ES 6-7-11

Most important today will be the 89 - 90 area...that is the April swing low point we mentioned yesterday. It is also the afternoon swing high point from yesterday and the VA low.

Best thing for bulls will be to hold that and avoid any gap fill from the higher open. We are currently at 90.50 in the O/N session and the close of yesterday is down at 85.

On the upside we have the current O/N high, the open from Monday, last weeks lows and the POC all at the 94 - 96 area....key resistance for early trade. I still have my eyes on that 1302 - 1304 area as a price that needs to be tested and soon. Hopefully today.

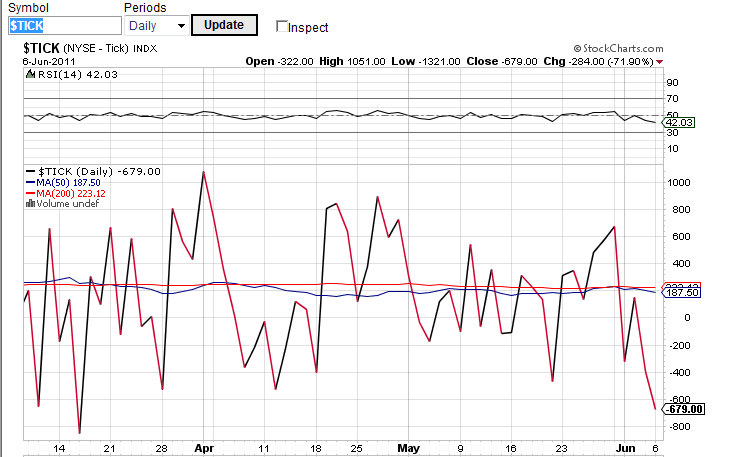

I was hoping yesterday would have been the rally day and was wrong. We have had 4 down days now and the $tick closes are now oversold so a bounce or consolidation is in order. Still lots of work on the upside and the areas mentioned in YD posts are still valid .

Here is a screen shot of the tick closes. Yesterday we had the lowest close since mid March and we are in a place where we see some snap back. Odds have increased for the up day I think. We need to watch to see if they attempt to fill the gap and then come back up through the open. They tried to come back through the open multiple times yesterday and failed.

Best thing for bulls will be to hold that and avoid any gap fill from the higher open. We are currently at 90.50 in the O/N session and the close of yesterday is down at 85.

On the upside we have the current O/N high, the open from Monday, last weeks lows and the POC all at the 94 - 96 area....key resistance for early trade. I still have my eyes on that 1302 - 1304 area as a price that needs to be tested and soon. Hopefully today.

I was hoping yesterday would have been the rally day and was wrong. We have had 4 down days now and the $tick closes are now oversold so a bounce or consolidation is in order. Still lots of work on the upside and the areas mentioned in YD posts are still valid .

Here is a screen shot of the tick closes. Yesterday we had the lowest close since mid March and we are in a place where we see some snap back. Odds have increased for the up day I think. We need to watch to see if they attempt to fill the gap and then come back up through the open. They tried to come back through the open multiple times yesterday and failed.

nice scalp john

very nice John...a good lesson in patience....you have your numbers and you wait for the market to come to u..great stuff

that short worked for 3 points. flat now

John..if u have time I'd be interested in why u picked 1.75 points for the target and why u put the stop where u had it.....Just wondering if u try to qualify what happens at peak volume prices or previous weeks lows etc,,

some use fixed stops and some use a stop based on a specific setup that is known to repeat...curious

some use fixed stops and some use a stop based on a specific setup that is known to repeat...curious

what were YOUR reasons INSYTE ?...perhaps I missed the post....well done !

Originally posted by insyte

that short worked for 3 points. flat now

bid under market as usd thrashing continues

I guess I'm looking for why that area INSYTE....you will notice that we give the reasons or charts for the trades in this forum...so I need to hold u to the same standard..

i had posted earlier 1295-97 as sell area.....and also today's double top....waiting on FED 3:45 statement now.....should be a market mover....i am a seller around 1297.50 and a reverse and long above 1300. both for 6 points moves.

bruce..i dont hold you to any standards...peace.....

Bruce,

I usually in all my trades i have a parameter setup on all my entries and exit. I use 1.75 points as a stop loss and 3-4points of profits but in this ocasion i measure the power on recent fibs level and saw that i only get 2pts of profits. Then i assure my exit on 1.75pts.

I usually in all my trades i have a parameter setup on all my entries and exit. I use 1.75 points as a stop loss and 3-4points of profits but in this ocasion i measure the power on recent fibs level and saw that i only get 2pts of profits. Then i assure my exit on 1.75pts.

Originally posted by BruceM

John..if u have time I'd be interested in why u picked 1.75 points for the target and why u put the stop where u had it.....Just wondering if u try to qualify what happens at peak volume prices or previous weeks lows etc,,

some use fixed stops and some use a stop based on a specific setup that is known to repeat...curious

hehe...you liked that?

Originally posted by BruceM

that was a bit greedy on your part LORN !!!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.