECIFIC order I beleive they do know that folks are taught to keep stops just below or above swing points and consolidation areas, like the triples. This is why I am a fader and like things like previous highs and lows and volume areas. We just don't trend enough and spend a huge amount of time consolidating...

Bring up a 5 minute chart of the ES and see how often we get a trend away from a price without going back to fill in the breakout area later.....look for my thread called "Price bar overlap" soon. The RTH session begins for me at 9:30 e.s.t and ends at 4:15 . Everything outside of that time is considered the overnight session for me.

Obviously they are not perfect and you can see 5 (5 minute bars) in a row down near the 988 area that have held.....those folks got rewarded but most times the triples give folks the false impression of being rewarded only to get run out later.

There are some who think that the floor or larger traders don't gun for stops.....while they may not gun for my SPECIFIC order I beleive they do know that folks are taught to keep stops just below or above swing points and consolidation areas, like the triples. This is why I am a fader and like things like previous highs and lows and volume areas. We just don't trend enough and spend a huge amount of time consolidating...

Bring up a 5 minute chart of the ES and see how often we get a trend away from a price without going back to fill in the breakout area later.....look for my thread called "Price bar overlap" soon. The RTH session begins for me at 9:30 e.s.t and ends at 4:15 . Everything outside of that time is considered the overnight session for me.

Originally posted by ak1

Thanks Bruce, if the triples are formed inside the days range on high volume will they be considered valid.Like the ones at 1006.5 on Friday. Also if we can't find triples in a 5 min. chart, is it OK to consider the 1 min chart then or do we go loking for them from 4min to 3min to 2min and then 1 min.i.e scale down.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.