ES 6-7-11

Most important today will be the 89 - 90 area...that is the April swing low point we mentioned yesterday. It is also the afternoon swing high point from yesterday and the VA low.

Best thing for bulls will be to hold that and avoid any gap fill from the higher open. We are currently at 90.50 in the O/N session and the close of yesterday is down at 85.

On the upside we have the current O/N high, the open from Monday, last weeks lows and the POC all at the 94 - 96 area....key resistance for early trade. I still have my eyes on that 1302 - 1304 area as a price that needs to be tested and soon. Hopefully today.

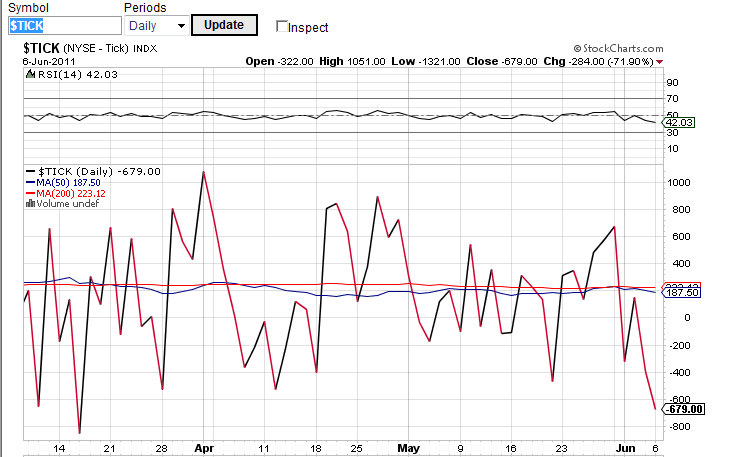

I was hoping yesterday would have been the rally day and was wrong. We have had 4 down days now and the $tick closes are now oversold so a bounce or consolidation is in order. Still lots of work on the upside and the areas mentioned in YD posts are still valid .

Here is a screen shot of the tick closes. Yesterday we had the lowest close since mid March and we are in a place where we see some snap back. Odds have increased for the up day I think. We need to watch to see if they attempt to fill the gap and then come back up through the open. They tried to come back through the open multiple times yesterday and failed.

Best thing for bulls will be to hold that and avoid any gap fill from the higher open. We are currently at 90.50 in the O/N session and the close of yesterday is down at 85.

On the upside we have the current O/N high, the open from Monday, last weeks lows and the POC all at the 94 - 96 area....key resistance for early trade. I still have my eyes on that 1302 - 1304 area as a price that needs to be tested and soon. Hopefully today.

I was hoping yesterday would have been the rally day and was wrong. We have had 4 down days now and the $tick closes are now oversold so a bounce or consolidation is in order. Still lots of work on the upside and the areas mentioned in YD posts are still valid .

Here is a screen shot of the tick closes. Yesterday we had the lowest close since mid March and we are in a place where we see some snap back. Odds have increased for the up day I think. We need to watch to see if they attempt to fill the gap and then come back up through the open. They tried to come back through the open multiple times yesterday and failed.

Originally posted by BruceM

Nice how that O/N high respected that..double top now between that O/N high and day session high......I was planning to short above the O/N high and the plus 2.5 but it looks like they front ran the numbers...

will need to be more selective when we break that double top

Hopefully some saw how we hit the minus 2.5 into our key support zone

Lorns volume chart should not be taken lightly...that was a perfcet bell curve at the upper distribution of O/N data

Yup, saw that pitbull trade coming!

To BruceM You placed here the daily $tick chart with -679 as oversold

I was under the impression that -1000 is oversold can you give me your numbers for oversold overbought please

I was under the impression that -1000 is oversold can you give me your numbers for oversold overbought please

triples in ym at 148; you don't see those very often with that level of precision

they did not take long to run them lol

Originally posted by apk781

triples in ym at 148; you don't see those very often with that level of precision

we opened in range and in value of yesterday. So with no 10 am reports we have no reason to expect trend type of trading. All targets should be tighter IMHO.

and there is the hour breakout into a key zone...now the fun starts

and there is the hour breakout into a key zone...now the fun starts

for those following the pitbull ideas you should think about the time factor....it is really designed for the first 90 minutes of trade and we only have 13 minutes left . Ideally we would need this to stay below the 60 minute and O/N highs to hold past that time frame.

we need to also think about all the gap traders that are sitting with losses..their buying back of losing shorts to cover can help support the market....

Those working shorts should try to cover at 92 even as that is 2.5 points off the high....failure to get that is telling us something too..

we need to also think about all the gap traders that are sitting with losses..their buying back of losing shorts to cover can help support the market....

Those working shorts should try to cover at 92 even as that is 2.5 points off the high....failure to get that is telling us something too..

I don't like to use static closing $tick values with daily closes.. I prefer to look at them in context and look for the extremes relative to other high and low points

Originally posted by khamore1

To BruceM You placed here the daily $tick chart with -679 as oversold

I was under the impression that -1000 is oversold can you give me your numbers for oversold overbought please

10:34 perfect retest of that 91 level(nice congruence with Lorns Bellcurve) Needs to hold that level(100% deviation level). So from two different methods it's the bomb either way. Any timeframe, any volume,imo only.

with my experimental 2.5 off a high or low number I am constatntly looking at where that number falls...so 92.25 is 2.5 points off that last high....a key place to take off contracts if you have some size..

need to stay inside the hour range and On highs now .....the bigger faders will push for the 50% mark on the day so we want to get some off in front of them too....91.50 is 50% of the range

need to stay inside the hour range and On highs now .....the bigger faders will push for the 50% mark on the day so we want to get some off in front of them too....91.50 is 50% of the range

hehe...you liked that?

Originally posted by BruceM

that was a bit greedy on your part LORN !!!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.