ES Thursday 9-3-15

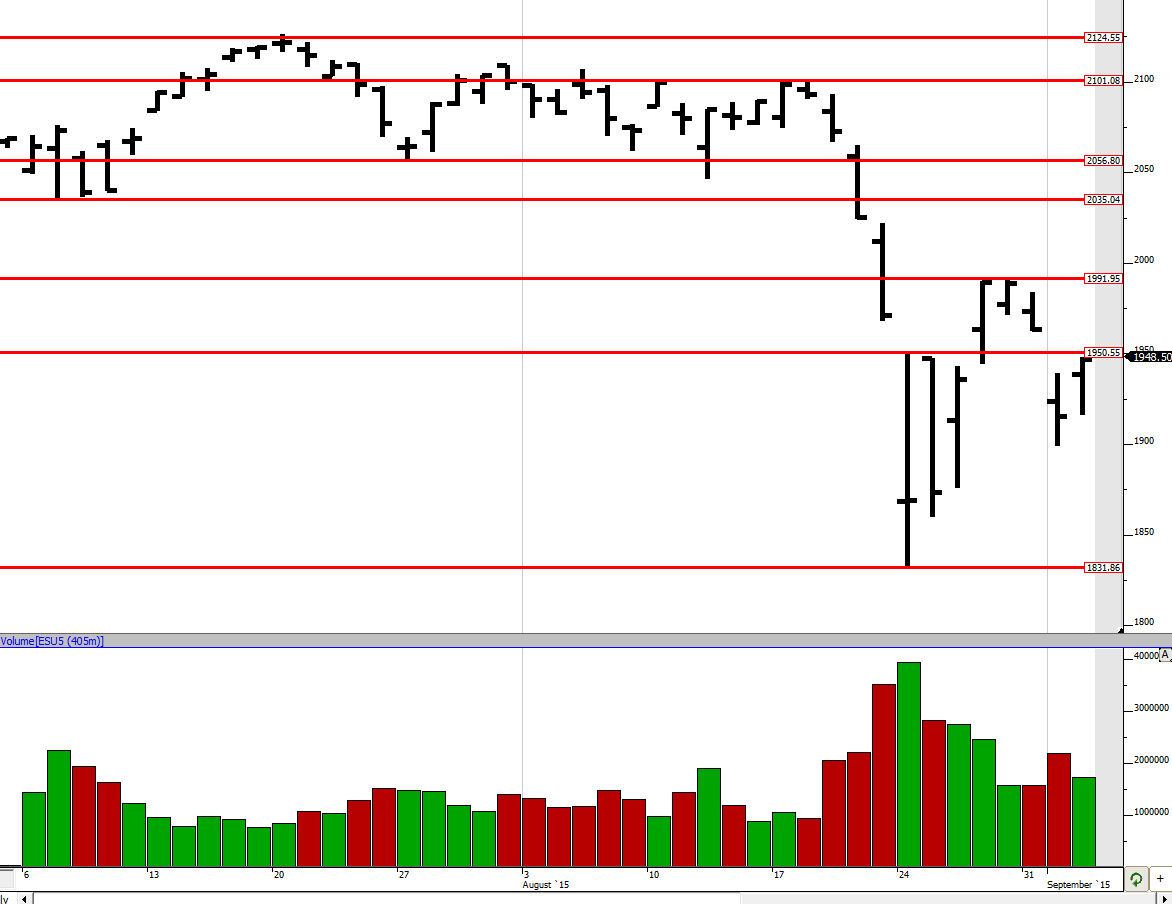

Good evening to all. We spent a majority of the day within Tuesday's range but a late day breakout to the upside meant we closed outside of it. The close was pretty close to the 1950.5 level we were originally tracking so that is something to be noted. The question from a slightly larger point of view is that was 1992 a lower high or was 1899 a higher low. That could potentially tell us whether the market moves back down or up. So I am going to look for how the market reacts around 1992 and 1899 moving forward to understand if we are going to be making new lows or not.

Greenies: 1894, 1922/24, 1930, 1969.5, 1979, 1995, 2014.25, 2053.25, 2077.75

Profile:

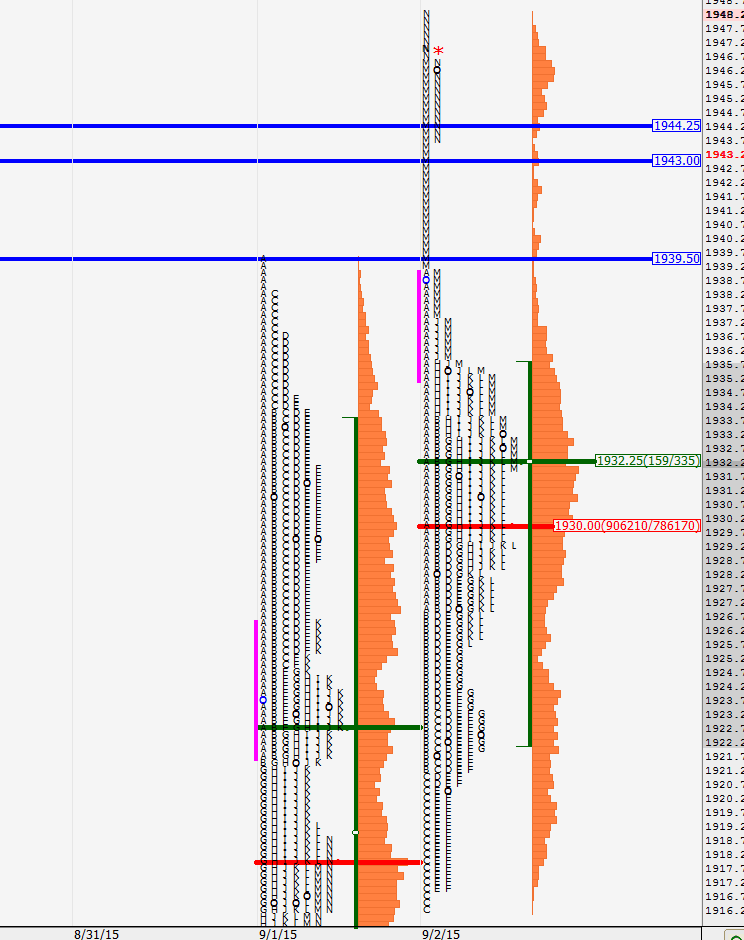

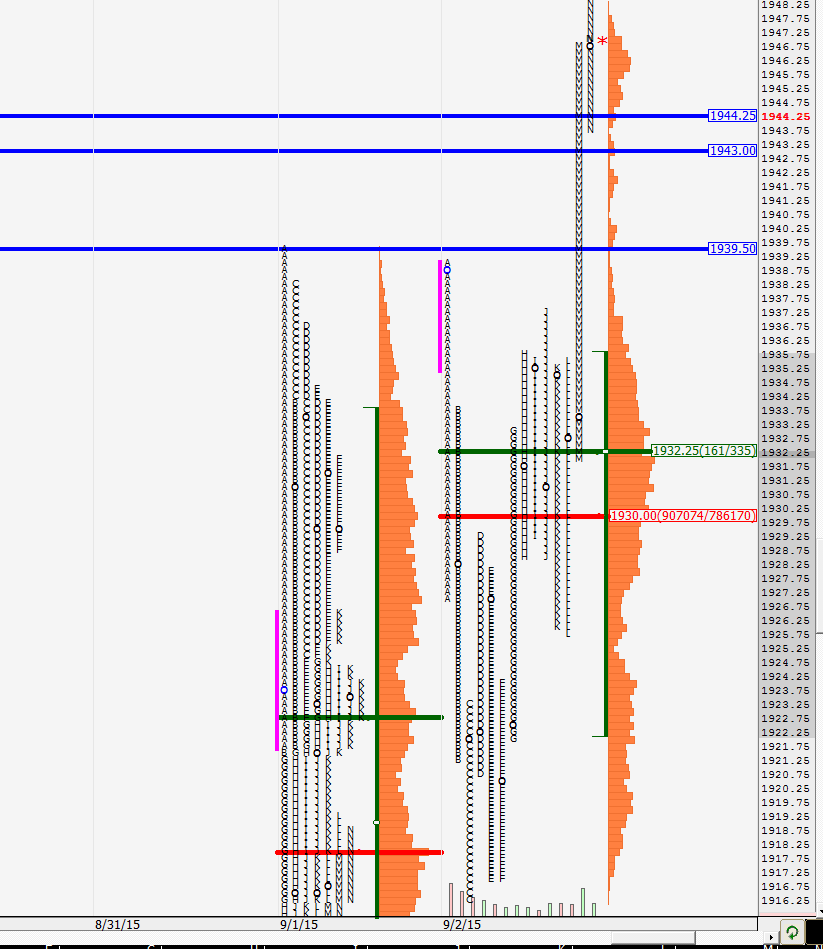

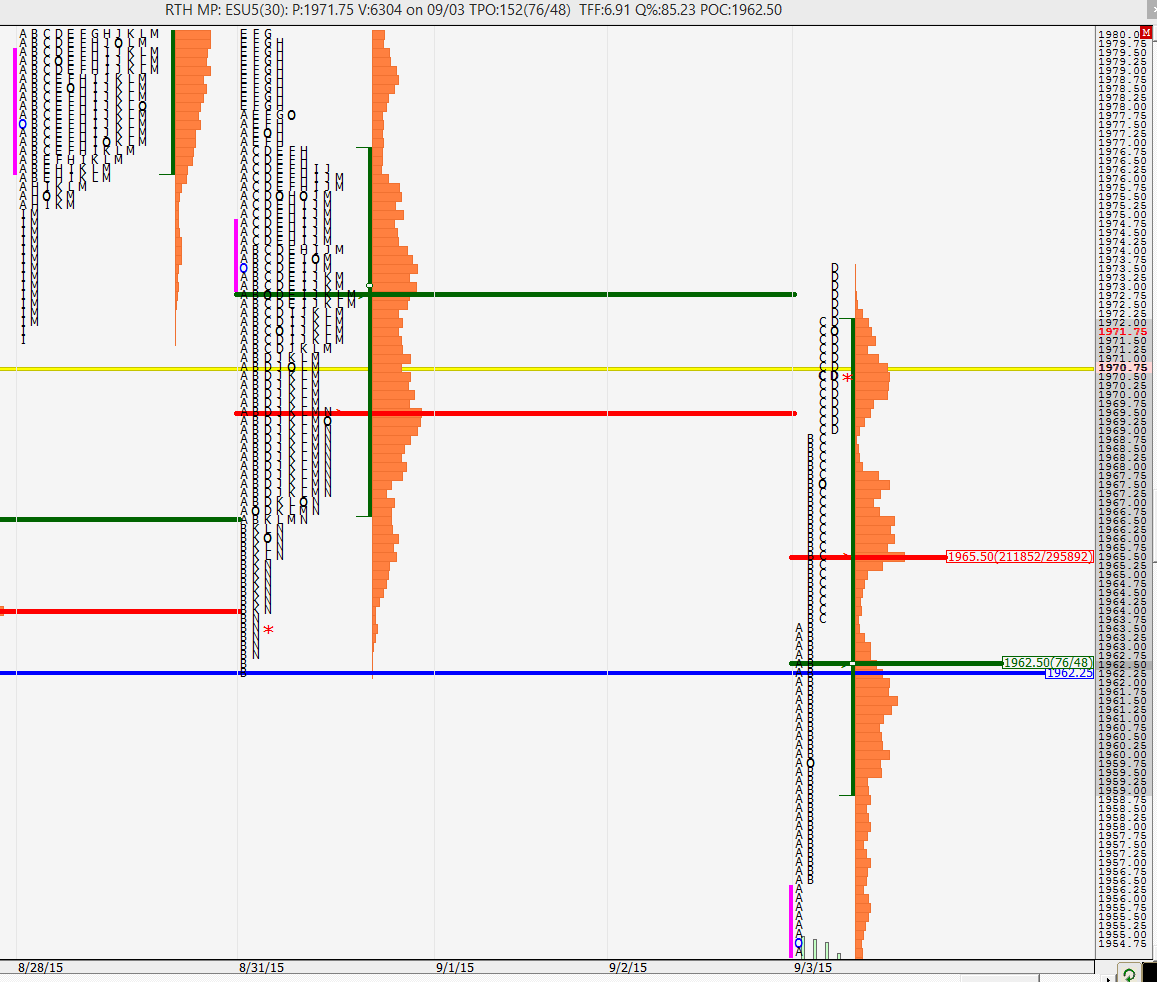

As noted earlier we stayed within 9/1's range all day until the late day breakout in the M and N periods. The buying tail at the lower end is technically fine but it does not look pretty. Today again we closed far from the VPOC with those single prints in the M period from 1939.25 to 1943.5. Those could be taken out tomorrow depending on how the O/N plays out and where we open. The gap between 1943 and 1944.25 from 8/27 was closed but the gap to 8/31 is yet to be fully closed until 1962.25. Let us see how tomorrow and the rest of the week plays out until the long weekend.

Looking at the split profile we can see the weak low formed with the E and F period lows. That coupled with the fact that they are only 3 ticks above the day's low gives me low confidence in that low holding up. But we shall see how that is carried forward. Sometimes it can take a while for those to be cleaned up. We can see how the day was largely a balancing day until the last 45 minutes where it seemed like there was some short covering and stop hunting going on.

We shall see how the O/N action is in absence of the Chinese markets which are off for holidays the rest of the week. Jobless claims report tomorrow at 8:30 am could provide a catalyst so be aware of that. Good evening to all.

Greenies: 1894, 1922/24, 1930, 1969.5, 1979, 1995, 2014.25, 2053.25, 2077.75

Profile:

As noted earlier we stayed within 9/1's range all day until the late day breakout in the M and N periods. The buying tail at the lower end is technically fine but it does not look pretty. Today again we closed far from the VPOC with those single prints in the M period from 1939.25 to 1943.5. Those could be taken out tomorrow depending on how the O/N plays out and where we open. The gap between 1943 and 1944.25 from 8/27 was closed but the gap to 8/31 is yet to be fully closed until 1962.25. Let us see how tomorrow and the rest of the week plays out until the long weekend.

Looking at the split profile we can see the weak low formed with the E and F period lows. That coupled with the fact that they are only 3 ticks above the day's low gives me low confidence in that low holding up. But we shall see how that is carried forward. Sometimes it can take a while for those to be cleaned up. We can see how the day was largely a balancing day until the last 45 minutes where it seemed like there was some short covering and stop hunting going on.

We shall see how the O/N action is in absence of the Chinese markets which are off for holidays the rest of the week. Jobless claims report tomorrow at 8:30 am could provide a catalyst so be aware of that. Good evening to all.

NFP tomorrow & long weekend so they may take some risk off the table.

it feels pretty strong right here. not so sure about the resistance. might have to give it some rope to work with

true and I really appreciate your comment. I had missed the 196400 (extension 2) earlier by one tick so I was anxious to get in.

I am out already. Not worth it. Low volume day.

spending more time and building volume inside 8/31's range

there is a prominent POC at 1972.75 so they could be targeting that as well

every pull back has been bought very mechanically. The B period low was right to the high of the OR. The C period low was right to the A period high. The D period low (so far) ir right up to the B period high. such mechanical buying usually does not last long so should be kept in mind as we move forward.

market could be getting too short here so be careful with the shorts. the VPOC is still at 1965.5. there could be late afternoon short covering

NK thank you for warning !

kool!!! you are back! glad to see you again and hope to see you posting regularly again! welcome back

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.