ES short term trading 6-04

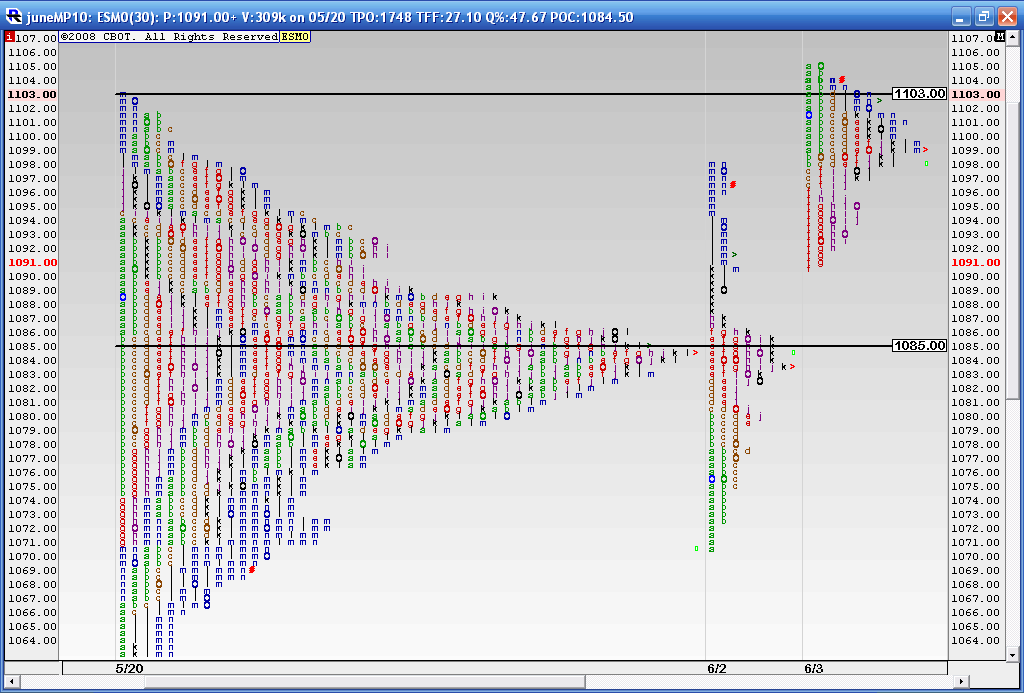

Here is a composite profile that includes all this consolidation from 5-20 including Tuesdays Trade. You may remember that Tuesday closed down at 1068 which is far below that huge volume node at 1085. This also shows what happened on Wednesday and today. Wednesday closed back above the 1085 and then today they established Value higher than Wednesday.

If I was writing an MP book then this would be "Textbook" with that high node at 1085 and then closing and building value higher today.

With any luck we will have a nice rally from here. The simplistic view is that if this rally fails then that 1085 becomes the attractor price and back down we go.

If I was writing an MP book then this would be "Textbook" with that high node at 1085 and then closing and building value higher today.

With any luck we will have a nice rally from here. The simplistic view is that if this rally fails then that 1085 becomes the attractor price and back down we go.

Like paul9 said, we had an NR25 day, so that will act like a coiled spring. A probe of 1070 would take to the bottom of a huge range formed last week.

Wed's trend day broke a 2.5 day downtrend. Today's NFP broke a 2-day uptrend. I think the NFP response puts us into a huge sideways range for the next little while.

1091 resistance looks significant to me.

Bruce,

check it out, A GAP, intraday, today, on 5min chart===the Open of the Big Bar Down was 96.00, the close of the previous bar was 96.50

Do you think it can be visited today?

check it out, A GAP, intraday, today, on 5min chart===the Open of the Big Bar Down was 96.00, the close of the previous bar was 96.50

Do you think it can be visited today?

They finally filled the air from Wednesday. Long 1072, as a lot of buyers are in loss.

short 81.00

Originally posted by ak1

They finally filled the air from Wednesday. Long 1072, as a lot of buyers are in loss.

Hi Ak1,

When did you go long 1072?

I do not see a print in that price range this morning.

Originally posted by BruceM

Feng, a possible stop and reverse idea is to watch the 30 minute closes in the RTH session. If we close below a Rat then get short to target the next Rat...if we break down and close below a Rat and then close above that Rat then go long......

This is completely untested so just throwing it out there....Ak1 was looking at the closes so perhaps he can offer some ideas on the close concept...

ON is tricky...we are stuck between two Rats in front of a report in 7 minutes......I think they will try and fill in that O/N air pocket....so if ya like to gamble....go for it!!

You are right bruce. A 30 min close below a Rat. has a bearish signal and viceverse. However a word of caution is that the signal is valid for the next 25 min and if you are getting no where then exit if the market is begin to close above the Rat in the last 5 min. I am sometimes amazed when venders say "Trade Parttime" They forget to add a line "Loose fulltime" This is a fulltime office job 9:30 est to 4:15 est

TICK has been persistently -ve, but price is inching up persistently.

Time to be cautious....

Time to be cautious....

Long 1082 for 2 pts

im f*ckin screwed today wow...sellers are dead so far.

wats so special about 83.5?

Oh great..u'll enjoy that...Have you read Daltons Book?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.