ES Tuesday 6-17-14

The numbers I am using as of 8:30 Monday night...I plan to review in the morning once we have Overnight trading winding down...

here are some additional comments...trying to lean towards the bearish side today but if we start poking at yesterdays VA highs then that would probably be a no-no and we may be wrong but so far good odds that the O/N low is gonna be run out today

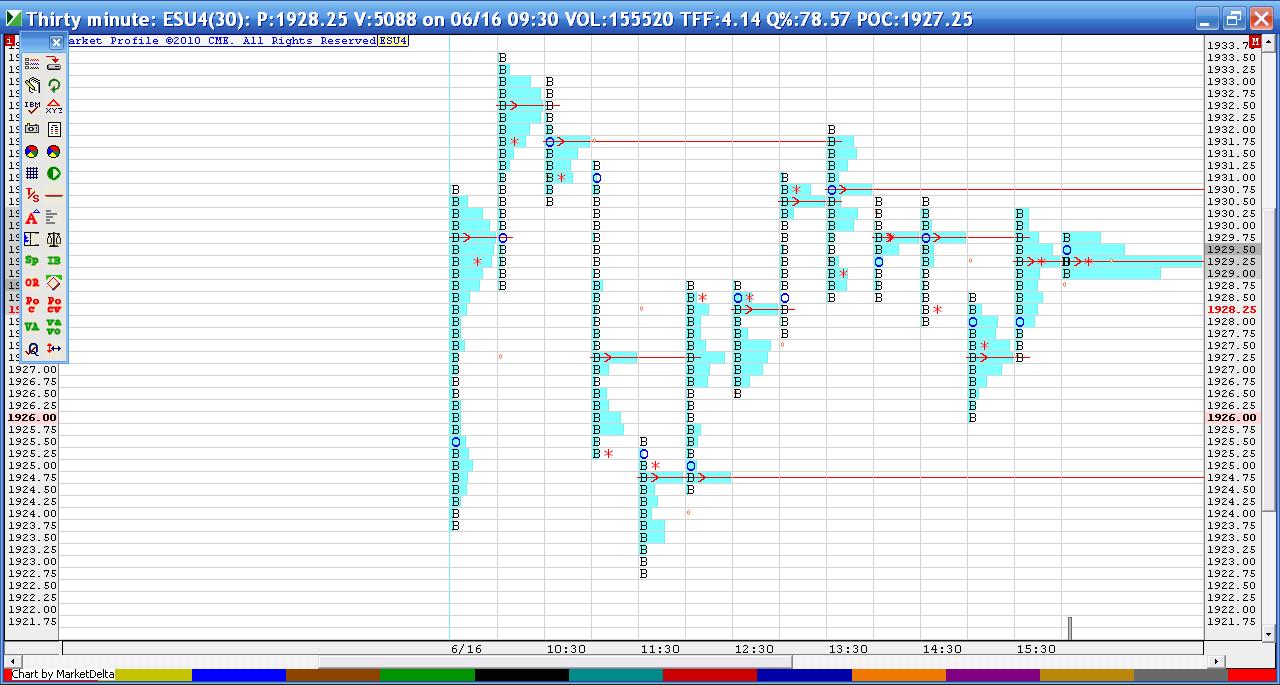

a quick look at how just the 30 minute VPOCs finished up from YD day session only.. ...I think good odds we will test that 24.75 vpoc in RTH today so if we open above I would like to use that as a first short target before the O/N low if possible...my first sell zone is 26.50 - 29.25....and may need to do it soon

Thanks for the video's, Bruce. I dug up my good ol' headset to counter my poor sound issues on my computer.

O/N low or O/N high have not been taken out (yet). Price moved away from O/N low.

As price is near O/N high, chances are that the O/N high will be taken out.

O/N low or O/N high have not been taken out (yet). Price moved away from O/N low.

As price is near O/N high, chances are that the O/N high will be taken out.

well the only thing interesting was that we opened in value and dropped to that 30 minute VPOC and then got right back into the VA from yesterday without letting runners get that O/N low.....that was telling me that maybe I was wrong with O/N low and perhaps nothing has really changed since yesterday.....getting back into value is a clue after a failed breakdown out of it......as long as we don't get back under 31 - 32.25 then my assumption is that the O/N high will eventually get run out...otherwise they will drag this back to the pivot at 28.50 again

nothing will really change in this market until we get outside of Thursdays range.....and stay out of that range for at least two TPO periods...this is just all short term traders respecting the r1 at 34.25 and s1 at 23.50.......nobody ever promised us the market would or should stop at exact prices !!

so value after the first hour will end up overlapping to higher so far...this could just be a repeat of yesterday so watch for those inside bars or low range bars on the 15 minute time frame...

revising my lower support area to 30.50......that's gonna be my spot to watch on this in order to keep poking at longs for O/N high.....don't really like trading for probabilities and certainly don't like that they can't stay outside of YD RTH highs...also don't like how all the volume is building up here....implies another struggle

So if:

value is O/L higher + O/N high will likely be taken out + 2 prominent unvisited POC's @ 1939.75 and 1936.00

would hunting for longs be the way forward?

value is O/L higher + O/N high will likely be taken out + 2 prominent unvisited POC's @ 1939.75 and 1936.00

would hunting for longs be the way forward?

more conflicts....Ideally on a break from a previous days range you'd want to see single prints left behind and closes above that range high ( in the case of an upside breakout) getting closes back inside is just terrible for longside trade now...... seems like the short side is gonna be the way to lean now.....anything I do is very small as I don't like any of this but would like to see them keep it inside the highs of YD va high for short to work back to 28.50

the point is that I am flip flopping and keeping it real small so I don't feel bad about getting it all wrong...idea is not to give too much back from the GOOD trades..

the point is that I am flip flopping and keeping it real small so I don't feel bad about getting it all wrong...idea is not to give too much back from the GOOD trades..

aladdin...I hate that they couldn't pop up quickly when they got back down to YD va high again.....so I am assuming that we have another fake out....they way they lingered at that VA high was a "tell" and if you look at the 30 minute VPOC all the volume was building there during this 30 minute period as it traded.....if it was buyers it would have moved back up quickly...the fact it didn't implied that at the very least we had a battle going on

2 pm closing bar's low never traded back to close of 1:30 bar...so gap in data there...but we all know how we can be tortured to fill those....fed announcment tomorrow

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.