ES Short Term Trading 8-24-2010

Range Based S/R

R1 = 1084.25

S1 = 1060.25

R2 = 1088.25

S2 = 1056.25

Steenbarger Pivot = 1068.875

Prices have already traded below S2 this morning.

R1 = 1084.25

S1 = 1060.25

R2 = 1088.25

S2 = 1056.25

Steenbarger Pivot = 1068.875

Prices have already traded below S2 this morning.

Since there's not a lot of traffic.

Mentioned the funny business the day they halted CSCO for errant sales at 26 that were let to stand. It was trading above 24 then. Todays' lod 21.20 so far.

GS had rumored plan to spin off trading business. Denied rumor after close yesterday. I think it's 6-7 points lower today from where it was when the rumor started. lod about 144. Above 145 currently.

Mentioned the funny business the day they halted CSCO for errant sales at 26 that were let to stand. It was trading above 24 then. Todays' lod 21.20 so far.

GS had rumored plan to spin off trading business. Denied rumor after close yesterday. I think it's 6-7 points lower today from where it was when the rumor started. lod about 144. Above 145 currently.

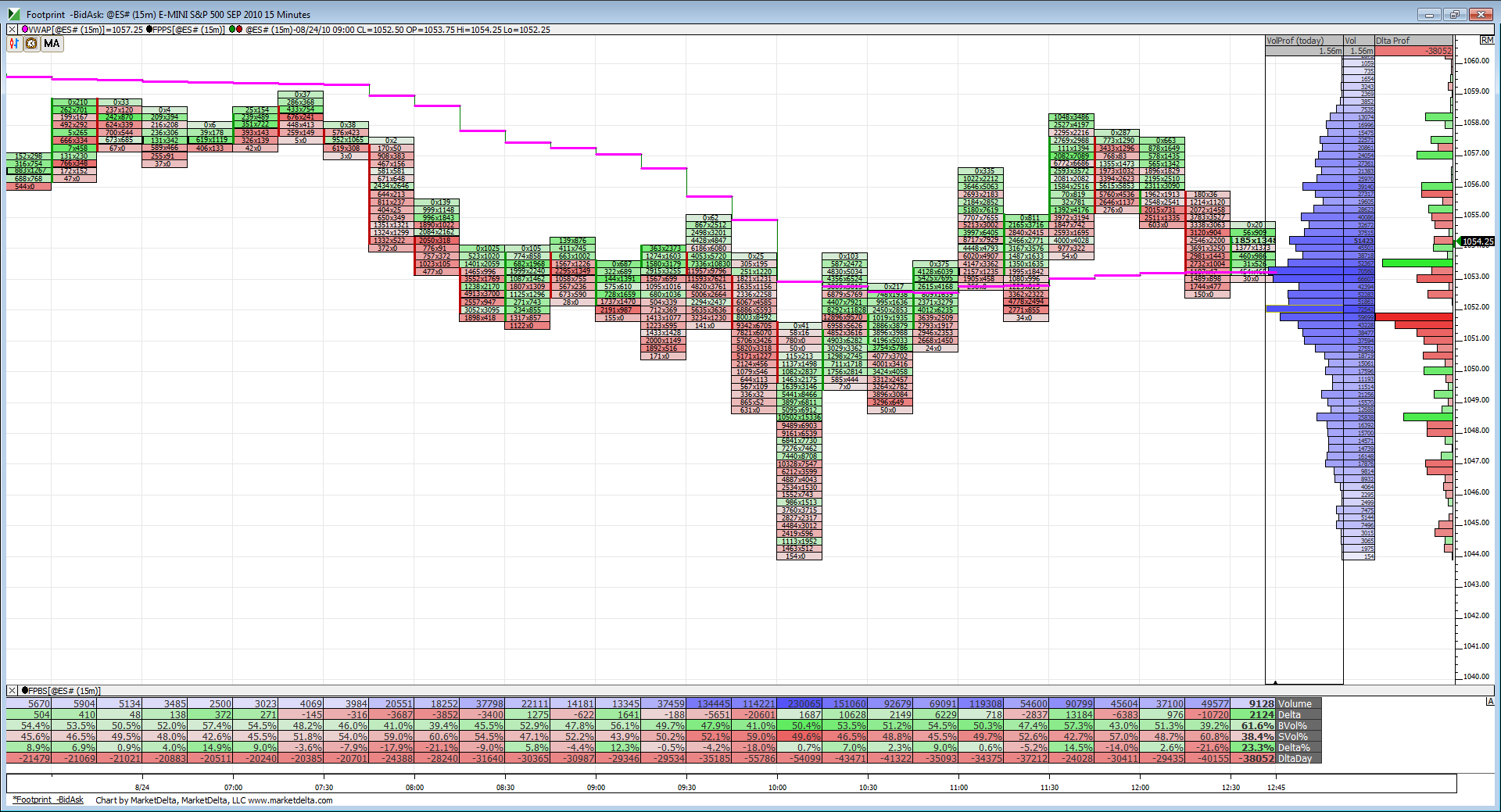

We can see the volume between 1054 and 1051. Not a lot of volume in relative terms above and below hence the journey back to VWAP.

51.50 is the exact highest Volume price today so it would not be uncommon to jerk around that price some more today...these areas are often like ledges and triples...meaning that they sometimes make you suffer to get it tagged

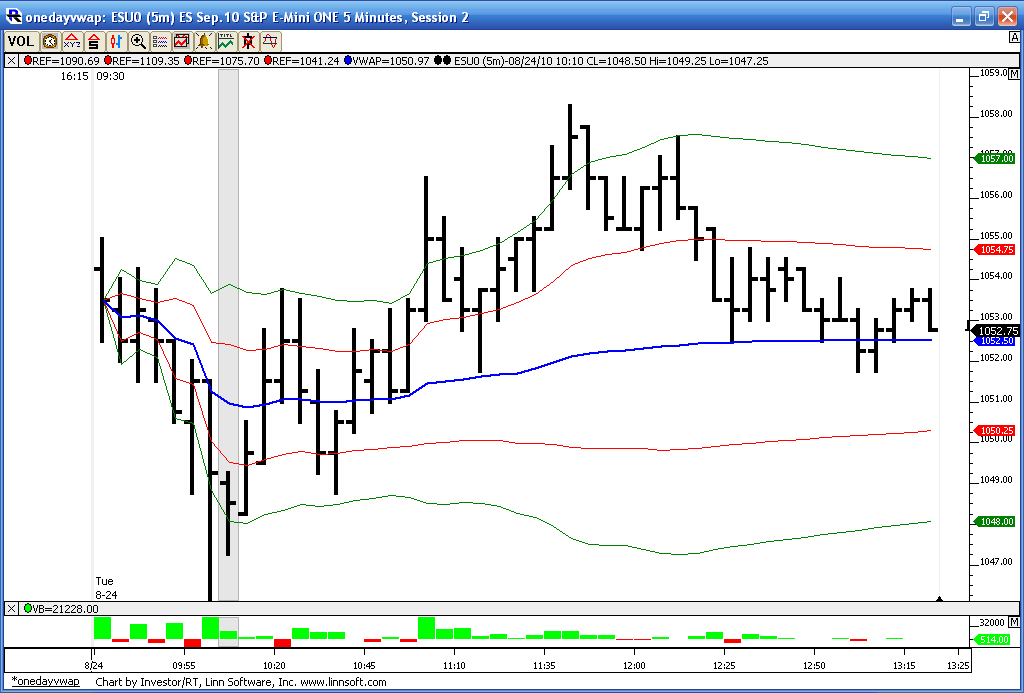

the vwap band traders will try breakout trades at 54.75 for longs and

50.25 for shorts....agressive trades at best....we can watch for failures at those

the vwap band traders will try breakout trades at 54.75 for longs and

50.25 for shorts....agressive trades at best....we can watch for failures at those

interesting that a ledge is trying to form at 51.75...one tick above that report volume of 51.50......the POC and Vwap are in the same area so we are neutral as per volume...many of us will be selling rallies up here to run that ledge....

we won't stay neutral for ever so if new high volume comes in on a rally or decline we need to give up the symetric idea and not count on trade back to the mean

wathc 54.75 if the run it above and come back down through it

we won't stay neutral for ever so if new high volume comes in on a rally or decline we need to give up the symetric idea and not count on trade back to the mean

wathc 54.75 if the run it above and come back down through it

here is how my VWAP screen looks....with SD bands above and below..what isn't shown is the Volume POC at 53.25

I'm on 56...don't want new highs before 53 prints...this is the attempted break out

the band traders would have bought the 54.75 long trade and try to push it to 57....we'll see...not me !still symetric until proven wrong

took 2 off at 54.25 and trying to hold for 2 VPOC and that ledge..reason for early cover is that we have a ledge trying to form up near 56.25 TOO...so confusion sets in

gotta resolve 54.75 band here

gotta resolve 54.75 band here

covered last at the print of 51.50..flat here...can't trade in the middle..too dangerous

Good point you bring up Jim. I've tried getting in touch with Dr. Brett about posting but he has no contact info. He does state on his blog he doesn't want links or posts re-posted but that was said in 2007 and now he is no longer blogging but keeps the site up as an archive for us blokes.

I just can't imagine at this point he would have a problem with re posts. Admin, what do you think?

I just can't imagine at this point he would have a problem with re posts. Admin, what do you think?

Originally posted by jimkane

Hey, Lorn, you should start a topic just for these kinds of posts they are so good (as long as Dr. Brett doesn't mind, I had heard something about him not wanting to be reposted or linked???). I voted you up on this one (and I think on another another one like this that you posted). Give it some thought.

Originally posted by Lorn

A good read to contemplate as we prepare for tomorrow's action.

http://traderfeed.blogspot.com/2010/03/most-common-problem-i-see-among-active.html

The Most Common Problem I See Among Active Traders

The recent post on listening to market communications highlights one of the most common problems I see among active traders, particularly those that trade on a day time frame.

We've all known people who seem to talk at you rather than with you. It seems as if they're uninterested in anything you have to say. They just want to get things off their minds. Indeed, even as you're talking, you can see that they can't wait to blurt out whatever is in their heads.

Can you imagine a psychologist who interacted like that? You're trying to describe your problems, and the shrink is talking right over you with whatever psychobabble he happens to be espousing at the time. That would be quite frustrating.

Well, that is how many traders approach markets. They don't listen to what the market has to say. Instead, they're looking for the next setup, the next trade to put on.

When you sit in front of the screen, the goal should be similar to the psychologist's: to understand what is going on before you take action. If you're approaching markets with your own opinions and your own need to put on trades, you'll miss the market's communications--its evolving patterns--and any hope of getting a gut feel for the action will be gone.

I often wondered why I tended to trade well after taking a break from markets. The reason, I discovered, was that I was following markets during the break, but not trying to put on trades. That freed me up to simply hear what the markets had to say.

If you have a *need* to talk, chances are you'll be a poor conversationalist because you'll be a poor listener.

And if you have a *need* to trade, odds are you'll be tone deaf with respect to what markets are actually telling you.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.